|

| Source: Seeking Alpha |

19 Cheap High-Yield Opportunities From The Financial Sector

Financial stocks can offer great opportunities for dividend investors. Financials will benefit from rising interest rate expectations and a steeper yield curve.

The sector offers the least expensive valuation of any sector in the S&P 500, trading at a mere 13.5 price/earnings multiple. Financials also benefit from positive loan growth, which should occur this year.

In addition, it is the sector that has the most sensitivity to higher interest rates. While multiples have increased for most of these stocks since the election, many are trading at a substantial discount to the market. Deregulation could create potential earnings per share upside for the entire sector.

Here are my results...

The sector offers the least expensive valuation of any sector in the S&P 500, trading at a mere 13.5 price/earnings multiple. Financials also benefit from positive loan growth, which should occur this year.

In addition, it is the sector that has the most sensitivity to higher interest rates. While multiples have increased for most of these stocks since the election, many are trading at a substantial discount to the market. Deregulation could create potential earnings per share upside for the entire sector.

Here are my results...

The Highest Yielding S&P 500 And The Dogs of the S&P 500

While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks. And you don’t have to wander far to find attractive payers. Just look at Standard & Poor’s 500-stock index.

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

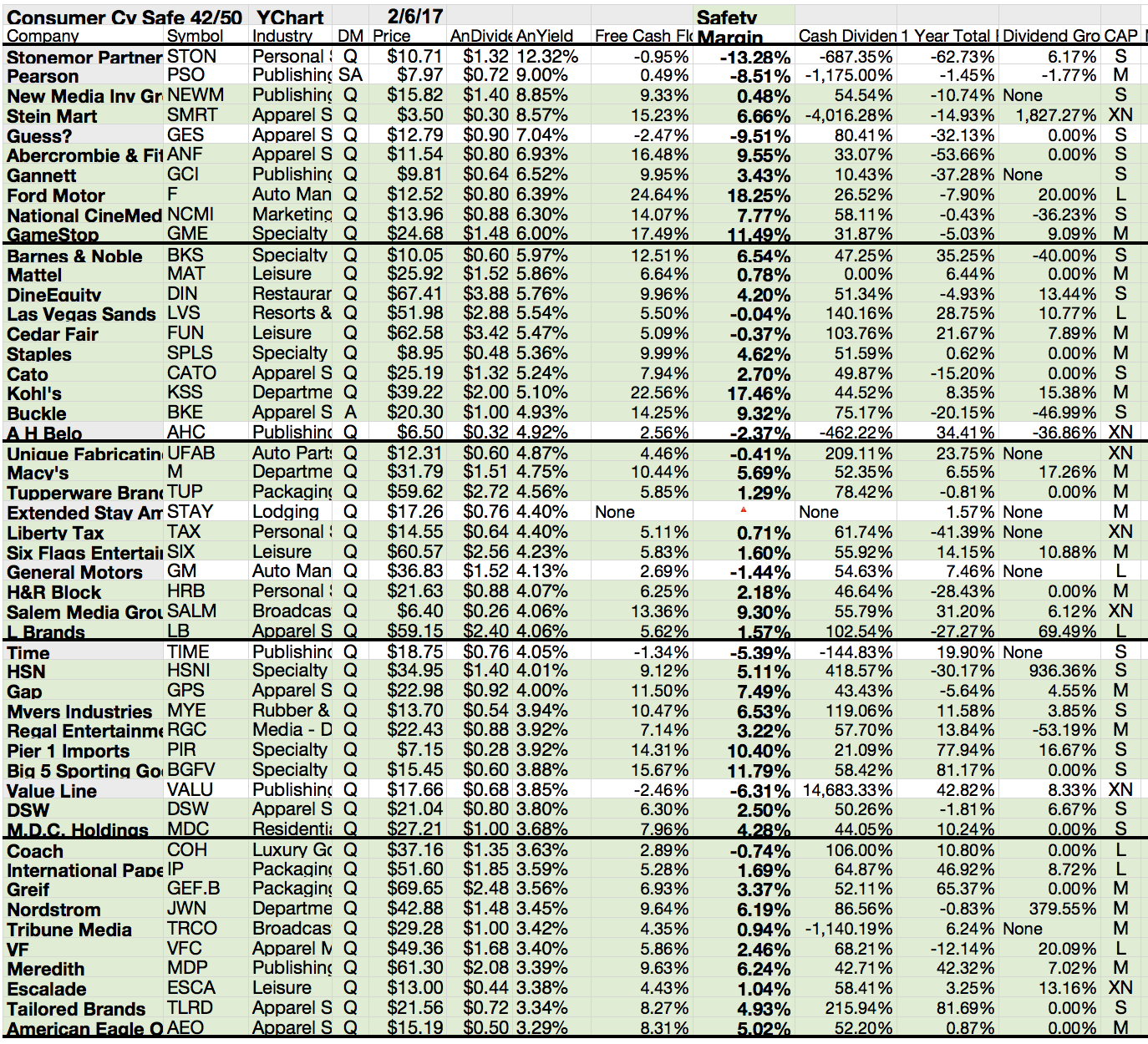

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

20 Undervalued Dividend-Paying Stocks

If you are concerned that current valuations may cast a shadow over the future returns of equity-income strategies, you're not alone. There's no telling how long dividend stocks' recent run of outperformance will continue.

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

Subscribe to:

Posts (Atom)