Showing posts with label PBT. Show all posts

Showing posts with label PBT. Show all posts

These Stocks Doubled Their Dividends This Year

|

Company

|

Ticker

|

New Yield

|

New Dividend

|

Old Dividend

|

Payment Period

|

Date Of Release

|

Dividend Growth in %

|

|

Fifth Street Finance

|

FSC

|

11.09

|

0.125

|

0.02

|

Quarterly

|

15.03.2017

|

525.00%

|

|

Pacific Coast Oil Trust

|

ROYT

|

16.27

|

0.02617

|

0.00487

|

Monthly

|

29.03.2017

|

437.37%

|

|

Carlyle Group

|

CG

|

7.74

|

0.42

|

0.1

|

Quarterly

|

03.08.2017

|

320.00%

|

|

Pacific Coast Oil Trust

|

ROYT

|

19.71

|

0.02776

|

0.00673

|

Monthly

|

05.07.2017

|

312.48%

|

|

Mesabi Trust

|

MSB

|

14.38

|

0.55

|

0.14

|

Quarterly

|

19.04.2017

|

292.86%

|

|

OCI Partners

|

OCIP

|

10.45

|

0.23

|

0.06

|

Quarterly

|

08.05.2017

|

283.33%

|

|

Pacific Coast Oil Trust

|

ROYT

|

7.65

|

0.00931

|

0.00266

|

Monthly

|

28.08.2017

|

250.00%

|

|

Alon USA Partners

|

ALDW

|

14.48

|

0.38

|

0.11

|

Quarterly

|

09.05.2017

|

245.45%

|

|

Blue Hills Bancorp

|

BHBK

|

3.34

|

0.15

|

0.05

|

Quarterly

|

07.09.2017

|

200.00%

|

|

Windstream Holdings

|

WIN

|

12.24

|

0.15

|

0.055

|

Quarterly

|

04.05.2017

|

172.73%

|

|

VOC Energy Trust

|

VOC

|

17.61

|

0.21

|

0.08

|

Quarterly

|

21.04.2017

|

162.50%

|

|

Enduro Royalty Trust

|

NDRO

|

11

|

0.0362

|

0.01398

|

Monthly

|

23.01.2017

|

158.94%

|

|

Cabot Oil&Gas

|

COG

|

0.85

|

0.05

|

0.02

|

Quarterly

|

04.05.2017

|

150.00%

|

|

Ormat Technologies

|

ORA

|

1.17

|

0.17

|

0.07

|

Quarterly

|

03.03.2017

|

142.86%

|

|

Ares Management

|

ARES

|

6.81

|

0.31

|

0.13

|

Quarterly

|

07.08.2017

|

138.46%

|

|

Ares Management

|

ARES

|

6.81

|

0.31

|

0.13

|

Quarterly

|

08.08.2017

|

138.46%

|

|

Hugoton Royalty Trust Un

|

HGT

|

4.3

|

0.00609

|

0.00257

|

Monthly

|

22.08.2017

|

136.96%

|

|

Enduro Royalty Trust

|

NDRO

|

14.23

|

0.0409

|

0.01733

|

Monthly

|

22.03.2017

|

136.01%

|

|

Permian Basin Royalty Tr

|

PBT

|

12.77

|

0.10191

|

0.04801

|

Monthly

|

21.02.2017

|

112.27%

|

|

Marine Petroleum Trust Un

|

MARPS

|

9.49

|

0.09574

|

0.04577

|

Quarterly

|

22.05.2017

|

109.18%

|

|

MV Oil Trust

|

MVO

|

14.6

|

0.25

|

0.12

|

Quarterly

|

05.04.2017

|

108.33%

|

|

Aetna

|

AET

|

1.58

|

0.5

|

0.25

|

Quarterly

|

21.02.2017

|

100.00%

|

|

Children's Place

|

PLCE

|

1.35

|

0.4

|

0.2

|

Quarterly

|

08.03.2017

|

100.00%

|

|

Eaton Vance Global Income

|

EVGBC

|

1.2

|

0.1

|

0.05

|

Monthly

|

01.05.2017

|

100.00%

|

|

First Mid-Illinois Bcsh

|

FMBH

|

1.91

|

0.32

|

0.16

|

SemiAnnual

|

02.05.2017

|

100.00%

|

|

Och-Ziff Capital Mgmt

|

OZM

|

3.25

|

0.02

|

0.01

|

Quarterly

|

03.05.2017

|

100.00%

|

|

Systemax

|

SYX

|

2.39

|

0.1

|

0.05

|

Quarterly

|

08.05.2017

|

100.00%

|

|

InnSuites Hospitality

|

IHT

|

1.03

|

0.01

|

0.005

|

SemiAnnual

|

23.06.2017

|

100.00%

|

|

Citigroup

|

C

|

1.93

|

0.32

|

0.16

|

Quarterly

|

20.07.2017

|

100.00%

|

Dividend Growth Stocks Of The Week - Stock Compilation

|

Company

|

Ticker

|

New Yield

|

Growth

|

|

Cross Timbers Royalty Tr

|

CRT

|

7.66

|

19.95%

|

|

MGE Energy

|

MGEE

|

2.02

|

4.88%

|

|

Westlake Chemical

|

WLK

|

1.19

|

10.18%

|

|

Hugoton Royalty Trust Un

|

HGT

|

4.3

|

136.96%

|

|

Marine Petroleum Trust Un

|

MARPS

|

14.23

|

31.90%

|

|

Newtek Business Services

|

NEWT

|

10.29

|

10.00%

|

|

Permian Basin Royalty Tr

|

PBT

|

6.49

|

11.93%

|

|

First Connecticut Bncp

|

FBNK

|

2.34

|

16.67%

|

|

Forest City

Realty Tr A

|

FCEA

|

2.32

|

55.56%

|

|

First Capital

|

FCAP

|

2.74

|

4.76%

|

|

Intuit

|

INTU

|

1.15

|

14.71%

|

|

Altria Group

|

MO

|

4.12

|

8.20%

|

|

Capital City Bank Group

|

CCBG

|

1.34

|

40.00%

|

|

Martin Marietta

|

MLM

|

0.9

|

4.76%

|

Dividend Growth Stocks Of The Week 21/2016

Dividend growth investing is a popular model followed by the investing community to build assets.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns.

Following companies announced dividend increases this week. These are the dividend grower from the past week... If you like them to receive in the future, just subscribe to my free newsletter.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns.

Following companies announced dividend increases this week. These are the dividend grower from the past week... If you like them to receive in the future, just subscribe to my free newsletter.

Here are the latest dividend growth stocks compiled...

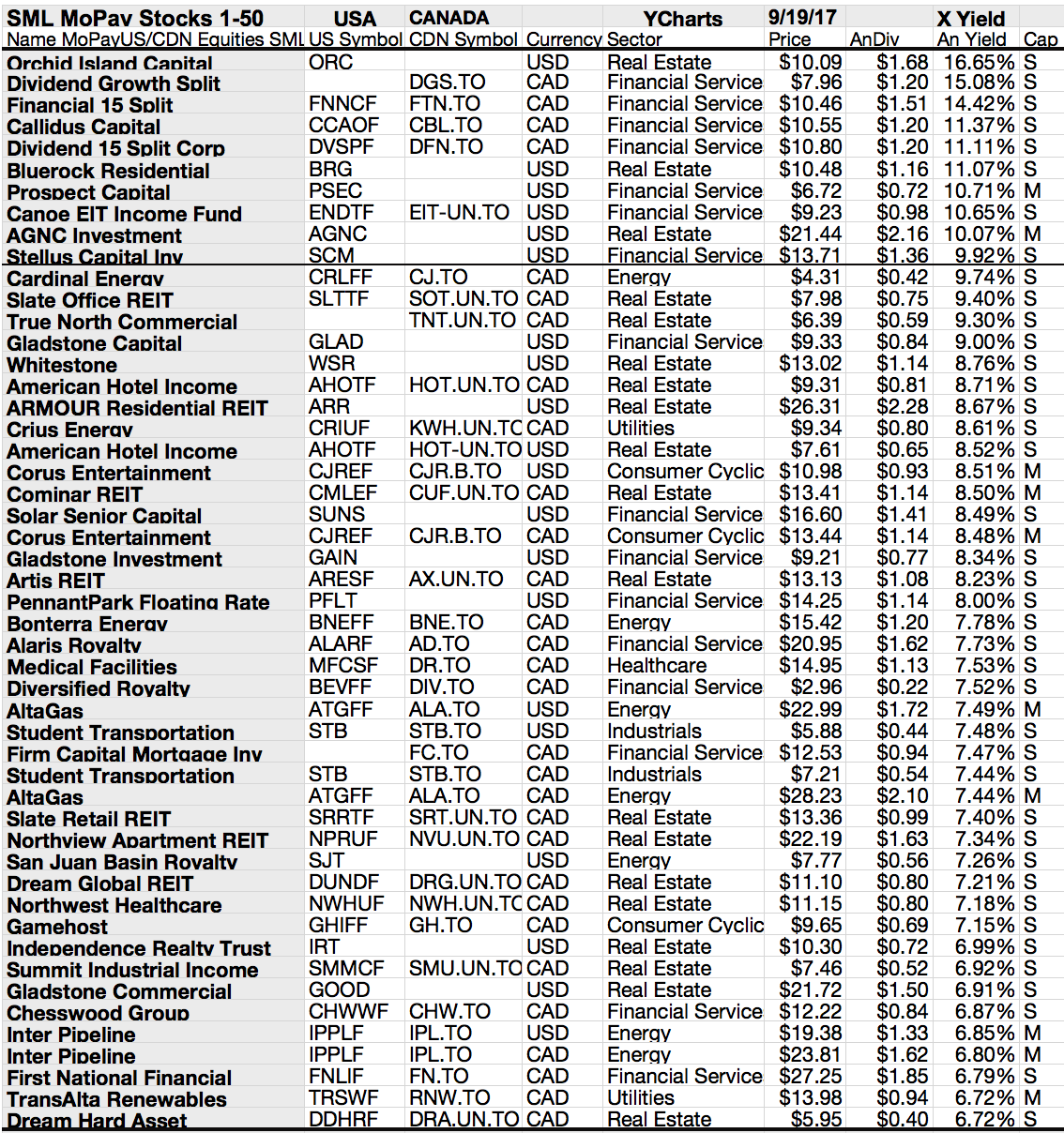

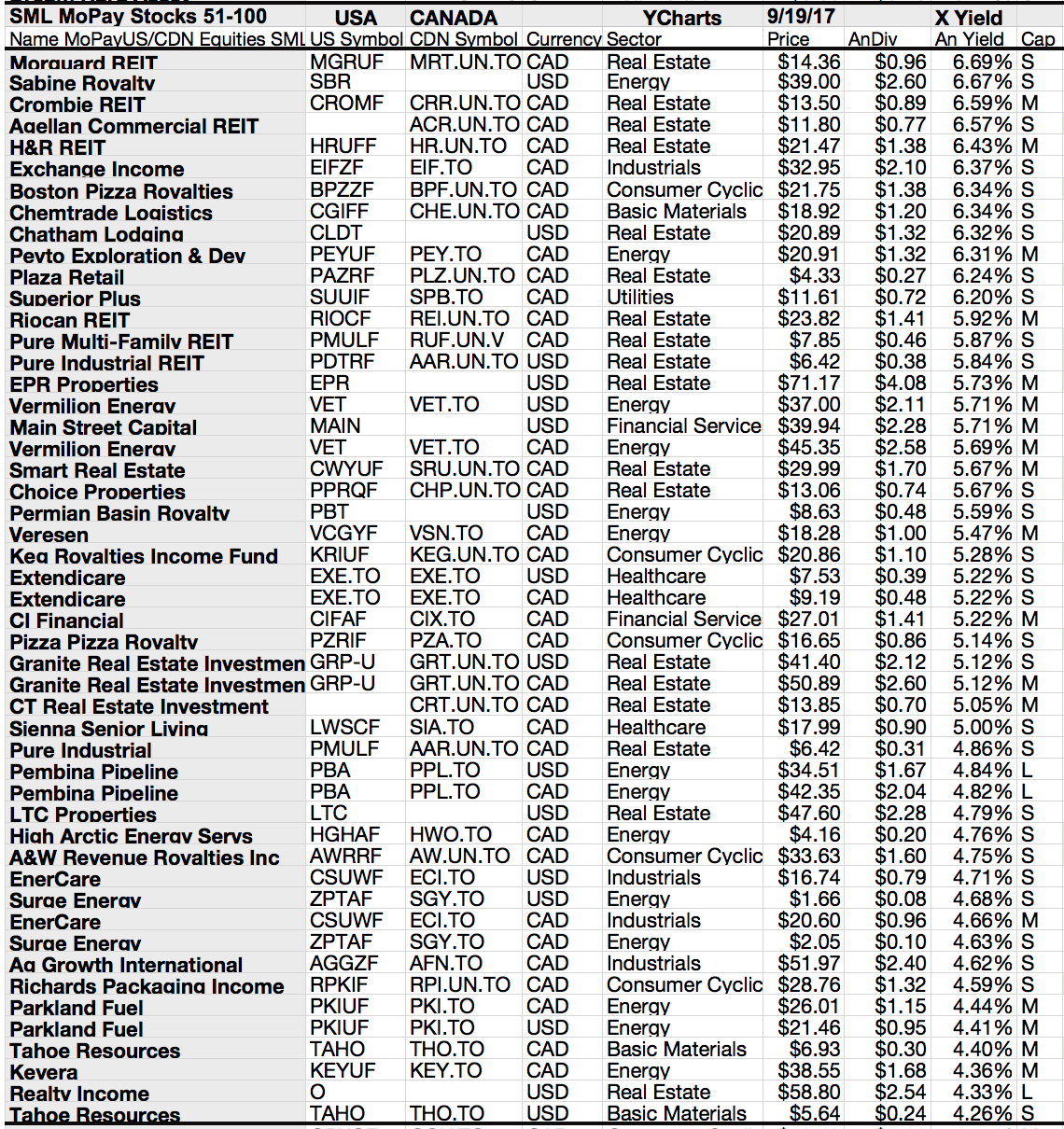

19 Monthly Dividend Paying Stocks With Yields Over 3%

Attached you will find another portfolio of high yielding monthly dividend paying stocks.

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

Each of the stocks offer a yield over 3%. Reits and Oil and Gas companies dominating the screening results.

Here is the portfolio...

13 Stocks With Dividend Growth In The Past Week

13 companies raised their dividends

during the recent week. Dividend is so important for investors who like to grow

their investments.

Below is a full

list of all stocks that have raised their dividend payments within the past

week. Five of the firms have a current yield of more than 3 percent.

Kroger, DTE

Energy, Matson, Disney and Worthington Industries were the biggest stocks, all

with a market capitalization above the one billion Mark.

Disney is for me

the most impressive stocks. It has grown more to a merchandise company and licensing

business than to an entertainment company, which is in general good.

I've missed the

chance to buy the stock. I still believe that the current prices are too high

but they truly reflect the strong growth which did not disappoint. Maybe I get

some shares within the next market correction.

These are the

latest dividend growers, sorted by yield....

7 Latest Dividend Grower | Full Compilation Of Stocks

The past week was one of the weakest for dividend growth because of the holiday and Christmas days.

Only seven companies announced to pay higher dividends. I've attached a list with all stocks and essential fundamentals in this article.

On the list are no big or popular names but it should help you to be informed which corporate is on track to be the next big long-term dividend play.

3 stocks with recent dividend growth I like...

Only seven companies announced to pay higher dividends. I've attached a list with all stocks and essential fundamentals in this article.

On the list are no big or popular names but it should help you to be informed which corporate is on track to be the next big long-term dividend play.

3 stocks with recent dividend growth I like...

14 Top Dividend Growers From Last Week

Stocks with dividend hikes from last week originally

published at long-term-investments.blogspot.com.

Only 14 stocks raised their dividend payments within the recent week. Despite

the low number of growth stocks, the quality is still available.

Big names are again on the list. The biggest player is

Lockheed Martin. The military group announced to boost dividends by 15.7

percent. I love this stock that is so deeply integrated into the U.S. economy.

Five High-Yields are part of the latest dividend

growth stocks but only three companies are currently valuated with a forward

P/E of less than 15. Also three of fourteen shares are currently recommended to

buy.

Basic material stocks as well as financial stocks are

dominating the results – A fact that we’ve also seen over the recent weeks. For

the financial sector it’s reasonable because of the abnormal dividend cuts in

2008 but basic or raw material stocks? It’s really hard to explain why these stocks

hike dividends when the whole sector is under pressure due to falling prices in

anticipation of a slowing Chinese economy.

We will see how it develops over the time. I’ve

attached, like every week, the full list of the latest dividend growth stocks.

You can also find attached the current price ratios in order to find and

compare the cheapest stocks from the list.

Subscribe to:

Comments (Atom)