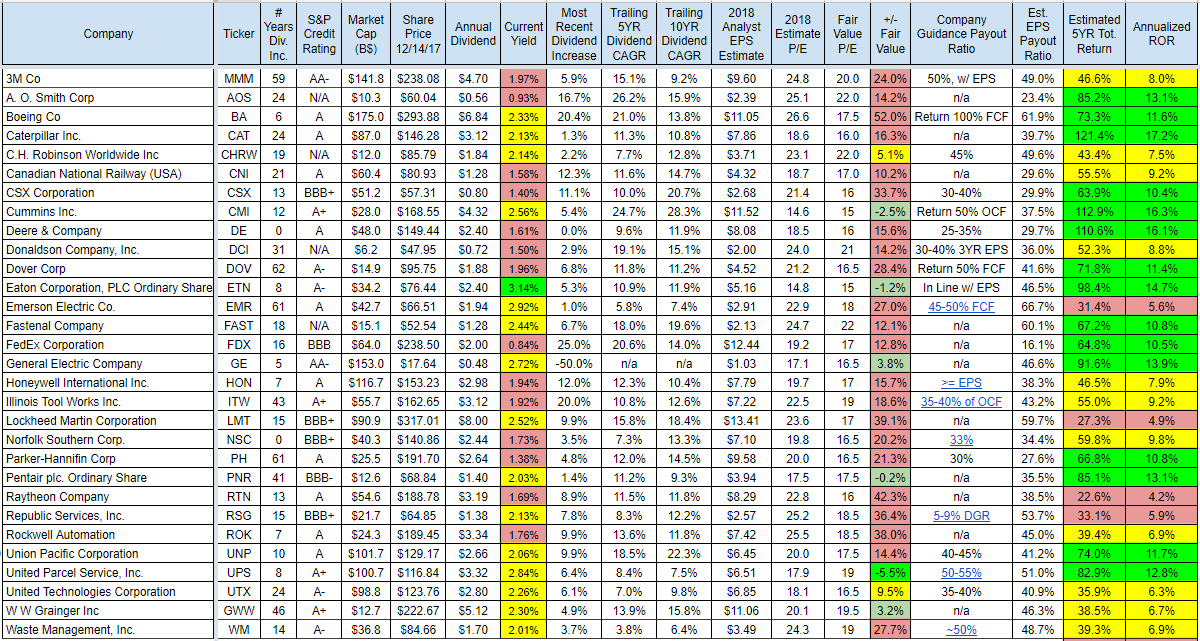

The companies on this list were originally selected based on their track records of dividend growth, financial ratings, and earnings growth.

Showing posts with label RTN. Show all posts

Showing posts with label RTN. Show all posts

18 Industrial Stocks I Love To Buy

I am personally finding plenty of interesting bargains and reasonable valuations in the industrial sector these days, one of the few places they exist.

Dividend investors might be tired of investing in the same old consumer staples or consider those trades too crowded to invest new money into. So where do they go?

Below I have outlined a few interesting industrial plays that have very cheap or reasonable valuations and competitive yields or future dividend growth prospects if the current yield is very low.

Here are the top yielding results...

Dividend investors might be tired of investing in the same old consumer staples or consider those trades too crowded to invest new money into. So where do they go?

Below I have outlined a few interesting industrial plays that have very cheap or reasonable valuations and competitive yields or future dividend growth prospects if the current yield is very low.

Here are the top yielding results...

30 Fast-Growing Dividend Growth Stocks For High Total Return

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

If the company

growth and with them the dividend payout, your passive income should also grow

and your investment finally be higher.

Attached you will

find a nice overview of the best dividend growth stocks of the recent decade

sorted by short-term, mid-term and long-term dividend growth.

For sure the past

performance is no guarantee for growth in the future but it gives a nice

overview about the good stocks in the past.

Maybe you own some

of them and you have made a decent amount of money with your investment.

Here are the best dividend growth stocks of the past...

These Military Stocks Profiting Mostly From Wars

Since the conclusion of World War

II, the United States and a number of Western European nations have maintained

extremely costly military industrial complexes — both in peacetime and during

the numerous other conflicts since.

Since the conclusion of World War

II, the United States and a number of Western European nations have maintained

extremely costly military industrial complexes — both in peacetime and during

the numerous other conflicts since.

The United States

is far and away the largest defense market, and U.S.-based companies

disproportionately comprise the top global arms dealers.

Global military

sales from the 100 largest dealers totaled $401 billion in 2014, down by 1.5% —

but still substantially higher than in 2002 — according to the latest estimates

released by the Stockholm International Peace Research Institute (SIPRI).

Today I like to

show you those military and defense stocks that offer the most values for

investors.

Each of the

attached results pays a dividend. The results are ranked by market

capitalization. There is a huge range of stocks available.

Here are the best choices

in my view...

Stocks With The Highest Annual Dividend Growth Of The Past 3, 5 and 10 Years

Recently, I showed you how your investment portfolio grows over 30 years if you own sustainable long-term dividend growth stocks.

Recently, I showed you how your investment portfolio grows over 30 years if you own sustainable long-term dividend growth stocks. The key notice from the article was that if you buy high yielding stocks with fast dividend growth, you could maximize your portfolio return.

It sounds quite easy but it’s hard to find those stocks because no one of us can look into the future or has crystal ball.

Today I like to show you those stocks with the highest short, mid and long-term dividend growth of the past 3, 5 and 10 years.

Over the next upcoming days, I will also deliver a few stocks with the highest 10year dividend growth rate of the most consistent dividend raiser in the market.

Here the best dividend growers of the past decade....

My Yield-Growth Screening Results June 2015 - (RTN, ADM, TRV)

The Yield/Growth stock Report for June 2015 is out. I've compiled the 20 cheapest high yielding dividend growers in a Factbook. You find there also the 20 fastest growing stocks with cheap forward P/E.

The idea is simple. I look for stocks with the most reliable dividend growth on the market. Those stocks have risen dividends over 10 consecutive years.

My favorites on the list are Travellers, ACE Limited, IBM and Qualcomm for yield. Top Picks from the fastest growing list are T. Rowe Price, AmTrust Financial Services, Archer-Daniels Midland and finally Raytheon. Which do you like?

The compilation includes the 20 top yielding stocks with a forward P/E of less than 15 and a dividend growth history of more than 10 years.

The idea is simple. I look for stocks with the most reliable dividend growth on the market. Those stocks have risen dividends over 10 consecutive years.

My favorites on the list are Travellers, ACE Limited, IBM and Qualcomm for yield. Top Picks from the fastest growing list are T. Rowe Price, AmTrust Financial Services, Archer-Daniels Midland and finally Raytheon. Which do you like?

The compilation includes the 20 top yielding stocks with a forward P/E of less than 15 and a dividend growth history of more than 10 years.

In addition, the factbook includes a list of the 20 fastest growing stocks with a cheap forward price-to-earnings ratio.

By giving us a small

PayPal donation, you get a fresh updated version. Just donate and we send you

the Factsheet to your PayPal donation e-mail. Thank you for supporting us. It

helps us do keep this site free for everyone.

Stocks For The Next Decade Each Safe Haven Investor Need To Know

When it comes to times of

uncertainty and volatility, nothing beats safe haven stocks. What are they?

They are dividend stocks with high yields and minimal risk as compared to other

stocks.

You might have

noticed that the federal banks flooding the markets with cheap money and

investors started to get greedy by taking more and more debt to buy stocks

higher and bonds extraordinary higher.

Those times come

to an end if rates rise or something else crosses like weak economic data. This

time, the strong dollar could bring the rally to an end.

Today I like to

show you 13 stocks with cheap price ratios and an extremely stable business

model that can resist the greatest market storm. It does not mean that the

stock price goes down but with every recession those stocks become stronger and

stronger.

These are my

ideas. What do you guess?

Labels:

ACE,

BBY,

Cheap Stock,

Dividend Achivers,

Dividend Aristocrats,

Dividend Champions,

Dividend Contenders,

Dividends,

EV,

GPS,

NSC,

QCOM,

RTN,

TROW,

TRV,

VZ

War Stocks: 8 Interesting Military, Aerospace & Defense Dividend Stocks Income Investors Need

Military expenditure shrunk in 2013 by 1.9% but not all countries are spending less.

Military spending in North America and in Western and Central European countries has continued to decline, while other countries such as Brazil and Russia have increased their arms investments.

I'm not a military guy but my guess is that it could be possible to come back to cold war times. Maybe Europe is creating an own army to fight against Russia. There is a lot of rumor in the market.

Who might benefit? Defense and Aerospace stocks. Today, I've created a small overview of defense stocks with good dividends that might catch a good part of military budget.

You can also get more dividend ideas from the military and defense industry in my recent articles.

Which stocks do you like?

These are the highlights....

Military spending in North America and in Western and Central European countries has continued to decline, while other countries such as Brazil and Russia have increased their arms investments.

I'm not a military guy but my guess is that it could be possible to come back to cold war times. Maybe Europe is creating an own army to fight against Russia. There is a lot of rumor in the market.

Who might benefit? Defense and Aerospace stocks. Today, I've created a small overview of defense stocks with good dividends that might catch a good part of military budget.

You can also get more dividend ideas from the military and defense industry in my recent articles.

Which stocks do you like?

These are the highlights....

8 Stocks to Beat Warren Buffett's Portfolio Return Easily

Warren Buffett is one of the most

trusted investors in the world. When he put money on the table, many

institutional investors follow his moves and discover if they could make any

money with the stocks he has chosen.

When I look at the

recent earnings figures of some of his investments, I saw that many stocks

reported results not in-line with investor’s expectations. As a result, they

got sold massively out.

IBM, Coca Cola,

Tesco, Exxon and now diabetes drug maker Sanofi who lost yesterday nine

percent. Are these long-term opportunities or will they run flat in the future?

I don't know but what I know is that some of the past results of those

companies are not comparable to the current economic environment.

I personally

checked some of his new investments and came to the result that Warren is

building a new investment company, based on energy and capital intensive

stocks.

I'm a fundamental

driven growth investors who love to see that the company is paying a good part

of its free cash flow to shareholders.

You also may like: 10 Stocks With The Highest Share Buyback Volume In 2014

You also may like: 10 Stocks With The Highest Share Buyback Volume In 2014

The market has

many great companies to offer which have doubled sales in the past decade and

paid 40 percent of the current stock price in dividends over the recent ten

years. That's a good number in my view.

Today, when the

markets have recovered, I start a new screen of high-quality dividend stocks

with attractive fundamentals. I know that it is hard to find cheap companies in

highly valuated markets but sometimes we must be creative to calculate the real

values.

Below are five

ideas with double digit-expected earnings per share growth figures for the next

five years. They have also a lower beta than the overall market and acceptable

debt-to-equity ratios.

I've compiled many

stocks from different sectors and industries in order to create a good

diversification. What do you think about my new ideas? Are they good enough to

buy or do you still have some of them? Please let me know and thank you for

reading and commenting.

These are my results:

These are my results:

6 Stock Ideas With Dividend Growth And Double-Digit Earnings Growth Forecasts

I always look for investment opportunities

that offer growth and dividends combined.

This weekend, I've summarized some stocks with over 5 years of consecutive dividend growth and expected 5-Year earnings growth above 10 percent yearly.

It's hard to find cheap stocks that grow safely, especially when the overall market is really ambitious valuated.

Below are six stock ideas from each of the popular dividend growth categories (Dividend Champions, Dividend Contenders as well as Dividend Challengers), with a low forward P/E of less than 15 as well as double-digit earnings predictions by analysts.

This weekend, I've summarized some stocks with over 5 years of consecutive dividend growth and expected 5-Year earnings growth above 10 percent yearly.

It's hard to find cheap stocks that grow safely, especially when the overall market is really ambitious valuated.

Below are six stock ideas from each of the popular dividend growth categories (Dividend Champions, Dividend Contenders as well as Dividend Challengers), with a low forward P/E of less than 15 as well as double-digit earnings predictions by analysts.

Labels:

BEN,

Cheap Stock,

Dividend Challengers,

Dividend Champions,

Dividend Contenders,

Dividend Growth,

Dividends,

Earnings,

GPS,

Growth,

QCOM,

RTN,

TGT,

WU

Potential Investment Targets Of Warren Buffett - Part III

Warren Buffett sits on big cash that is growing each month. I've started an article serial that discovers potential white elephants which could be potential takeover targets for the big guru investor.

The ideas came from Bloomberg. In my view, they are a little bit abstract and far away from that you might think because they were discovered by strict criteria.

Today you can find additional 5 stocks which could be interesting for the institutional investor from Omaha.

Here you can find the first two articles with the criteria:

5 Stocks That Warren Buffett Would Love: Part II

Warren Buffett's Targets Part I

5 stocks that Warren Buffett should like are..

The ideas came from Bloomberg. In my view, they are a little bit abstract and far away from that you might think because they were discovered by strict criteria.

Today you can find additional 5 stocks which could be interesting for the institutional investor from Omaha.

Here you can find the first two articles with the criteria:

5 Stocks That Warren Buffett Would Love: Part II

Warren Buffett's Targets Part I

5 stocks that Warren Buffett should like are..

Labels:

Berkshire Hathaway,

CAH,

Dividend Growth,

Dividends,

Guru,

MCK,

Portfolio Strategies,

RTN,

Warren Buffett,

WPZ,

YUM

Next Week's 20 Top Yielding Ex-Dividend Shares - An Overview

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

In total, 57 stocks go ex dividend

- of which 20 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the next week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Oi

SA

|

3.21B

|

5.76

|

0.61

|

0.23

|

13.27%

|

|

Chimera

Investment Corporation

|

3.14B

|

27.73

|

0.99

|

17.78

|

11.80%

|

|

Corrections

Corporation of America

|

3.78B

|

12.45

|

2.52

|

2.17

|

5.45%

|

|

Brandywine

Realty Trust

|

2.08B

|

-

|

1.09

|

3.70

|

4.47%

|

|

Kimco

Realty Corporation

|

8.30B

|

59.91

|

1.76

|

8.67

|

4.12%

|

|

DCT

Industrial Trust Inc.

|

2.12B

|

-

|

1.52

|

7.45

|

3.85%

|

|

The

Toronto-Dominion Bank

|

82.92B

|

13.47

|

1.87

|

3.81

|

3.66%

|

|

Sysco

Corp.

|

18.99B

|

19.18

|

3.66

|

0.43

|

3.50%

|

|

American

Eagle Outfitters, Inc.

|

2.76B

|

12.79

|

2.29

|

0.80

|

3.49%

|

|

Erie

Indemnity Co.

|

3.43B

|

24.10

|

5.30

|

0.59

|

3.22%

|

|

Bristol-Myers

Squibb Company

|

75.95B

|

56.34

|

5.29

|

4.81

|

3.03%

|

|

Cisco

Systems, Inc.

|

125.24B

|

12.54

|

2.12

|

2.58

|

2.91%

|

|

JPMorgan

Chase & Co.

|

197.59B

|

8.72

|

1.00

|

3.67

|

2.91%

|

|

Banco

Bradesco S.A.

|

59.00B

|

11.26

|

1.82

|

2.74

|

2.84%

|

|

Raytheon

Co.

|

25.58B

|

13.32

|

2.99

|

1.05

|

2.79%

|

|

Banco

Bradesco S.A.

|

66.19B

|

11.67

|

2.04

|

2.62

|

2.35%

|

|

Gentex

Corp.

|

3.65B

|

20.37

|

3.02

|

3.36

|

2.20%

|

|

Medtronic,

Inc.

|

53.51B

|

15.23

|

2.89

|

3.21

|

2.11%

|

|

Comcast

Corporation

|

117.71B

|

17.68

|

2.40

|

1.84

|

1.74%

|

|

Royal

Gold, Inc.

|

3.12B

|

43.78

|

1.33

|

10.79

|

1.66%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On September 30, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 8 stocks go ex dividend

- of which 3 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Oi

SA

|

3.26B

|

5.85

|

0.62

|

0.23

|

13.07%

|

|

Corrections

Corporation of America

|

3.81B

|

12.53

|

2.54

|

2.19

|

5.41%

|

|

American

Eagle Outfitters, Inc.

|

2.74B

|

12.71

|

2.28

|

0.80

|

3.51%

|

|

CVB

Financial Corp.

|

1.41B

|

18.27

|

1.88

|

5.86

|

2.96%

|

|

Raytheon

Co.

|

25.93B

|

13.50

|

3.03

|

1.06

|

2.76%

|

|

Village

Super Market Inc.

|

520.66M

|

19.88

|

2.23

|

0.35

|

2.59%

|

|

Mackinac

Financial Corp.

|

50.06M

|

13.25

|

0.80

|

2.01

|

1.78%

|

|

Comcast

Corporation

|

116.03B

|

17.43

|

2.36

|

1.81

|

1.77%

|

Subscribe to:

Posts (Atom)