I believe that it makes sense to observe the market by

good valuated long-term growth stocks. For sure many of the results are lucky strikes,

companies that have had an extraordinary good financial strength and growth due

to a fantastic business environment. But the developments are not sustainable.

But sometimes there are new ideas on my list like Herbalife

or recently the weapon maker Sturm & Ruger. Those were corporate stocks in special

situations.

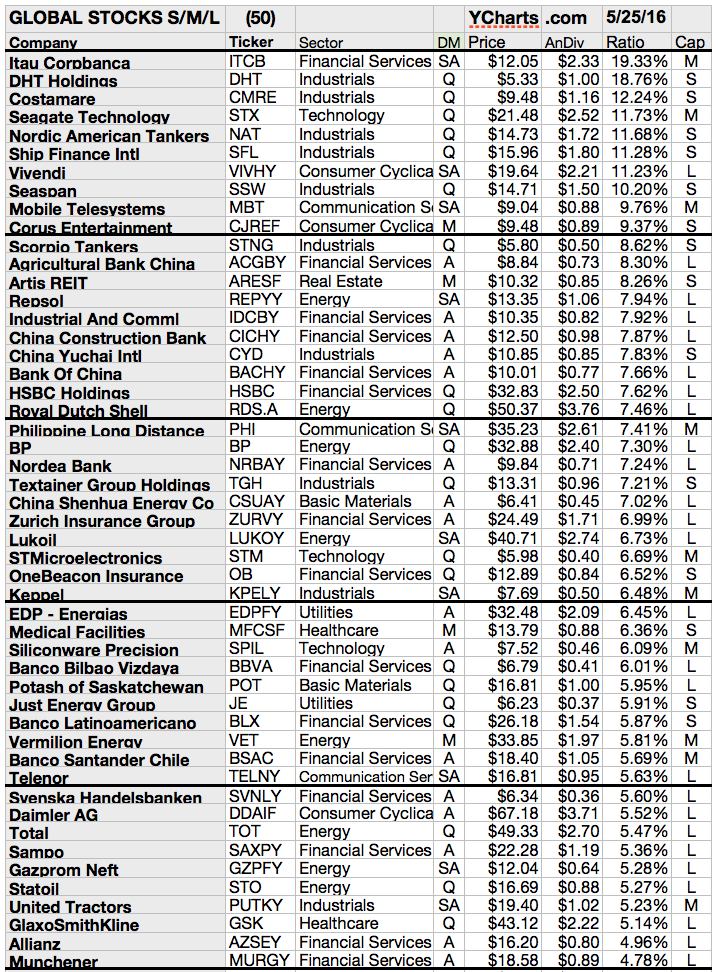

The best dividend paying stock list is a small compilation

with seven tough investing criteria, summarized below. The list includes each

month around 20 to 30 results. It’s a quick dividend list (from low-yield to

high-yield paying stocks) of stocks with interesting performance and valuation

figures. Stocks from that list are mid- and large caps (market capitalization

of more than USD 1 billion) with double-digit long-term earnings growth rates.

The companies are traded at AMEX, NYSE, NASDAQ and part of the Dow Jones,

S&P 500 or Nasdaq Composite. The list is selected by the following criteria

and sorted by dividend yield.

My Criteria to find the best dividend stock

Market Capitalization: > 1 Billion

Price/Earnings Ratio: > 0 < 100

Dividend Yield: > 3 < 20

Return on Investment: > 10 < 100

Operating Margin: > 10 < 100

10 Year Revenue Growth: > 8 < 200

10 Year EPS Growth: > 10 < 100

28 companies are part of the best dividend paying

stock list for October 2013. The top pick is still Southern Copper, a commodity

based stock with a double-digit dividend yield. 8 additional stocks have a

dividend yield over 5 percent and fourteen got a buy or better rating by brokerage

firms.

+Dividends.png)

+Logo.jpg)