|

| Source: Seeking Alpha |

Showing posts with label MAT. Show all posts

Showing posts with label MAT. Show all posts

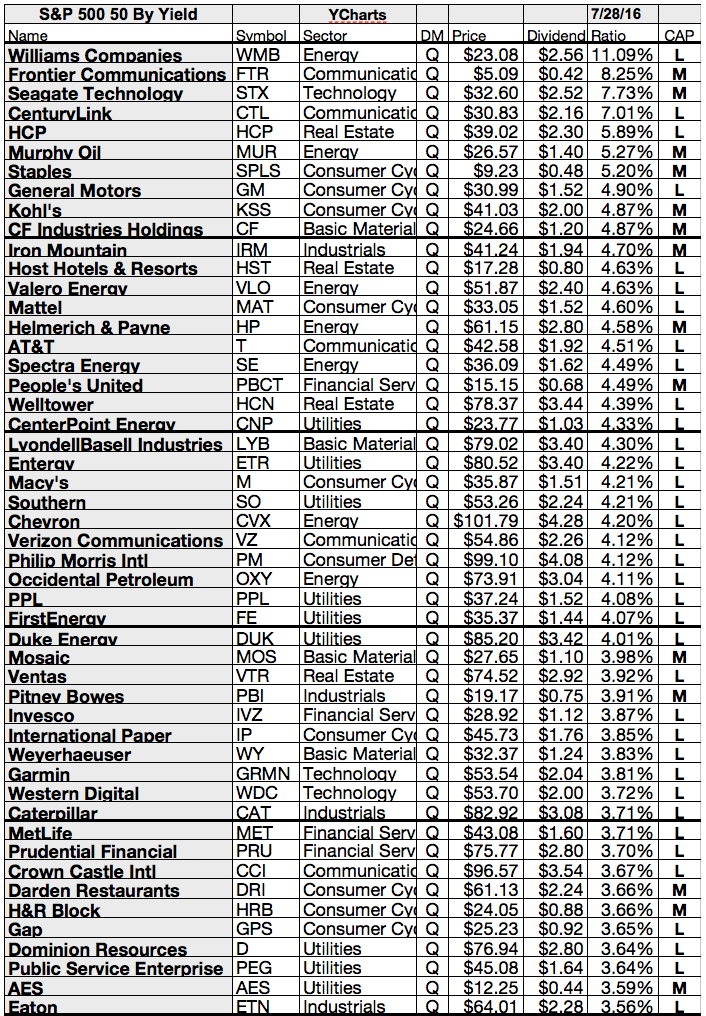

The Highest Yielding S&P 500 And The Dogs of the S&P 500

While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks. And you don’t have to wander far to find attractive payers. Just look at Standard & Poor’s 500-stock index.

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

20 Undervalued Dividend-Paying Stocks

If you are concerned that current valuations may cast a shadow over the future returns of equity-income strategies, you're not alone. There's no telling how long dividend stocks' recent run of outperformance will continue.

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely.

Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

To get a better sense of how over- or undervalued dividend-paying stocks are today, we run a screen with selection of dividend yield, P/E and growth and filtered those stocks with attractive ratios in most of the areas.

Here are the top results from our screen...

9 Top Dividend Paying Stocks To Consider

In an uncertain market there’s a lot to be said for having a firm foundation of dividend stocks for your portfolio. A good income play at a good price isn’t quite as sexy as a roaring momentum stock, but over the long-term, the reliable returns from dividends really add up.

Every investor needs to be biased toward income stocks right now — even if they are at or near retirement, and looking to take some risk off the table. After all, current yields are about 1.8% on T-Notes and just under 2.2% on investment-grade corporates.

Where else are you going to get income?

If you want stability, then well-priced dividend stocks will provide a great backbone for your portfolio in 2017. And if you’re looking for income, you have to remember that even conservative bond funds still have interest rate risk and could lose principle value if and when the Federal Reserve raises rates in the coming month. In short, there’s no better place to put your money than dividend stocks right now.

Here are nine great picks to consider:

Every investor needs to be biased toward income stocks right now — even if they are at or near retirement, and looking to take some risk off the table. After all, current yields are about 1.8% on T-Notes and just under 2.2% on investment-grade corporates.

Where else are you going to get income?

If you want stability, then well-priced dividend stocks will provide a great backbone for your portfolio in 2017. And if you’re looking for income, you have to remember that even conservative bond funds still have interest rate risk and could lose principle value if and when the Federal Reserve raises rates in the coming month. In short, there’s no better place to put your money than dividend stocks right now.

Here are nine great picks to consider:

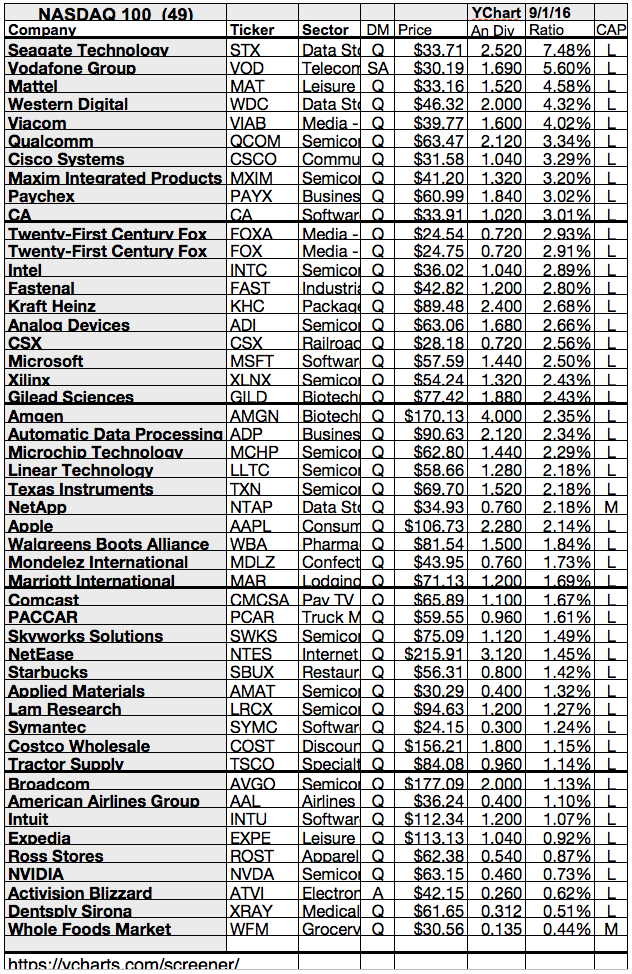

The Cheapest Dividend Stocks On NASDAQ

You might not think of the Nasdaq as synonymous with big dividends. The Nasdaq Composite index, which essentially consists of every domestic and foreign stock that trades on the exchange, has long been heavy on technology and those technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders.

But if you dig a little deeper, you’ll find some rich payouts. Attached are 50 Nasdaq-listed companies with generous dividends that have the potential to grow. Even better, many of the stocks are dirt cheap. The yields grow up to 8.06% and starts at 0.56%.

Several of the companies have similar profiles: large technology firms that are past their years of rapid growth but still throw off a lot of cash, which can be used to boost distributions. But the Nasdaq holds more than just tech, so we’ve also included a few companies from other sectors, as well as some less-well-known tech firms.

These are the latest dividend dogs from NASDAQ....

But if you dig a little deeper, you’ll find some rich payouts. Attached are 50 Nasdaq-listed companies with generous dividends that have the potential to grow. Even better, many of the stocks are dirt cheap. The yields grow up to 8.06% and starts at 0.56%.

Several of the companies have similar profiles: large technology firms that are past their years of rapid growth but still throw off a lot of cash, which can be used to boost distributions. But the Nasdaq holds more than just tech, so we’ve also included a few companies from other sectors, as well as some less-well-known tech firms.

These are the latest dividend dogs from NASDAQ....

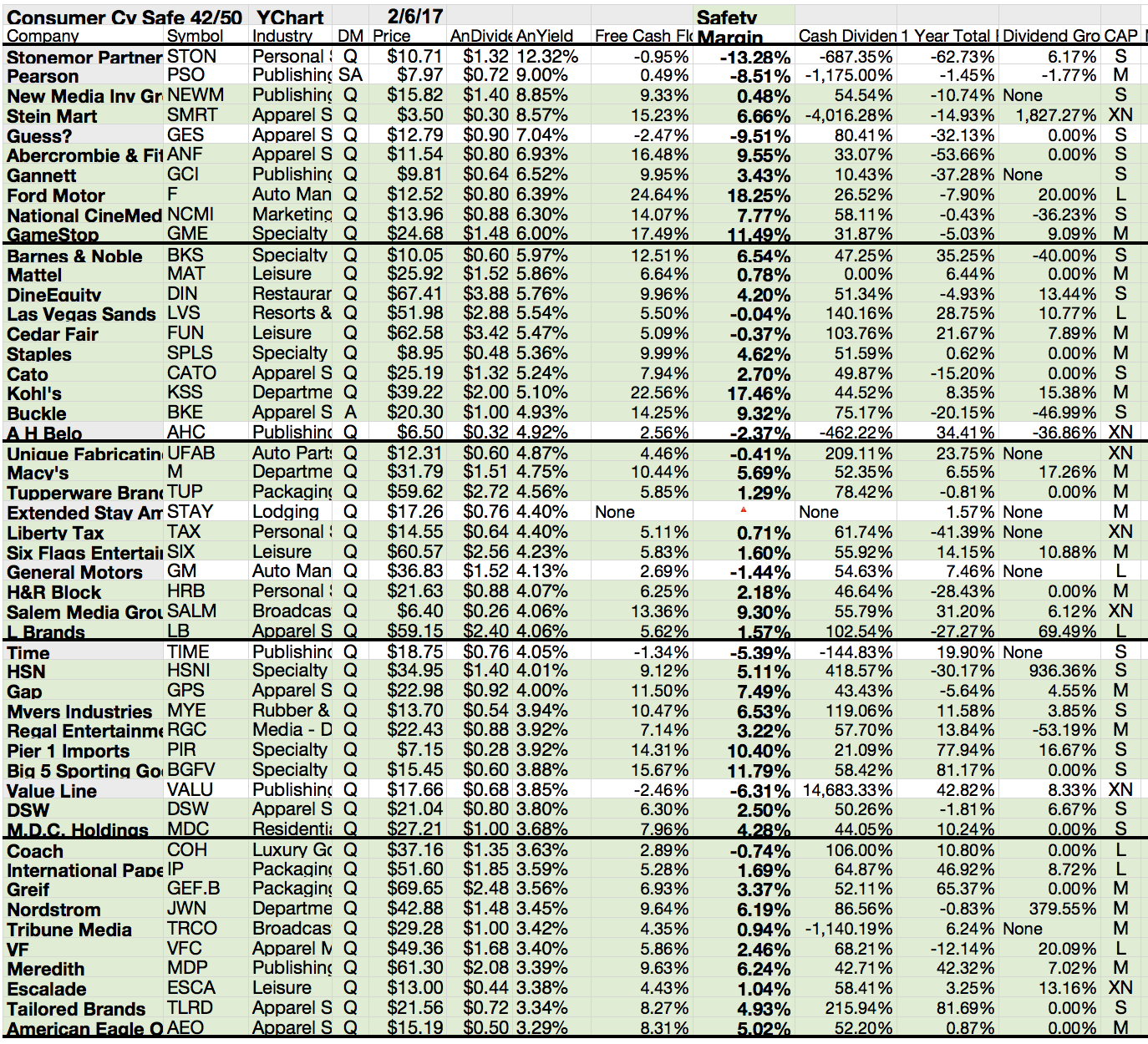

32 Of 60 S&P 500 Dogs Have Cash Margins To Cover Dividends

“Dogs of the Dow” is a popular investment strategy.

There are thousands other or similar strategies out there trying to beat the

market by finding undervalued stocks without deep research.

The approach is simple and easy. On seeking alpha,

there are many writers creating great screens with attractive stocks.

Attached you will find a list of dogs from the

S&P500. A dog by definition from the article is a stock from the S&P

500 with a dividend yield higher than their peers and lower than their

historical average.

High yields also under pressure of dividend cuts. In

order to eliminate those risks, the author created the safety margin rule. This

ratio shows how much of the dividend yield is covered by the free cash flow

yield. A ratio below 100% tells us that the dividend is paid with free cash,

generated by operating activities.

Check out the dogs with high safety margins here...

7 Safe And Cheap High Yielding Dividend Stocks

The Brexit vote pushed U.S. Treasury rates to record lows and the S&P 500 Index to new record highs, creating a sort of dash for stocks with a modicum of safety.

It's hard to discover nearly safe stocks. The truth is that you will not find any safeness at the stock market.

There are companies with a more risky growth strategy and companies with lower risk exposure.

Today I will share a couple of stocks with high dividends that might offer a bit safeness for you.

Here are the results...

It's hard to discover nearly safe stocks. The truth is that you will not find any safeness at the stock market.

There are companies with a more risky growth strategy and companies with lower risk exposure.

Today I will share a couple of stocks with high dividends that might offer a bit safeness for you.

Here are the results...

20 Attactive Low Volatility Consumer Goods Stocks

When I'm thinking about how to arrange a portfolio, I think there is a uniquely human aspect to the process.

The ideal dividend portfolio depends on the risk factors an investor feels comfortable accepting.

After the year is over, any investor can easily see which companies delivered the best returns, but when the period is starting, the goal is for an investor is to be carrying a portfolio that meets their individual objectives.

This piece is going to focus on the dividend champions of the consumer staples sector.

Given the relatively high valuation of the market, I believe it is more rational to focus investments on sectors with less volatility in their ability to generate sales.

Attached you will find a compilation of stocks from the consumer goods sector with solid yields, modest growth predictions and low beta ratios.

These are my favorites...

The ideal dividend portfolio depends on the risk factors an investor feels comfortable accepting.

After the year is over, any investor can easily see which companies delivered the best returns, but when the period is starting, the goal is for an investor is to be carrying a portfolio that meets their individual objectives.

This piece is going to focus on the dividend champions of the consumer staples sector.

Given the relatively high valuation of the market, I believe it is more rational to focus investments on sectors with less volatility in their ability to generate sales.

Attached you will find a compilation of stocks from the consumer goods sector with solid yields, modest growth predictions and low beta ratios.

These are my favorites...

30 Fast-Growing Dividend Growth Stocks For High Total Return

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

If the company

growth and with them the dividend payout, your passive income should also grow

and your investment finally be higher.

Attached you will

find a nice overview of the best dividend growth stocks of the recent decade

sorted by short-term, mid-term and long-term dividend growth.

For sure the past

performance is no guarantee for growth in the future but it gives a nice

overview about the good stocks in the past.

Maybe you own some

of them and you have made a decent amount of money with your investment.

Here are the best dividend growth stocks of the past...

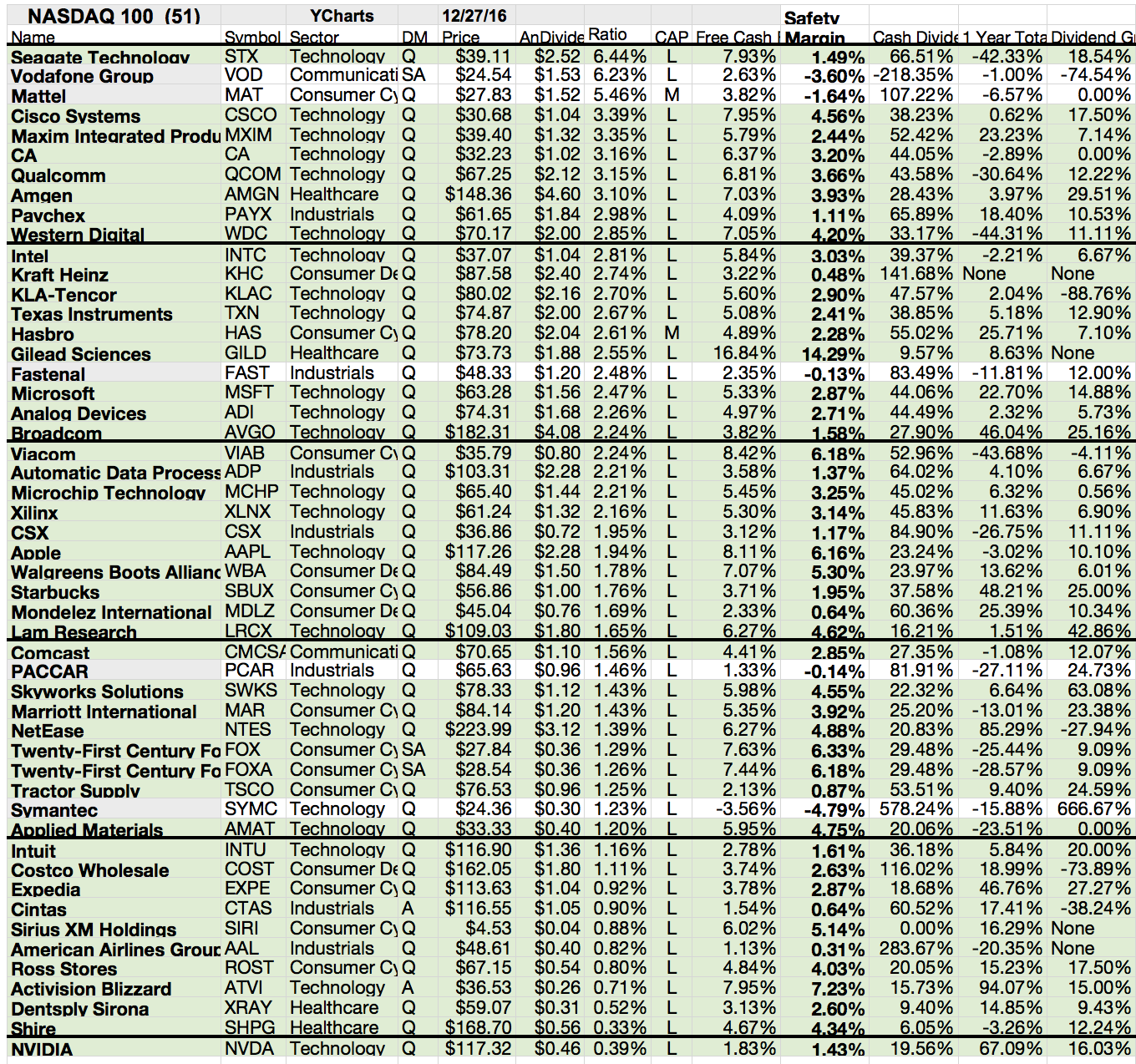

A List Of The Top Dividend Payer From The Nasdaq 100

You might not think of “Nasdaq” as synonymous with big dividends. The Nasdaq Composite index, which essentially consists of every domestic and foreign stock that trades on the exchange, has long been heavy on technology.

And technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders. None of the FANGs — Facebook (symbol FB), Amazon.com (AMZN), Netflix (NFLX) and Google (GOOGL), now called Alphabet — pays a dividend but delivered one of the best returns in the past decade.

But dividends could give you a small hedge if a new game changer destroys the business model.

If you own a great Amazon or Facebook for a decade and you don't get money from them, you might be happy for a while if your stock positing skyrocked but what if your investment comes back to your initial investment amount? Right, you have nothing earned. That's the reason why dividends matter.

I've attached a list of the highest yielding stocks from the Nasdaq 100. If you like my news and dividend yield lists, you can easily subscribe my daily dividend newsletter for free. Just put your email in the subscription box and confirm the first mail.

And technology companies have historically shown a bias for reinvesting their profits to finance future growth, rather than returning cash to shareholders. None of the FANGs — Facebook (symbol FB), Amazon.com (AMZN), Netflix (NFLX) and Google (GOOGL), now called Alphabet — pays a dividend but delivered one of the best returns in the past decade.

But dividends could give you a small hedge if a new game changer destroys the business model.

If you own a great Amazon or Facebook for a decade and you don't get money from them, you might be happy for a while if your stock positing skyrocked but what if your investment comes back to your initial investment amount? Right, you have nothing earned. That's the reason why dividends matter.

I've attached a list of the highest yielding stocks from the Nasdaq 100. If you like my news and dividend yield lists, you can easily subscribe my daily dividend newsletter for free. Just put your email in the subscription box and confirm the first mail.

20 Best Performing Dividend Stocks Year-To-Date 2016

The

start in the year was not as perfect as we have expected. At the end of last

year, we saw a small bounce back to all-time highs but during the first month

of the year 2016 we saw a small disaster.

The Dow Jones is down 7.29% and the

S&P 500 6.88% for the first 4 weeks of the year. Despite the bad start into

the year, a dozen of stocks gained more than 10 percent.

If this is a small signal for the rest of the year or a simple different reaction, we will see it over the next months.

If this is a small signal for the rest of the year or a simple different reaction, we will see it over the next months.

Today I like to show you the 20 best

performing dividend stocks since the start of the year 2016. They gained from

11.23% to 50.57% in the first 30 days of the year 2016.

Here are the best dividend stocks since

the start of the year 2016...

Stocks With The Highest Annual Dividend Growth Of The Past 3, 5 and 10 Years

Recently, I showed you how your investment portfolio grows over 30 years if you own sustainable long-term dividend growth stocks.

Recently, I showed you how your investment portfolio grows over 30 years if you own sustainable long-term dividend growth stocks. The key notice from the article was that if you buy high yielding stocks with fast dividend growth, you could maximize your portfolio return.

It sounds quite easy but it’s hard to find those stocks because no one of us can look into the future or has crystal ball.

Today I like to show you those stocks with the highest short, mid and long-term dividend growth of the past 3, 5 and 10 years.

Over the next upcoming days, I will also deliver a few stocks with the highest 10year dividend growth rate of the most consistent dividend raiser in the market.

Here the best dividend growers of the past decade....

14 High Yielding Dividend Investments Qualified As Safe Heaven

With the S&P 500 down nearly 7% in the last three weeks alone, you can’t be blamed for wanting to throw up your hands and sell all your stocks. That's a stupid idea in my view.

With the S&P 500 down nearly 7% in the last three weeks alone, you can’t be blamed for wanting to throw up your hands and sell all your stocks. That's a stupid idea in my view.You need to stay disciplined. If you are a long-term investor, sell-offs shouldn't care you because you have studied the long-term fundamentals and persectives of your investment and nothing chageged, you don't need to act.

If you have a long time horizon and you mainly hold dividend-paying US companies your are on the smartest side of the market. Stocks are risky, for sure but long-term dividend growth stocks offer a smaller risk than high leveradged oil drilling companies.

Attached you will find a few Dividend Growth Stocks that might filfill the needs of high-quality dividend investing and also might be hold this rating for years to come.

These are 14 of the results...

The Best Yielding Income Opportunities From The Nasdaq

Investors always like stocks that pay large dividends. Yet for years, those who focused on the tech-heavy Nasdaq 100 Index didn't expect much in the way of dividends, since many high-growth companies didn't pay any dividends at all to their shareholders.

Investors always like stocks that pay large dividends. Yet for years, those who focused on the tech-heavy Nasdaq 100 Index didn't expect much in the way of dividends, since many high-growth companies didn't pay any dividends at all to their shareholders.Now, even tech companies have gotten on the dividend bandwagon, and you'll find some impressive yields among the Nasdaq's top 100 stocks. Let's take a look at the highest yielding stocks from the technology and growth dominated index.

The attached list is a compilation of next years estimated dividend and their estimated yields from the Nasdas index members. If you find some values in the list, please share it with your social connections.

If you like to receive more high-quality dividend income ideas, just subscribe my free newsletter.

Here are the top yielding results from the Nasdaq ...

10 S&P 500 Stocks With A Big Gap Between Free Cash Flow Yield And Dividend Yield

One way to gauge a company’s ability to raise dividends, or at least not cut them, is to divide its free cash flow per share by the share price to come up with a free cash flow yield. And that can be compared with the dividend yield.

One way to gauge a company’s ability to raise dividends, or at least not cut them, is to divide its free cash flow per share by the share price to come up with a free cash flow yield. And that can be compared with the dividend yield.A company’s free cash flow is its remaining cash flow after capital expenditures. To present a useful list of dividend stocks with dividend yields that appear safe, we started with the S&P 500, and then removed stocks with negative returns of 15% or more this year.

After all, investors have little confidence in them. We then pared the list to companies that have paid dividends for at least five years, while removing any that have cut regular dividends at any time over the past five years, according to FactSet.

Here are the results...

Subscribe to:

Comments (Atom)