Find below a list of Agribusiness Stocks. The agribusiness portfolio includes stocks engaged in activities related to growing crops, processing grains, and producing food.

This list is only a small part of the full Dividend Yield Investor Fact Book Collection you can get for a small donation.

The full package contains excel sheets with essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth) and 204 Dividend Contenders (10 to 24 years of consecutive dividend growth). It's an open version, so you can work with it very easily and do your own research.

Help us by giving to our work here. When you make a little donation, you will instantly receive our latest Dividend Yield Factbook Package as a thank you gift.

| Ticker | Company | Market Cap | P/E | P/S | P/B | Dividend | Get the PDF… |

| BG | Bunge Limited | 9.62B | 111.4 | 0.21 | 1.5 | 2.93% | Security Analysis of BG |

| ADM | Archer-Daniels-Midland Company | 26.66B | 24.31 | 0.43 | 1.42 | 2.83% | Security Analysis of ADM |

| INGR | Ingredion Incorporated | 7.20B | 13.12 | 1.23 | 2.37 | 2.41% | Security Analysis of INGR |

| DWDP | DowDuPont Inc. | 157.67B | 114.2 | 2.23 | 1.56 | 2.23% | Security Analysis of DWDP |

| DE | Deere & Company | 44.98B | 17.17 | 1.34 | 4.3 | 2.00% | Security Analysis of DE |

| ANDE | The Andersons, Inc. | 986.84M | - | 0.28 | 1.21 | 1.92% | Security Analysis of ANDE |

| FMC | FMC Corporation | 12.00B | 27.15 | 3.43 | 4.02 | 0.74% | Security Analysis of FMC |

| AVD | American Vanguard Corporation | 688.29M | 34.84 | 1.77 | 1.98 | 0.38% | Security Analysis of AVD |

| IPI | Intrepid Potash, Inc. | 533.60M | - | 3.28 | 1.3 | - | Security Analysis of IPI |

| SEED | Origin Agritech Limited | 217.25M | - | - | 1.23 | - | Security Analysis of SEED |

This list is only a small part of the full Dividend Yield Investor Fact Book Collection you can get for a small donation.

The full package contains excel sheets with essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth) and 204 Dividend Contenders (10 to 24 years of consecutive dividend growth). It's an open version, so you can work with it very easily and do your own research.

A donation from you can helps us to develop this books and improve the quality of the work. Together we can make the world a better and smarter place. A place with no information advantage between poor and rich persons who have enough budget to buy the expensive data from Reuters and Bloomberg.

The Dividend Yield Fact Book compilation contains the following books and one Excel File with financial ratios from all Dividend Champions and Dividend Contenders. Here is what you get for your donation:

Monthly updated Factbooks and Excelsheets

- Foreign Yield Fact Book - 42 Pages PDF

- World Index Yield Fact Book - 35 Pages PDF

- Dividend Growth Stock Fact Book - 32 Pages PDF

- World Index Yield Fact Book - 35 Pages PDF

- Dividend Growth Stock Fact Book - 32 Pages PDF

- Dividend Growth Excel Sheet of Dividend Champions and Dividend Contenders

These books and Excel Sheets are frequently updated and keeps you up-to date with current yield figures from the best Dividend Growth Stocks. Here is a preview of the content:

There is no donation minimum or limit. You can choose the donation amount you want to give. The more you support us, the more we can create and give back to you. We think this is a fair deal.

Donate to the our Factbooks because investor education and learning can’t wait.

A small donation will help us to create in distribute more and more high-quality content for investors and students.

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us to support people with no income or big budget to get free and easy information on the web. Thank you.

#1 Get an overview about the best yielding stocks of the world with the Foreign Yield Database for a special country

Check out more details here: Foreign Yield Factbook and Excelsheet.

Here is a preview of Canada:

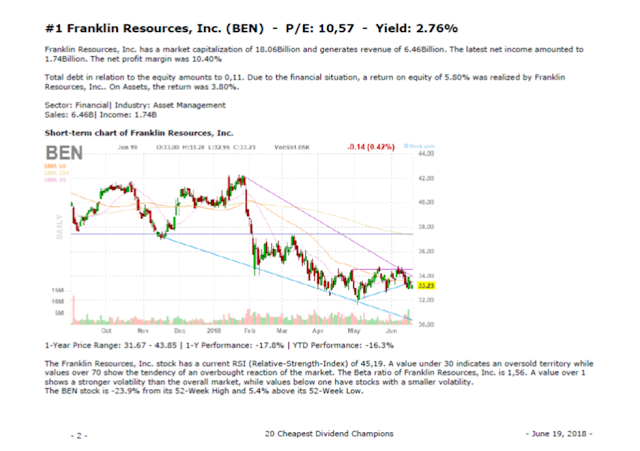

#2 Receive Corporate Factbooks from Dividend Champions to stay up-to-date

See more details here: Corporate Factbooks

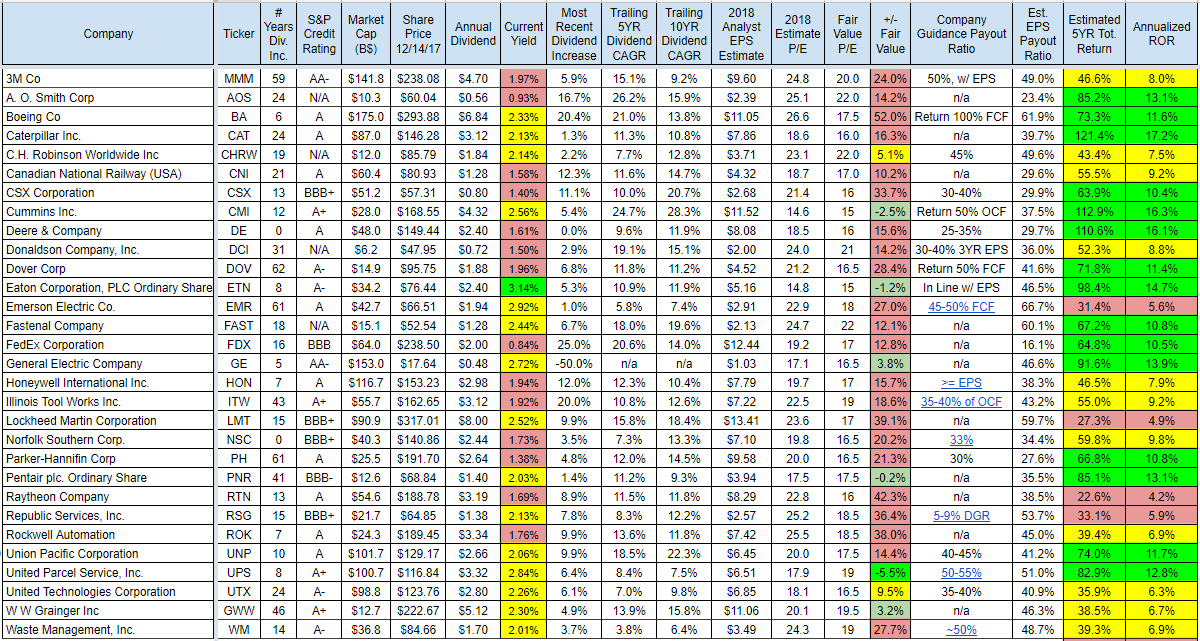

#3 - Get Factbook Compilations around interesting investing themes like Dogs of the Dow

Find more details here: Factbook compilation around investment themes

Here is a preview of the 20 Cheapest Dividend Champions:

These books and Excel Sheets are frequently updated and keeps you up-to date with current yield figures from the best Dividend Growth Stocks. Here is a preview of the content:

There is no donation minimum or limit. You can choose the donation amount you want to give. The more you support us, the more we can create and give back to you. We think this is a fair deal.

Donate to the our Factbooks because investor education and learning can’t wait.

A small donation will help us to create in distribute more and more high-quality content for investors and students.

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us to support people with no income or big budget to get free and easy information on the web. Thank you.

----Bonus for your donation----

Special Reports if released:

#1 Get an overview about the best yielding stocks of the world with the Foreign Yield Database for a special country

Check out more details here: Foreign Yield Factbook and Excelsheet.

Here is a preview of Canada:

#2 Receive Corporate Factbooks from Dividend Champions to stay up-to-date

See more details here: Corporate Factbooks

#3 - Get Factbook Compilations around interesting investing themes like Dogs of the Dow

Find more details here: Factbook compilation around investment themes

Here is a preview of the 20 Cheapest Dividend Champions:

You get all this stuff for a small donation. There is no minimum or limit to donate. You can choose how much you like to support us. The more you give, the more we can give back to you. That's a fair deal in our view.

Thank you very much for your help. Thank YOU, it's a great pleasure!!!