To keep this blog running free without ads, we need your help. For a small donation by using this link or clicking the paypal donation button below, you can help us to keep this blog alive.

As gift for your support, we send you our full Dividend Growth Stock Factbook Collection with over 800+ long-term dividend growth stocks in PDF and Excel. You can also join our distribution list to receive these tools every month.

Here is an example of our open Excel Database for your own research:

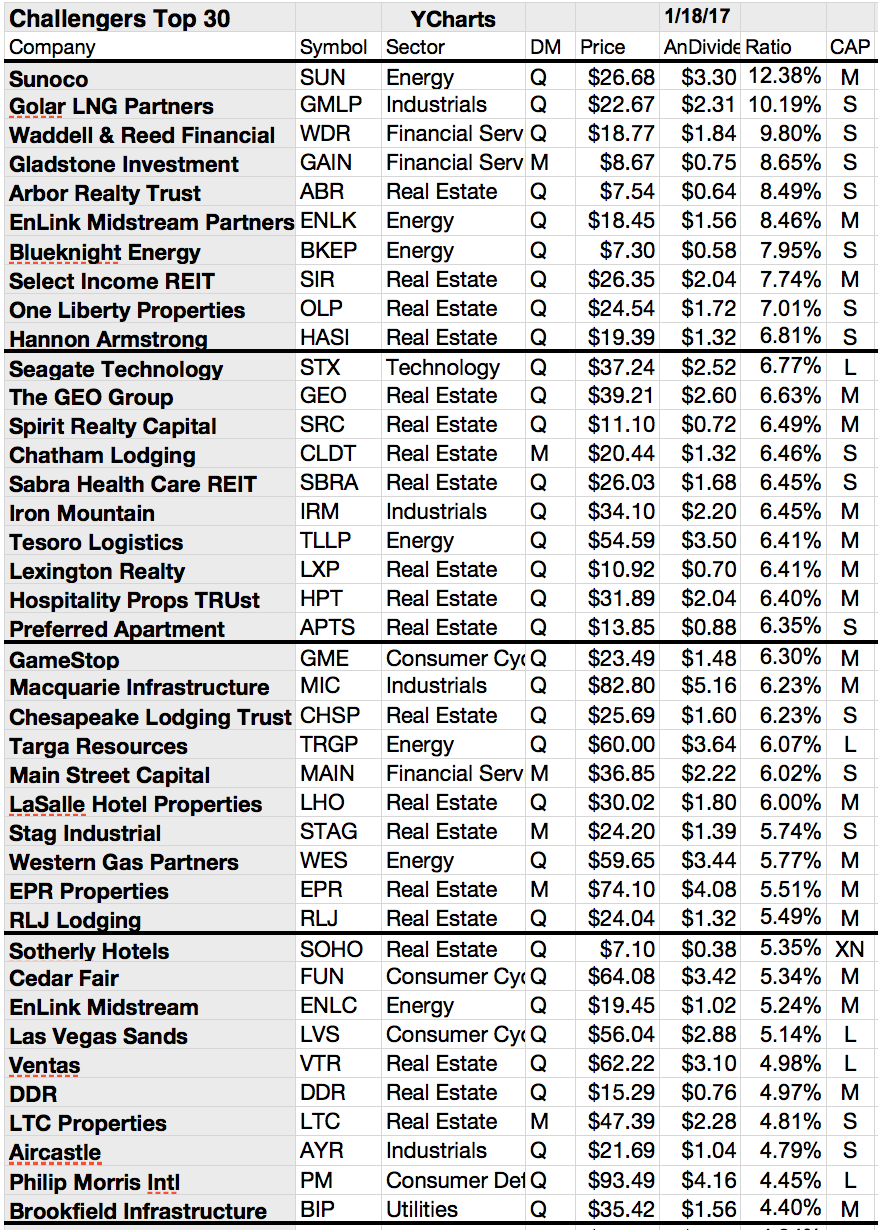

Here are the Dividend Challenger Growth Stocks

With Yields Over 8%...

|

Ticker

|

Company

|

P/E

|

Fwd P/E

|

P/S

|

P/B

|

Dividend

|

|

SUN

|

Sunoco LP

|

80.2

|

11.02

|

0.15

|

2.52

|

11.79%

|

|

NRZ

|

New Residential Investment Corp.

|

4.33

|

7.43

|

2.45

|

1.01

|

11.68%

|

|

SRLP

|

Sprague Resources LP

|

20.49

|

11.27

|

0.16

|

3.59

|

10.60%

|

|

SIR

|

Select Income REIT

|

22.08

|

28.47

|

3.89

|

0.83

|

10.54%

|

|

DKL

|

Delek Logistics Partners, LP

|

12.63

|

7.79

|

1.24

|

4.35

|

10.20%

|

|

ANDX

|

Andeavor Logistics LP

|

17.39

|

12.5

|

2.74

|

3.21

|

10.02%

|

|

EQM

|

EQM Midstream Partners, LP

|

8.59

|

9.2

|

4.05

|

1

|

9.96%

|

|

GME

|

GameStop Corp.

|

-

|

5.45

|

0.18

|

0.74

|

9.90%

|

|

HMLP

|

Hoegh LNG Partners LP

|

11.64

|

9.9

|

4.11

|

1.52

|

9.84%

|

|

PEGI

|

Pattern Energy Group Inc.

|

13.87

|

33.29

|

4.09

|

1.52

|

9.23%

|

|

LXP

|

Lexington Realty Trust

|

138.93

|

27.49

|

4.72

|

1.65

|

9.13%

|

|

PBFX

|

PBF Logistics LP

|

11.21

|

9.96

|

3.97

|

-

|

9.07%

|

|

GEO

|

The GEO Group, Inc.

|

17.33

|

15.16

|

1.23

|

2.45

|

8.44%

|

|

ABR

|

Arbor Realty Trust, Inc.

|

9.78

|

10.98

|

2.27

|

1.15

|

8.41%

|

|

GLOP

|

GasLog Partners LP

|

10.82

|

11.76

|

3.41

|

1.38

|

8.34%

|

|

SBRA

|

Sabra Health

Care REIT, Inc.

|

10.43

|

16.73

|

6.53

|

1.15

|

8.23%

|

|

HPT

|

Hospitality Properties Trust

|

14.69

|

24.89

|

1.93

|

1.54

|

8.19%

|