The senior population (65+) is expected to grow 80% between 2010 and 2030, and 85+ cohort by over 60%, increasing patient acuity.

It is estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years.

Healthcare policy is the primary driver in which patients are being treated in low cost settings.

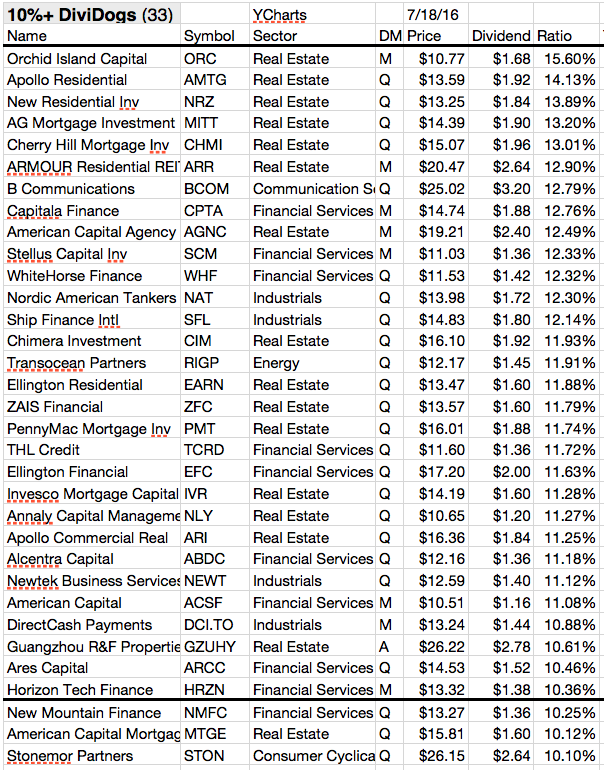

Here is a great overview of property-owning REITs that can give you excellent dividends and lots of growth potential, listed in no particular order:

|

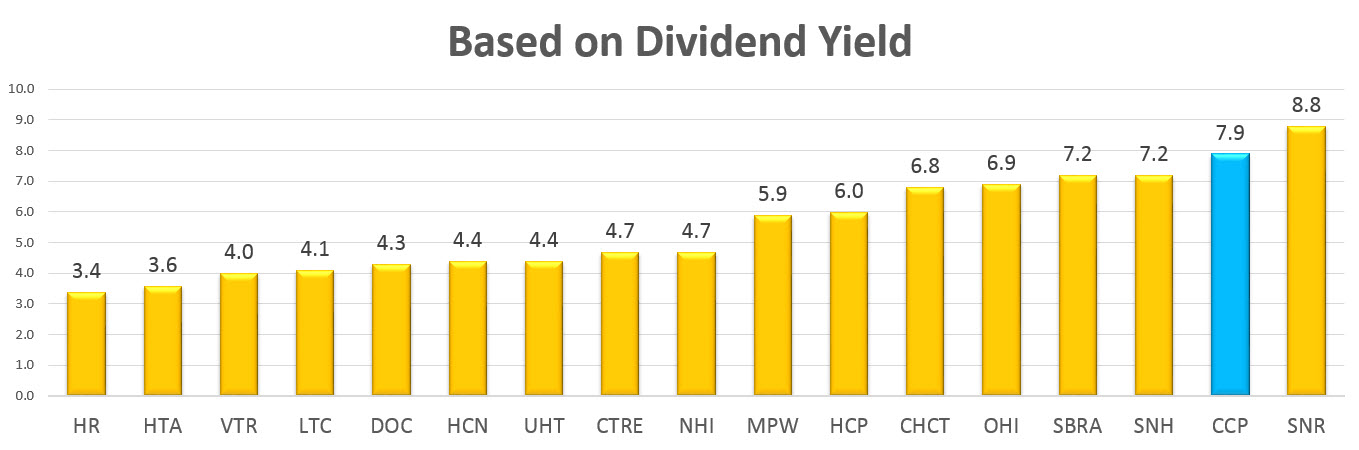

| Dividend Yield of Major REITs (click to enlarge) Source: Seeking Alpha |

|

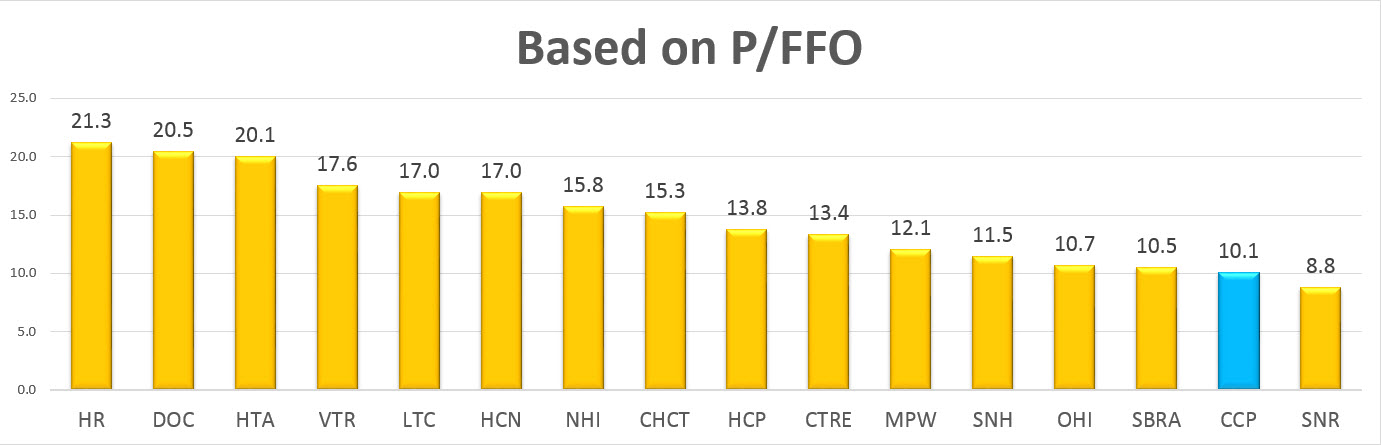

| Price to FFO of Major REITs (click to enlarge) Source: Seeking Alpha |