|

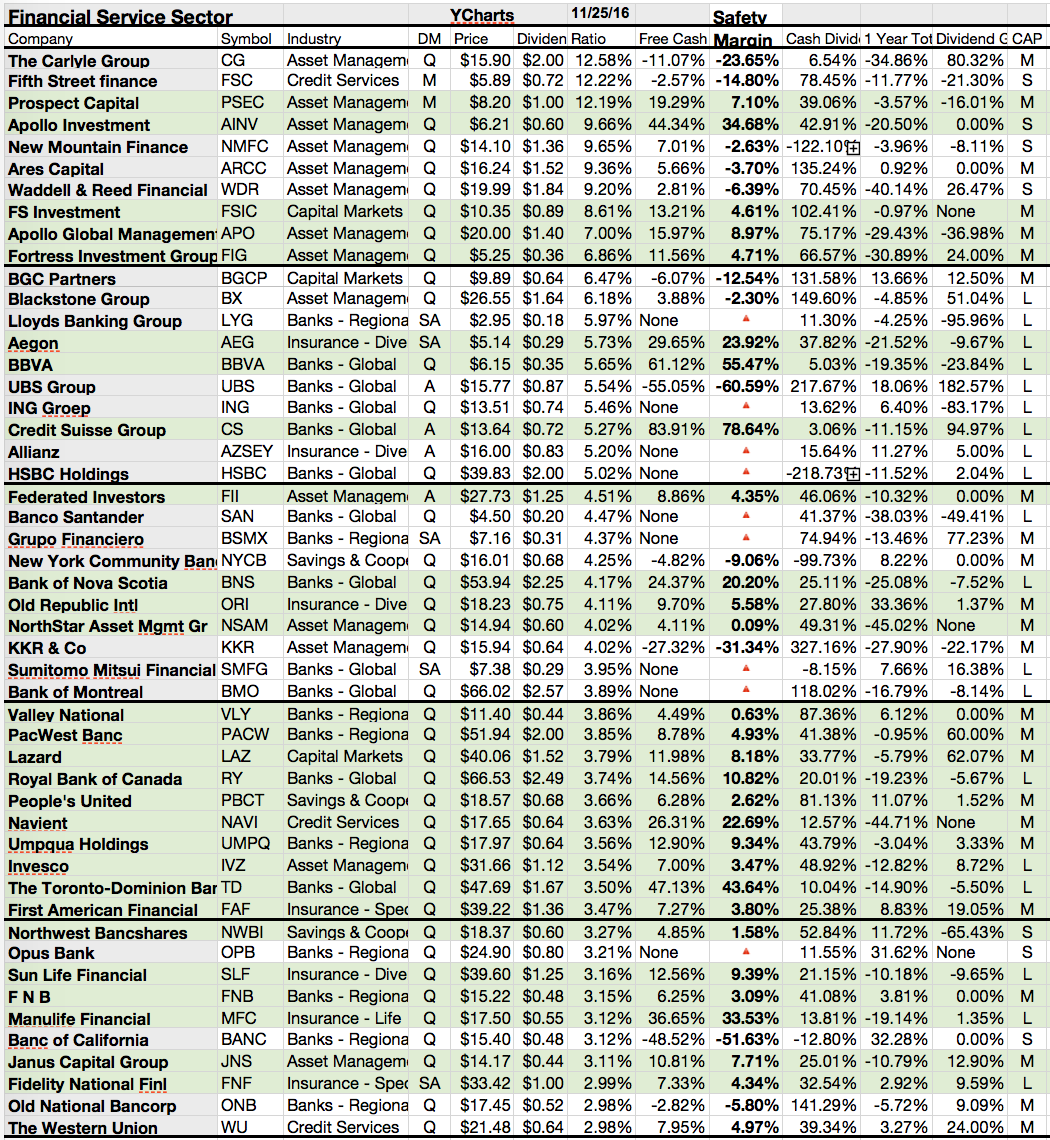

| 50 Financial Dividend Financial Dogs (Source: Seeking Alpha) |

Showing posts with label PACW. Show all posts

Showing posts with label PACW. Show all posts

20 Cheap Dividend Challenger Dogs With Yields Up To 11.79%

If income is your investment objective, the deck is stacked against you, as interest rates remain velcroed to record lows. But there are attractive dividend stocks out there, provided you can commit for the long run.

The Dividend Growth stocks from 5 to 50 years of consecutive dividend growth are the most popular stocks within the long-term income asset class.

I often write about stocks with a longer investment period and one basic approach is to look at the past performance of a business in order to develop future prospects of the firm.

I believe that a good past performance tells us something about the quality of the business, the market barriers, brands and consumer loyalty. It also tells us something about volume products and the art of business, the magic formula about selling a product.

Today I like to introduce some of the highest yielding stocks with cheap price mutiples from the Dividend Challengers list. Each of the stocks has increased dividends by more than 5 years in a row.

These are the best dogs from the Dividend Challengers list...

The Dividend Growth stocks from 5 to 50 years of consecutive dividend growth are the most popular stocks within the long-term income asset class.

I often write about stocks with a longer investment period and one basic approach is to look at the past performance of a business in order to develop future prospects of the firm.

I believe that a good past performance tells us something about the quality of the business, the market barriers, brands and consumer loyalty. It also tells us something about volume products and the art of business, the magic formula about selling a product.

Today I like to introduce some of the highest yielding stocks with cheap price mutiples from the Dividend Challengers list. Each of the stocks has increased dividends by more than 5 years in a row.

These are the best dogs from the Dividend Challengers list...

15 High Yielding Cheap Stocks By Price To Free Cashfow

It's no secret that dividend-yielding stocks are the cornerstones of a solid retirement portfolio. Usually, such stocks represent ownership in stalwart businesses that pay shareholders on a quarterly basis.

Those payments not only offer downside protection, but they can also compound returns over time. Still, one of the dangers of dividend investing is chasing after high yields.

Case in point: The 10 stocks listed below have the highest yields of all the companies in the S&P 500, but not all of them are worth your investing dollars. In many cases, there's a good reason such stocks have high yields -- because there's a lot of risk involved. If you're a dividend investor, there's nothing more important than free cash flow (FCF).

This represents the amount of money a company was able to put in its pocket at the end of the year, minus capital expenditures. It is from FCF that dividends are paid, and investors should generally aim for companies that use less than 85% of their FCF to pay dividends.

Attached you will find a couple of stocks with a low price multiple in relation to its free cash flow. Each of the listed stocks has a dividend yield over 4 percent, a market capitalization over 2 billion and a debt-to-equity ratio below 1.

These are the results...

Those payments not only offer downside protection, but they can also compound returns over time. Still, one of the dangers of dividend investing is chasing after high yields.

Case in point: The 10 stocks listed below have the highest yields of all the companies in the S&P 500, but not all of them are worth your investing dollars. In many cases, there's a good reason such stocks have high yields -- because there's a lot of risk involved. If you're a dividend investor, there's nothing more important than free cash flow (FCF).

This represents the amount of money a company was able to put in its pocket at the end of the year, minus capital expenditures. It is from FCF that dividends are paid, and investors should generally aim for companies that use less than 85% of their FCF to pay dividends.

Attached you will find a couple of stocks with a low price multiple in relation to its free cash flow. Each of the listed stocks has a dividend yield over 4 percent, a market capitalization over 2 billion and a debt-to-equity ratio below 1.

These are the results...

These 3 Stocks Quadrupled Dividends And Should Grow Them Further

Companies that can afford to keep paying their shareholders are great, but dividend stocks that have the potential to pay their shareholders more over time are even better.

We have found three such stocks which have proven themselves with regards to growing dividend payouts significantly over the last five years.

They also appear well-positioned to see continued dividend growth over the long run.

Here are the stocks...

We have found three such stocks which have proven themselves with regards to growing dividend payouts significantly over the last five years.

They also appear well-positioned to see continued dividend growth over the long run.

Here are the stocks...

20 Cheapest High-Yield Dividend Challengers

Today's screen is focused on high yields and low P/E within the Dividend Challengers space. Those stocks managed to raise dividends by more than 5 years in a row.

Challengers jumped over the first level of dividend growth barriers. One day they could become a Dividend Contender, Achiever, Champion, Aristocrat or even a Dividend King.

Most Challengers have in common that they could fail to raise dividends in the future. There are more cyclic stocks on the list. The top yielding results com the credit services, REIT and oil and gas sector.

My favorites are GMLP, SSW, STX, WDR, SSI, and SAFT. Which stocks do you like from the screen? Please let me know some of your thoughts by leaving a comment. Here are the 20 cheapest high-yield Dividend Challengers….

Here are the 20 cheapest high-yield Dividend Challengers…

Challengers jumped over the first level of dividend growth barriers. One day they could become a Dividend Contender, Achiever, Champion, Aristocrat or even a Dividend King.

Most Challengers have in common that they could fail to raise dividends in the future. There are more cyclic stocks on the list. The top yielding results com the credit services, REIT and oil and gas sector.

My favorites are GMLP, SSW, STX, WDR, SSI, and SAFT. Which stocks do you like from the screen? Please let me know some of your thoughts by leaving a comment. Here are the 20 cheapest high-yield Dividend Challengers….

Here are the 20 cheapest high-yield Dividend Challengers…

19 Cheap Stocks With A Free Cashflow Yield Over 6.67%

Everyone needs cheap stocks for a

solid return. But what cheap really means depends on your growth expectations.

Everyone needs cheap stocks for a

solid return. But what cheap really means depends on your growth expectations.

I tell you that

earnings are not equal to free cash flow. Some companies need much money to

grow or they put large amounts of cash into the business to keep them alive due

to high amortizations.

If you look for

cheap stocks, you also need to cheap price to free cash flow ratios.

Today I would like

to introduce a few dozen or and a few more stocks with a cheap price to free cash

flow ratio (less than 15). A ratio under 15 indicates that the potential payout

yield is over 6.67%.

In addition, I've

only listed those stocks with a positive earnings growth outlook for the next

five years. That's in my view a method to filter only well-running business.

Despite the tight

criteria, the screen also produced some struggling companies like BHP or Rio

Tinto. I like them for sure but I do believe that they are not worth investing

while the commodity price still low or at multi-year lows.

Here are the

results from my screen...

11 Dividend Growth Stocks With Low Debt, Solid Growth And Yields Over 4%

All too often, yield-starved investors give in to the temptation of high yield dividend stocks. Dividend yields greater than 5% look like an easy way to grab more current income on the surface, but dividend income is just part of the total return equation.

All too often, yield-starved investors give in to the temptation of high yield dividend stocks. Dividend yields greater than 5% look like an easy way to grab more current income on the surface, but dividend income is just part of the total return equation.If a stock with a 6% dividend yield sees its price cut in half, an investor living off dividends in retirement would have been better off purchasing a lower yielding stock with less business risk and volatility, occasionally selling shares to meet his or her cash flow needs.

That's the reason for my today's screen. I've tried to catch some companies with high dividends which are not at risk to cut.

The total amount of debt is one important criterion for a dividend cut. Growth is also an important issue.

Each stock I've researched has a dividend yield over 4% and positive 5 year EPS growth forecasts. In addition, debt-to-equity ratios are under 0.4. Eleven stocks fulfilled my tight criteria of which 3 got a buy or better rating by analysts.

Here are the best yielding results from my research...

20 Highly Shorted Financial Dividend Stocks And Which 11 Are Wrong

Financial dividend stocks with highest float

short ratio originally published at "long-term-investments.blogspot.com". Financials are in

focus of many investors because they have a great possibility to leverage profits and they benefit if the

economy starts to grow.

But the whole sector is also very vulnerable for systematic risks. Due to the concatenation of many firms, a bail in of one company can hurt the whole system deeply.

But the whole sector is also very vulnerable for systematic risks. Due to the concatenation of many firms, a bail in of one company can hurt the whole system deeply.

This is also one of the reasons why financial

stocks are very popular targets for short sellers. If there develops a rumor, it ends

in a bank run.

Today I like to show you which stocks from the

financial sector (excluded by ETFs) have the highest float short ratio. My only

restriction is a market capitalization of more than USD 300 million.

The 20 top results have a float short ratio between 11.56

and 28.67 percent. The Insuring industry is the biggest industry followed by

REITs. Despite the negative view of the investors, eleven of the results have a

current buy or better recommendation.

Subscribe to:

Posts (Atom)