Please find attached the highest yielding Apparel Stores Stocks

This is only a small part of the Dividend Yield Factbook Collection. You can get the full access for small donation.

The full package contains PDF's and Excel Sheets with essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth), 204 Dividend Contenders (10 to 24 years of consecutive dividend growth) and finally 500 Dividend Challengers (5 to 10 years). It's an open excel version, so you can work with it very easily. Sort the database with your investment criteria and get your specific results.

In addition, you will receive the Foreign Yield Factbook and the World Index Yield Factbook. Each book has content tables of the highest yielding stocks from the most important economies/stock indices in the world.

| Ticker | Company | Market Cap | P/E | P/S | P/B | Dividend | Get the PDF… |

| SMRT | Stein Mart, Inc. | 107.76M | - | 0.08 | 1.83 | 13.57% | Security Analysis of SMRT |

| SSI | Stage Stores, Inc. | 64.41M | - | 0.04 | 0.19 | 9.39% | Security Analysis of SSI |

| LB | L Brands, Inc. | 8.85B | 10.66 | 0.69 | - | 7.58% | Security Analysis of LB |

| CATO | The Cato Corporation | 654.37M | 27.18 | 0.77 | 1.77 | 5.30% | Security Analysis of CATO |

| BKE | The Buckle, Inc. | 1.24B | 12.58 | 1.37 | 2.92 | 4.16% | Security Analysis of BKE |

This is only a small part of the Dividend Yield Factbook Collection. You can get the full access for small donation.

The full package contains PDF's and Excel Sheets with essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth), 204 Dividend Contenders (10 to 24 years of consecutive dividend growth) and finally 500 Dividend Challengers (5 to 10 years). It's an open excel version, so you can work with it very easily. Sort the database with your investment criteria and get your specific results.

In addition, you will receive the Foreign Yield Factbook and the World Index Yield Factbook. Each book has content tables of the highest yielding stocks from the most important economies/stock indices in the world.

For a small donation, we send you every month an update direct to your donation e-mail adress.

Why should you donate?

A donation from you helps us to develop this books and improve the quality of our work. Together we can make the world a better and smarter place. A place with no information advantage between poor and rich persons who have enough budget to buy the expensive data from Reuters and Bloomberg.

Why should you donate?

A donation from you helps us to develop this books and improve the quality of our work. Together we can make the world a better and smarter place. A place with no information advantage between poor and rich persons who have enough budget to buy the expensive data from Reuters and Bloomberg.

The full Dividend Yield Factbook Collection consists of the following ebooks and excel files with financial ratios form all Dividend Champions, Dividend Contenders and Dividend Challengers as well. Here is a summary what you get for your donation:

Monthly updated Factbooks and Excelsheets

- Foreign Yield Factbook - 42 Pages PDF

- World Index Yield Book - 34 Pages PDF

- Champion / Contender / Challenger Factbook Sorted By Yield - 58 Pages PDF

- World Index Yield Book - 34 Pages PDF

- Champion / Contender / Challenger Factbook Sorted By Yield - 58 Pages PDF

- Dividend Growth Stock Database Excel Sheet

(Over 800 Dividend Champions, Contenders and Challengers combined)

You'll get all these PDF's and Excel Sheets fresh updated every month via e-mail. It's a one-donation-lifetime service, as long as we can create it. These books need much time to create and we make them unsalaried, only for little donations like yours.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

All ebooks and excel sheets are frequently updated. They keep you up-to date with current yield figures from the best Dividend Growth Stocks.

Here is a preview of the content:

Your benefits…

- Find the top yielding stocks at the first view

- A great overview about market price ratios of stocks

- Compilation of the best dividend growth stocks

- Easy to compare stocks

- Find your best stocks fast

- Generate better returns

- Reduce your portfolio risk

- Generate stable and growing dividend income long-term

There is no donation minimum or limit. You can choose the donation amount you want to give. The more you support us, the more we can create and give back to you. We think this is a fair deal.

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us to support people with no income or big budget to get free and easy information on the web. Thank you.

Here is what others say:

#1 Get an overview about the best yielding stocks of the world with the Foreign Yield Database for a special country

Check out more details here: Foreign Yield Factbook and Excelsheet.

Here is a preview of Canada:

#2 Receive Corporate Factbooks from Dividend Champions to stay up-to-date

See more details here: Corporate Factbooks

Example from Coca Cola:

(Over 800 Dividend Champions, Contenders and Challengers combined)

You'll get all these PDF's and Excel Sheets fresh updated every month via e-mail. It's a one-donation-lifetime service, as long as we can create it. These books need much time to create and we make them unsalaried, only for little donations like yours.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Here is a preview of the content:

The Dividend Yield Factbooks and excel sheets could help you to find the right investments at the right time. They could support you to generate a better returns with less risk – It’s a simple database about the best dividend growth stocks for long-term income investors.

Your benefits…

- Find the top yielding stocks at the first view

- A great overview about market price ratios of stocks

- Compilation of the best dividend growth stocks

- Easy to compare stocks

- Find your best stocks fast

- Generate better returns

- Reduce your portfolio risk

- Generate stable and growing dividend income long-term

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us to support people with no income or big budget to get free and easy information on the web. Thank you.

Here is what others say:

"As an experienced

professional financial consultant for over 20 years, there isn't much I haven't already seen. This e-book and

Excel tool is an absolute must have!

If you’re looking

to improve your personal portfolio returns and you want a quick overview of the best dividend grower on the market, I would definitely recommend those

Dividend Yield Factbooks.

They introduce, with a clear and simple database, a large

number of the best dividend growth stocks worldwide.

If you look for dividend

stocks abroad? No problem, you get a large and easy overview with the Foreign Yield Factbook. Try

to find similar worksheets on the web. There is no alternative!

All I can say is, study

these e-books, discover the excel sheet and you'll walk away as a much better

educated and more informed person. I will be looking for

more dividend information tools like this and I will be sharing this

information with my fellow colleagues."

Carl Holst – Financial Consultant

"As a dividend growth investor, I’m a big believer in stocks with a long dividend growth history and it worked for me over the past 30 years.

This excellent

ebooks and excel tools cover all essential aspects for private and

institutional investors. I use these tools often to sharpen my view on the

markets."

"I discovered the

market for years as an analyst and know that dividend growth stocks are the top

investments on the market. They offer less risks because of their ability to

pay and grow dividends. The price you pay for this is simple: They have a limited ability to become the next

tenbagger or game changer company. If you look for high growth technology stocks or want to make money with Penny stocks or binary options, you should take other sources for your research.

I’ve analyzed many value stocks in my career

and most of them were dividend growers like constituents from the yield fact

books. These lists compile a big number of high quality stocks. If you have

less time, it’s the perfect tool to stay up to date."

Robert Escable – Senior Analyst

“As a market professional, I need to be active

to justify my work to clients. The stock market goes up and down and these

Factbooks and Excelsheets help me to find the right stocks in very market

situation.”

Jane Lulowsi – Portfolio Manager

----Bonus for your donation----

Special Reports if released:

#1 Get an overview about the best yielding stocks of the world with the Foreign Yield Database for a special country

Check out more details here: Foreign Yield Factbook and Excelsheet.

Here is a preview of Canada:

#2 Receive Corporate Factbooks from Dividend Champions to stay up-to-date

See more details here: Corporate Factbooks

Example from Coca Cola:

#3 - Get Factbook Compilations around interesting investing themes like Dogs of the Dow

Find more details here: Factbook compilation around investment themes

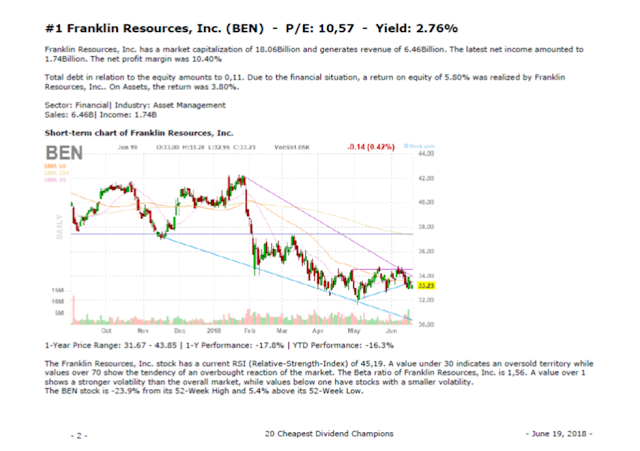

Here is a preview of the 20 Cheapest Dividend Champions:

You get all this stuff for a small donation. There is no minimum or limit to donate. You can choose how much you like to support us. The more you give, the more we can give back to you. That's a fair deal in our view.

Thank you very much for your support and help!!!