|

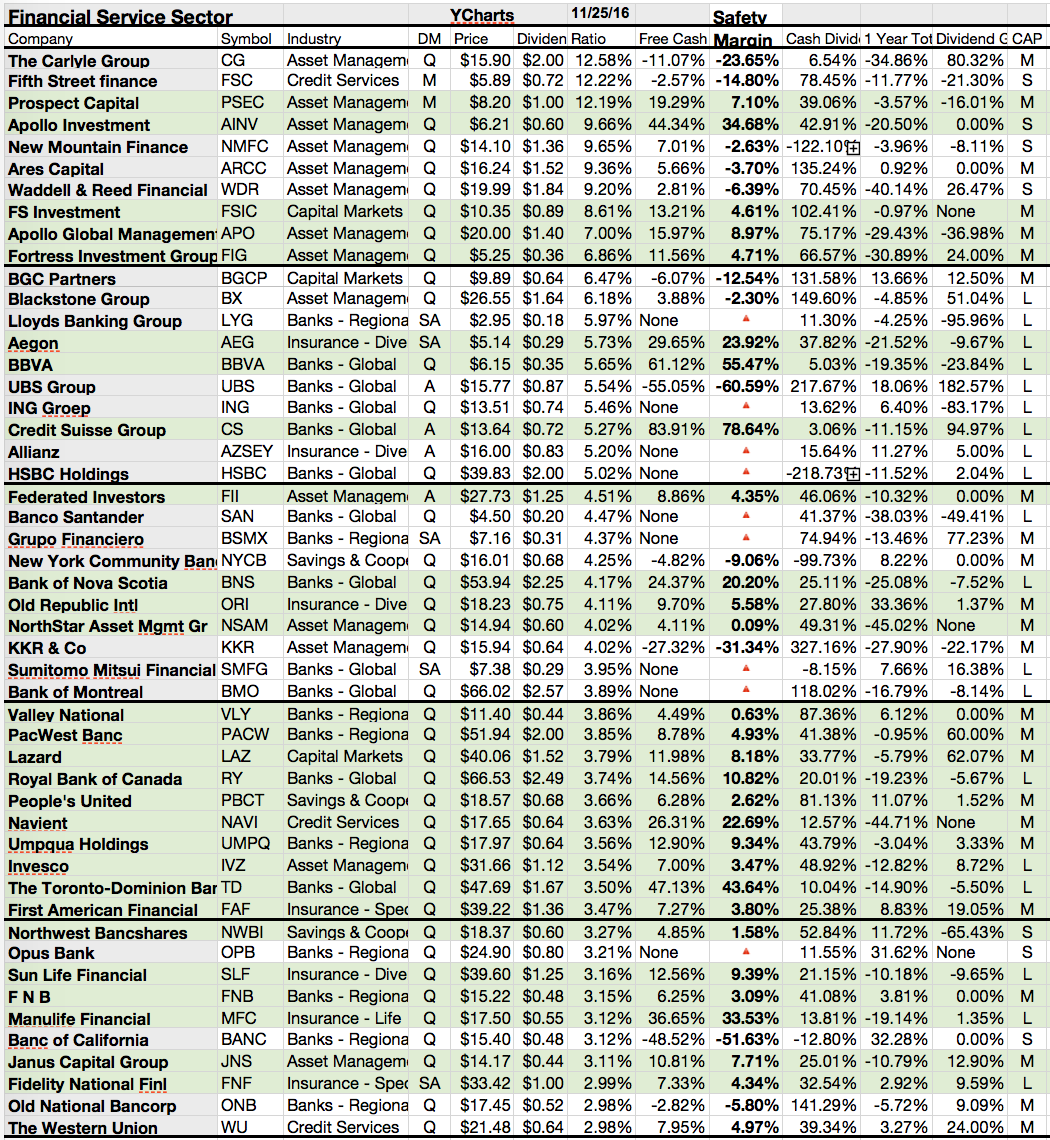

| 50 Financial Dividend Financial Dogs (Source: Seeking Alpha) |

Showing posts with label BMO. Show all posts

Showing posts with label BMO. Show all posts

10 Really Cheap Dividend Stocks To Look For

The only thing that is better than buying the stock of a great company is buying a stock of a great company at a low price.

While there aren't a whole lot of companies out there selling at decent discounted prices these days -- the market is hitting all-time highs, after all -- there's still a decent handful of stocks that investors should consider if they want to buy a company on the cheap.

After all, picks trading that low often have gone through hard times. And while you can sometimes catch a falling knife and make a bundle on a swing trade, cheap dividend stocks are inherently long-term investments.

I mean, what’s the point of buying an income investment only to trade out of it before the ex-dividend date?

As the old saying goes, price is what you pay but value is what you get. So instead, investors should look at valuation metrics and payout ratios to determine which are the best cheap dividend stocks to buy now.

So we run a stock screener to find stocks currently trading for a 'cheap' price. There came a lot results but we like to share the best in our view with you.

These are the results...

While there aren't a whole lot of companies out there selling at decent discounted prices these days -- the market is hitting all-time highs, after all -- there's still a decent handful of stocks that investors should consider if they want to buy a company on the cheap.

After all, picks trading that low often have gone through hard times. And while you can sometimes catch a falling knife and make a bundle on a swing trade, cheap dividend stocks are inherently long-term investments.

I mean, what’s the point of buying an income investment only to trade out of it before the ex-dividend date?

As the old saying goes, price is what you pay but value is what you get. So instead, investors should look at valuation metrics and payout ratios to determine which are the best cheap dividend stocks to buy now.

So we run a stock screener to find stocks currently trading for a 'cheap' price. There came a lot results but we like to share the best in our view with you.

These are the results...

Bank Stocks With Big Dividend Yields

When savvy investors hunt for great dividend stocks, one of the first things they look at is the dividend yield, which expresses a stock's annual dividend payout as a percentage of its stock price.

One of the reasons investors are often drawn to bank stocks is because they tend to pay generous dividends. But just like any other industry, some banks stocks are more generous than others when it comes to their quarterly payouts.

Which are the best from the perspective of an income-seeking investor on the hunt for a high yield? You can find the answer in the table below.

With this in mind, I drew up the table below, which ranks the nation's biggest banks by dividend yield.

Here are higher capitalized bank/money center stocks with dividend yields above 3 percent....

One of the reasons investors are often drawn to bank stocks is because they tend to pay generous dividends. But just like any other industry, some banks stocks are more generous than others when it comes to their quarterly payouts.

Which are the best from the perspective of an income-seeking investor on the hunt for a high yield? You can find the answer in the table below.

With this in mind, I drew up the table below, which ranks the nation's biggest banks by dividend yield.

Here are higher capitalized bank/money center stocks with dividend yields above 3 percent....

20 Top Picks From My Safe Haven High-Yield Large Cap Screen

Every month, I run a screen to find value stocks with high dividends. Well, it's not easy to find a bargain and if you found a stock that looks like one, you could also wait years until the market detects the value.

Today I like to share a list of 20 stocks with a low beta ratio and yields over 2.77%. You will find the complete list at the end of this article. Below is also a detail view of the top yielding stocks. I hope you will find some values in it.

In addition to the screening criteria, each stock from the screen had a positive sales growth over the past five years while earnings are expected to grow by more than 5% for the next five years.

The debt-to-equity ratio is also under one and the market capitalization over 10 billion USD.

Here are the top yielding results...

Today I like to share a list of 20 stocks with a low beta ratio and yields over 2.77%. You will find the complete list at the end of this article. Below is also a detail view of the top yielding stocks. I hope you will find some values in it.

In addition to the screening criteria, each stock from the screen had a positive sales growth over the past five years while earnings are expected to grow by more than 5% for the next five years.

The debt-to-equity ratio is also under one and the market capitalization over 10 billion USD.

Here are the top yielding results...

9 Multi Generation Stocks: Dividend Stocks With A 200 Year Payment History

Long-term investors looking for

stocks with positive earnings growth for the future and sales boost as well. I

personally look at the past performance or history of a company.

Long-term investors looking for

stocks with positive earnings growth for the future and sales boost as well. I

personally look at the past performance or history of a company.

If I see

doubled sales over the past decade, it could be a good sign for a rosy business

environment.

A solid business

environment is the basis for dividend growth and share buybacks. Only a smart

company with rising operating structures can increase the shareholder value

over the long run.

If you followed my

blog for years, you might have read often articles about stocks with the

longest dividend growth history, 50 year or more. Those are real Dividend Kings,

the top of the top stocks.

I've enlarged the

screen by showing you stocks with 100 years of dividend payments. They reduced

dividends but paid always money to its owners.

Today I will give you

a snapshot of stocks that paid dividends over 200 years or more. Yes, you read

right, 200 years. That’s a generation project.

Here are the results....

19 Safe And Top Yielding Stock Ideas From Abroad

When I discover the news about

stock markets, I can see a big trend of money which is moving into the U.S.

investing space.

P/E multiples are

rising and the dollar is gaining nearly on a daily basis but this trend should not work

for years, it’s a technical driven reaction.

What I see is that

more and more investors look oversea for new investment targets. Europe is one

of the favorite investment areas if you believe that the problem of the 28

nation currency is recovering and the economy gets more grips.

Today I like to

show you the best ADR dividend stocks on the American Capital market with a

solid earnings growth prediction.

You also may like: 41 UK Dividend Growth Kings You Must Know

You also may like: 41 UK Dividend Growth Kings You Must Know

These are my

criteria:

- U.S. listed

stock with headquarter abroad (ADR)

- Large

capitalized stock

- Expected 5-year

earnings growth over 5 percent yearly

- Low forward P/E

(under 20)

- Dividend over 2

percent

- Low Volatility

19 stocks

fulfilled these ambitious criteria of which one stock has a double-digit

dividend yield. These are my

5 favorites from the screen.

Believe me, there

are a lot more top stocks but not all are included in my screening criteria

because of the ADR restriction. You can also check out my latest articles about foreign dividend stocks.

My 5 top results from the screen are…

Next Week's 20 Top Yielding Large Cap Ex-Dividend Shares

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview about stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

In total, 175 stocks go ex dividend

- of which 89 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Telefonica

Brasil, S.A.

|

25.37B

|

13.29

|

1.29

|

1.60

|

6.82%

|

|

|

Energy

Transfer Partners LP

|

19.09B

|

30.41

|

1.60

|

0.54

|

6.61%

|

|

|

Kinder

Morgan Energy Partners

|

34.70B

|

25.54

|

2.59

|

3.30

|

6.28%

|

|

|

Cheniere

Energy Partners LP.

|

10.24B

|

-

|

5.66

|

38.30

|

5.48%

|

|

|

ONEOK

Partners, L.P.

|

11.99B

|

21.97

|

2.80

|

1.12

|

5.29%

|

|

|

Southern

Company

|

37.11B

|

21.44

|

2.06

|

2.20

|

4.78%

|

|

|

Plains All American Pipeline, L.P.

|

18.19B

|

19.17

|

2.66

|

0.46

|

4.49%

|

|

|

Kinder

Morgan

|

37.80B

|

37.23

|

2.77

|

2.87

|

4.38%

|

|

|

Telefonica,

S.A.

|

79.56B

|

14.72

|

3.15

|

0.97

|

4.28%

|

|

|

Enterprise

Products Partners LP

|

57.33B

|

23.28

|

4.05

|

1.30

|

4.22%

|

|

|

Bank

of Montreal

|

45.16B

|

11.54

|

1.57

|

3.50

|

4.11%

|

|

|

Energy Transfer Equity, L.P.

|

19.23B

|

51.17

|

12.99

|

0.53

|

3.82%

|

|

|

Paychex,

Inc.

|

15.71B

|

27.22

|

8.98

|

6.67

|

3.26%

|

|

|

The

Clorox Company

|

11.65B

|

20.52

|

79.86

|

2.07

|

3.20%

|

|

|

ConAgra

Foods, Inc.

|

13.36B

|

20.08

|

2.49

|

0.82

|

3.15%

|

|

|

NiSource

Inc.

|

10.09B

|

22.92

|

1.77

|

1.88

|

3.09%

|

|

|

Texas

Instruments Inc.

|

44.37B

|

22.35

|

4.01

|

3.61

|

2.98%

|

|

|

Weyerhaeuser

Co.

|

17.35B

|

28.80

|

2.96

|

2.21

|

2.80%

|

|

|

Norfolk

Southern Corp.

|

27.53B

|

16.17

|

2.70

|

2.52

|

2.37%

|

|

|

Eaton

Corporation

|

33.91B

|

21.64

|

2.20

|

1.77

|

2.35%

|

47 Top High-Yielding Stocks With Ex-Dividend Date In October 2013

Monthly high yielding shares researched by long-term-investments.blogspot.com. Close to

the end of the month, I would like to highlight some of the best yielding ex-dividend

shares for October.

If you are a daily reader of my blog, you would have noticed

that I publish regularly lists about ex-dividend stocks. It’s a great information

tool for investors who love it to receive dividends. If you purchase a stocks quick

before the ex-dividend date, you get a faster cash return but you will not make

extra gains with these money because on the ex-date, the stock would also be traded

ex-dividend but with yields of about 0.5 percent quarter dividend or so, you will

definitely see no big changes because the daily fluctuations are much higher.

However, every month, I create a small list about

interesting high yielding stocks with ex-dividend date for the next month. I

think it could bring you some values to see what companies pay you cash next

month with an attractive equity story.

As result, I found 47 stocks with an average dividend

yield of 5.76 percent. Eight stocks have a double-digit yield and additional eight

stocks have a high yield below 10 percent but over 5 percent. 21 stocks from

the results have a buy or better recommendation.

Ex-Dividend Stocks: Best Dividend Paying Shares On July 30, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks July 30,

2013. In total, 42 stocks go ex

dividend - of which 17 yield more than 3 percent. The average yield amounts to 4.13%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Realty

Income Corp.

|

8.66B

|

62.39

|

1.94

|

14.31

|

4.92%

|

|

|

Bank

of Montreal

|

41.57B

|

11.01

|

1.60

|

3.18

|

4.45%

|

|

|

People's

United Financial Inc.

|

4.77B

|

20.86

|

1.02

|

4.72

|

4.27%

|

|

|

Genesis

Energy LP

|

4.18B

|

41.85

|

4.65

|

0.98

|

3.96%

|

|

|

Pinnacle

West Capital

|

6.55B

|

15.74

|

1.63

|

1.95

|

3.65%

|

|

|

Paychex,

Inc.

|

14.32B

|

25.17

|

8.08

|

6.16

|

3.57%

|

|

|

Hasbro

Inc.

|

6.14B

|

19.30

|

4.21

|

1.51

|

3.40%

|

|

|

MeadWestvaco

Corporation

|

6.41B

|

37.09

|

1.91

|

1.17

|

2.75%

|

|

|

The

Mosaic Company

|

22.41B

|

11.90

|

1.67

|

2.25

|

1.90%

|

|

|

NRG

Energy, Inc.

|

8.94B

|

13.11

|

0.93

|

1.03

|

1.73%

|

|

|

Advanced

Semiconductor

|

6.16B

|

14.03

|

1.64

|

0.92

|

1.72%

|

|

|

Brookfield

Asset Management

|

23.29B

|

20.13

|

1.35

|

1.19

|

1.59%

|

|

|

CARBO

Ceramics Inc.

|

2.02B

|

26.21

|

2.77

|

3.34

|

1.36%

|

|

|

The

AES Corporation

|

9.30B

|

-

|

2.01

|

0.52

|

1.28%

|

|

|

First

Republic Bank

|

5.59B

|

13.75

|

1.80

|

4.26

|

1.13%

|

|

|

Casey's

General Stores Inc.

|

2.57B

|

23.47

|

4.27

|

0.35

|

1.07%

|

|

|

Aon

Corporation

|

21.41B

|

21.64

|

2.83

|

1.84

|

1.04%

|

|

|

Zoetis

Inc.

|

15.22B

|

32.72

|

21.43

|

3.47

|

0.85%

|

Subscribe to:

Posts (Atom)