Showing posts with label APLE. Show all posts

Showing posts with label APLE. Show all posts

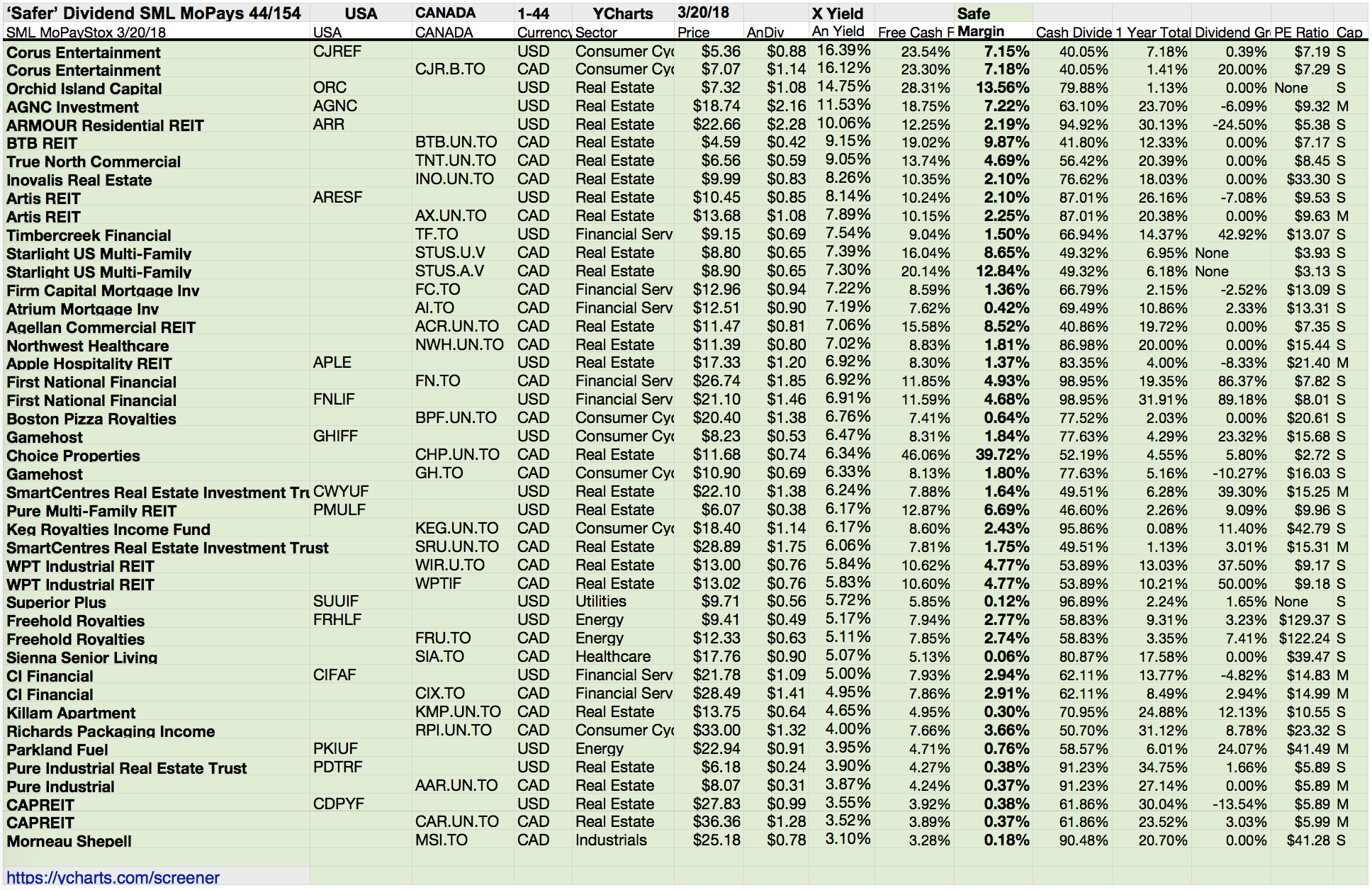

Safe Monthly Paying Dividend Stocks WIth Yields Up To 16%

If you like this blog, just donate a small amount. As a gift, you will get the latest dividend growth fact book for free. We send you to book to you donation e-mail from paypal. Thank you for supporting us.

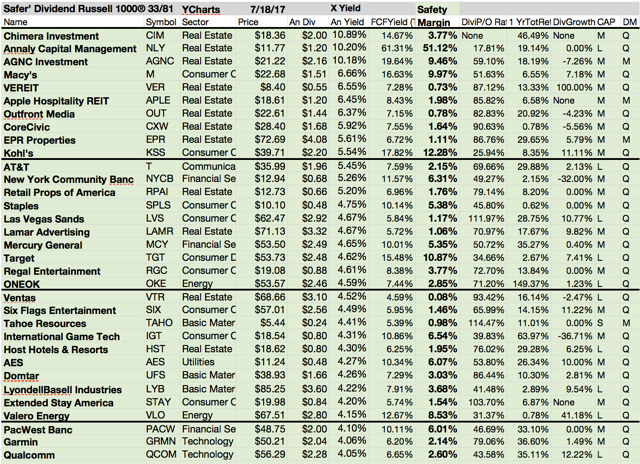

10 Really Cheap Dividend Stocks To Look For

The only thing that is better than buying the stock of a great company is buying a stock of a great company at a low price.

While there aren't a whole lot of companies out there selling at decent discounted prices these days -- the market is hitting all-time highs, after all -- there's still a decent handful of stocks that investors should consider if they want to buy a company on the cheap.

After all, picks trading that low often have gone through hard times. And while you can sometimes catch a falling knife and make a bundle on a swing trade, cheap dividend stocks are inherently long-term investments.

I mean, what’s the point of buying an income investment only to trade out of it before the ex-dividend date?

As the old saying goes, price is what you pay but value is what you get. So instead, investors should look at valuation metrics and payout ratios to determine which are the best cheap dividend stocks to buy now.

So we run a stock screener to find stocks currently trading for a 'cheap' price. There came a lot results but we like to share the best in our view with you.

These are the results...

While there aren't a whole lot of companies out there selling at decent discounted prices these days -- the market is hitting all-time highs, after all -- there's still a decent handful of stocks that investors should consider if they want to buy a company on the cheap.

After all, picks trading that low often have gone through hard times. And while you can sometimes catch a falling knife and make a bundle on a swing trade, cheap dividend stocks are inherently long-term investments.

I mean, what’s the point of buying an income investment only to trade out of it before the ex-dividend date?

As the old saying goes, price is what you pay but value is what you get. So instead, investors should look at valuation metrics and payout ratios to determine which are the best cheap dividend stocks to buy now.

So we run a stock screener to find stocks currently trading for a 'cheap' price. There came a lot results but we like to share the best in our view with you.

These are the results...

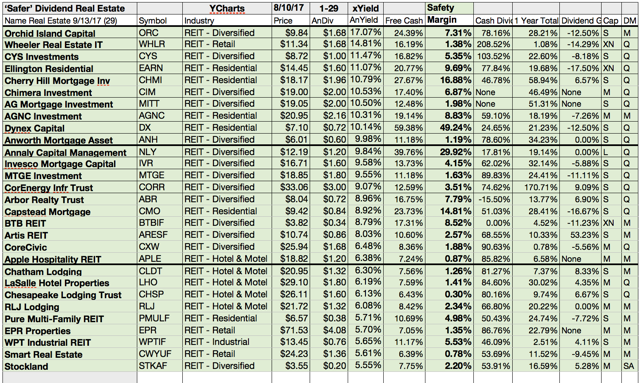

8 Big-Dividend REITs Worth Considering Now

It's been a choppy year so far for big-dividend Real Estate Investment Trusts (REITs). This has created some attractive buying opportunities as the market moved from January/February distress, to a near-infatuation with yield in the months that followed, a Brexit-induced flight to quality, a new real estate sector, and perhaps another leg lower following the upcoming November 1-2 Federal Reserve meeting.

For your consideration, we've provided a ranking of the best and worst performing big-dividend REITs year-to-date, and we've also provided five general recommendations on how to "play" the current state of the REIT sector. Further, we cover several specific REIT opportunities in this article, and here is our list of Top 8 Big-Dividend REITs Worth Considering.

These are the results...

For your consideration, we've provided a ranking of the best and worst performing big-dividend REITs year-to-date, and we've also provided five general recommendations on how to "play" the current state of the REIT sector. Further, we cover several specific REIT opportunities in this article, and here is our list of Top 8 Big-Dividend REITs Worth Considering.

These are the results...

7 High Yielding Monthly Paying Dividend Stocks

One of the main motivations for income investors is to earn monthly dividends by investing in companies which provide a stable and predictable dividend income.

Buying a stock with monthly dividend rather than a quarterly payout has an added advantage: you can multiply your income faster by more frequently reinvesting in the company’s stock.

It works exactly the same way as compounding works in an interest-paying bank account, where you can multiply your income by reinvesting your profit. But most of the blue-chip companies included in the S&P-500 index pay quarterly dividends.

Investors seeking a monthly dividend income are usually left with real estate income trusts (REITs) or business development companies with a basket of risky portfolios.

If you’re looking for a stable monthly income from your stock investing, here are the seven top monthly dividend stocks.

Buying a stock with monthly dividend rather than a quarterly payout has an added advantage: you can multiply your income faster by more frequently reinvesting in the company’s stock.

It works exactly the same way as compounding works in an interest-paying bank account, where you can multiply your income by reinvesting your profit. But most of the blue-chip companies included in the S&P-500 index pay quarterly dividends.

Investors seeking a monthly dividend income are usually left with real estate income trusts (REITs) or business development companies with a basket of risky portfolios.

If you’re looking for a stable monthly income from your stock investing, here are the seven top monthly dividend stocks.

17 Best Rated Monthly Dividend Paying Stocks With Big Yields

While most dividend paying stocks that trade on exchanges in the US pay quarterly, there are some stocks that pay their dividends on other schedules.

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

| 17 Monthly Dividend Stocks (click to enlarge), Source: Valuewalk.com |

The Best Monthly Dividend Stocks For High-Yield Income Investors

The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

40 Highest Yielding Ex-Dividend Stocks Of The Coming Week

Here I share all higher capitalized stocks going ex-dividend next week. A huge number of stocks plan to go ex-dividend, in total 271 dividend stocks. 132 of them are capitalized over 2 billion. Attached you can find those stocks with the highest payment

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

Subscribe to:

Posts (Atom)