There are multiple styles of dividend investing out of which dividend growth is the most appealing.

Stocks with dividend growth generally outperform their peers and generate increased profits year after year.

Thus, the dividend growth strategy has an edge over the steady dividend strategy. By investing in stocks with dividend growth, investors can enjoy rising current income while awaiting capital appreciation.

Dividend growth stocks also provide some margin of safety, which enables investors to withstand shocks.

In fact, stocks that have a strong history of dividend growth, as opposed to those that have high yields, form a healthy portfolio.

Moreover, these stocks often have superior fundamentals compared to other dividend paying stocks. This is because dividend growth is often an outcome of a sustainable business model, a long track record of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics.

Here is a selection of stocks that could result in a winning dividend growth portfolio:

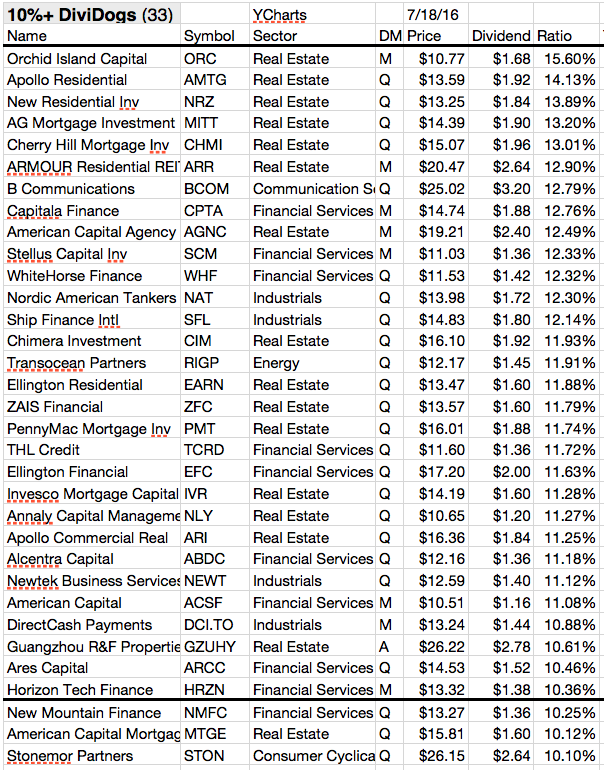

10 Nearly Safe High Yielding Stocks For Retirement Investors

As yields on the 10-year Treasury note fall to all-time lows and stock prices rise, the search for safety and return can be challenging.

Many know now that you will make loses if you buy bonds while rates rise in the mid and long-term.

In my view, it's much better to buy high yielding dividend stocks with growth perspectives.

Rising earnings and dividends will lead to higher stock prices when earnings multiples are the same.

High yields and price appreciation combine to make for interesting investing, and most of these companies are among the best blue-chip dividend stocks, due to their long histories of paying higher dividends.

Let's take a look at these top high-yield dividend stocks....

Many know now that you will make loses if you buy bonds while rates rise in the mid and long-term.

In my view, it's much better to buy high yielding dividend stocks with growth perspectives.

Rising earnings and dividends will lead to higher stock prices when earnings multiples are the same.

High yields and price appreciation combine to make for interesting investing, and most of these companies are among the best blue-chip dividend stocks, due to their long histories of paying higher dividends.

Let's take a look at these top high-yield dividend stocks....

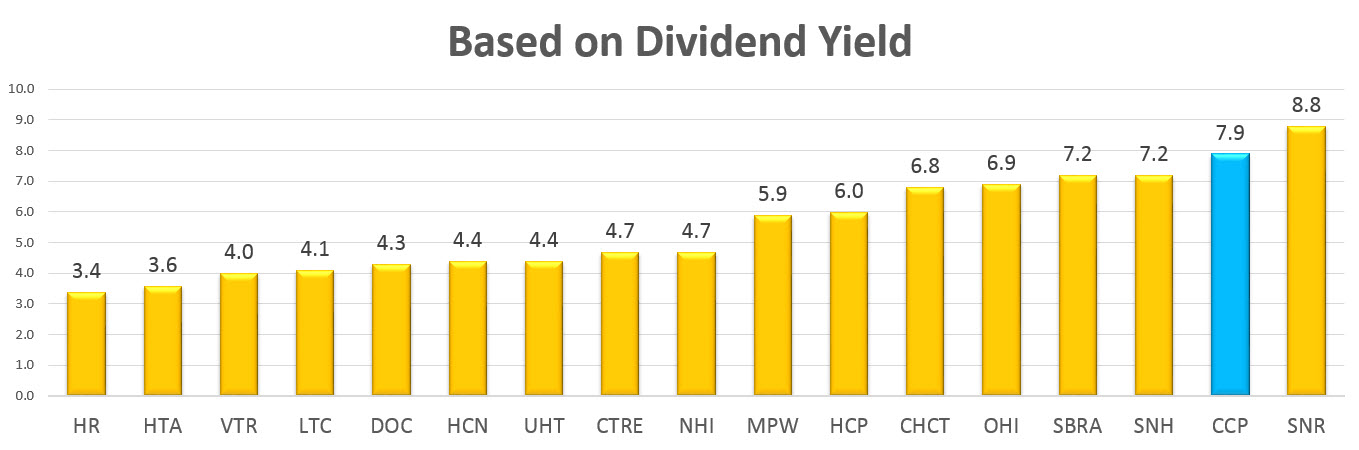

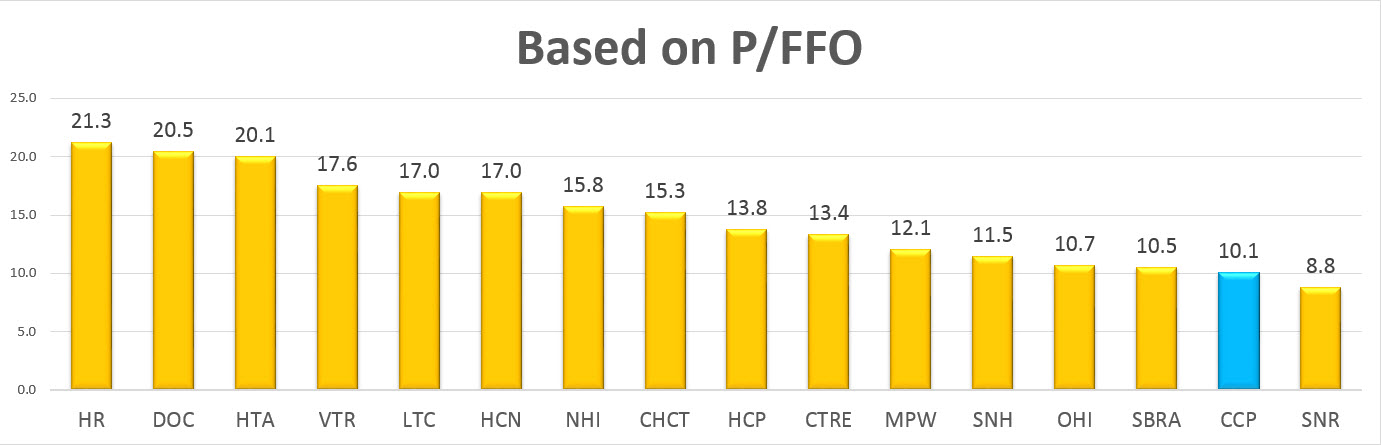

10 Top Yielding And Cheap Healthcare REITs For Income Seeking Investors

Real estate investment trusts, or REITs, can give investors exposure to real estate without the challenges and risks of buying property.

The senior population (65+) is expected to grow 80% between 2010 and 2030, and 85+ cohort by over 60%, increasing patient acuity.

It is estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years.

Healthcare policy is the primary driver in which patients are being treated in low cost settings.

Here is a great overview of property-owning REITs that can give you excellent dividends and lots of growth potential, listed in no particular order:

The senior population (65+) is expected to grow 80% between 2010 and 2030, and 85+ cohort by over 60%, increasing patient acuity.

It is estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years.

Healthcare policy is the primary driver in which patients are being treated in low cost settings.

Here is a great overview of property-owning REITs that can give you excellent dividends and lots of growth potential, listed in no particular order:

|

| Dividend Yield of Major REITs (click to enlarge) Source: Seeking Alpha |

|

| Price to FFO of Major REITs (click to enlarge) Source: Seeking Alpha |

10 High Quality Growth Dividend Contenders Looking Really Cheap

Long term orientated investors need growth to lift its portfolio value.

Dividends are good but the real boost will come from growth. Only growth can make you rich in the long term.

Today I've screened the Dividend Contenders by cheap stocks with double-digit earnings growth for the next five years.

Exactly 10 stocks fulfilled the following criteria:

- Market capitalization over 2 billion

- Low forward P/E of less than 15

- EPS growth for the next five years over 10%

- Positive return on assets

- Debt/Equity under 1

Here are the results...

Subscribe to:

Posts (Atom)