When it comes to the history of wealth, there is always one sector that needs to be mention, and that is real estate. The cash flow that real estate investing brings in from business operations can be great, especially for dividend investors.

Purchasing a rental property in your local neighborhood is pretty easy to do because the capital required is not a great amount. However, when it comes to investing in the healthcare real estate sector, it is much more difficult–that is, unless you have millions of dollars in your bank account.

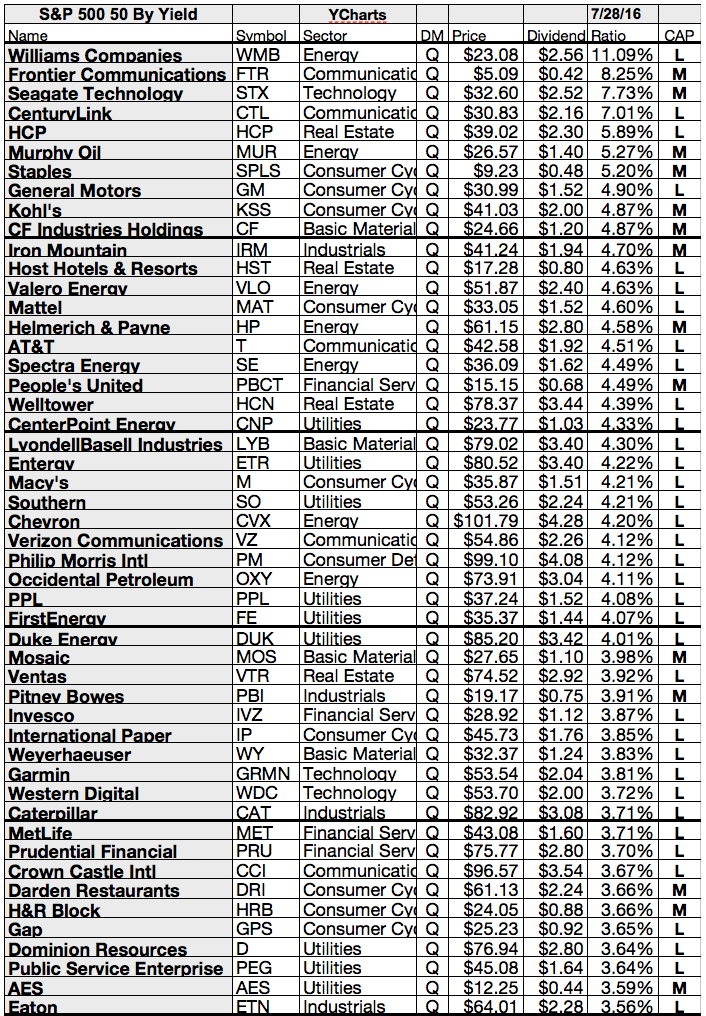

There are a lot of healthcare Reits on the market with solid yields which have been grown over years. I will show you some of the highest yielding and most promising healthcare Reits with the attached list.

Here are the highest yielding and most promising healthcare Reits...

Showing posts with label HCN. Show all posts

Showing posts with label HCN. Show all posts

8 Big-Dividend REITs Worth Considering Now

It's been a choppy year so far for big-dividend Real Estate Investment Trusts (REITs). This has created some attractive buying opportunities as the market moved from January/February distress, to a near-infatuation with yield in the months that followed, a Brexit-induced flight to quality, a new real estate sector, and perhaps another leg lower following the upcoming November 1-2 Federal Reserve meeting.

For your consideration, we've provided a ranking of the best and worst performing big-dividend REITs year-to-date, and we've also provided five general recommendations on how to "play" the current state of the REIT sector. Further, we cover several specific REIT opportunities in this article, and here is our list of Top 8 Big-Dividend REITs Worth Considering.

These are the results...

For your consideration, we've provided a ranking of the best and worst performing big-dividend REITs year-to-date, and we've also provided five general recommendations on how to "play" the current state of the REIT sector. Further, we cover several specific REIT opportunities in this article, and here is our list of Top 8 Big-Dividend REITs Worth Considering.

These are the results...

10 Recession-Proof Dividend Stocks With High Yields To Beat The Market Over Years

Some companies, such as Dividend Aristocrats, actually perform well during bad times, while others are extremely affected.

We strongly believe that stocks with a solid financial performance will do better in crises times.

Dividend Aristocrats are a major popular class of stocks that offer solid financials and most of them have outperformed the market in recent years. Dividend Aristocrats are stocks in the S&P 500 that have increased dividends every year for the past 25 straight years.

Today I like to introduce a couple of Dividend Aristocrats that might look good despite the high market valuation and could hedge you against an upcoming market storm.

For sure, Dividend Aristocrats are also not safe when the markets under pressure but often they perform better. They have a lower beta ratio and could pay dividends.

Here are 10 high-quality dividend stocks that are bear market beaters and how they do it. Many of these blue-chip stocks are holdings in our Conservative Retirees dividend portfolio, which seeks to avoid dividend cuts, earn a 4% yield and preserve capital.

Here are the results...

We strongly believe that stocks with a solid financial performance will do better in crises times.

Dividend Aristocrats are a major popular class of stocks that offer solid financials and most of them have outperformed the market in recent years. Dividend Aristocrats are stocks in the S&P 500 that have increased dividends every year for the past 25 straight years.

Today I like to introduce a couple of Dividend Aristocrats that might look good despite the high market valuation and could hedge you against an upcoming market storm.

For sure, Dividend Aristocrats are also not safe when the markets under pressure but often they perform better. They have a lower beta ratio and could pay dividends.

Here are 10 high-quality dividend stocks that are bear market beaters and how they do it. Many of these blue-chip stocks are holdings in our Conservative Retirees dividend portfolio, which seeks to avoid dividend cuts, earn a 4% yield and preserve capital.

Here are the results...

9 Stocks For Value Investors With Dividend Focus

Value investing, perhaps more than any other type of investing, is more concerned with the fundamentals of a company's business rather than its stock price or market factors affecting its price.

In the Cabot Benjamin Graham Value Investor, I utilize a value investing strategy developed by Benjamin Graham in the 1920s.

The details of this value strategy are spelled out clearly in his book, "The Intelligent Investor," published 60 years ago.

The objective of Graham's strategy is to identify unappreciated stocks and show you how to find undervalued stocks that meet certain criteria for quality and quantity ... stocks that are poised for stellar price appreciation.

Out of the multitude of companies, which ones would legendary value investor Benjamin Graham buy today? I've compiled nine great companies that fit Benjamin Graham's methods and criteria.

The companies in this list pass the rigorous requirements of either the Defensive Investor or the Enterprising Investor and are undervalued by the market.

These are the results:

In the Cabot Benjamin Graham Value Investor, I utilize a value investing strategy developed by Benjamin Graham in the 1920s.

The details of this value strategy are spelled out clearly in his book, "The Intelligent Investor," published 60 years ago.

The objective of Graham's strategy is to identify unappreciated stocks and show you how to find undervalued stocks that meet certain criteria for quality and quantity ... stocks that are poised for stellar price appreciation.

Out of the multitude of companies, which ones would legendary value investor Benjamin Graham buy today? I've compiled nine great companies that fit Benjamin Graham's methods and criteria.

The companies in this list pass the rigorous requirements of either the Defensive Investor or the Enterprising Investor and are undervalued by the market.

These are the results:

My Favorite Dividend Growth Stocks With Yields Over 4%

Finding a quality dividend stock these days trading at an attractive value and yielding more than 4% isn't easy.

With interest rates remaining low, investors have piled into dividend payers looking for a good yield, causing stock prices to rise and yields to fall.

There are still a few stocks out there worth taking a look at, though. Here are two stocks to buy with dividends yielding more than 4%.

Here are my favorites...

With interest rates remaining low, investors have piled into dividend payers looking for a good yield, causing stock prices to rise and yields to fall.

There are still a few stocks out there worth taking a look at, though. Here are two stocks to buy with dividends yielding more than 4%.

Here are my favorites...

20 Stocks With A Free Cashflow Inital Yield Over 5%

A profitable company is solid and a good investment if it growth and

scales its profits. That's a fact.

But often we see earnings that are no earnings. The cash flow is often higher or lower and the need for capital expenditures makes it more complicated to evaluate the true earnings for return orientated investors.

But often we see earnings that are no earnings. The cash flow is often higher or lower and the need for capital expenditures makes it more complicated to evaluate the true earnings for return orientated investors.

A High free cash flow can be used for so many interesting things like

organic growth, merger and acquisitions or even buybacks and special dividends.

Attached I've compiled a few stocks that offer a free cash flow yield

over 5 percent. That’s a good initial yield in my view.

Here are my favorite results...

20 Top Picks From My Safe Haven High-Yield Large Cap Screen

Every month, I run a screen to find value stocks with high dividends. Well, it's not easy to find a bargain and if you found a stock that looks like one, you could also wait years until the market detects the value.

Today I like to share a list of 20 stocks with a low beta ratio and yields over 2.77%. You will find the complete list at the end of this article. Below is also a detail view of the top yielding stocks. I hope you will find some values in it.

In addition to the screening criteria, each stock from the screen had a positive sales growth over the past five years while earnings are expected to grow by more than 5% for the next five years.

The debt-to-equity ratio is also under one and the market capitalization over 10 billion USD.

Here are the top yielding results...

Today I like to share a list of 20 stocks with a low beta ratio and yields over 2.77%. You will find the complete list at the end of this article. Below is also a detail view of the top yielding stocks. I hope you will find some values in it.

In addition to the screening criteria, each stock from the screen had a positive sales growth over the past five years while earnings are expected to grow by more than 5% for the next five years.

The debt-to-equity ratio is also under one and the market capitalization over 10 billion USD.

Here are the top yielding results...

20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

I'm also focused on higher yielding stocks because I

do believe that those companies offer a better risk compensation and their

business model allows it to generate a higher amount of free cash which could

be distributed to shareholders.

But you need to look more into the balance sheets and

income statements of a company in order to identify such a cash flow strength.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

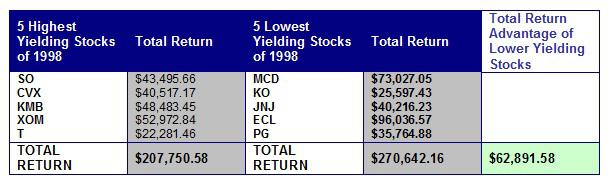

The attached chart spells out the cost to the investor of focusing on yield over a long period of investing history.

Investors who emphasized yield when purchasing stocks from this group of beloved cherry-picked Dividend Growth stocks missed out on earning the equivalent of a year's worth of a nice middle-class salary over the 18 years studied here.

You might see that a portfolio with lower yielding stocks delivered more total return due to a larger stock price appreciation than higher yielding stocks with lower growth possibilities.

Today I would like to introduce a few lower yielding Dividend Achievers with a fantastic future prediction. The attached list ranks midcap plus Dividend Achievers by its future EPS growth forecast. Only stocks with a debt to equity ratio under 1 were observed.

Here are the 20 top results, sorted by growth...

|

| 20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks (click to enlarge) |

20 Safe Stocks To Survive A High Volatility While Receiveing 3% Plus Dividends

Every time it seems safe to go back in the water, oil gets hammered and the stock market dives again. One very good sign is that most of Wall Street is as bearish now as they were in 2009, and after a correction to open the year in January, things are very negative to say the least.

Given the sparsity of good income investment alternatives now, especially with interest rates continuing to plummet, one good alternative for gun-shy investors is conservative stocks that pay big dividends.

Attached you can find a few stocks from our research that might offer a special hedge in times of high market volatility and rising anxious.

Each of the attached results has a market capitalization over 10 billion and a very low beta of less than half of the market.

Finally I've only listed those stocks with the highest dividend yield.

Here are the 20 best yielding low beta dividend large cap stocks...

8 Reliable Dividend Payers To Watch

A stock's dividend yield equals the

dollar value of the dividend it pays, divided into the dollar value of the

stock that pays it. When the price on that equation gets smaller, the number on

the other side of the equation gets bigger -- and the dividend yield increases.

A stock's dividend yield equals the

dollar value of the dividend it pays, divided into the dollar value of the

stock that pays it. When the price on that equation gets smaller, the number on

the other side of the equation gets bigger -- and the dividend yield increases.

For dividend

hunters like me, falling stock prices are good. I will only receive a higher

dividend when the company pays the same dividend in the future. Reliability is

a key issue when you put money into stocks.

The most important

figure to evaluate business stability is to look at the 10 year fundamentals of

the company. If you see earnings changes only at a small level, you might have

found a non cyclic business model with a solid dominated market position.

Most of our

long-term dividend growth stocks have such a not accounted asset. The price we

pay for this invisible value is a premium on the book value on the company

accounted assets.

Today I like to

show you some interesting Dividend Achievers, stocks with more than 10 years of

consecutive dividend growth, with attractive fundamentals.

Here are my

screening criteria:

- Beta under 0.5

- 5 Year EPS

growth predictions over 5%

- Sales of the

past 5 years grown over 5%

- Debt to equity

under 0.5

Here are the

results in detail...

14 High Yielding Dividend Investments Qualified As Safe Heaven

With the S&P 500 down nearly 7% in the last three weeks alone, you can’t be blamed for wanting to throw up your hands and sell all your stocks. That's a stupid idea in my view.

With the S&P 500 down nearly 7% in the last three weeks alone, you can’t be blamed for wanting to throw up your hands and sell all your stocks. That's a stupid idea in my view.You need to stay disciplined. If you are a long-term investor, sell-offs shouldn't care you because you have studied the long-term fundamentals and persectives of your investment and nothing chageged, you don't need to act.

If you have a long time horizon and you mainly hold dividend-paying US companies your are on the smartest side of the market. Stocks are risky, for sure but long-term dividend growth stocks offer a smaller risk than high leveradged oil drilling companies.

Attached you will find a few Dividend Growth Stocks that might filfill the needs of high-quality dividend investing and also might be hold this rating for years to come.

These are 14 of the results...

20 High-Yield Stocks With Extreme Low Beta Ratios (Half Of The Market)

Everyone has a different appetite for risk. Some people like to chase those high growth companies that have chances of doubling in a year or two, while others would likely never sleep at night while three out of 10 of its investments destroy the market while the other 7 crash & burn.

Everyone has a different appetite for risk. Some people like to chase those high growth companies that have chances of doubling in a year or two, while others would likely never sleep at night while three out of 10 of its investments destroy the market while the other 7 crash & burn. If you are one of those investors that don't have the sensibility to invest in those higher risk/higher reward type of companies, that's ok, there are plenty of lower risk companies that can generate good returns over time.

One ratio to measure the risk compared to the market is the beta ratio. A ratio under one shows us that the unique stock moves less than the overall market while a ratio far above one indicates that the stock is more volatile than the market.

If you look for more stability of your portfolio, you should look at low beta stocks. Mostly, you need to give up some of your return or dividend yield due to the higher safeness. But only sometimes.

Attached you can find a couple of stocks with the lowest beta ratio on the market while paying the highest available yields in their field. I've only included stocks with a market cap of more than 2 billion.

These are the results...

10 S&P 500 Stocks With A Big Gap Between Free Cash Flow Yield And Dividend Yield

One way to gauge a company’s ability to raise dividends, or at least not cut them, is to divide its free cash flow per share by the share price to come up with a free cash flow yield. And that can be compared with the dividend yield.

One way to gauge a company’s ability to raise dividends, or at least not cut them, is to divide its free cash flow per share by the share price to come up with a free cash flow yield. And that can be compared with the dividend yield.A company’s free cash flow is its remaining cash flow after capital expenditures. To present a useful list of dividend stocks with dividend yields that appear safe, we started with the S&P 500, and then removed stocks with negative returns of 15% or more this year.

After all, investors have little confidence in them. We then pared the list to companies that have paid dividends for at least five years, while removing any that have cut regular dividends at any time over the past five years, according to FactSet.

Here are the results...

13 High-Yield Large Caps From The S&P 500 Stock Index

Despite all the hand-wringing over

the beginning of the Federal Reserve interest rate increases, the fact of the

matter is they will start small, stay small and happen at a very slow

pace.

In fact, most Wall

Street strategists predict that by the end of 2017, the fed funds rate will

only be 2% at the very most. It could be even lower if economic growth slows

down between now and then.

With that scenario

very likely, solid stocks with a big yield will remain in demand. I screened

the S&P 500 index for large cap, blue chip stocks that paid a 5% dividend.

As of now, 13 stocks pay such a high yield of which 5 have also a low forward P/E and 8 a buy or better rating.

As of now, 13 stocks pay such a high yield of which 5 have also a low forward P/E and 8 a buy or better rating.

A major worry for many yield-hungry

investors is that when the Federal Reserve begins raising the federal funds

rate, market prices for any yield-producing investment can come under pressure.

When interest rates rise, the value of an existing bond or preferred stock must adjust itself lower so it has the same yield as a similarly rated new security.

When interest rates rise, the value of an existing bond or preferred stock must adjust itself lower so it has the same yield as a similarly rated new security.

A good advice from me is to avoid

stocks with high debt leverage like REITs. Those stocks are living from an

interest margin that could be destroyed.

Here are the large cap high-yields

from the S&P 500...

40 Top Yielding Results From My Safe Haven Large Cap Screen

As a long reader of my blog, you

might know that I love dividend paying stocks, high cash compensations at low

risk.

Everything at all is not possible but I do my best to find great stock ideas each day. Today I like to move forward by taking a look into my safe heaven screen.

I run this screen several times till now. There are more stocks with an inconsistent dividend growth history but this does not mean that they are not high-quality.

Everything at all is not possible but I do my best to find great stock ideas each day. Today I like to move forward by taking a look into my safe heaven screen.

I run this screen several times till now. There are more stocks with an inconsistent dividend growth history but this does not mean that they are not high-quality.

Many oil and gas

companies jumped into the screen within the recent weeks thanks to the low oil

price. In addition, Money Center Banks are also top picks in the higher yield

area but take a look by yourself...

18 Dividend Growth Stocks With 4% Yields And The Lowest Beta Ratios

Defensive Investors are defined as

investors who are not able or willing to do substantial research into

individual investments, and therefore need to select only the companies that

present the least amount of risk.

Risk taking should

be rewarded with higher yields. Most investors don't get paid for their

investments or risk preference. Dividend stocks could offer a small risk

compensation. Each dividend payment reduces your initial investment cost which

is really nice. Over years, you will have a large risk buffer.

Today I like to

show you some stocks with a long dividend growth history, high yields and low

beta ratios. I guess this should be a great middle way. My research focus is

limited to stocks with a consecutive dividend growth history of more than 10

years. Each stock should have a yield over 4% and a beta ratio under 0.5.

18 companies fulfilled my criteria of which eight are high-yields. 5 Master Limited

Partnerships lead the list of the results. Do you like any of the results?

Please leave a comment in the box below the article and we discuss it. Thank

you for reading and commenting.

Here are the top

yielding results in detail...

8 Value Stocks With Enormous Dividend Yields

Many investors like to watch the dividend yield, which is calculated as the annual dividend income per share divided by the current share price. I do it daily and screen the market by the highest yielding and most attractive stocks.

I also look for smaller companies and stocks that pay only a small part of its annual income. The idea behind is that growth can boost your future dividend yield.

The dividend yield measures the amount of income received in proportion to the share price. To use the ratio is an easy way to compare the relative attractiveness of various dividend-paying stocks. It tells an investor the yield he/she can expect by purchasing a stock.

Today I like to focus on value stocks with high yields. Attached are 8 ideas that pay enormous dividends while having deep values.

These are the results:

I also look for smaller companies and stocks that pay only a small part of its annual income. The idea behind is that growth can boost your future dividend yield.

The dividend yield measures the amount of income received in proportion to the share price. To use the ratio is an easy way to compare the relative attractiveness of various dividend-paying stocks. It tells an investor the yield he/she can expect by purchasing a stock.

Today I like to focus on value stocks with high yields. Attached are 8 ideas that pay enormous dividends while having deep values.

17 Fast Growing Dividend Stocks With An Unbelievable Momentum

Growth investors are looking for

the next big thing that rules the market. They scout for stocks with enormous

growth with hopes to pay later big dividends on a small investment when they

have grown out.

Growth is

wonderful and if I'm honest, I like stocks like Apple or Facebook too. Regretless,

they are not only unicorns, more often prices are skyrocket; more likely in the

case of Salesforce or Amazon than for Apple.

Today I've tried

to compile a list of the fastest growing dividend stocks with unbelievable high

growth rates, stocking not at a rate of more than 10 percent for the latest

quarter over quarter reports.

I've selected only

those stocks with a very large market capitalization of more than 10 billion in

order to keep the big risk off the table.

As a result, 17 stocks joined my finishing list. Four of them have a yield over 2 percent,

which is very comfortable in times of low interest rates.

Please let me know

your thoughts about the winning list. Do you like some of the stocks?

Here are some highlights....

Why You Should Look At These 16 Stocks With Cheap Free Cash Flows

When you put money into the market,

you should be aware of the market valuation. One of the major problems in valuation

is definitely to predict future cash-flows.

Nobody of us has a

crystal-ball and no one can predict the future.

The second problem

is that there are companies that must invest massively into the business model

in order to boost growth or to replace old machines or buildings.

Investors often

calculate with free cash flows. Those are the real income of the company, available

for dividends, buybacks or mergers and acquisitions.

Today I like to

introduce the cheapest Dividend Achievers with a low price to free cash flow of

less than 15.

16 companies

fulfilled my criteria of which four have a dividend yield over 3 percent. The

most of the results come from the property and casualty insurance industry.

Insurer generates massive cash but

they have also big problems with decreasing premiums and increasing

competition. There are always good reasons why some companies are cheap.

You may also like my article about the best dividend stocks from the title insurance industry. I still prefer, like Warren Buffett, the fastest growing companies from the insurance sector. Those are ACE, UNH and TRV.

You may also like my article about the best dividend stocks from the title insurance industry. I still prefer, like Warren Buffett, the fastest growing companies from the insurance sector. Those are ACE, UNH and TRV.

What do you think

about the screen?

Subscribe to:

Posts (Atom)