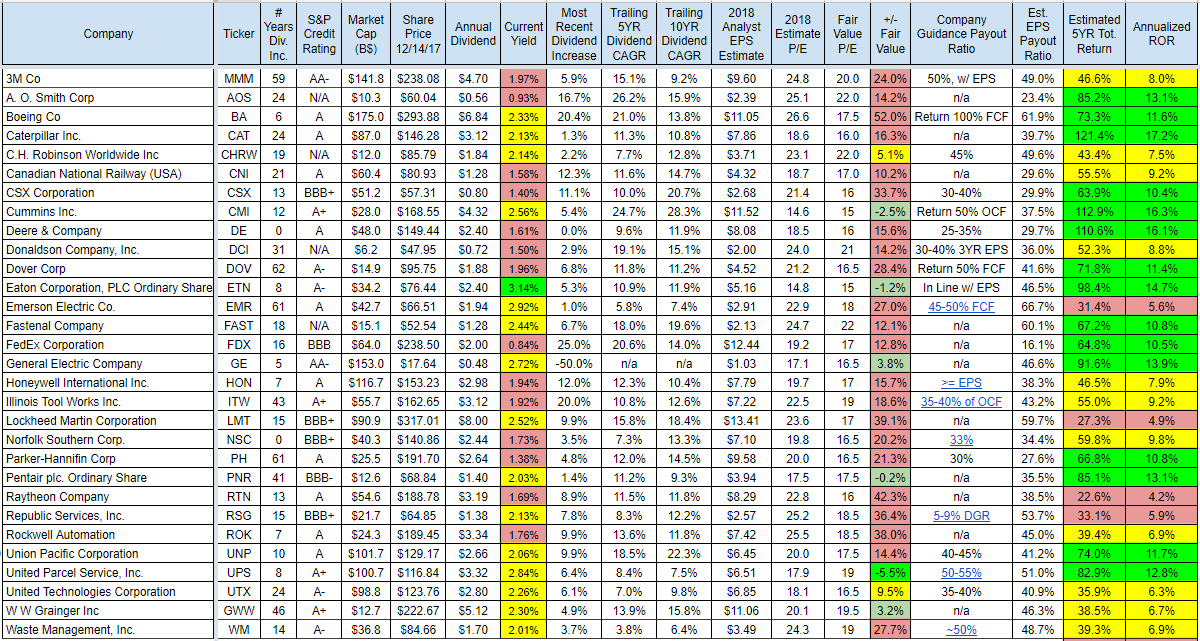

The companies on this list were originally selected based on their track records of dividend growth, financial ratings, and earnings growth.

Showing posts with label HON. Show all posts

Showing posts with label HON. Show all posts

24 Dividend Growth Stocks With Solid Yields To Consider

Dividend growth is a wonderful thing, but you should also require the stocks you buy to look cheap. Here I seek out stocks trading at multiples of price to sales, earnings, and cash flow lower than five-year averages.

Stocks that trade at discounted valuations can be cheap for a reason, so I also require expected sales growth for the year ahead to be positive. Using these criteria, the 24 stocks shown in the table have proven themselves to be “dividend growth superstars” that kept on paying and even raising their dividends through the 2008-2009 financial crisis. They also trade at historically cheap valuations on at least two of the three ratios I use to determine value: price/sales, price/earnings, and price/cash flow.

If you follow a strategy of investing in temporarily cheap stocks of companies that habitually hike their dividends, not only will you experience significant capital gains when the stock falls back into favor with the market, but the yield you earn on your original investment can balloon to downright plump proportions.

These are the results...

Stocks that trade at discounted valuations can be cheap for a reason, so I also require expected sales growth for the year ahead to be positive. Using these criteria, the 24 stocks shown in the table have proven themselves to be “dividend growth superstars” that kept on paying and even raising their dividends through the 2008-2009 financial crisis. They also trade at historically cheap valuations on at least two of the three ratios I use to determine value: price/sales, price/earnings, and price/cash flow.

If you follow a strategy of investing in temporarily cheap stocks of companies that habitually hike their dividends, not only will you experience significant capital gains when the stock falls back into favor with the market, but the yield you earn on your original investment can balloon to downright plump proportions.

These are the results...

10 Dividend Stocks For A Rate Rise

Recent economic data could cause the Federal Reserve to raise interest rates. When this will happen is anybody's guess.

When it does happens, however, stocks with big valuations could see a lot more volatility.

In building a portfolio or planning for retirement, we need to be ready. Here are some options.

This group of safe dividend stocks won't necessarily impress you with their dividend yields, but they offer attractive value. The key is their low payout ratios and rapid dividend growth.

If and when interest rates increase, these 10 dividend stocks could be a reasonably safe place to be.

Here are the results....

When it does happens, however, stocks with big valuations could see a lot more volatility.

In building a portfolio or planning for retirement, we need to be ready. Here are some options.

This group of safe dividend stocks won't necessarily impress you with their dividend yields, but they offer attractive value. The key is their low payout ratios and rapid dividend growth.

If and when interest rates increase, these 10 dividend stocks could be a reasonably safe place to be.

Here are the results....

156 October Dividend Growth Stocks Compilation

Dividend growth investing is a popular model followed by the investing community to build assets.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns. A big part of this involves capturing the details.

As part of my due diligence, I closely monitor all companies that raise dividends (or cut them) and this article shares the dividend amount changes announced by companies.

Note that only companies with a market cap of $2B+ are included, as the list of small/micro cap companies is too long to include here.

October dividend raises and can be found here...

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns. A big part of this involves capturing the details.

As part of my due diligence, I closely monitor all companies that raise dividends (or cut them) and this article shares the dividend amount changes announced by companies.

Note that only companies with a market cap of $2B+ are included, as the list of small/micro cap companies is too long to include here.

October dividend raises and can be found here...

18 Industrial Stocks I Love To Buy

I am personally finding plenty of interesting bargains and reasonable valuations in the industrial sector these days, one of the few places they exist.

Dividend investors might be tired of investing in the same old consumer staples or consider those trades too crowded to invest new money into. So where do they go?

Below I have outlined a few interesting industrial plays that have very cheap or reasonable valuations and competitive yields or future dividend growth prospects if the current yield is very low.

Here are the top yielding results...

Dividend investors might be tired of investing in the same old consumer staples or consider those trades too crowded to invest new money into. So where do they go?

Below I have outlined a few interesting industrial plays that have very cheap or reasonable valuations and competitive yields or future dividend growth prospects if the current yield is very low.

Here are the top yielding results...

20 Stocks With A Billion Dollar Buyback Program And Yields Over 2%

Let me ask you this: Would you rather buy a 10-year Treasury, which currently yields about 2%, or would you rather buy a large-cap stock with a 2% dividend yield, a billion-dollar stock buyback program, and share appreciation potential?

With bond yields as low as they are, there's no contest. The Fed's zero interest rate policy has created a situation where there's nowhere to go except the stock market.

Of course, the story will change once the Fed raises interest rates, which will make it more expensive for companies to borrow on the bond market. So there is a raging debate about when that will happen.

It is always better to own stocks in such situations. Those can hedge you against inflation. Fur sure, stocks are risky but if you look at the values of a company, and you avoid the big risks by not taking very cyclic stocks into your portfolio, you should be rewarded with a solid return.

Here are some alternatives with yields over 2% and a current buyback program worth over a billion dollar...

With bond yields as low as they are, there's no contest. The Fed's zero interest rate policy has created a situation where there's nowhere to go except the stock market.

Of course, the story will change once the Fed raises interest rates, which will make it more expensive for companies to borrow on the bond market. So there is a raging debate about when that will happen.

It is always better to own stocks in such situations. Those can hedge you against inflation. Fur sure, stocks are risky but if you look at the values of a company, and you avoid the big risks by not taking very cyclic stocks into your portfolio, you should be rewarded with a solid return.

Here are some alternatives with yields over 2% and a current buyback program worth over a billion dollar...

8 Best Stocks For Retirement Investors

We went hunting for dividend stocks that meet two conditions important to many retirees: first, low risk that the dividend could be cut, and second, reasonable expectations for long-term dividend growth as well as share price gains.

We found eight names worth considering, depending on your goals and risk tolerance. Some offer relatively high yields but slow dividend-growth prospects; some offer lower yields but strong growth prospects; and others are in the middle ground, with decent yields and good growth prospects.

Here are the results...

We found eight names worth considering, depending on your goals and risk tolerance. Some offer relatively high yields but slow dividend-growth prospects; some offer lower yields but strong growth prospects; and others are in the middle ground, with decent yields and good growth prospects.

Here are the results...

This Well Diversified Global Industrial Stock Portfolio Generated 9.84% Yearly

There is only a small way to make money with dividend paying stocks. If we look at the past performances, we can easily discover those stocks that generated a long-term return for investors.

Industrials were some of them. You made not tons of money but a solid return for your retirement portfolio. The great disadvantage for industrials is that they are more cyclic. They measure the economic activity and health of the global economy.

However, a portfolio of the top industrials generated an annual return of 9.84% during the past decade. Attached you can find 11 members of the global diversified industrial portfolio that pay solid dividends.

Those are some of the best picks from the industrial sector you can find.

Industrials were some of them. You made not tons of money but a solid return for your retirement portfolio. The great disadvantage for industrials is that they are more cyclic. They measure the economic activity and health of the global economy.

However, a portfolio of the top industrials generated an annual return of 9.84% during the past decade. Attached you can find 11 members of the global diversified industrial portfolio that pay solid dividends.

Those are some of the best picks from the industrial sector you can find.

These are the results...

10 Potential Dividend Champs With An Impressing Outperformance

It's hard to find good managed stocks that work with backwind and develop their industy as a leader. Out there a several stocks with an impressive performance in the past. They lead their industy and have a major footprint and big market share against their competition. I'm talking about Apple or Nike. Those stocks are an expression of the working American capitalism.

Well, I look for rising earnings and cash flow because without those variables, dividends can't grow long term. I also look for low payout ratios and reasonable debt loads. Without further ado, here are my 10 potential Dividend Champions listed in order of current dividend growth streaks. What do you think? Do you agree with me in some of the results?

Here are the stocks....

Well, I look for rising earnings and cash flow because without those variables, dividends can't grow long term. I also look for low payout ratios and reasonable debt loads. Without further ado, here are my 10 potential Dividend Champions listed in order of current dividend growth streaks. What do you think? Do you agree with me in some of the results?

Here are the stocks....

12 Stocks With A Fantastic Dividend History But Partly Flat Dividends (Part II)

A growing dividend is the basis for future wealth if they will be paid regular and grown over years.

Dividend growth investors focus on this issue and have strong efforts when selecting a stock.

Recently, I wrote about stocks with a wonderful dividend history but they are not part of the Dividend Champions League due to the fact that they have run its dividends flat for a while.

In my view, it's not a reason why you should not own the company. I've selected a few great names and hope you can find some inpirational ideas.

These are the results....

Dividend growth investors focus on this issue and have strong efforts when selecting a stock.

Recently, I wrote about stocks with a wonderful dividend history but they are not part of the Dividend Champions League due to the fact that they have run its dividends flat for a while.

In my view, it's not a reason why you should not own the company. I've selected a few great names and hope you can find some inpirational ideas.

These are the results....

82 Shareholder Friendly Stocks of the Week

Below

are the top dividend growth stocks and share buyback companies of the week. On

the list are some pretty good yielding stocks. Big names like Starbucks,

Emerson Electric or Honeywell.

AIG, Motorola and Royal Caribbean Cruises are the

biggest stocks with a fresh buyback announcement during the past week.

Cheap is a question of growth. A faster growing

company can be higher valuated. Only 17 of the stocks have a forward P/E of

less than 15.

The 7 Top Dividend Growth Stocks Of the past Week are...

6 Stocks With New Billion Share Buyback Announcements

I love dividends, growth and also share buybacks.

Good companies pay half of its net income via dividends to shareholders and the second half should be invested in own shares in order to increase the share of all investors of the company. It's a very tax-efficent way to create shareholder value if the corporate don't overpay it's own intrinsic value.

Today would like to present you six of the latest stocks with over a billion in refreshed or new share buyback programs. The amounts are limited for the next five years or so.

Good companies pay half of its net income via dividends to shareholders and the second half should be invested in own shares in order to increase the share of all investors of the company. It's a very tax-efficent way to create shareholder value if the corporate don't overpay it's own intrinsic value.

Today would like to present you six of the latest stocks with over a billion in refreshed or new share buyback programs. The amounts are limited for the next five years or so.

Ex-Dividend Stocks: Best Dividend Paying Shares On August 16, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should

have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks August 16,

2013. In total, 28 stocks go ex

dividend - of which 6 yield more than 3 percent. The average yield amounts to 3.31%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Macerich

Co.

|

8.25B

|

33.89

|

2.73

|

8.83

|

3.87%

|

|

|

Manulife

Financial Corporation

|

32.88B

|

22.00

|

1.44

|

1.64

|

2.99%

|

|

|

Teva

Pharmaceutical Industries

|

33.83B

|

83.02

|

1.57

|

1.69

|

2.74%

|

|

|

Bemis

Company, Inc.

|

4.28B

|

22.85

|

2.69

|

0.84

|

2.50%

|

|

|

Walgreen

Co.

|

47.82B

|

22.23

|

2.52

|

0.67

|

2.50%

|

|

|

ResMed

Inc.

|

6.95B

|

23.20

|

4.32

|

4.59

|

2.05%

|

|

|

Energizer

Holdings Inc.

|

6.21B

|

15.02

|

2.69

|

1.37

|

2.01%

|

|

|

Honeywell

International Inc.

|

65.65B

|

20.79

|

4.77

|

1.73

|

1.97%

|

|

|

Spectrum

Brands Holdings, Inc.

|

3.33B

|

-

|

3.71

|

0.88

|

1.56%

|

|

|

Bunge

Limited

|

11.51B

|

39.31

|

1.19

|

0.18

|

1.53%

|

|

|

Timken

Co.

|

5.75B

|

18.56

|

2.49

|

1.30

|

1.53%

|

|

|

Moody's

Corp.

|

14.56B

|

19.61

|

32.59

|

4.97

|

1.22%

|

|

|

The

Babcock & Wilcox Company

|

3.45B

|

15.13

|

3.56

|

1.03

|

1.04%

|

|

|

Woodward,

Inc.

|

2.87B

|

21.00

|

2.70

|

1.51

|

0.76%

|

|

|

QEP

Resources, Inc.

|

5.22B

|

35.49

|

1.53

|

1.94

|

0.27%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On May 16, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks May 16,

2013. In total, 22 stocks and

preferred shares go ex dividend - of which 9 yield more than 3 percent. The

average yield amounts to 4.43%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Seaspan

Corp.

|

1.45B

|

28.52

|

1.15

|

2.19

|

5.48%

|

|

|

Giant

Interactive Group

|

1.92B

|

11.96

|

3.73

|

5.47

|

5.24%

|

|

|

Select

Medical Holdings

|

1.15B

|

8.22

|

1.55

|

0.39

|

4.87%

|

|

|

Atmos

Energy Corporation

|

4.02B

|

17.22

|

1.58

|

1.17

|

3.15%

|

|

|

PartnerRe

Ltd.

|

5.32B

|

6.15

|

0.78

|

0.96

|

2.75%

|

|

|

Teva

Pharmaceutical Industries

|

37.56B

|

17.77

|

1.49

|

1.85

|

2.74%

|

|

|

Deluxe

Corp.

|

1.99B

|

11.62

|

4.27

|

1.30

|

2.56%

|

|

|

Honeywell

International Inc.

|

62.28B

|

20.45

|

4.63

|

1.65

|

2.07%

|

|

|

Ryder

System, Inc.

|

3.20B

|

15.31

|

2.14

|

0.51

|

2.01%

|

|

|

Snap-on

Inc.

|

5.33B

|

16.91

|

2.91

|

1.81

|

1.66%

|

|

|

Hanesbrands

Inc.

|

5.01B

|

16.61

|

5.28

|

1.11

|

1.57%

|

|

|

Bunge

Limited

|

10.61B

|

28.75

|

0.93

|

0.17

|

1.50%

|

|

|

FLIR

Systems, Inc.

|

3.50B

|

16.34

|

2.35

|

2.49

|

1.46%

|

|

|

Moody's

Corp.

|

14.86B

|

21.44

|

32.53

|

5.28

|

1.20%

|

|

|

Watts

Water Technologies

|

1.66B

|

23.55

|

1.77

|

1.15

|

1.11%

|

|

|

Woodward,

Inc.

|

2.54B

|

17.91

|

2.38

|

1.35

|

0.87%

|

|

|

Tractor

Supply Company

|

8.00B

|

29.63

|

7.74

|

1.69

|

0.70%

|

Subscribe to:

Posts (Atom)