|

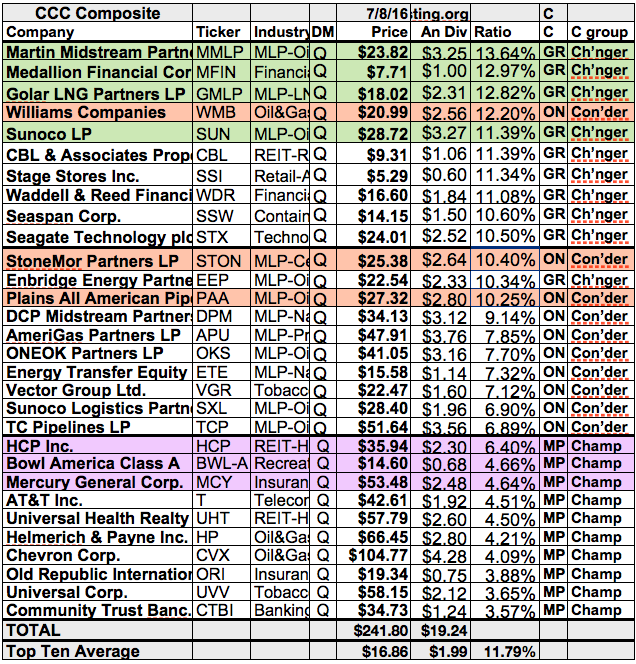

| Top CCC Combo Dogs; Source: Seeking Alpha |

8 Cheap Long-Term Dividend Growth Stocks Growing At Double-Digit Rates

I like dividend growth stocks and they should be bought at a reasonable price. If so, you can expect a solid return on your invested capital.

One important criteria to measure this issue is the PEG ratio. Toady I will not use this ratio but therefore stay at the P/E and EPS growth figures.

Well, I screened the Dividend Contenders list, stocks with consecutive dividend growth of more than 10 year, by the cheapest stocks with double-digit EPS growth expectations.

These are the criteria in detail:

- Market Capitalization over 2 billion

- EPS growth for the next five years over 10%

- Return on Assets over 10%

- Sales growth over the past 5 year's positive

- Low Forward P/E

- Debt/Equity under 1

Only eight stocks fulfilled my criteria. These are the results...

One important criteria to measure this issue is the PEG ratio. Toady I will not use this ratio but therefore stay at the P/E and EPS growth figures.

Well, I screened the Dividend Contenders list, stocks with consecutive dividend growth of more than 10 year, by the cheapest stocks with double-digit EPS growth expectations.

These are the criteria in detail:

- Market Capitalization over 2 billion

- EPS growth for the next five years over 10%

- Return on Assets over 10%

- Sales growth over the past 5 year's positive

- Low Forward P/E

- Debt/Equity under 1

Only eight stocks fulfilled my criteria. These are the results...

These Are The 20 Highest Yielding Dividend Champions

As a long-term orientated income investor, I screen the best long-term dividend growth stocks by yield several times a month.

Today I like to share my view on the current screen results from the Dividend Champions List with you here on the blog.

Each of the 105 stocks with more than 25 years of consecutive dividend growth yield over 3 percent. Big names like HCP, AT&T or Mercury General are the top yielding results.

For sure, not all of them are qualified for my private portfolio but a few of them.

When I'm looking at the best yielding stocks, I guess AT&T, Emerson Electric, Altria, Target and Procter & Gamble are my current favorites. Which stocks are your best picks right now?

Please leave a comment and we discuss it. Thank you for reading and commenting.

Here are the 20 highest yielding Dividend Champions...

Today I like to share my view on the current screen results from the Dividend Champions List with you here on the blog.

Each of the 105 stocks with more than 25 years of consecutive dividend growth yield over 3 percent. Big names like HCP, AT&T or Mercury General are the top yielding results.

For sure, not all of them are qualified for my private portfolio but a few of them.

When I'm looking at the best yielding stocks, I guess AT&T, Emerson Electric, Altria, Target and Procter & Gamble are my current favorites. Which stocks are your best picks right now?

Please leave a comment and we discuss it. Thank you for reading and commenting.

Here are the 20 highest yielding Dividend Champions...

These 3 Stocks Quadrupled Dividends And Should Grow Them Further

Companies that can afford to keep paying their shareholders are great, but dividend stocks that have the potential to pay their shareholders more over time are even better.

We have found three such stocks which have proven themselves with regards to growing dividend payouts significantly over the last five years.

They also appear well-positioned to see continued dividend growth over the long run.

Here are the stocks...

We have found three such stocks which have proven themselves with regards to growing dividend payouts significantly over the last five years.

They also appear well-positioned to see continued dividend growth over the long run.

Here are the stocks...

Subscribe to:

Posts (Atom)