Showing posts with label SLB. Show all posts

Showing posts with label SLB. Show all posts

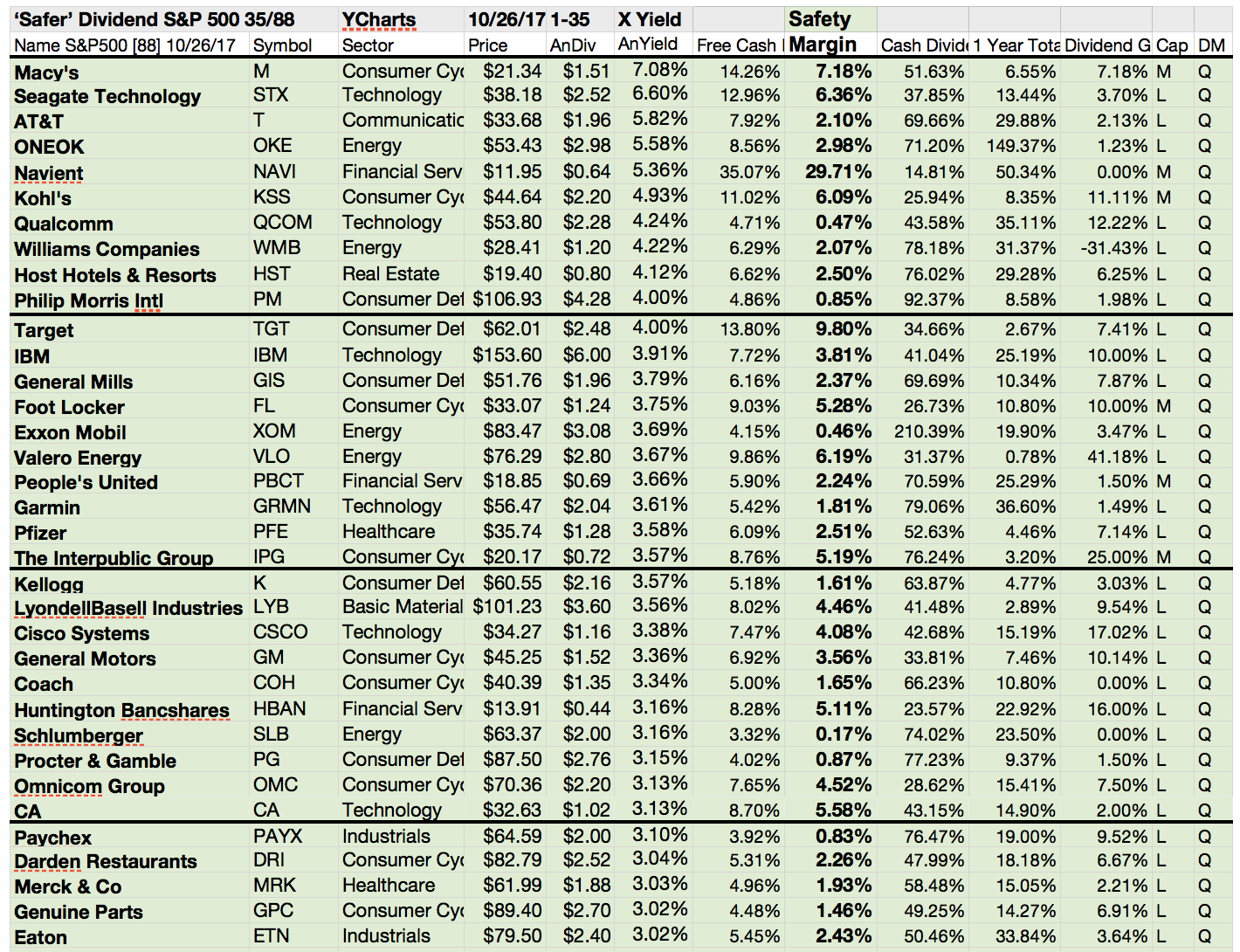

The Most Important Buyback Champions On The Market

Over the past few years, I've been conducting quarterly reviews of companies that are aggressive repurchasers of their own stock.

I've tended to focus on companies that announced a share repurchase plan that represents at least 5% of shares outstanding. Anything smaller may not have much of an impact on earnings per share ( EPS ).

Yet in recent months, we have broadened our measure of corporate generosity to focus not just on buybacks but also dividends and debt reductions.

Below you'll find a group of companies that meet the criteria, based on share buyback announcements during the current earnings season.

I've tended to focus on companies that announced a share repurchase plan that represents at least 5% of shares outstanding. Anything smaller may not have much of an impact on earnings per share ( EPS ).

Yet in recent months, we have broadened our measure of corporate generosity to focus not just on buybacks but also dividends and debt reductions.

Below you'll find a group of companies that meet the criteria, based on share buyback announcements during the current earnings season.

Best Dividend Stocks To Buy For 2017

Dividends, the share of their revenues that companies pay to their shareholders, are a big deal:

Over the past century, they’ve accounted for roughly half of total returns earned by stock investors. And if stock returns flatten out over the next few years, as many economists anticipate, dividends will matter even more in driving growth for investors.

But these days, it’s unusually difficult to find dividend-paying stocks that look like good buys.

Stock valuations in the category are lofty after years of outperforming the broader market. The forward price/earnings ratio of the top 25% of S&P 500 stocks by dividend yield is 17, vs. a 36-year average of 12.

And the dividends themselves can seem relatively stingy: The number of companies increasing their dividend has been shrinking, and the number of decreases is accelerating. And there’s also the danger that if interest rates rise, as is expected, investors could flee the sector and send stocks careening downward.

With those in mind, we asked ourself what could be the best investment ideas for 2017. Here are 11 stocks where the experts see opportunity and safety.

These are the results...

Over the past century, they’ve accounted for roughly half of total returns earned by stock investors. And if stock returns flatten out over the next few years, as many economists anticipate, dividends will matter even more in driving growth for investors.

But these days, it’s unusually difficult to find dividend-paying stocks that look like good buys.

Stock valuations in the category are lofty after years of outperforming the broader market. The forward price/earnings ratio of the top 25% of S&P 500 stocks by dividend yield is 17, vs. a 36-year average of 12.

And the dividends themselves can seem relatively stingy: The number of companies increasing their dividend has been shrinking, and the number of decreases is accelerating. And there’s also the danger that if interest rates rise, as is expected, investors could flee the sector and send stocks careening downward.

With those in mind, we asked ourself what could be the best investment ideas for 2017. Here are 11 stocks where the experts see opportunity and safety.

These are the results...

20 Best Stocks to Hold for the Long-Term

Forget about buying and selling stocks within a matter of days or months. Morgan Stanley is out with a new note recommending 30 companies that you should hold until 2018.

Below is a list of the 20 top dividend payers.

That's not to say you should then sell them in 2018, it's to say that Morgan Stanley believes these companies are poised to perform well over the next three years.

Below is a list of the 20 top dividend payers.

That's not to say you should then sell them in 2018, it's to say that Morgan Stanley believes these companies are poised to perform well over the next three years.

These are the 5 highest yielding resuts in detail:

10 Most Popular Dividend Stocks Bought By Investment Gurus

Recently I published an article

about Warren Buffett's latest dividend stock buys and sells of the recent

quarter.

I'm ever surprised

about his new investment. He bought Deere, a great company with high market

share in the farmer’s equipment segment, while I was selling it due to high

debt loads and operational headwinds.

You also may like my article about 10 stocks with the highest Share Buyback Program on the market.

Today I like to

show you what the other super investors like George Soros, David Tepper, Bill

Ackman, Bruce Berkowitz or others bought during the latest quarter. Each of the attached stocks were bought at least four times by one of the 60+ superinvestors.

It's a clear

signal. They put money into the oil services industry. Drilling and exploration

companies- Those are suffering mostly from the low oil price. Is it an

anti-cyclic bet? What do you think; please share your thoughts by leaving a

small comment.

These are my main favorites from the list....

18 Cheap And Perfect Dividend Stocks To Consider

I write a lot about investments,

mostly about dividend paying stocks which have grown payments over a long

period of time.

I personally

believe that those companies offer true values for normal do-it-yourself

investors like you and me.

The great risk is

always that the company is leaving its growth path and cannot hike dividends in

the future.

Today I try finding

a perfect stock. It is a cheaply valuated company with solid debt and growth

perspectives. In addition the corporate should generate a double-digit return

on investment.

16 stocks

fulfilled my criteria. I've selected only companies with a large market cap. I

love bigger capitalized companies because they are often more secure than small

and midcaps. Safety is a key element in my investment philosophy.

Attached is the

list of my 16 results. Most of them are low yielders but in times of low

interest rates, it is no shame to own stocks with a yield below 3

percent.

What is your perfect

stock? Please leave a comment at the end of this article. I hope you have

enjoyed reading my stuff and keep following my news by subscribing. Thank you

so much.

These are my 6 top

results from the list:

100 Most Bought Stocks By Investment Gurus

100 most bought stocks by investment professionals originally published

on Dividend Yield – Stock,

Capital, Investment. I love it to see how the big investors act on the market. Some of them

have a really interesting and creative investing strategy which works only with

huge amounts of capital.

Some hedge funds play with money and try to boost its return by ignoring

a good diversification. But if they know the business and management team the risk

might be lower as for desk research investors like us.

However, each month I publish a little list about the largest stock buys

from 49 super investors. I analyze how often a stock was bought over the recent

six months and ranked them in my 100 best guru buy list. All super gurus

combined bought 655 stocks within the recent half year.

In my view, it’s a good tool to look at the activities of guru investors

in the market because they have big money in their pockets and if they invest

combined, they could change the market very easily.

Their attitude to stocks is also lightning the way to return, not always

but sometimes because the media notices the portfolio changes of the hedge fund

managers and create additional publicity.

Technology is still the place to be for the investment guru’s. I think that

they have noticed the huge cash reserves of Apple and the other stocks. Not enough,

most of them are very profitable and grow further despite they don’t have new technologies

developed.

Ex-Dividend Stocks: Best Dividend Paying Shares On August 30, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 18 stocks go ex dividend

- of which 4 yield more than 3 percent. The average yield amounts to 2.21%.

Here is a full list of all stocks with ex-dividend

date within the upcoming week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Six

Flags Entertainment

|

3.23B

|

10.16

|

8.01

|

2.99

|

5.33%

|

|

Orchids

Paper Products Company

|

216.68M

|

20.58

|

2.68

|

2.05

|

5.04%

|

|

Greenhill

& Co., Inc.

|

1.46B

|

27.97

|

5.71

|

4.55

|

3.68%

|

|

Arthur

J Gallagher & Co.

|

5.31B

|

23.19

|

3.12

|

1.91

|

3.35%

|

|

Avery

Dennison Corporation

|

4.30B

|

21.00

|

2.84

|

0.71

|

2.68%

|

|

Suncor

Energy Inc.

|

52.39B

|

20.23

|

1.34

|

1.41

|

2.24%

|

|

QUALCOMM

Incorporated

|

114.95B

|

17.70

|

3.06

|

4.94

|

2.10%

|

|

Interval

Leisure Group, Inc.

|

1.25B

|

20.56

|

4.01

|

2.56

|

2.02%

|

|

Xylem

Inc.

|

4.54B

|

19.61

|

2.21

|

1.22

|

1.92%

|

|

Forrester

Research Inc.

|

720.58M

|

33.90

|

3.31

|

2.46

|

1.77%

|

|

Computer

Sciences Corporation

|

7.49B

|

12.53

|

2.42

|

0.51

|

1.60%

|

|

Schlumberger

Limited

|

109.72B

|

17.70

|

2.97

|

2.45

|

1.51%

|

|

Joy

Global, Inc.

|

5.20B

|

7.17

|

1.81

|

0.95

|

1.43%

|

|

HSN,

Inc.

|

2.94B

|

20.74

|

6.30

|

0.88

|

1.31%

|

|

Imperial

Oil Ltd.

|

36.23B

|

11.77

|

2.17

|

1.18

|

1.10%

|

|

Alliant

Techsystems Inc.

|

3.13B

|

11.66

|

2.01

|

0.72

|

1.06%

|

|

Halliburton

Company

|

45.23B

|

24.95

|

2.95

|

1.58

|

1.02%

|

|

Itau Unibanco Holding S.A.

|

59.99B

|

9.08

|

1.57

|

2.03

|

0.66%

|

13 Cheap High Beta Basic Material Dividend Stocks

Cheap

high beta dividend stocks from the basic material sector originally published

at long-term-investments.blogspot.com. The basic material sector

is under fire. Nobody wants to go long on raw material producer or related

industries. The fear of a slowing growth in China with the result of cheaper

commodity prices is still aware.

The whole sector is down 3.1 percent over the recent six months while the best sector gained 17.9 percent during the same period. So many stocks can be bought for a single P/E within the sector but the risk is still high.

Today I would like to proceed my monthly screening serial about high beta dividend stocks. The basic material sector has a huge base of stock ideas on this field. In order to get the best results, I need to increase my limitations like this:

Thirteen companies fulfilled these criteria of which one is a High-Yield. All results have a current buy or better rating.

The whole sector is down 3.1 percent over the recent six months while the best sector gained 17.9 percent during the same period. So many stocks can be bought for a single P/E within the sector but the risk is still high.

Today I would like to proceed my monthly screening serial about high beta dividend stocks. The basic material sector has a huge base of stock ideas on this field. In order to get the best results, I need to increase my limitations like this:

- Market capitalization over USD 10 billion

- Forward P/E below 15

- 5Y future earnings per share growth over 15 percent yearly

- Beta ratio over 1

Thirteen companies fulfilled these criteria of which one is a High-Yield. All results have a current buy or better rating.

Ex-Dividend Stocks: Best Dividend Paying Shares On June 03, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 03,

2013. In total, 28 stocks and

preferred shares go ex dividend - of which 10 yield more than 3 percent. The

average yield amounts to 3.12%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

France

Telecom

|

27.76B

|

27.58

|

0.88

|

0.49

|

14.31%

|

|

|

Enerplus

Corporation

|

3.14B

|

-

|

1.01

|

2.72

|

6.82%

|

|

|

Cedar

Fair, L.P.

|

2.33B

|

23.28

|

14.65

|

2.18

|

5.97%

|

|

|

Ventas,

Inc.

|

21.34B

|

57.31

|

2.33

|

8.20

|

3.68%

|

|

|

Hancock

Holding Co.

|

2.45B

|

13.77

|

0.99

|

3.25

|

3.32%

|

|

|

Avery

Dennison Corporation

|

4.38B

|

23.79

|

2.80

|

0.72

|

2.64%

|

|

|

Stanley

Black & Decker, Inc.

|

12.99B

|

31.22

|

1.94

|

1.27

|

2.44%

|

|

|

QUALCOMM

Incorporated

|

110.89B

|

18.08

|

2.95

|

5.12

|

2.18%

|

|

|

Brown-Forman

Corporation

|

15.15B

|

26.27

|

9.97

|

5.43

|

1.97%

|

|

|

Flowers

Foods, Inc.

|

4.65B

|

22.27

|

4.92

|

1.42

|

1.90%

|

|

|

Nielsen

Holdings N.V.

|

12.67B

|

43.45

|

2.45

|

2.24

|

1.89%

|

|

|

Schlumberger

Limited

|

99.46B

|

18.52

|

2.79

|

2.31

|

1.67%

|

|

|

Everest

Re Group Ltd.

|

6.48B

|

7.41

|

0.95

|

1.29

|

1.48%

|

|

|

HSN,

Inc.

|

3.04B

|

23.03

|

6.47

|

0.92

|

1.27%

|

|

|

Halliburton

Company

|

39.73B

|

20.50

|

2.53

|

1.39

|

1.17%

|

|

|

Southwest

Airlines Co.

|

10.31B

|

27.98

|

1.50

|

0.60

|

1.12%

|

|

|

Compuware

Corporation

|

2.41B

|

34.48

|

2.30

|

2.49

|

1.10%

|

|

|

Itau Unibanco Holding S.A.

|

76.58B

|

10.96

|

1.84

|

2.62

|

0.59%

|

Subscribe to:

Comments (Atom)