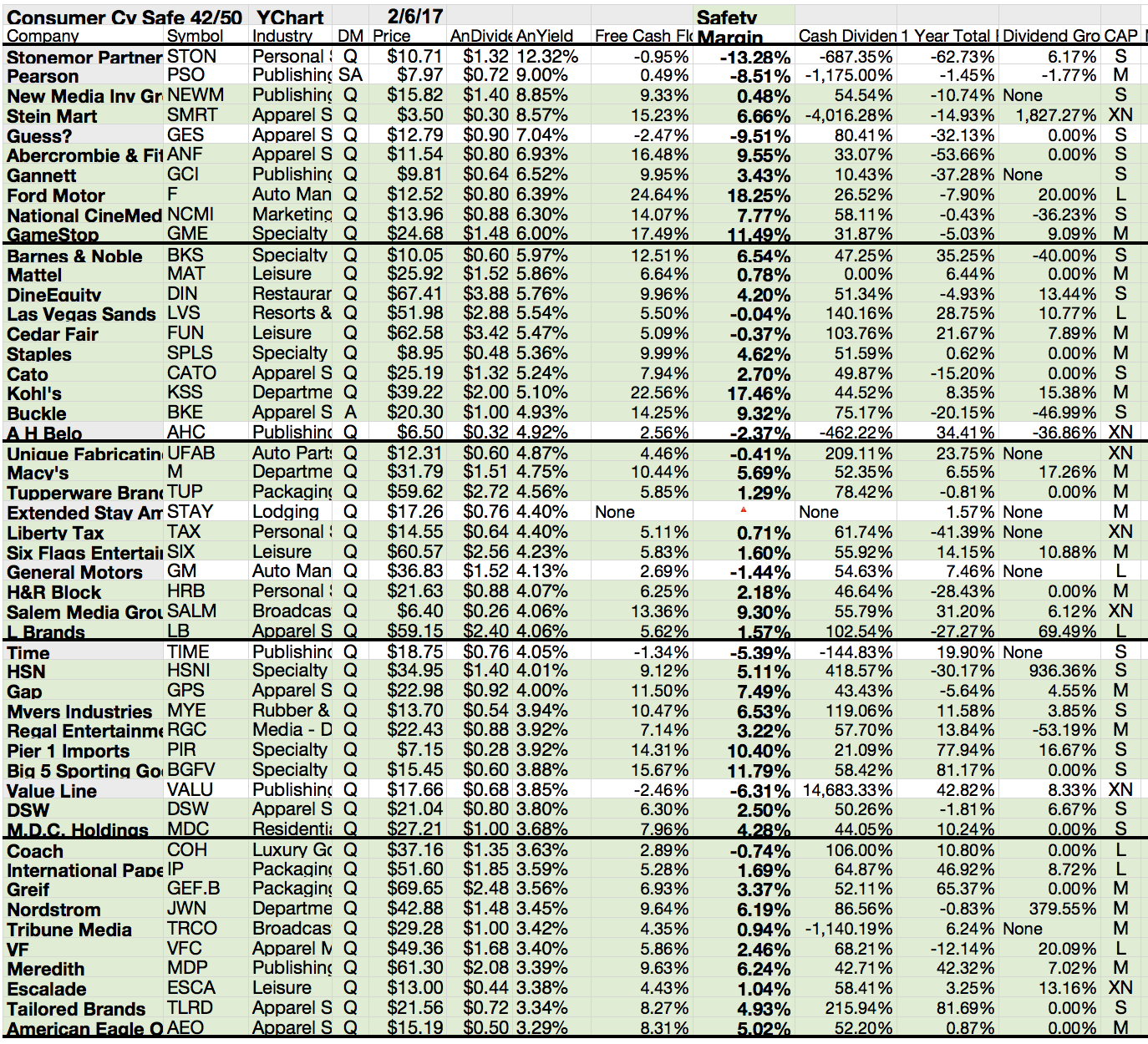

Dividend growth is a wonderful thing, but you should also require the stocks you buy to look cheap. Here I seek out stocks trading at multiples of price to sales, earnings, and cash flow lower than five-year averages.

Stocks that trade at discounted valuations can be cheap for a reason, so I also require expected sales growth for the year ahead to be positive. Using these criteria, the 24 stocks shown in the table have proven themselves to be “dividend growth superstars” that kept on paying and even raising their dividends through the 2008-2009 financial crisis. They also trade at historically cheap valuations on at least two of the three ratios I use to determine value: price/sales, price/earnings, and price/cash flow.

If you follow a strategy of investing in temporarily cheap stocks of companies that habitually hike their dividends, not only will you experience significant capital gains when the stock falls back into favor with the market, but the yield you earn on your original investment can balloon to downright plump proportions.

These are the results...

Stock Compilation Of The Latest Dividend Raiser 2017

Every week there are dozens of companies that increase their dividend payout. Over the past week, there were several companies that raised their dividends to shareholders. I summarized them in a list in order to get a quick overview of the latest dividend raiser.

Most of those companies have lower yields, but pretty good rates of historical dividend growth. The companies are listed below:

Most of those companies have lower yields, but pretty good rates of historical dividend growth. The companies are listed below:

These 5 Stocks Give Over 15% Return To Shareholders

Now let's apply those lessons to 2017, and highlight five that should do even better (17%+ returns) this year (and likely beyond).

Remember, projecting our returns from any given stock is simple. We simply add together the three ways it can pay us:

Its current dividend. A future dividend hike. Share repurchases. It also helps if the stock is inexpensive, as buybacks deliver more bang for management's buck. So let's stick with stocks that are dirt-cheap, trading for 10-times free cash flow (FCF) or less for this exercise.

Here's an example of a stock ready to return 17% or more over the next year.

Remember, projecting our returns from any given stock is simple. We simply add together the three ways it can pay us:

Its current dividend. A future dividend hike. Share repurchases. It also helps if the stock is inexpensive, as buybacks deliver more bang for management's buck. So let's stick with stocks that are dirt-cheap, trading for 10-times free cash flow (FCF) or less for this exercise.

Here's an example of a stock ready to return 17% or more over the next year.

6 Attractive Dividend Stocks

In order to get a nice return on your investment, you need to buy stocks at a cheap or reasonable price related to the expected growth. Today I like to share a screen with you that includes some in my view attractive dividend stocks.

I started with a custom made list of the dividend champions. Being a dividend champion fulfills the quality criterion.

I then sorted the list by P/E ratio, and picked the companies with a P/E below 20. I have a maximum P/E requirement in order to avoid overpaying for companies. Even the best company in the world is not worth overpaying for.

The next step in the process included evaluating trends in earnings per share and dividends per share. As I mentioned above, I want companies that can grow earnings per share over time. Earnings per share growth should be over5 percenjt for the next half decade.

This will drive future increases in dividends, and protect the purchasing power of my income in retirement.

I do not want companies that increase dividends merely by increasing their payout ratios, or who have slowed down on dividend increases because their earnings are stagnant.

Six stocks remain at the end of my screening process.

These are the results...

I started with a custom made list of the dividend champions. Being a dividend champion fulfills the quality criterion.

I then sorted the list by P/E ratio, and picked the companies with a P/E below 20. I have a maximum P/E requirement in order to avoid overpaying for companies. Even the best company in the world is not worth overpaying for.

The next step in the process included evaluating trends in earnings per share and dividends per share. As I mentioned above, I want companies that can grow earnings per share over time. Earnings per share growth should be over5 percenjt for the next half decade.

This will drive future increases in dividends, and protect the purchasing power of my income in retirement.

I do not want companies that increase dividends merely by increasing their payout ratios, or who have slowed down on dividend increases because their earnings are stagnant.

Six stocks remain at the end of my screening process.

These are the results...

Subscribe to:

Posts (Atom)