Showing posts with label GHL. Show all posts

Showing posts with label GHL. Show all posts

Russell 2000 Dogs With Hard Safe Yields

Dividend investors face a constant battle of choosing between dividend yield and sustainability.

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

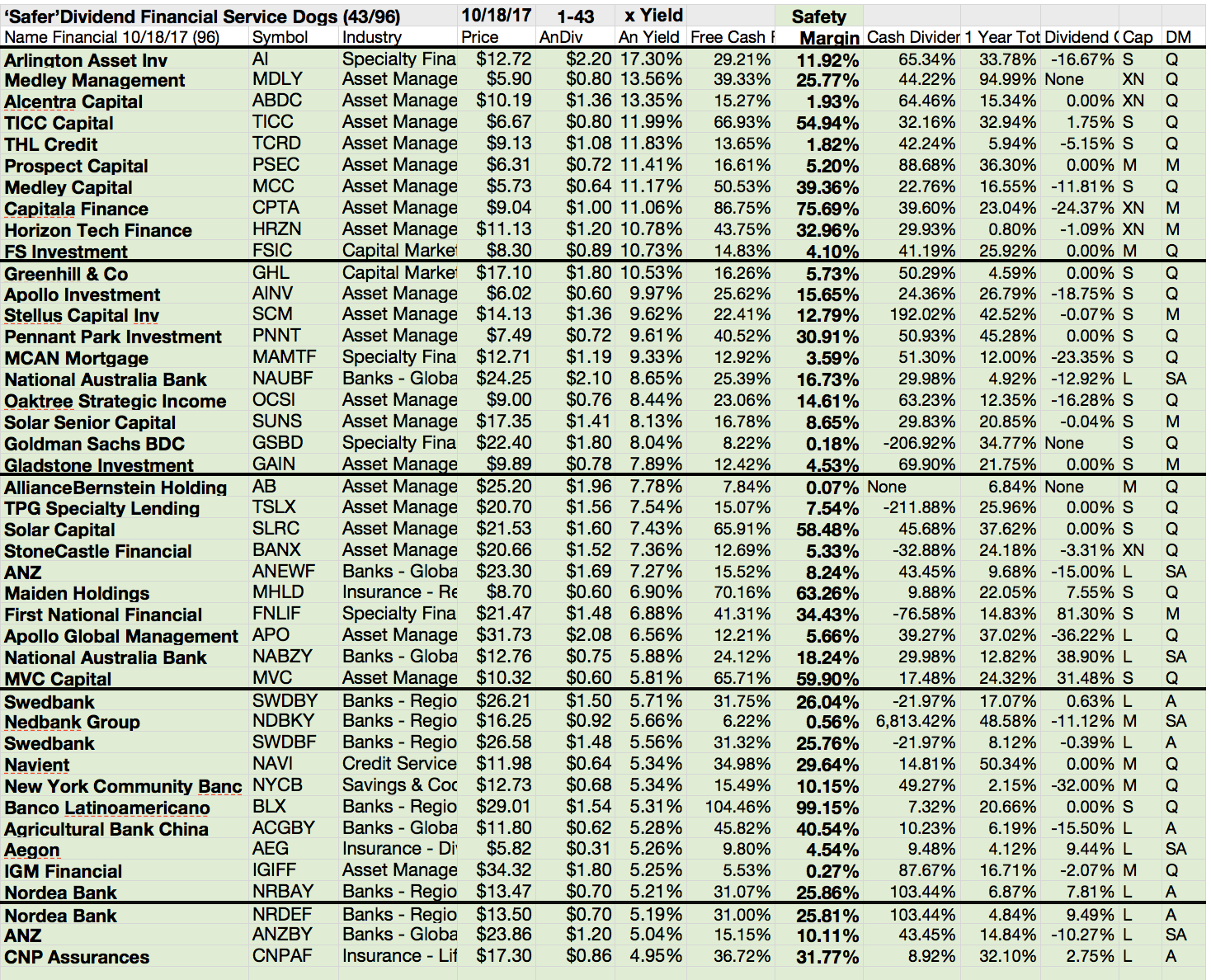

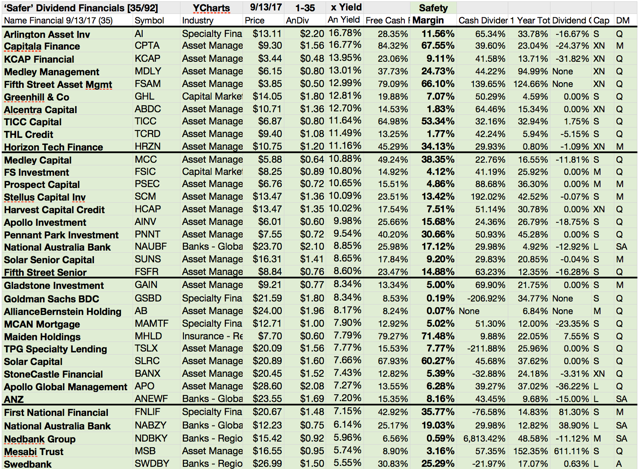

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Ex-Dividend Stocks: Best Dividend Paying Shares On August 30, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 18 stocks go ex dividend

- of which 4 yield more than 3 percent. The average yield amounts to 2.21%.

Here is a full list of all stocks with ex-dividend

date within the upcoming week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Six

Flags Entertainment

|

3.23B

|

10.16

|

8.01

|

2.99

|

5.33%

|

|

Orchids

Paper Products Company

|

216.68M

|

20.58

|

2.68

|

2.05

|

5.04%

|

|

Greenhill

& Co., Inc.

|

1.46B

|

27.97

|

5.71

|

4.55

|

3.68%

|

|

Arthur

J Gallagher & Co.

|

5.31B

|

23.19

|

3.12

|

1.91

|

3.35%

|

|

Avery

Dennison Corporation

|

4.30B

|

21.00

|

2.84

|

0.71

|

2.68%

|

|

Suncor

Energy Inc.

|

52.39B

|

20.23

|

1.34

|

1.41

|

2.24%

|

|

QUALCOMM

Incorporated

|

114.95B

|

17.70

|

3.06

|

4.94

|

2.10%

|

|

Interval

Leisure Group, Inc.

|

1.25B

|

20.56

|

4.01

|

2.56

|

2.02%

|

|

Xylem

Inc.

|

4.54B

|

19.61

|

2.21

|

1.22

|

1.92%

|

|

Forrester

Research Inc.

|

720.58M

|

33.90

|

3.31

|

2.46

|

1.77%

|

|

Computer

Sciences Corporation

|

7.49B

|

12.53

|

2.42

|

0.51

|

1.60%

|

|

Schlumberger

Limited

|

109.72B

|

17.70

|

2.97

|

2.45

|

1.51%

|

|

Joy

Global, Inc.

|

5.20B

|

7.17

|

1.81

|

0.95

|

1.43%

|

|

HSN,

Inc.

|

2.94B

|

20.74

|

6.30

|

0.88

|

1.31%

|

|

Imperial

Oil Ltd.

|

36.23B

|

11.77

|

2.17

|

1.18

|

1.10%

|

|

Alliant

Techsystems Inc.

|

3.13B

|

11.66

|

2.01

|

0.72

|

1.06%

|

|

Halliburton

Company

|

45.23B

|

24.95

|

2.95

|

1.58

|

1.02%

|

|

Itau Unibanco Holding S.A.

|

59.99B

|

9.08

|

1.57

|

2.03

|

0.66%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On March 04, 2013

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 04,

2013. In total, 15 stocks and

preferred shares go ex dividend - of which 2 yield more than 3 percent. The

average yield amounts to 2.62%.

Here is the sheet of the best yielding ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Royce

Focus Trust, Inc.

|

144.77M

|

-

|

0.97

|

58.61

|

9.80%

|

|

Tronox

Incorporated

|

2.33B

|

1.13

|

0.82

|

1.34

|

4.87%

|

|

Greenhill

& Co., Inc.

|

1.72B

|

43.73

|

6.04

|

6.04

|

2.96%

|

|

Avery

Dennison Corporation

|

4.07B

|

25.06

|

2.57

|

0.67

|

2.64%

|

|

Banco

Bradesco S.A.

|

68.73B

|

12.14

|

1.99

|

3.26

|

2.45%

|

|

Commerce

Bancshares, Inc.

|

3.48B

|

13.09

|

1.61

|

5.14

|

2.36%

|

|

Banco

Bradesco S.A.

|

66.85B

|

11.99

|

1.94

|

2.56

|

2.29%

|

|

Forrester

Research Inc.

|

612.36M

|

20.96

|

2.07

|

2.09

|

2.04%

|

|

Nielsen

Holdings N.V.

|

12.58B

|

45.53

|

2.45

|

2.24

|

1.90%

|

|

Cooper

Tire & Rubber Co.

|

1.59B

|

4.47

|

2.16

|

0.38

|

1.66%

|

|

Everest

Re Group Ltd.

|

6.44B

|

7.94

|

0.95

|

1.31

|

1.54%

|

|

Fresh Del Monte Produce Inc.

|

1.51B

|

10.78

|

0.84

|

0.44

|

1.53%

|

|

The

Cheesecake Factory

|

1.86B

|

18.14

|

3.23

|

1.02

|

1.39%

|

|

HSN,

Inc.

|

2.95B

|

25.00

|

6.21

|

0.91

|

1.35%

|

|

Halliburton

Company

|

38.68B

|

14.93

|

2.44

|

1.36

|

0.87%

|

Best Dividend Paying Ex-Dividend Shares On December 03, 2012

The Best Yielding And

Biggest Ex-Dividend Stocks Researched By Dividend Yield - Stock, Capital, Investment. Dividend Investors should have

a quiet overview of stocks with upcoming ex dividend dates. The ex dividend

date is the final date on which the new stock buyer couldn’t receive the next

dividend. If you like to receive the dividend, you need to buy the stock before

the ex dividend date. I made a little screen of the best yielding stocks with a

higher capitalization that have their ex date on the next trading day.

A full list of all stocks

with ex-dividend date can be found here: Ex-Dividend Stocks on December

03, 2012. In total, 20 stocks and

preferred shares go ex dividend - of which 8 yield more than 3 percent. The

average yield amounts to 2.74%. If you like to receive the next dividend you

need to buy the dividend stocks now.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

American Strategic Income Portfolio III

|

162.12M

|

-

|

-

|

-

|

5.93%

|

|

|

REGAL

ENTERTAINMENT GROUP

|

2.46B

|

21.97

|

-

|

0.91

|

5.31%

|

|

|

Cedar

Fair, L.P.

|

1.85B

|

16.88

|

9.93

|

1.70

|

4.81%

|

|

|

Ecology

& Environment, Inc.

|

47.28M

|

58.68

|

0.98

|

0.30

|

4.30%

|

|

|

Greenhill

& Co., Inc.

|

1.35B

|

33.47

|

4.07

|

4.69

|

3.79%

|

|

|

CVB

Financial Corp.

|

1.06B

|

13.89

|

1.41

|

4.00

|

3.35%

|

|

|

Avery

Dennison Corporation

|

3.35B

|

21.42

|

2.12

|

0.56

|

3.21%

|

|

|

Hancock

Holding Co.

|

2.70B

|

22.08

|

1.11

|

3.51

|

3.02%

|

|

|

Chicago

Rivet & Machine Co.

|

19.59M

|

11.95

|

0.85

|

0.59

|

2.97%

|

|

|

Kohl's

Corp.

|

10.56B

|

10.35

|

1.73

|

0.56

|

2.84%

|

|

|

Forrester

Research Inc.

|

625.74M

|

21.42

|

2.11

|

2.14

|

2.00%

|

|

|

Cass

Information Systems Inc.

|

488.28M

|

20.87

|

2.80

|

10.49

|

1.53%

|

|

|

HSN,

Inc.

|

2.86B

|

24.67

|

6.13

|

0.88

|

1.36%

|

|

|

Old

Line Bancshares Inc.

|

80.80M

|

10.47

|

1.09

|

2.14

|

1.35%

|

|

|

ChipMOS

TECHNOLOGIES (Bermuda)

|

369.16M

|

31.09

|

0.78

|

0.59

|

1.29%

|

|

|

KBW

Inc.

|

591.16M

|

-

|

1.37

|

2.57

|

1.17%

|

|

|

Ross

Stores Inc.

|

12.89B

|

17.39

|

7.59

|

1.38

|

0.97%

|

|

|

Itau Unibanco Holding S.A.

|

69.20B

|

10.44

|

1.87

|

2.37

|

0.59%

|

|

|

Fair

Isaac Corp.

|

1.51B

|

16.92

|

3.17

|

2.23

|

0.19%

|

|

|

TSR

Inc.

|

10.06M

|

-

|

0.81

|

0.22

|

Subscribe to:

Comments (Atom)