Showing posts with label DRI. Show all posts

Showing posts with label DRI. Show all posts

10 Top Yielding Dividend Stocks For Your Retirement Portfolio

That means receiving a reliable stack of dividend checks no matter what else is going on. Investors can learn more about how to live off dividends in retirement here.

To help you in this process, here are 10 quality, recession-beating stocks that have delivered very reliable dividend income for many years. Each of these stocks weathered the financial crisis well and yields more than 2%.

A handful of these companies is held in our Conservative Retirees dividend portfolio for this reason. Here are the stocks you should consider for your retirement portfolio...

To help you in this process, here are 10 quality, recession-beating stocks that have delivered very reliable dividend income for many years. Each of these stocks weathered the financial crisis well and yields more than 2%.

A handful of these companies is held in our Conservative Retirees dividend portfolio for this reason. Here are the stocks you should consider for your retirement portfolio...

20 Best Dividend Paying Restaurants

Restaurant stocks are a little risky, since they're subject to food scares, seasons and recessions, but they're fun, especially if they have dividends.

Yet some analysts are predicting a bear market will impact restaurant stocks in the near future, since consumers cut their discretionary dining budgets when times are tight.

The sector is on the front lines when the bear market appears. But others say the public might head toward affordable food, so restaurants with lower priced menus might do well. And, with consumer confidence in July at one of the highest points since the recovery, at 97, and unemployment claims so low, these may be signals of a healthy economy.

Making income through dividend investing involves searching for solid companies that have a good chance of increasing the dividend year after year. As the company's sales and profits grow, dividends usually grow also, and the money you make can be reinvested or used as cash.

Attached you will find a list of all dividend payers in the restaurant business.

Here are the best dividend paying restaurants on the market...

Yet some analysts are predicting a bear market will impact restaurant stocks in the near future, since consumers cut their discretionary dining budgets when times are tight.

The sector is on the front lines when the bear market appears. But others say the public might head toward affordable food, so restaurants with lower priced menus might do well. And, with consumer confidence in July at one of the highest points since the recovery, at 97, and unemployment claims so low, these may be signals of a healthy economy.

Making income through dividend investing involves searching for solid companies that have a good chance of increasing the dividend year after year. As the company's sales and profits grow, dividends usually grow also, and the money you make can be reinvested or used as cash.

Attached you will find a list of all dividend payers in the restaurant business.

Here are the best dividend paying restaurants on the market...

10 Good Dividend Stocks To Be Oversold And Ready For A Rebound

Today I've focussed my research on oversold dividend stocks. I've also implemented a few restrictions: My yield effort was at least 3 percent and the debt-to-equity should be normal, not overleveraged.

Stocks become oversold for many reasons, but the basic reason that I care about as a trend follower is that there were more sellers than buyers. Sure, this is simplistic, but why make trading any more difficult than it has to be?

Once a stock becomes oversold, I try to identify when buyers are moving back into the stock for a possible oversold bounce.

One way to identify an oversold stock is to follow the relative strength index once it gets near or below 30. Another way is to look for a stock that's had an extended downtrend.

Traders have to remember that oversold can always become more oversold.

That's why it's important to follow the price action and look for oversold stocks that have a probability--not a guarantee--of changing their trend and potentially spiking higher off depressed levels.

These types of trades can yield big gains quickly, but remember that the price action is more important than the simple fact the stock is extremely oversold.

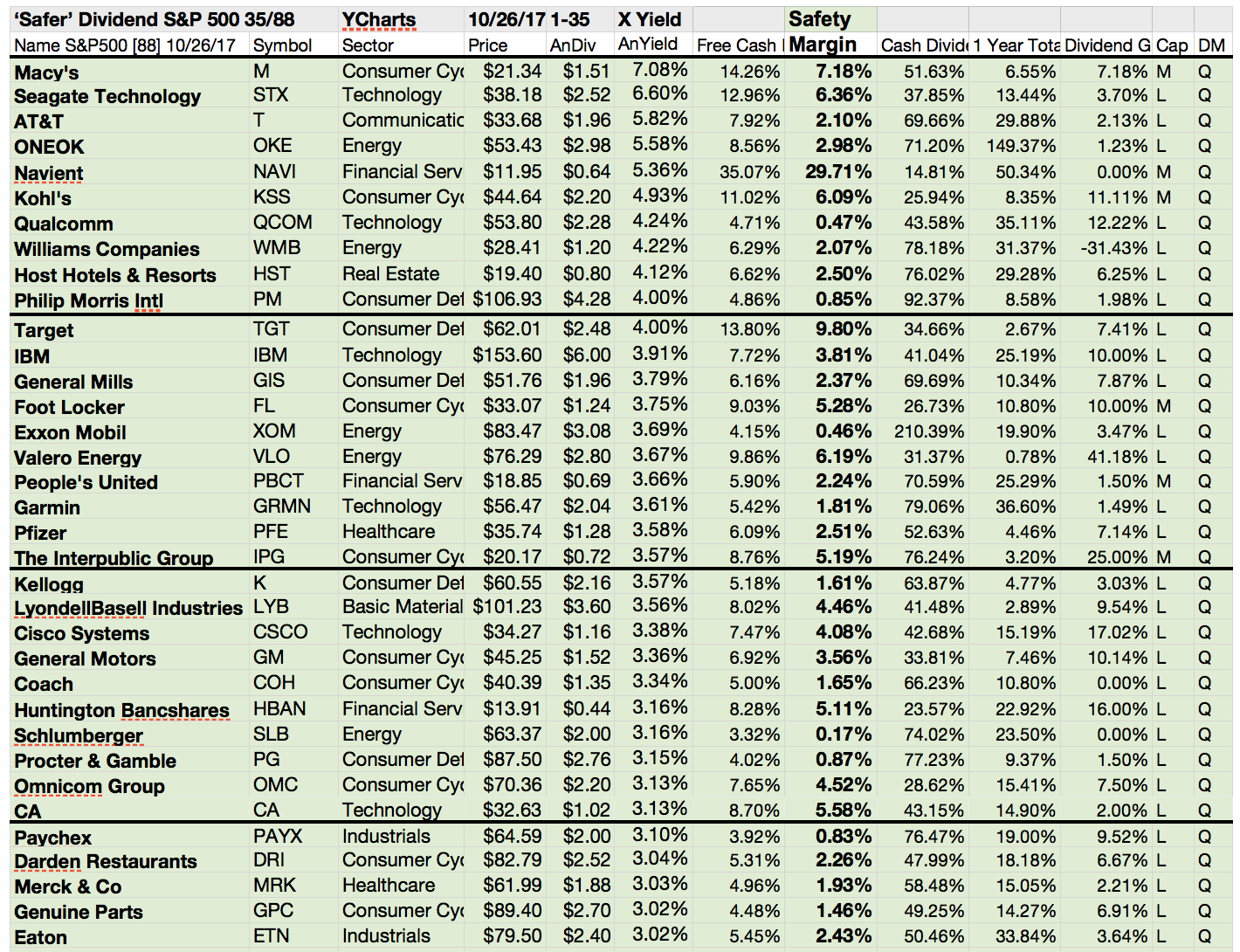

Attached you find the results of 10 oversold dividend stocks from my research screen...

Stocks become oversold for many reasons, but the basic reason that I care about as a trend follower is that there were more sellers than buyers. Sure, this is simplistic, but why make trading any more difficult than it has to be?

Once a stock becomes oversold, I try to identify when buyers are moving back into the stock for a possible oversold bounce.

One way to identify an oversold stock is to follow the relative strength index once it gets near or below 30. Another way is to look for a stock that's had an extended downtrend.

Traders have to remember that oversold can always become more oversold.

That's why it's important to follow the price action and look for oversold stocks that have a probability--not a guarantee--of changing their trend and potentially spiking higher off depressed levels.

These types of trades can yield big gains quickly, but remember that the price action is more important than the simple fact the stock is extremely oversold.

Attached you find the results of 10 oversold dividend stocks from my research screen...

30 Fast-Growing Dividend Growth Stocks For High Total Return

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

If the company

growth and with them the dividend payout, your passive income should also grow

and your investment finally be higher.

Attached you will

find a nice overview of the best dividend growth stocks of the recent decade

sorted by short-term, mid-term and long-term dividend growth.

For sure the past

performance is no guarantee for growth in the future but it gives a nice

overview about the good stocks in the past.

Maybe you own some

of them and you have made a decent amount of money with your investment.

Here are the best dividend growth stocks of the past...

12 Stocks That Might Get A Boost Indirectly From Low Energy Prices

Crude oil’s crash may have roiled

stocks to start 2016, but cheap fuel is actually a great thing for the average

American. Consumer confidence is heading higher, thanks to low gas prices and a

continually improving job market.

Crude oil’s crash may have roiled

stocks to start 2016, but cheap fuel is actually a great thing for the average

American. Consumer confidence is heading higher, thanks to low gas prices and a

continually improving job market.

In general, it

should be good the US economy to have a low oil price. The states are net

import of oil. The cheaper the oil price, the cheaper the energy bill of the

USA.

A negative impact

is expected from the oil and gas industry, especially from own energy companies

like Chevron, Exxon Mobil. A hard environment has share fracker and oil

equipment firms.

Also headwinds

faced by banks with a big loan portfolio related to the energy sector.

Today I would like

to introduce some stocks that might get some backwinds from the low oil price.

It's not only the consumer. Many energy consumption stocks like manufacturer,

travel stocks, airlines could also improve margins due to lower energy costs.

Here are 12 higher yielding stocks that are directly benefiting from more leisure travel. They’re all

on sale at the moment, too.

Here are the results...

Here are the results...

3 S&P 500 Stocks With Yields Above The Market And Rising Earnings Estimates

Today we screened for companies in the Standard & Poor’s 500 index with yields over 3%, versus 2.3% for the overall index, and with 2016 earnings estimates that have increased by at least 1% over the past three months.

Today we screened for companies in the Standard & Poor’s 500 index with yields over 3%, versus 2.3% for the overall index, and with 2016 earnings estimates that have increased by at least 1% over the past three months.There are more than 150 companies in the index yielding 3% or more, but fewer than 15% of them have been the subject of such an estimate increase.

Close to 60%, meanwhile, have had their 2016 earnings consensus cut by at least 1% over the past three months. Rising earnings estimates could help signal the ability of the high-yielders below to perform well in the year ahead.

Here are the results from the screener...

19 Dividend Stocks With A Cash Return Yield Over 10%

Dividends and share buybacks help increase value for people holding a stock, and there's a lot of money to be had as companies shovel record amounts of cash back to shareholders.

We recognize activist investors often agitate for firms to return excess cash to shareholders via buybacks. However, while repurchases may lift share prices in the near term, they are a questionable use of cash at the current time when the median S&P 500 multiple is so high. In our view, acquisitions – particularly in the form of stock deals – represent a more compelling strategic use of cash than buybacks given the current stretched valuation of US equities.

I've compiled a list of the top 19 stocks, all with a total cash return yield of more than 10%. Below include how much of the return is from dividends or buybacks. You'll also find a comment about cash returns from company executives on the during their latest quarterly earnings call.

Check out the 19 stocks here...

We recognize activist investors often agitate for firms to return excess cash to shareholders via buybacks. However, while repurchases may lift share prices in the near term, they are a questionable use of cash at the current time when the median S&P 500 multiple is so high. In our view, acquisitions – particularly in the form of stock deals – represent a more compelling strategic use of cash than buybacks given the current stretched valuation of US equities.

I've compiled a list of the top 19 stocks, all with a total cash return yield of more than 10%. Below include how much of the return is from dividends or buybacks. You'll also find a comment about cash returns from company executives on the during their latest quarterly earnings call.

Check out the 19 stocks here...

12 Oversold 3%+ Yielding Dividend Stocks As Buying Opportunity

I love it when the market is

anxious and everybody sells stocks. That's the moment when panic and emotions

rule the manner of actors.

But when stocks

fall, it does not necessary mean that stocks are bad. Those moments can change

into a great buy opportunity for long-term investors.

When the markets

are in panic, investors will sell their stocks below the intrinsic value. Today

I like to introduce a few dividend stocks that seem oversold by several

technical indicators. I've only focused my efforts on higher capitalized stocks

with regular dividend payments.

Dividends are small

risk compensation. For sure, if you get only 0.5 percent per quarter, it's a

very small compensation but if you buy only stocks with a solid, valuable and

predictable business, your risk compensation develops to yield compensation.

These are the top

results....

Ex-Dividend Stocks: Best Dividend Paying Shares On October 08, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 22 stocks go ex dividend

- of which 8 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Anworth

Mortgage Asset Corp.

|

669.33M

|

7.73

|

0.78

|

3.70

|

10.34%

|

|

|

AT&T,

Inc.

|

181.61B

|

25.57

|

2.11

|

1.42

|

5.33%

|

|

|

Darden

Restaurants, Inc.

|

6.08B

|

16.57

|

2.94

|

0.70

|

4.71%

|

|

|

Verizon

Communications Inc.

|

134.94B

|

87.22

|

3.96

|

1.14

|

4.50%

|

|

|

WGL

Holdings Inc.

|

2.16B

|

15.50

|

1.61

|

0.87

|

4.01%

|

|

|

UDR,

Inc.

|

5.90B

|

-

|

2.09

|

7.85

|

3.98%

|

|

|

General

Mills, Inc.

|

30.83B

|

18.03

|

4.52

|

1.70

|

3.17%

|

|

|

E. I. du Pont de Nemours

|

54.12B

|

23.09

|

4.14

|

1.53

|

3.07%

|

|

|

Brady

Corp.

|

1.54B

|

-

|

1.86

|

1.34

|

2.61%

|

|

|

Ingles

Markets Inc.

|

659.00M

|

53.37

|

1.65

|

0.17

|

2.42%

|

|

|

OGE

Energy Corp.

|

7.13B

|

21.02

|

2.53

|

1.97

|

2.34%

|

|

|

Covidien

plc

|

28.04B

|

16.80

|

2.90

|

2.63

|

2.12%

|

|

|

Choice

Hotels International Inc.

|

2.50B

|

22.43

|

-

|

3.52

|

1.72%

|

|

|

Kadant

Inc.

|

360.38M

|

13.00

|

1.43

|

1.12

|

1.55%

|

|

|

Raven

Industries Inc.

|

1.14B

|

25.92

|

4.82

|

2.98

|

1.53%

|

|

|

Ethan

Allen Interiors Inc.

|

776.42M

|

24.20

|

2.32

|

1.06

|

1.49%

|

|

|

Barnes

Group Inc.

|

1.91B

|

26.12

|

1.96

|

1.64

|

1.24%

|

|

|

Aetna

Inc.

|

23.67B

|

13.26

|

1.76

|

0.59

|

1.20%

|

|

|

Intuit

Inc.

|

19.76B

|

24.20

|

5.59

|

4.74

|

1.15%

|

|

|

Lincoln

National Corp.

|

11.48B

|

9.39

|

0.86

|

0.98

|

1.11%

|

47 Top High-Yielding Stocks With Ex-Dividend Date In October 2013

Monthly high yielding shares researched by long-term-investments.blogspot.com. Close to

the end of the month, I would like to highlight some of the best yielding ex-dividend

shares for October.

If you are a daily reader of my blog, you would have noticed

that I publish regularly lists about ex-dividend stocks. It’s a great information

tool for investors who love it to receive dividends. If you purchase a stocks quick

before the ex-dividend date, you get a faster cash return but you will not make

extra gains with these money because on the ex-date, the stock would also be traded

ex-dividend but with yields of about 0.5 percent quarter dividend or so, you will

definitely see no big changes because the daily fluctuations are much higher.

However, every month, I create a small list about

interesting high yielding stocks with ex-dividend date for the next month. I

think it could bring you some values to see what companies pay you cash next

month with an attractive equity story.

As result, I found 47 stocks with an average dividend

yield of 5.76 percent. Eight stocks have a double-digit yield and additional eight

stocks have a high yield below 10 percent but over 5 percent. 21 stocks from

the results have a buy or better recommendation.

13 Cheap Stocks With Dividend Yields Over 3% And A Predictable Business

Cheaply valuated stocks with a predictable

business and yields over 3% originally published at long-term-investments.blogspot.com. It’s important not to

overpay a stock. The first rule you need to follow is to pay acceptable prices

for a growing business that is somehow calculable. I talk about a business

model with nearly stable sales that grow over the long-run.

On my blog, I present often such companies with a

low volatile business and good yields. Today I would like to use the gurufocus screener

about predictable companies.

The screener gave me the opportunity to look for new, customized stock ideas which I

would like to share with you here now. Below is a list of the best yielding

cheaply valuated stocks with yields over 3 percent as well as a forward P/E

under 15.

Eighteen stocks with a better than 4-Star

gurufocus rating fulfilled the above mentioned criteria. Three of the results

have a high yield and four are currently recommended to buy or even better.

Ex-Dividend Stocks: Best Dividend Paying Shares On July 08, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks July 05, 2013. In total, 19 stocks and preferred shares go ex dividend - of which 6 yield more than 3 percent. The average yield amounts to 2.38%.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks July 05, 2013. In total, 19 stocks and preferred shares go ex dividend - of which 6 yield more than 3 percent. The average yield amounts to 2.38%.

Here is the sheet of the best yielding ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

AT&T,

Inc.

|

196.37B

|

27.83

|

2.23

|

1.55

|

5.05%

|

|

Verizon

Communications Inc.

|

146.19B

|

127.52

|

4.39

|

1.25

|

4.04%

|

|

Darden

Restaurants, Inc.

|

6.61B

|

16.28

|

3.21

|

0.77

|

3.92%

|

|

WGL

Holdings Inc.

|

2.21B

|

14.13

|

1.61

|

0.91

|

3.92%

|

|

UDR,

Inc.

|

6.48B

|

-

|

2.25

|

8.75

|

3.62%

|

|

General

Mills, Inc.

|

31.74B

|

18.00

|

4.52

|

1.82

|

3.11%

|

|

CSG

International, Inc.

|

748.38M

|

14.56

|

2.29

|

0.99

|

2.58%

|

|

United

Microelectronics

|

6.11B

|

15.13

|

0.88

|

1.56

|

2.48%

|

|

Brady

Corp.

|

1.60B

|

33.39

|

1.54

|

1.35

|

2.45%

|

|

Industrias Bachoco S.A.B. de C.V.

|

1.73B

|

10.29

|

1.22

|

0.57

|

1.67%

|

|

Raven

Industries Inc.

|

1.10B

|

23.34

|

4.76

|

2.82

|

1.58%

|

|

Hingham

Institution for Savings

|

145.10M

|

10.95

|

1.52

|

2.98

|

1.52%

|

|

Gap

Inc.

|

19.90B

|

16.69

|

6.30

|

1.25

|

1.40%

|

|

Lincoln

National Corp.

|

9.99B

|

8.16

|

0.67

|

0.86

|

1.30%

|

|

Ethan

Allen Interiors Inc.

|

838.93M

|

26.91

|

2.55

|

1.15

|

1.24%

|

|

Intuit

Inc.

|

18.53B

|

23.45

|

5.19

|

4.17

|

1.09%

|

|

InterDigital,

Inc.

|

1.56B

|

6.48

|

3.09

|

2.44

|

1.05%

|

|

FEI

Company

|

2.82B

|

25.97

|

3.31

|

3.15

|

0.66%

|

|

Lennar

Corp.

|

6.72B

|

19.11

|

1.92

|

1.38

|

0.45%

|

Subscribe to:

Posts (Atom)

+Dividends.png)