Showing posts with label RGLD. Show all posts

Showing posts with label RGLD. Show all posts

20 Highest Yielding NASDAQ And NYSE Dividend Achievers

There are numerous studies suggesting that dividend-paying stocks are effective tools for accumulating wealth over an extended time horizon.

Simply investing in dividend-paying stocks, however, hardly limits the investable universe or indicates a realistic strategy.

More than two-thirds of the stocks in the S&P 500 pay dividends, including the majority of the larger companies in the benchmark.

Globally, there are thousands of dividend-paying stocks. There are a number of strategies that further refine the idea of dividend investing, focusing only on dividend payers that meet certain yield, consistency, or balance sheet criteria.

The good thing for us normal investors is that we can easily discover some the most popular indices with focus on long term dividend growth in order to select high-quality dividend stocks.

Today I like to show you some of the 20 highest yielding stocks from the NASDAQ and NYSE Dividend Achievers Index. The strategy is ideal for high-income investors who don't want to invest into junk.

The NASDAQ US Dividend Achievers Select Index includes dividend-paying stocks that meet the following requirements:

- Be incorporated in the United States.

- Trade on the NYSE or NASDAQ.

- Have increased its annual dividend for the last ten or more consecutive years.

- Meet volume requirements.

- The NASDAQ OMX maintains the NASDAQ US Dividend Achievers Select Index.

These are 20 highest yielding, selected Dividend Achievers, sorted by Dividend Yield...

Simply investing in dividend-paying stocks, however, hardly limits the investable universe or indicates a realistic strategy.

More than two-thirds of the stocks in the S&P 500 pay dividends, including the majority of the larger companies in the benchmark.

Globally, there are thousands of dividend-paying stocks. There are a number of strategies that further refine the idea of dividend investing, focusing only on dividend payers that meet certain yield, consistency, or balance sheet criteria.

The good thing for us normal investors is that we can easily discover some the most popular indices with focus on long term dividend growth in order to select high-quality dividend stocks.

Today I like to show you some of the 20 highest yielding stocks from the NASDAQ and NYSE Dividend Achievers Index. The strategy is ideal for high-income investors who don't want to invest into junk.

The NASDAQ US Dividend Achievers Select Index includes dividend-paying stocks that meet the following requirements:

- Be incorporated in the United States.

- Trade on the NYSE or NASDAQ.

- Have increased its annual dividend for the last ten or more consecutive years.

- Meet volume requirements.

- The NASDAQ OMX maintains the NASDAQ US Dividend Achievers Select Index.

These are 20 highest yielding, selected Dividend Achievers, sorted by Dividend Yield...

Gold Comes Back: Here Are The 15 Best Dividend Ideas From The Industry

Dividend stocks – that term says a

lot. You buy a stock and on a recurring basis it pays you a cash

dividend....And over time, thanks to those cash distributions and capital

appreciation fueled by shareholder loyalty, the stock price rises.

Dividend stocks – that term says a

lot. You buy a stock and on a recurring basis it pays you a cash

dividend....And over time, thanks to those cash distributions and capital

appreciation fueled by shareholder loyalty, the stock price rises.

That’s a great way

to build wealth. Another way is to buy gold. Gold is a true hard value and

should hedge your cash against inflation.

In the past, it

worked really well until gold prices began to crash. In recent days we see a

small turnaround of gold prices. The leading big reserve banks still pumping

tons of money into the market and a fear of recession is increasing.

However, I'm not a

gold investor and don't have any gold stocks but for sentiment or momentum

trader, it could be a great trading idea to bet on rising gold prices with gold

dividend stocks.

Attached I've

compiled all 15 gold stocks that pay a dividend. If you have any comments,

please share your thoughts at the box below. Thank you for reading and contributing.

20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

I'm also focused on higher yielding stocks because I

do believe that those companies offer a better risk compensation and their

business model allows it to generate a higher amount of free cash which could

be distributed to shareholders.

But you need to look more into the balance sheets and

income statements of a company in order to identify such a cash flow strength.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

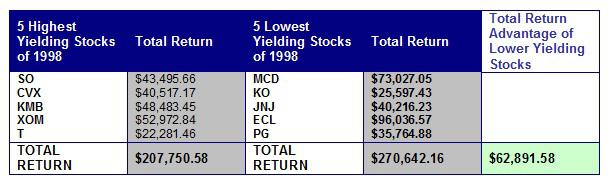

The attached chart spells out the cost to the investor of focusing on yield over a long period of investing history.

Investors who emphasized yield when purchasing stocks from this group of beloved cherry-picked Dividend Growth stocks missed out on earning the equivalent of a year's worth of a nice middle-class salary over the 18 years studied here.

You might see that a portfolio with lower yielding stocks delivered more total return due to a larger stock price appreciation than higher yielding stocks with lower growth possibilities.

Today I would like to introduce a few lower yielding Dividend Achievers with a fantastic future prediction. The attached list ranks midcap plus Dividend Achievers by its future EPS growth forecast. Only stocks with a debt to equity ratio under 1 were observed.

Here are the 20 top results, sorted by growth...

|

| 20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks (click to enlarge) |

19 Dividend Achievers Below Book Value

In a rising

stock market, all eyes are on the income statement. But in a

flat or falling market, the balance sheet moves into the spotlight. Investors

want to know the real core accounted values of the company.

If you look at the

book value per share, you can easily identify stocks that are traded below

their accounted assets.

If a

company’s P/B ratio is less than one, the shares are selling for less than the

value of the company’s assets.

What Is

Book Value?

Book value

is a measure of all of a company's assets: stocks, bonds, inventory,

manufacturing equipment, real estate, etc. In theory, book value should include

everything down to the pencils and staples used by employees, but for

simplicity's sake companies generally only include large assets that are easily

quantified.

Today I’ve

screened my Dividend Achievers list by stocks with a current P/B ratio below

one. 19 stocks matched exactly my criteria. The attached list shows all of

them, sorted by the lowest ratio to the highest.

Here are

the highest yielding results in detail…

6 Dividend Contenders Growing Earnings At Fastest Pace While Keeping Margins High

Each of the stocks has an operating margin over 15%. In addition, sales grew by more than 5 percent yearly in the past half decade.

Only 6 stocks fulfilled my criteria of which two paying yields over 6 percent. Attached you can also find a full list with more fundamentals. I hope it helps you do evaluate the stocks better.

Here are the results...

Ex-Dividend Stocks: Best Dividend Paying Shares On October 02, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 33 stocks go ex dividend

- of which 12 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Chimera

Investment Corporation

|

3.13B

|

27.64

|

0.98

|

17.72

|

11.84%

|

|

|

Enerplus

Corporation

|

3.32B

|

-

|

1.09

|

2.94

|

6.15%

|

|

|

Brandywine

Realty Trust

|

2.05B

|

-

|

1.07

|

3.63

|

4.55%

|

|

|

DCT

Industrial Trust Inc.

|

2.09B

|

-

|

1.51

|

7.36

|

3.89%

|

|

|

Sysco

Corp.

|

18.87B

|

19.06

|

3.63

|

0.42

|

3.52%

|

|

|

Erie

Indemnity Co.

|

3.38B

|

23.76

|

5.23

|

0.58

|

3.27%

|

|

|

Bristol-Myers

Squibb Company

|

76.08B

|

56.44

|

5.30

|

4.81

|

3.03%

|

|

|

JPMorgan

Chase & Co.

|

195.51B

|

8.63

|

0.99

|

3.63

|

2.94%

|

|

|

Banco

Bradesco S.A.

|

58.16B

|

11.28

|

1.80

|

2.75

|

2.88%

|

|

|

Banco

Bradesco S.A.

|

66.15B

|

11.67

|

2.04

|

2.62

|

2.35%

|

|

|

Gentex

Corp.

|

3.67B

|

20.47

|

3.04

|

3.38

|

2.19%

|

|

|

Medtronic,

Inc.

|

53.77B

|

15.30

|

2.90

|

3.23

|

2.10%

|

|

|

Washington

Federal Inc.

|

2.15B

|

15.09

|

1.12

|

4.14

|

1.74%

|

|

|

Monsanto

Co.

|

55.74B

|

22.69

|

4.02

|

3.78

|

1.65%

|

|

|

Royal

Gold, Inc.

|

3.15B

|

44.24

|

1.34

|

10.90

|

1.64%

|

|

|

American

Express Company

|

82.32B

|

18.56

|

4.33

|

2.40

|

1.22%

|

|

|

Torchmark

Corp.

|

6.67B

|

12.83

|

1.75

|

1.80

|

0.94%

|

|

|

Steven

Madden, Ltd.

|

2.34B

|

19.50

|

3.55

|

1.87

|

-

|

Ex-Dividend Stocks: Best Dividend Paying Shares On July 02, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks July 02, 2013. In total, 33 stocks and preferred shares go ex dividend - of which 11 yield more than 3 percent. The average yield amounts to 2.98%.

A full list of all stocks with payment dates can be found here: Ex-Dividend Stocks July 02, 2013. In total, 33 stocks and preferred shares go ex dividend - of which 11 yield more than 3 percent. The average yield amounts to 2.98%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

DCT

Industrial Trust Inc.

|

2.01B

|

-

|

1.50

|

7.40

|

3.92%

|

|

Sysco

Corp.

|

20.13B

|

19.75

|

3.90

|

0.46

|

3.28%

|

|

BankUnited,

Inc.

|

2.47B

|

12.81

|

1.34

|

3.40

|

3.23%

|

|

Bristol-Myers

Squibb Company

|

73.20B

|

50.78

|

5.36

|

4.52

|

3.13%

|

|

Banco

Bradesco S.A.

|

54.52B

|

10.58

|

1.60

|

2.54

|

3.07%

|

|

Erie

Indemnity Co.

|

3.73B

|

26.39

|

5.86

|

0.67

|

2.97%

|

|

JPMorgan

Chase & Co.

|

201.56B

|

9.43

|

1.02

|

3.68

|

2.88%

|

|

General

Dynamics Corp.

|

27.56B

|

-

|

2.38

|

0.88

|

2.86%

|

|

Banco

Bradesco S.A.

|

58.21B

|

10.34

|

1.71

|

2.33

|

2.67%

|

|

Gentex

Corp.

|

3.29B

|

19.70

|

2.82

|

3.05

|

2.43%

|

|

Medtronic,

Inc.

|

52.20B

|

15.23

|

2.80

|

3.15

|

2.02%

|

|

Royal

Gold, Inc.

|

2.73B

|

32.88

|

1.16

|

9.34

|

1.90%

|

|

Masco

Corporation

|

6.82B

|

-

|

24.06

|

0.88

|

1.54%

|

|

Monsanto

Co.

|

52.77B

|

21.48

|

3.80

|

3.58

|

1.52%

|

|

American

Express Company

|

82.16B

|

18.93

|

4.26

|

2.42

|

1.23%

|

|

Torchmark

Corp.

|

6.10B

|

11.80

|

1.42

|

1.67

|

1.04%

|

|

Whole

Foods Market, Inc.

|

19.08B

|

37.04

|

5.25

|

1.52

|

0.78%

|

Subscribe to:

Posts (Atom)