|

| Source: Seeking Alpha |

4 Best Income Stocks Worth Buying in 2017

Income stocks are considered to be good investment options as they generate a secure ongoing stream of regular income for the duration that the stock is held. Hence, such stocks can be an excellent option for risk-averse, long-term investors.

Investors often look for quick money-making alternatives by investing in stocks and achieving fast capital appreciation through increases in share prices. However, the risks involved in the selection process - unexpected stock price declines, market selloffs and elevated tax costs on short-term investments - are often overlooked.

Dividend investing is prudent as dividends are a less risky component of total return than capital appreciation. Also, dividend stocks are historically less volatile than non-dividend stocks. Moreover, they reflect a company's solid financial structure and strong fundamentals.

Whether it's an up market or a down market, there's always a place for dividend investing. Here's why: The yields on dividend stocks rise when their share prices go down.

That's an opportunity to chase extra yield. On the flip side, if the market is escalating upwards - that's obviously good for all equities. Hence, it can be easily said that dividend-paying stocks are always appropriate for long-term investors.

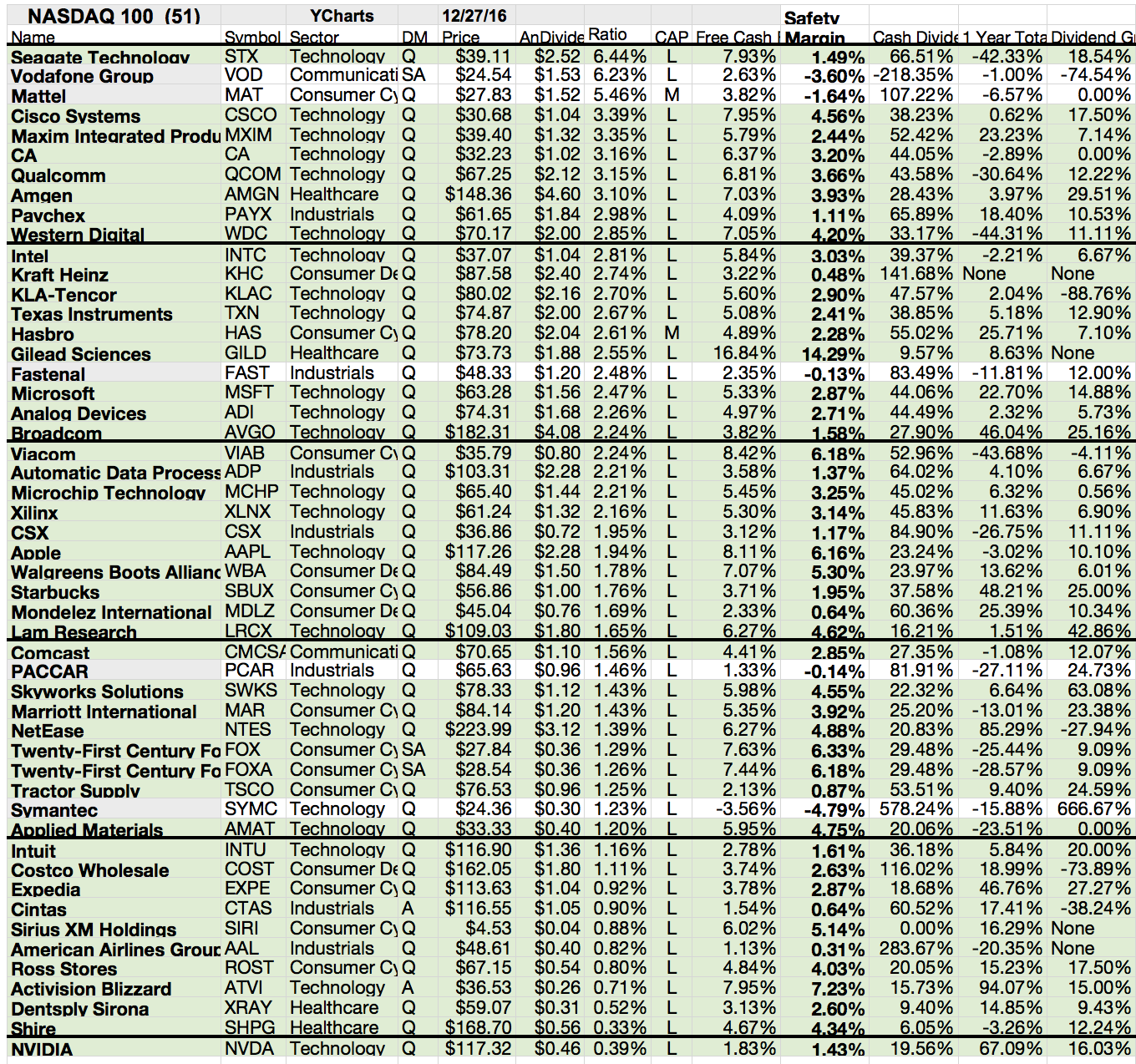

Attached I've compiled a couple of dividend stocks that might be interesting to buy and hold for the next year. All stocks offer a dividend yield of minimum 3% and have a steady dividend growth rate of above 5% in the last five years.

These are the results...

Investors often look for quick money-making alternatives by investing in stocks and achieving fast capital appreciation through increases in share prices. However, the risks involved in the selection process - unexpected stock price declines, market selloffs and elevated tax costs on short-term investments - are often overlooked.

Dividend investing is prudent as dividends are a less risky component of total return than capital appreciation. Also, dividend stocks are historically less volatile than non-dividend stocks. Moreover, they reflect a company's solid financial structure and strong fundamentals.

Whether it's an up market or a down market, there's always a place for dividend investing. Here's why: The yields on dividend stocks rise when their share prices go down.

That's an opportunity to chase extra yield. On the flip side, if the market is escalating upwards - that's obviously good for all equities. Hence, it can be easily said that dividend-paying stocks are always appropriate for long-term investors.

Attached I've compiled a couple of dividend stocks that might be interesting to buy and hold for the next year. All stocks offer a dividend yield of minimum 3% and have a steady dividend growth rate of above 5% in the last five years.

These are the results...

10 Best Dividend Growth Stocks For 2017

It's no secret that a high-quality portfolio of dividend growth stocks is one of the most powerful long-term wealth compounding tools.

Of course, the hardest part of investing is identifying high-quality companies and separating them from lesser-quality ones.

One great way to do this is find companies with high returns on invested capital, or ROIC. ROIC tells us how good management is at converting capital into profits that can go toward paying secure and growing dividends over time.

Better yet, studies show that over the long term a company's total returns generally track its ROIC, which means that dividend growth companies with high ROICs are good choices for your diversified dividend portfolio.

Let's take a look at 10 high-quality, high-ROIC dividend growth names, all of which have bright futures and can be great allies in reaching your own financial goals, such as living off dividends in retirement.

These are the results...

Of course, the hardest part of investing is identifying high-quality companies and separating them from lesser-quality ones.

One great way to do this is find companies with high returns on invested capital, or ROIC. ROIC tells us how good management is at converting capital into profits that can go toward paying secure and growing dividends over time.

Better yet, studies show that over the long term a company's total returns generally track its ROIC, which means that dividend growth companies with high ROICs are good choices for your diversified dividend portfolio.

Let's take a look at 10 high-quality, high-ROIC dividend growth names, all of which have bright futures and can be great allies in reaching your own financial goals, such as living off dividends in retirement.

These are the results...

5 Great Dividend Paying Stocks With Yields Over 3% To Buy For 2017

Dividend stocks are income investor favorites because they not only pay cash to shareholders but also boost their payouts over time. These stocks are generally less volatile in nature and hence are often more dependable when it comes to long-term investment planning.

Dividend-paying stocks are particularly beneficial amid a low interest rate environment, as these stocks offer substantial yields on a regular basis. Moreover, such stocks are historically proven to outperform in the long term and are quite reliable in terms of wealth creation.

Yield is basically a stock’s annual dividend rate divided by its share price. A dividend yield can increase if a company boosts its payout. The yield can also rise if the share price falls. In fact, an ultra-high yield due to a plunging stock price may signal that a company is in trouble and is likely to cut or even suspend the dividend.

It's very important to own safe high yielding stocks. Not a high yield is the key for a successful investing, a stable and growing yield is the conclusion.

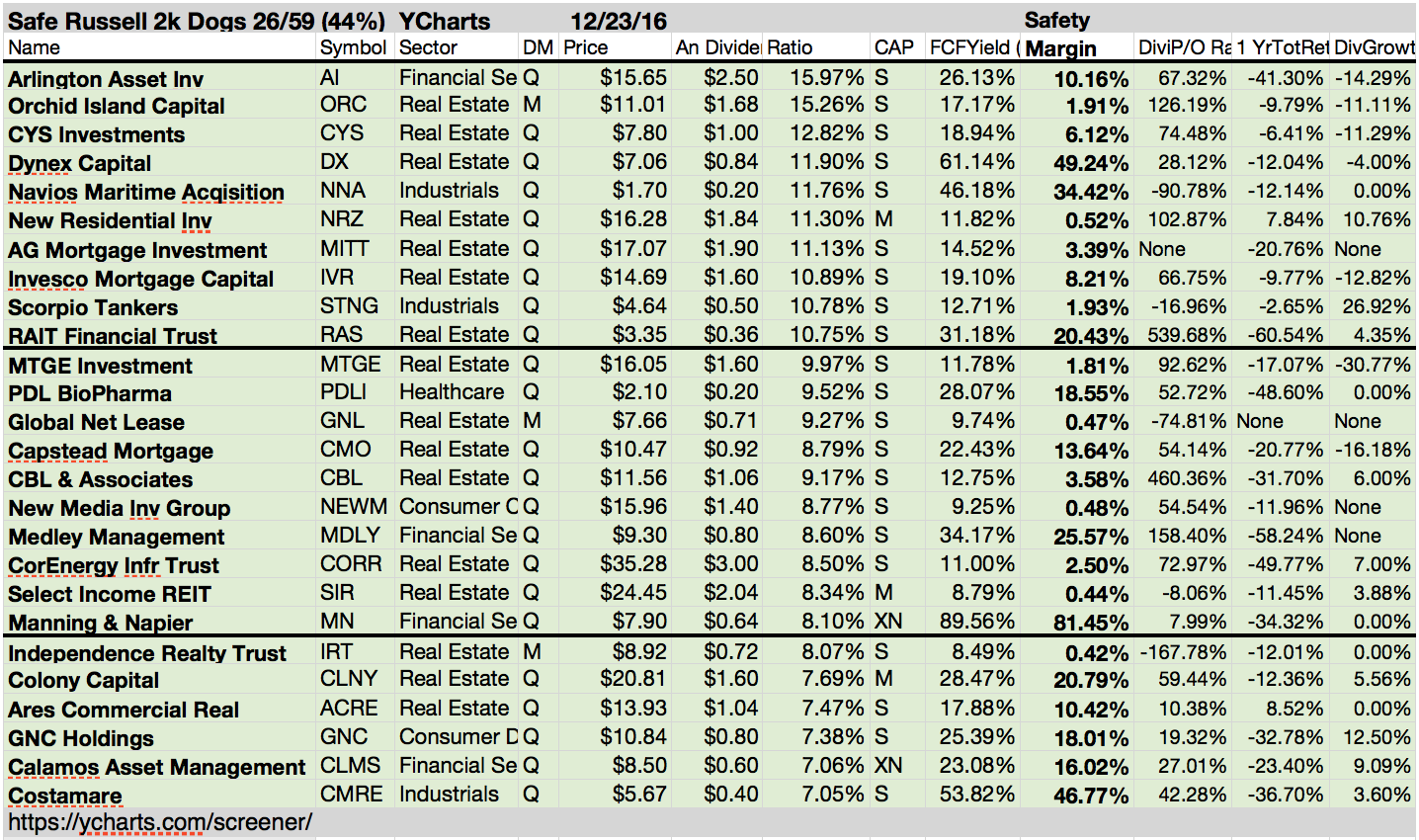

Attached you will find five stocks that offer current and historical dividend yield of more than 3% and might pay them for the next quarters.

These are the results...

Dividend-paying stocks are particularly beneficial amid a low interest rate environment, as these stocks offer substantial yields on a regular basis. Moreover, such stocks are historically proven to outperform in the long term and are quite reliable in terms of wealth creation.

Yield is basically a stock’s annual dividend rate divided by its share price. A dividend yield can increase if a company boosts its payout. The yield can also rise if the share price falls. In fact, an ultra-high yield due to a plunging stock price may signal that a company is in trouble and is likely to cut or even suspend the dividend.

It's very important to own safe high yielding stocks. Not a high yield is the key for a successful investing, a stable and growing yield is the conclusion.

Attached you will find five stocks that offer current and historical dividend yield of more than 3% and might pay them for the next quarters.

These are the results...

Subscribe to:

Posts (Atom)