Long-Term Dividend Income Stocks With Great Growth Figures by Dividend Yield - Stock, Capital, Investment. Here is a current overview of dividend stocks with long-term double digit earnings and sales growth. In addition, the companies created value due to a return on investment of more than 10 percent over the past five years. These are the criteria in detail:

Dividend Yield: Over 2 percent

5-Year Return On Investment: Over 10 percent

10-Year Sales Growth: More than 15 percent

10-Year Earnings per Share growth: Above 20 percent

The results are impressive. There are five high yields available and 7 have a buy or better recommendation outstanding. The only stock with a strong buy rating is Mobile Telesystems (MBT). The company has a current yield of 6.41 percent and has also the biggest sales growth in our screen. The biggest income growth was realized by American Science & Engineering (ASEI) with an earnings per share growth of 43 percent yearly. However, the most profitable companies are Strayer Education (STRA) and Southern Copper (SCCO).

Here are my favorite stocks:

Strayer Education (NASDAQ:STRA) has a market capitalization of $1.34 billion. The company employs 2,099 people, generates revenues of $636.73 million and has a net income of $131.26 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $233.08 million. Because of these figures, the EBITDA margin is 36.61 percent (operating margin 33.89 percent and the net profit margin finally 20.61 percent).

Financial Analysis:

The total debt representing 0.00 percent of the company’s assets and the total debt in relation to the equity amounts to 0.00 percent. Due to the financial situation, a return on equity of 71.76 percent was realized. Twelve trailing months earnings per share reached a value of $9.25. Last fiscal year, the company paid $3.25 in form of dividends to shareholders.

Market Valuation:

Here are the price ratios of the company: The P/E ratio is 12.08, Price/Sales 2.23 and Price/Book ratio 8.95. Dividend Yield: 3.43 percent. The beta ratio is 0.72.

|

| Long-Term Stock History Chart Of Strayer Education, Inc. (Click to enlarge) |

|

| Long-Term Dividends History of Strayer Education, Inc. (STRA) (Click to enlarge) |

|

| Long-Term Dividend Yield History of Strayer Education, Inc. (NASDAQ: STRA) (Click to enlarge) |

Companhia de Bebidas das Americas (NYSE:ABV) has a market capitalization of $115.67 billion. The company employs 44,924 people, generates revenues of $14,337.10 million and has a net income of $4,329.09 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6,497.78 million. Because of these figures, the EBITDA margin is 45.32 percent (operating margin 39.72 percent and the net profit margin finally 30.20 percent).

Financial Analysis:

The total debt representing 15.87 percent of the company’s assets and the total debt in relation to the equity amounts to 27.80 percent. Due to the financial situation, a return on equity of 32.61 percent was realized. Twelve trailing months earnings per share reached a value of $1.50. Last fiscal year, the company paid $0.88 in form of dividends to shareholders.

Market Valuation:

Here are the price ratios of the company: The P/E ratio is 24.81, Price/Sales 7.19 and Price/Book ratio 8.32. Dividend Yield: 4.01 percent. The beta ratio is 0.98.

|

| Long-Term Stock History Chart Of Companhia de Bebidas d... (Click to enlarge) |

|

| Long-Term Dividends History of Companhia de Bebidas d... (ABV) (Click to enlarge) |

|

| Long-Term Dividend Yield History of Companhia de Bebidas d... (NYSE: ABV) (Click to enlarge) |

Southern Copper Corp. (NYSE:SCCO) has a market capitalization of $30.28 billion. The company employs 11,126 people, generates revenues of $5,149.50 million and has a net income of $1,562.71 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $2,885.90 million. Because of these figures, the EBITDA margin is 56.04 percent (operating margin 50.57 percent and the net profit margin finally 30.35 percent).

Financial Analysis:

The total debt representing 33.96 percent of the company’s assets and the total debt in relation to the equity amounts to 70.95 percent. Due to the financial situation, a return on equity of 40.02 percent was realized. Twelve trailing months earnings per share reached a value of $2.70. Last fiscal year, the company paid $1.68 in form of dividends to shareholders.

Market Valuation:

Here are the price ratios of the company: The P/E ratio is 13.32, Price/Sales 5.89 and Price/Book ratio 7.89. Dividend Yield: 6.96 percent. The beta ratio is 1.63.

|

| Long-Term Stock History Chart Of Southern Copper Corp. (Click to enlarge) |

|

| Long-Term Dividends History of Southern Copper Corp. (SCCO) (Click to enlarge) |

|

| Long-Term Dividend Yield History of Southern Copper Corp. (NYSE: SCCO) (Click to enlarge) |

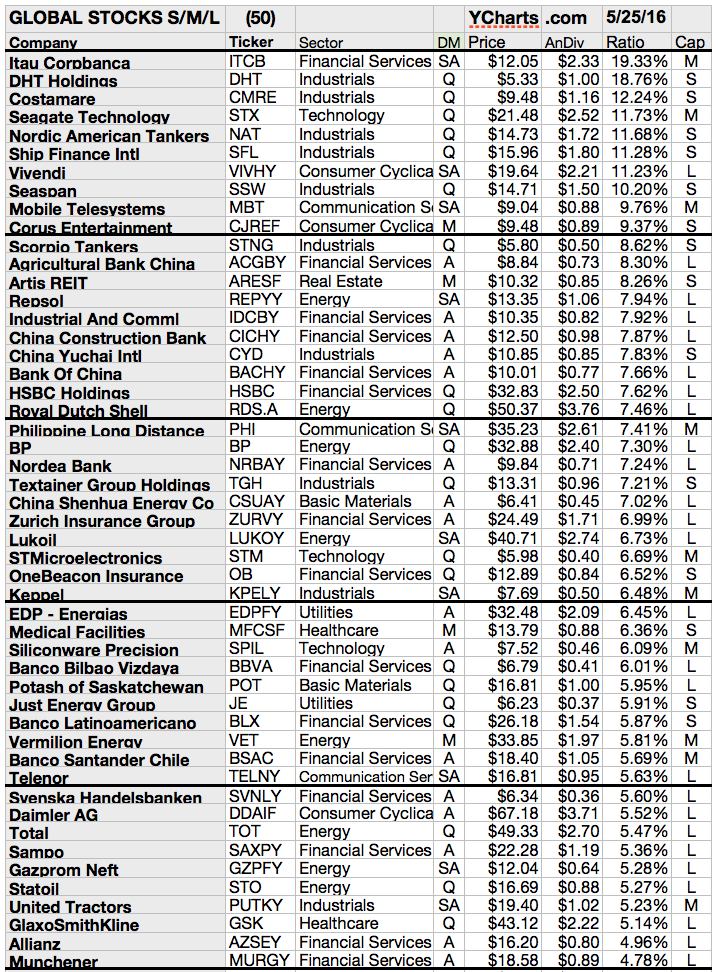

Take a closer look at the full table. The average price to earnings ratio (P/E ratio) amounts to 10.91. The dividend yield has a value of 4.88 percent. Price to book ratio is 3.78 and price to sales ratio 4.88. The operating margin amounts to 28.81 percent.

Here is the full table with some fundamentals (TTM):

|

| 15 Most Impressive Dividend Growth Stocks (Click to enlarge) |

Related stock ticker symbols:

SXL, VALE, SCCO, MBT, QCCO, ARLP, ABV, YZC, STRA, RES, CYD, BBL, ASEI, BHP, MANT

Selected Articles:

* I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.