20 Large Caps With High Aggressive Earnings Growth For The Mid-Term

Dividend investors focus on dividend payments but you need also a focus on growth.

Today I like to show you some of the highest growth large caps on the market. Intel bought the number one stock recently. Maybe you will find some attractive targets on the attached list.

But beware of the high valuation from most of the stocks. Consider only stocks with a good balance between high growth and modest valuation.

Here are the results from my high growth large cap screen...

10 Cheap Larg Cap Pharma Dividend Stocks

Given global market dynamics, I'm a big fan of investing in pharmaceutical companies right now. The aging western population and growth in developing countries will continue increasing drug demand for the foreseeable future. According to Centers for Medicare & Medicaid Services, prescription drug spending is projected to grow at an average of 6.3% per year through 2025.

What I also like about pharmaceutical stocks is that an investor doesn't have to choose between growth and income. It's possible to invest in a company that is growing faster than the overall market but also consistently returning a significant amount of capital to shareholders.

Attached, I've compiled stocks from the pharma drug, generic drug and major drug manufacturing industry with a low forward P/E. I like some of them, especially ABBVIE, PFIZER and NOVO NORDISK.

What are your favorites?

What I also like about pharmaceutical stocks is that an investor doesn't have to choose between growth and income. It's possible to invest in a company that is growing faster than the overall market but also consistently returning a significant amount of capital to shareholders.

Attached, I've compiled stocks from the pharma drug, generic drug and major drug manufacturing industry with a low forward P/E. I like some of them, especially ABBVIE, PFIZER and NOVO NORDISK.

What are your favorites?

19 Best European Dividend Stocks

The table below lists the 19 European dividend stocks most widely held in at least a third of the European dividend-focused mutual funds. In other words, the stocks listed in the table are held as a Top 30 holding by at least 6 of the 16 funds studied. In addition, the table also shows the subset of Morningstar 4- and 5-star rated funds that hold the same stocks.

5 Simple Great And Safe Dividend Growth Stocks

Dividend growth stocks offer the best of both worlds -- potential for capital appreciation and rising income even in a volatile market. This is because these stocks belong to mature companies, which are less susceptible to large swings in the market, while simultaneously offer outsized payouts or sizable yields on a regular basis irrespective of the market direction.

Additionally, these companies have a sustainable business model and enjoy competitive advantages, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics.

All these superior fundamentals make dividend growth stocks quality and promising investments for the long term. Further, a history of strong dividend growth indicates that a future hike is likely. This makes the portfolio healthy and safe.

Attached you will find a 5 stocks that might be a great asset for your portfolio...

Additionally, these companies have a sustainable business model and enjoy competitive advantages, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics.

All these superior fundamentals make dividend growth stocks quality and promising investments for the long term. Further, a history of strong dividend growth indicates that a future hike is likely. This makes the portfolio healthy and safe.

Attached you will find a 5 stocks that might be a great asset for your portfolio...

12 Good Dividend Growth Investments Now

Someone recently asked me to "let them know what my next investment was going to be, so they could get in at the price I pay." I usually keep a running list of dividend stocks that I want to buy, along with target prices, but I hadn't updated the list in a while. So I decided to do a little research and see what sort of compelling buys I could find in today's environment.

I used the following screening filters to give me a starting list of dividend growth stocks that I might want to consider:

Yield between 4% and 8%

1-year dividend growth rate at least 10%

Recent average dividend growth rate at least 8%

Exclude All MLPs

These were the results...

I used the following screening filters to give me a starting list of dividend growth stocks that I might want to consider:

Yield between 4% and 8%

1-year dividend growth rate at least 10%

Recent average dividend growth rate at least 8%

Exclude All MLPs

These were the results...

19 Dividend Aristocrast With Buy Rating And Low Forward P/E's

Finding a company with a long track record of consistent dividend payments is only part of the winning formula for investing in dividend stocks. Dividend growth matters, too. Rising dividends not only make a stock more attractive to new income investors, but steady dividend hikes also reward existing investors with increasingly higher yields on shares purchased at lower prices in the past.

It's an opportune time to target dividend growers, according to Heidi Richardson, an investment strategist for BlackRock. Companies raising dividends are attractive in an aging bull market, when the pace of shareholder-friendly stock buybacks and mergers can slow. Dividend growers, she adds, can also offer an edge when interest rates are going up: "Stocks with a history of consistently growing their dividends have historically tended to perform well and exhibit less volatility in a rising-rate environment." Kiplinger expects at least two Federal Reserve rate hikes in 2017.

Identify reliable dividend stocks by concentrating on the Dividend Aristocrats, 50 companies in Standard & Poor's 500-stock index that have hiked their dividends every year for at least 25 consecutive years.

Since size, longevity and familiarity can provide comfort amid market uncertainty, here are the 25 biggest Dividend Aristocrats by market capitalization. Dominated by household names, the list is a good starting point to find high-quality companies for your long-term portfolio.

It's an opportune time to target dividend growers, according to Heidi Richardson, an investment strategist for BlackRock. Companies raising dividends are attractive in an aging bull market, when the pace of shareholder-friendly stock buybacks and mergers can slow. Dividend growers, she adds, can also offer an edge when interest rates are going up: "Stocks with a history of consistently growing their dividends have historically tended to perform well and exhibit less volatility in a rising-rate environment." Kiplinger expects at least two Federal Reserve rate hikes in 2017.

Identify reliable dividend stocks by concentrating on the Dividend Aristocrats, 50 companies in Standard & Poor's 500-stock index that have hiked their dividends every year for at least 25 consecutive years.

Since size, longevity and familiarity can provide comfort amid market uncertainty, here are the 25 biggest Dividend Aristocrats by market capitalization. Dominated by household names, the list is a good starting point to find high-quality companies for your long-term portfolio.

My Favorite Dividend Paying Buyback Hero Stocks

As you might know, I am a big fan of dividend growth and stock buybacks. Each action is a shareholder friendly way to give money back to the owner of the company.

Dividends are direct and share buybacks are indirect and more tax efficient. Both activities only make sense if the management team has a clear view about the valuation and growth perspectives or potential of the corporation. If there is an opportunity to grow with low risk, dividends shouldn't be paid in a big way. The same is neccessary for buybacks. There must be a mix of both in balance with growth.

Today I like to share a sheet of interesting stocks with good outstanding buyback programs. I've focused my research on growth and dividends while the valuation level doesn't exceed critical levels.

Here are my results...

6 Potential Stocks To Benefit From A Trump Policy

For deep value investors, the U.S. stock market offers slim pickings. A quick glance at the Russell 1000 Value Index will tell you that large capitalization, U.S., companies are not cheap at a price-to-earnings ratio of 19 times.

The S&P 500 is up almost 2.8% since the beginning of February and up over 8% since Donald Trump was elected President. Consequently, it is important to focus on stocks with two characteristics: an attractive relative valuation and sensitivity to policy changes.

The Trump administration has promised to cut corporate regulations and tax rates, and engage in massive fiscal stimulus. Assuming those policy changes can be implemented they are naturally bullish for the stock market. The key is to find companies that are likely to be benefit asymmetrically for those policy changes and which do not already carry unreasonable valuations.

Attached you will find a couple of stocks that might be interesting in this enviroment. I run a screen with a main focus on valuation and growth.

These were my results...maybe you agree. There are some names on the list that are not popular but might be interesting in terms of free cash flow.

Here are the results...

The S&P 500 is up almost 2.8% since the beginning of February and up over 8% since Donald Trump was elected President. Consequently, it is important to focus on stocks with two characteristics: an attractive relative valuation and sensitivity to policy changes.

The Trump administration has promised to cut corporate regulations and tax rates, and engage in massive fiscal stimulus. Assuming those policy changes can be implemented they are naturally bullish for the stock market. The key is to find companies that are likely to be benefit asymmetrically for those policy changes and which do not already carry unreasonable valuations.

Attached you will find a couple of stocks that might be interesting in this enviroment. I run a screen with a main focus on valuation and growth.

These were my results...maybe you agree. There are some names on the list that are not popular but might be interesting in terms of free cash flow.

Here are the results...

My Favorite Dividend Contenders For March 2017

With a new month close at hand, it is time, once again, for me to lay out some of my stock considerations for the next several weeks of March.

The point of these posts is to help take some of the guesswork out of where I plan to allocate my fresh capital going forward. By making my selections ahead of time, I find it easier to commit to buys, as all the homework and investment theses have already been completed on my end.

All that's left to do is pull the "buy" trigger. These days, it seems easier said than done as the market - and many stocks I am considering - continue to march higher. I am finding it increasingly difficult to decide where I'd like to allocate my fresh capital.

Rest assured, I will be making at least one buy in March, as I aim to stick to my own mantra of remaining consistent with my buys during all market conditions.

I have no intentions of breaking my streak of making monthly buys. That being said, as I look at my portfolio, I am left with a handful of potential choices for the month of March.

Here are my favorite Dividend Contenders...

The point of these posts is to help take some of the guesswork out of where I plan to allocate my fresh capital going forward. By making my selections ahead of time, I find it easier to commit to buys, as all the homework and investment theses have already been completed on my end.

All that's left to do is pull the "buy" trigger. These days, it seems easier said than done as the market - and many stocks I am considering - continue to march higher. I am finding it increasingly difficult to decide where I'd like to allocate my fresh capital.

Rest assured, I will be making at least one buy in March, as I aim to stick to my own mantra of remaining consistent with my buys during all market conditions.

I have no intentions of breaking my streak of making monthly buys. That being said, as I look at my portfolio, I am left with a handful of potential choices for the month of March.

Here are my favorite Dividend Contenders...

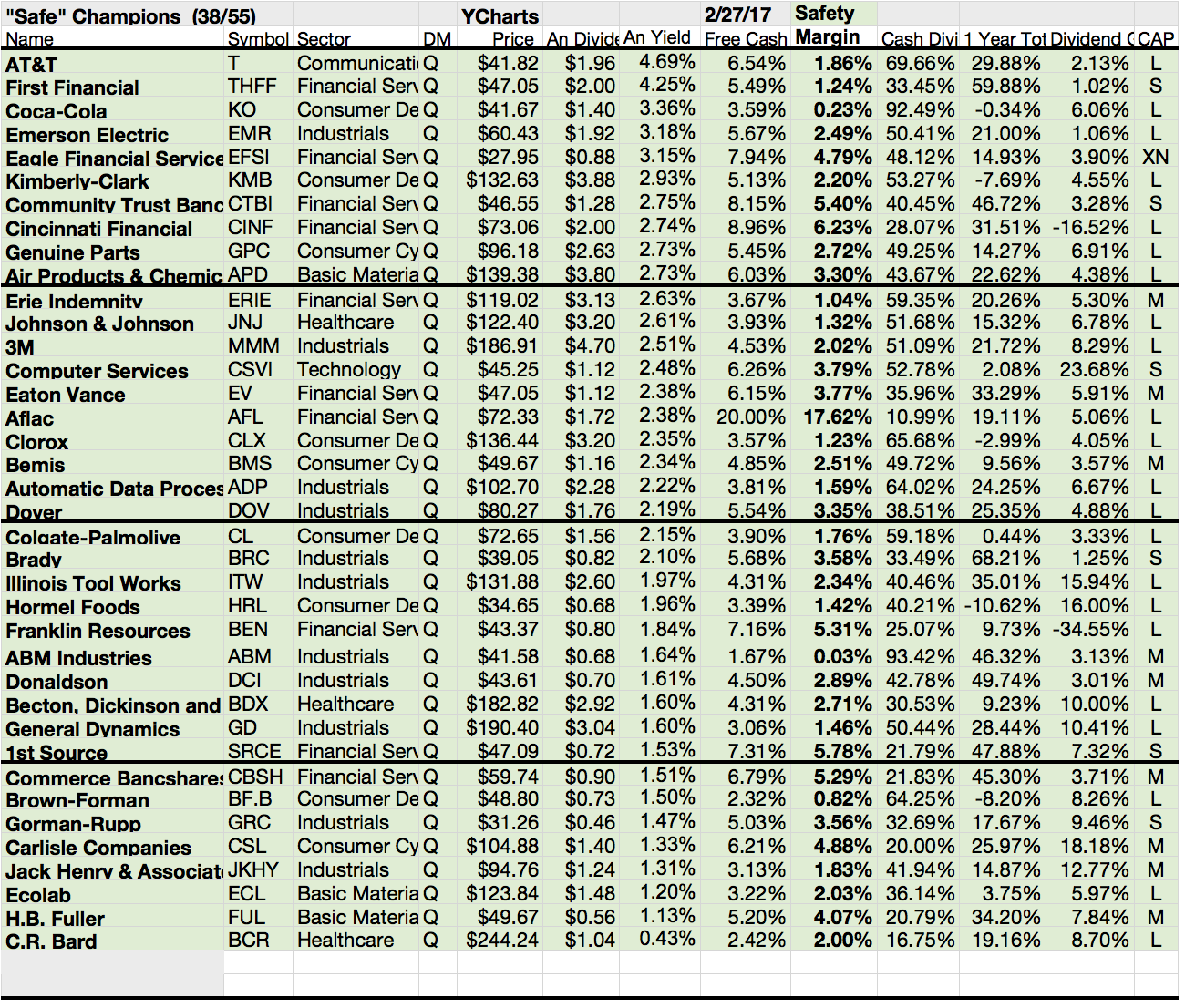

My Favorite Dividend Champions As Of March 2017

In the beginning of the first Quarter of the year, many investors review their portfolios and adjust the basic risks. We all hope for a good year on the market and, most importantly, steady dividend growth increase among our portfolio.

I selected a couple of companies with long-term dividend growth growth of which I think they will perform well in 2017 and will increase their dividend payouts.

My main criteria are the following onces:

- Dividend Champion

- Debt-to-Equity under 1

- 5 Year EPS Growth over 5%

- Forward P/E under 20

- Positive Past Sales growth

18 Stocks from the Dividend Champs List remain. Maybe you agree or not. Please leave a comment about your thoughts related to the list.

Here are my favorite Dividend Champs for March 2017...

I selected a couple of companies with long-term dividend growth growth of which I think they will perform well in 2017 and will increase their dividend payouts.

My main criteria are the following onces:

- Dividend Champion

- Debt-to-Equity under 1

- 5 Year EPS Growth over 5%

- Forward P/E under 20

- Positive Past Sales growth

18 Stocks from the Dividend Champs List remain. Maybe you agree or not. Please leave a comment about your thoughts related to the list.

Here are my favorite Dividend Champs for March 2017...

Subscribe to:

Posts (Atom)