|

| Source: Seeking Alpha |

20 Oversold And Cheap Dividend With Yields Over 3%

The only thing better than oversold stocks are oversold dividend stocks. The dividend, even if it’s a small one, acts as a hedge if you decide to purchase the stock and the trade moves against you.

I do a screen for oversold dividend stocks from time to time, not only because I’m hunting for value, but because oftentimes some names turn up that I’ve never heard of. There’s nothing I like more than a new stock with either a really boring name or one that piques my interest.

As an investor who finds value stocks to be less risky with higher chances of yielding market-beating returns, I’m always on the lookout for stocks that are oversold. Sometimes a lousy stock gets rightfully sold off and you should avoid it.

However, sometimes a stock gets taken down because investors are reacting emotionally. They sell first and ask questions later. That can create great opportunities for investors who are seeking a good stock at an undervalued price.

Other times, you have a stock that is subject to things like fluctuating commodity prices, but is likely to get back up once external factors stabilize.

Sometimes you might get lucky, and find that oversold stock that also pays a dividend. If you are correct in your assessment, you may get paid that dividend while you wait for the market to realize how wrong it was and send the stock back up.

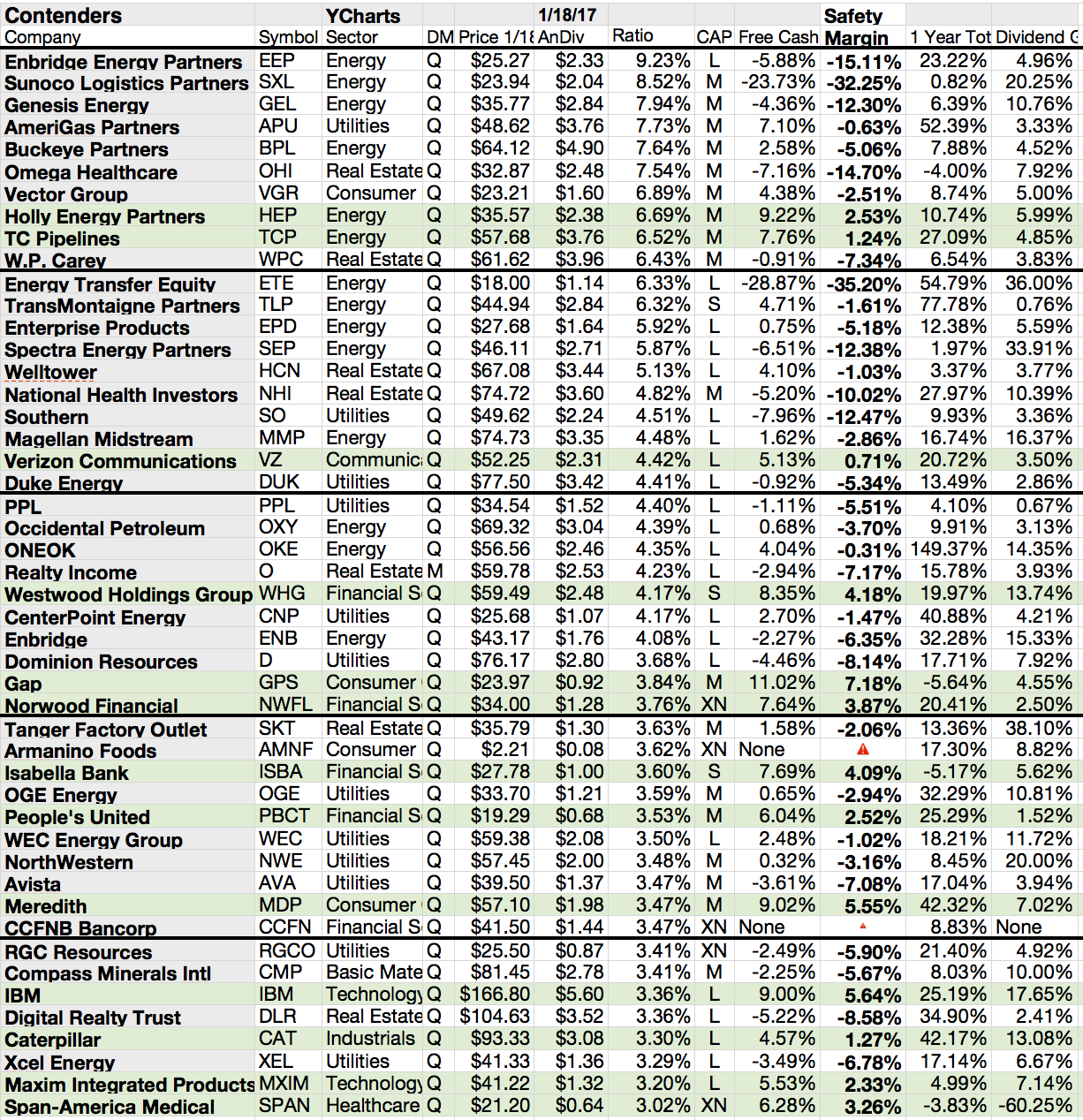

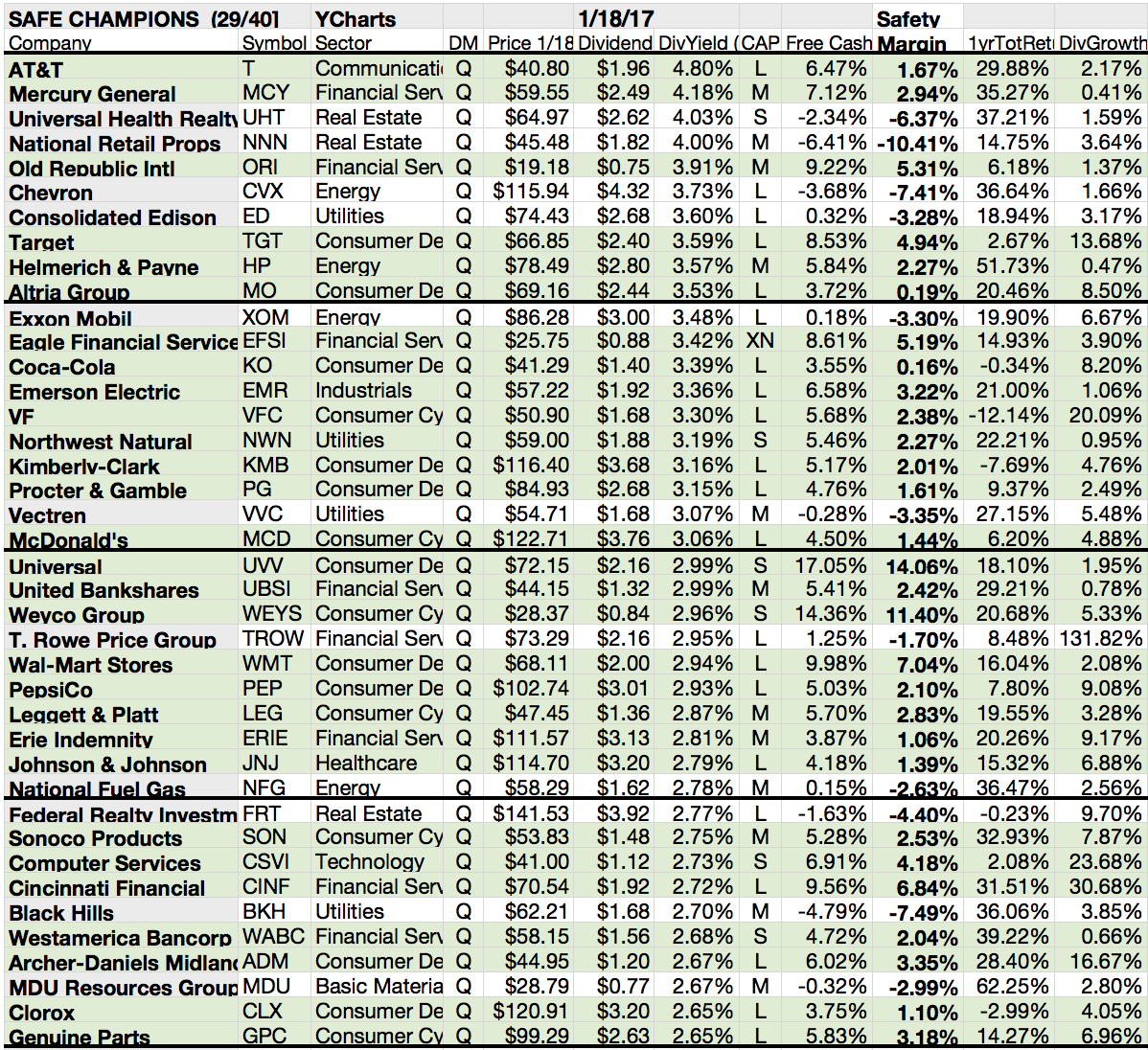

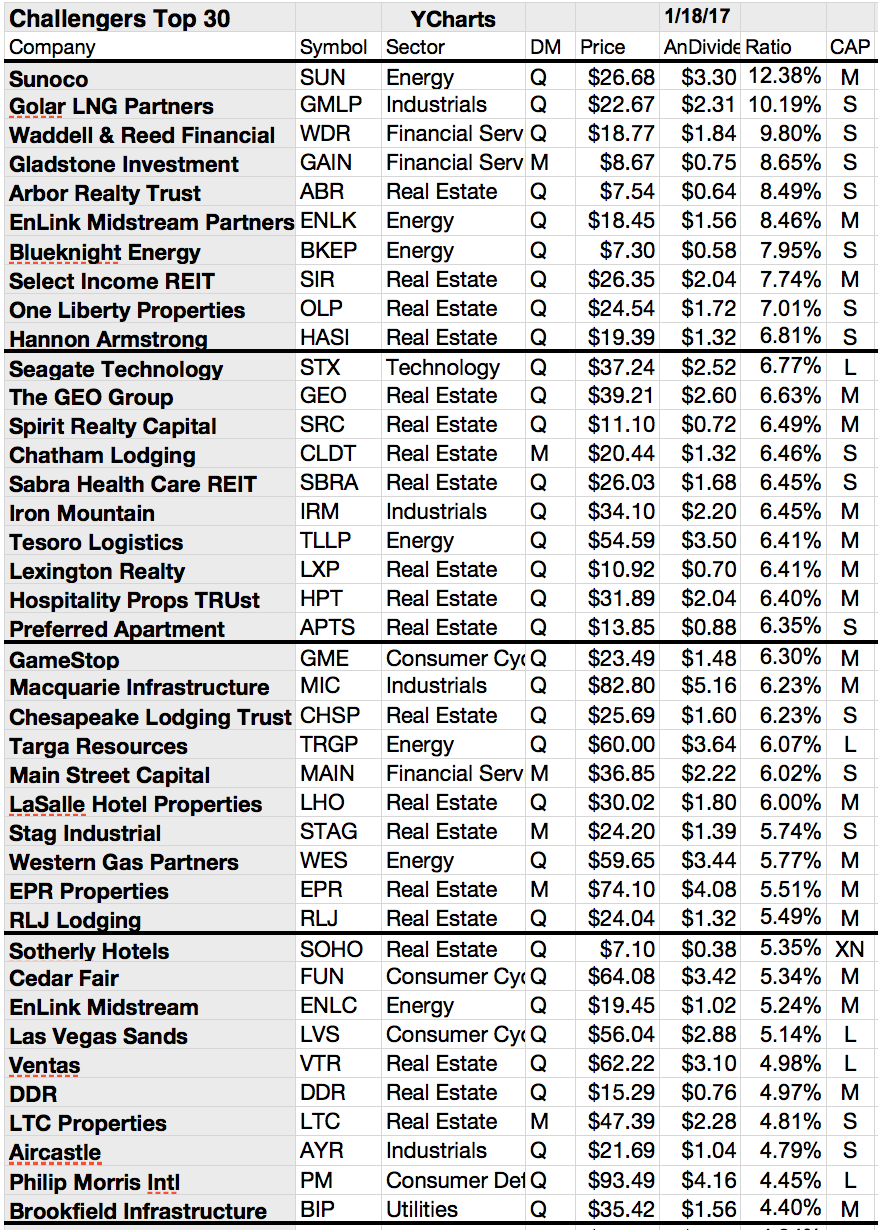

Here are 20 interesting oversold dividend stocks worthy of consideration:

I do a screen for oversold dividend stocks from time to time, not only because I’m hunting for value, but because oftentimes some names turn up that I’ve never heard of. There’s nothing I like more than a new stock with either a really boring name or one that piques my interest.

As an investor who finds value stocks to be less risky with higher chances of yielding market-beating returns, I’m always on the lookout for stocks that are oversold. Sometimes a lousy stock gets rightfully sold off and you should avoid it.

However, sometimes a stock gets taken down because investors are reacting emotionally. They sell first and ask questions later. That can create great opportunities for investors who are seeking a good stock at an undervalued price.

Other times, you have a stock that is subject to things like fluctuating commodity prices, but is likely to get back up once external factors stabilize.

Sometimes you might get lucky, and find that oversold stock that also pays a dividend. If you are correct in your assessment, you may get paid that dividend while you wait for the market to realize how wrong it was and send the stock back up.

Here are 20 interesting oversold dividend stocks worthy of consideration:

The Most Important Buyback Champions On The Market

Over the past few years, I've been conducting quarterly reviews of companies that are aggressive repurchasers of their own stock.

I've tended to focus on companies that announced a share repurchase plan that represents at least 5% of shares outstanding. Anything smaller may not have much of an impact on earnings per share ( EPS ).

Yet in recent months, we have broadened our measure of corporate generosity to focus not just on buybacks but also dividends and debt reductions.

Below you'll find a group of companies that meet the criteria, based on share buyback announcements during the current earnings season.

I've tended to focus on companies that announced a share repurchase plan that represents at least 5% of shares outstanding. Anything smaller may not have much of an impact on earnings per share ( EPS ).

Yet in recent months, we have broadened our measure of corporate generosity to focus not just on buybacks but also dividends and debt reductions.

Below you'll find a group of companies that meet the criteria, based on share buyback announcements during the current earnings season.

Subscribe to:

Posts (Atom)