If you might be concern about the

current financial turmoil, there are many questions for the reason for the recent

uncertainty.

I believe that one

reason in the price corrections is the slowing growth which triggered also the

oil price into new lows.

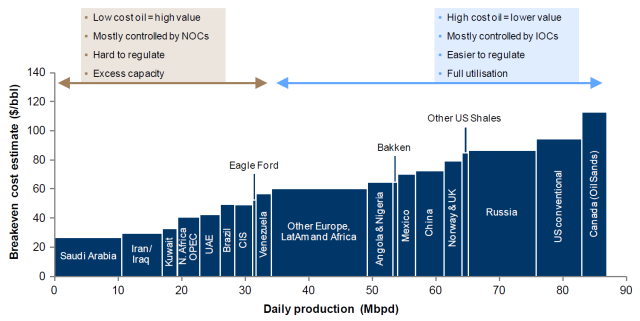

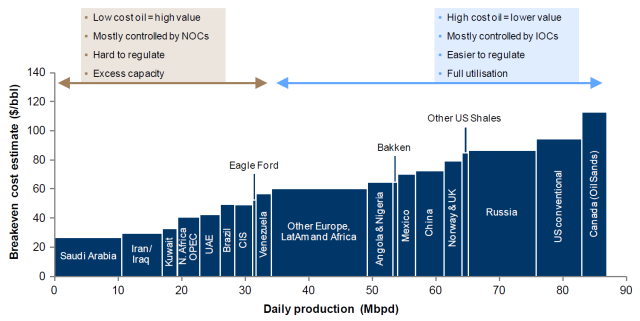

Saudi Arabia and

other oil producing countries are pumping oil at record levels. Now at 28 USD

per Barrel all market members make losses. That's a fact; just take a look at

this chart:

|

| Source: Zerohedge 1/2015 and Aliance Bernstein, 10/2014 |

No one can sell

under production cost at a long time. This will cause also mainly pain,

especially in the oil and gas sector and emerging markets. A big wave of market

consolidation will come in the future if oil stays at these levels or fall.

Only the fittest stocks with the highest financial reserves will survive.

The good thing is

that the American economy is doing well. They have no expose to the energy market.

Refiners could also benefit a little from the decreasing oil prices.

The biggest risk

is the loan portfolio of major banks. According to Bloomberg, JPM has the

highest exposure to the energy sector with a 5% Portfolio share. That's a high

value compared to the equity.

The final question

is in my view how many of them will be writing down and could they cause a

financial crises?

I hope the leaders

will have learned from the financial crisis in 2008 and not let one bank go bankruptcy.

How do you evaluate the market? Do we see an end of the dark tunnel?

Today we screened for companies in the Standard & Poor’s 500 index with yields over 3%, versus 2.3% for the overall index, and with 2016 earnings estimates that have increased by at least 1% over the past three months.

Today we screened for companies in the Standard & Poor’s 500 index with yields over 3%, versus 2.3% for the overall index, and with 2016 earnings estimates that have increased by at least 1% over the past three months.