| Ticker | Company | Fwd P/E | P/S | P/B | Dividend |

| ETP | Energy Transfer Partners, L.P. | 12.82 | 0.69 | 0.75 | 13.24% |

| BPL | Buckeye Partners, L.P. | 10.86 | 1.57 | 1.23 | 13.16% |

| TCP | TC PipeLines, LP | 9.94 | 5.29 | 2.3 | 12.98% |

| HEP | Holly Energy Partners, L.P. | 14.62 | 6.66 | 6.41 | 9.21% |

| SEP | Spectra Energy Partners, LP | 11.16 | 8.68 | 0.94 | 8.49% |

| WES | Western Gas Partners, LP | 14.81 | 3.03 | 2.05 | 8.34% |

| ETE | Energy Transfer Equity, L.P. | 6.99 | 0.4 | - | 8.23% |

| TLP | Transmontaigne Partners L.P. | 12.71 | 3.37 | 1.96 | 8.21% |

| SCG | SCANA Corporation | 12.18 | 1.2 | 0.98 | 6.82% |

| OMI | Owens & Minor, Inc. | 7.23 | 0.11 | 0.94 | 6.52% |

| PPL | PPL Corporation | 11.31 | 2.57 | 1.77 | 5.95% |

| MMP | Magellan Midstream Partners, L.P. | 14.28 | 5.68 | 6.68 | 5.90% |

| AFSI | AmTrust Financial Services, Inc. | 7.42 | 0.42 | 1.09 | 5.39% |

| SO | The Southern Company | 14.4 | 1.93 | 1.82 | 5.29% |

| VZ | Verizon Communications Inc. | 10.27 | 1.57 | 4.53 | 4.94% |

| GIS | General Mills, Inc. | 13.99 | 1.69 | 5.14 | 4.40% |

| OGE | OGE Energy Corp. | 14.96 | 2.83 | 1.64 | 4.21% |

| QCOM | QUALCOMM Incorporated | 14.77 | 3.79 | 3.41 | 4.13% |

| EAT | Brinker International, Inc. | 10.22 | 0.56 | - | 4.02% |

| EIX | Edison International | 13.86 | 1.67 | 1.76 | 3.85% |

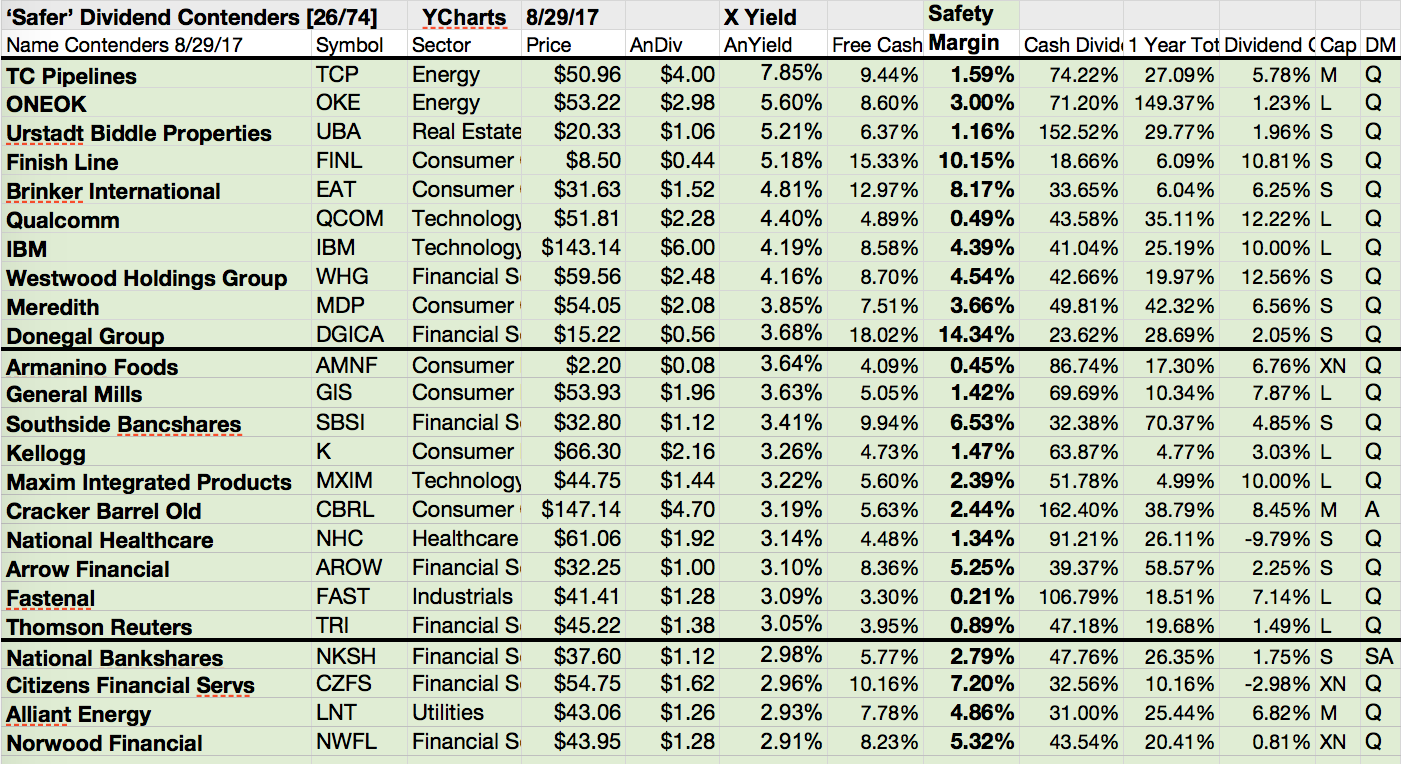

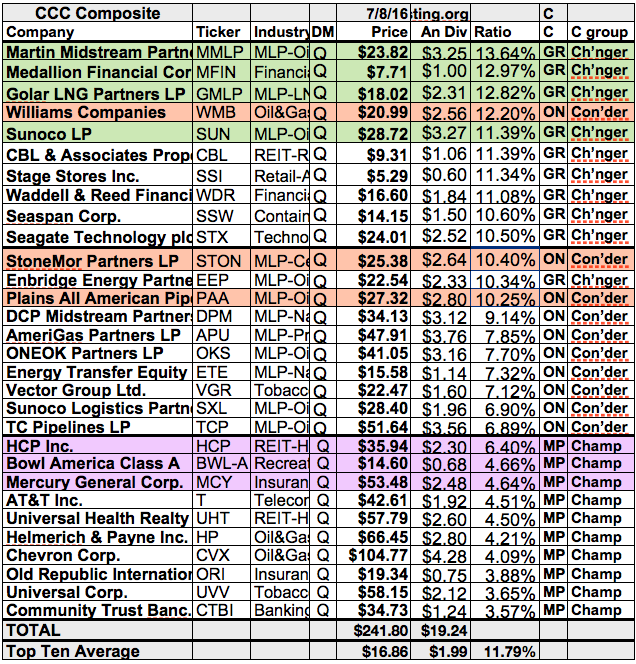

This is only a small part of the full Dividend Yield Investor Fact Book Package. The full package contains excel sheets of essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth) and 204 Dividend Contenders (10 to 24 years of consecutive dividend growth). It's an open version, so you can work with it very easily.

Donate now and get the Dividend Yield Investor Fact Book Package each month. This compilation contains the following books:

- Foreign Yield Fact Book (updated weekly)

- Dividend Growth Stock Fact Book (updated monthly)

- Dividend Growth Excel Sheet (updated weekly)

The books are updated on a regular basis and keeps you up-to date with current yield figures from the Dividend Growth Investing Area.