Showing posts with label SUNS. Show all posts

Showing posts with label SUNS. Show all posts

17 Best Rated Monthly Dividend Paying Stocks With Big Yields

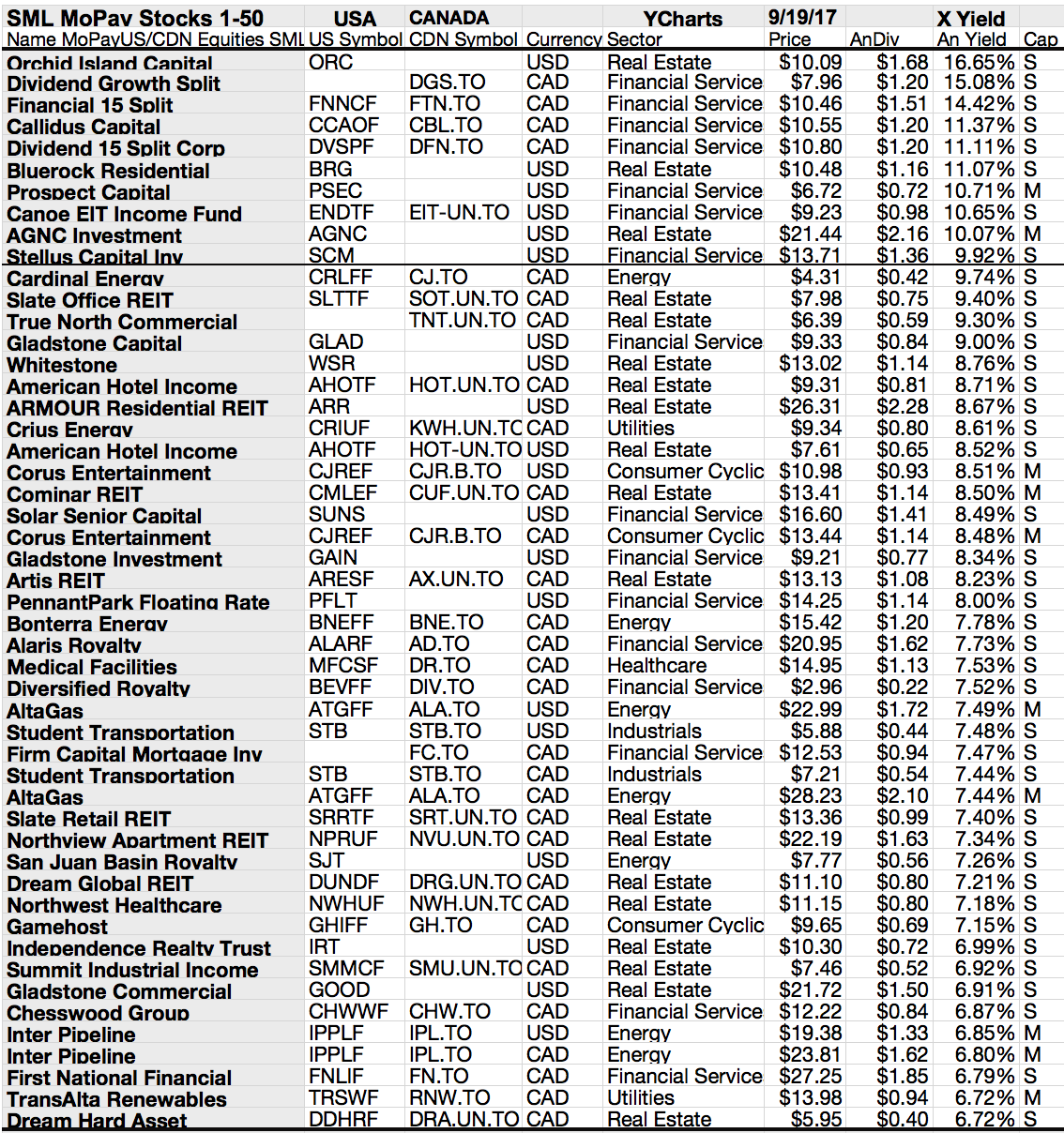

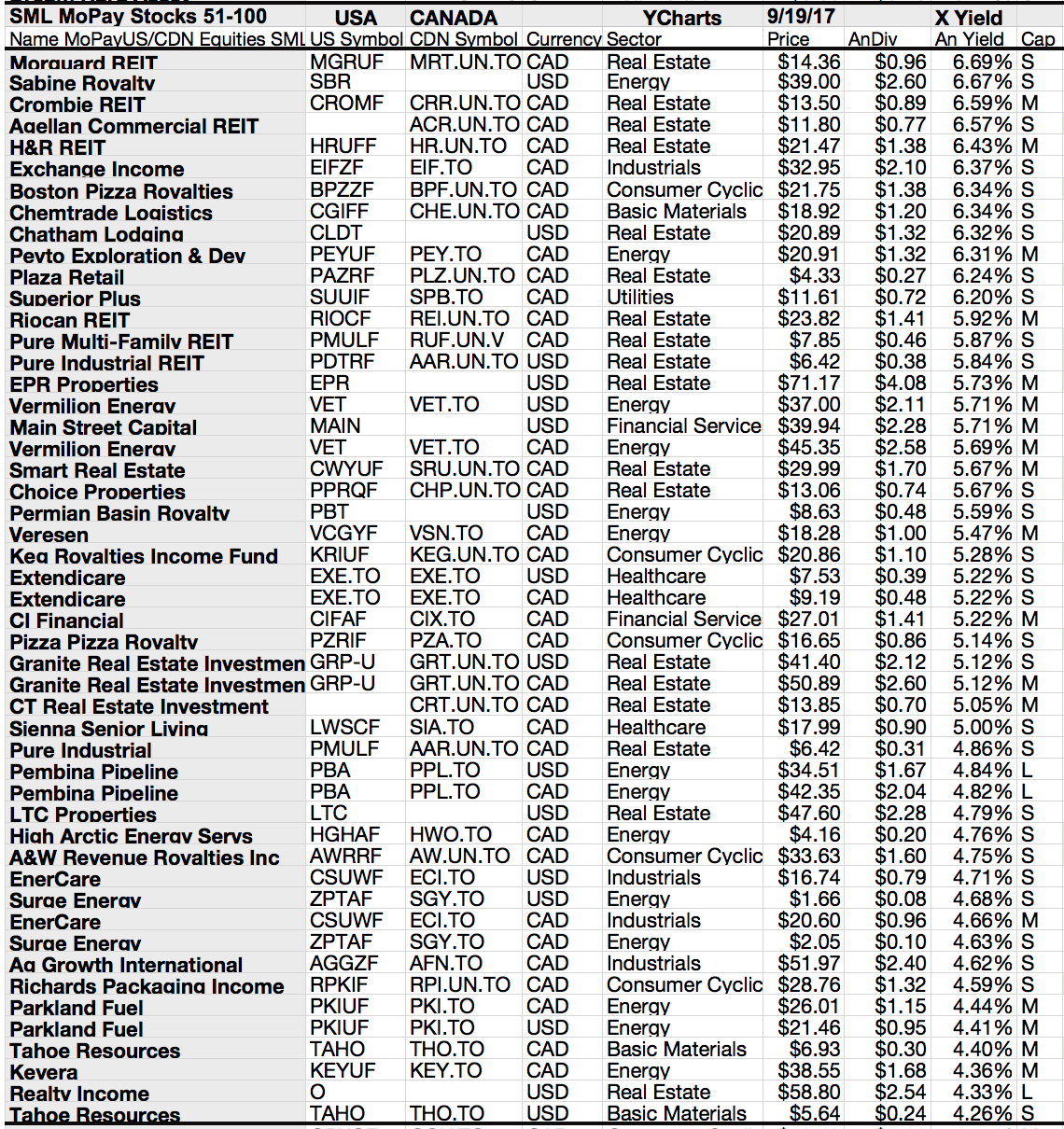

While most dividend paying stocks that trade on exchanges in the US pay quarterly, there are some stocks that pay their dividends on other schedules.

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

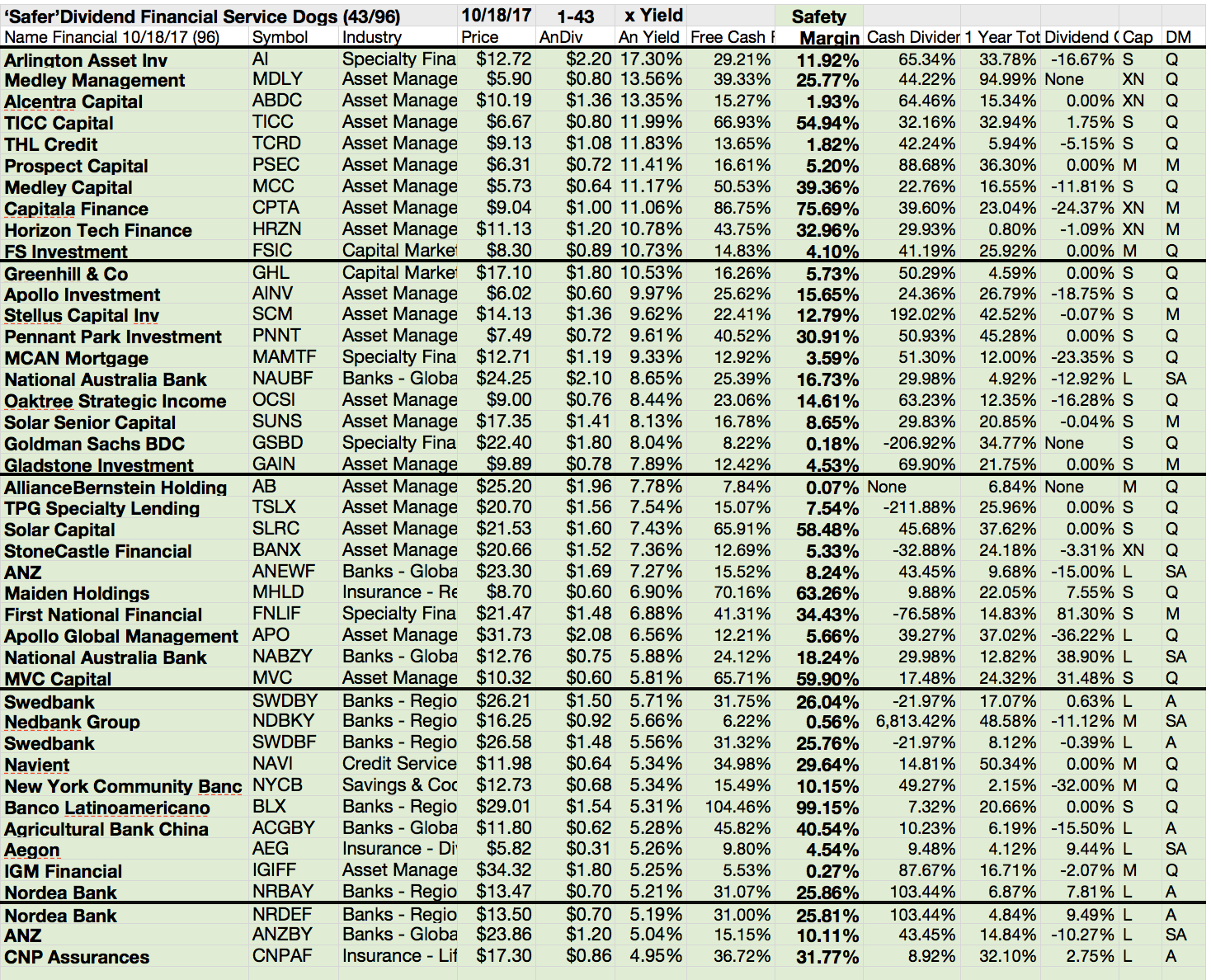

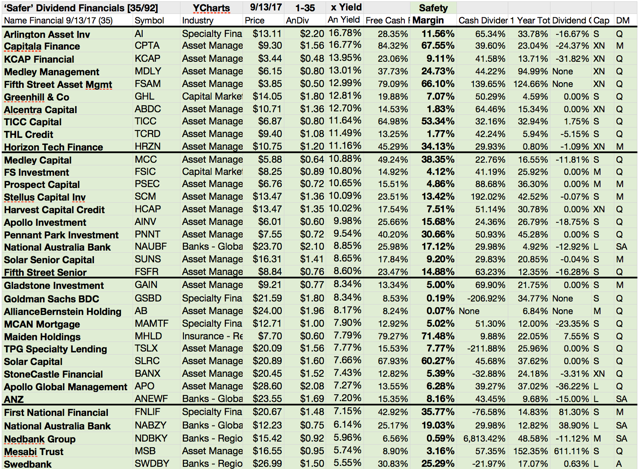

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

A handful pay their dividends semi-annually while there is a larger population of monthly dividend stocks.

While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

Attached you will find a compilation of monthly paying stocks that met the following criteria:

- Pay dividends of 6% (plus or minus)

- Are growing those dividends

- Have solid balance sheets

A handful of these businesses even have investment grade credit ratings. The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

These are the results...

| 17 Monthly Dividend Stocks (click to enlarge), Source: Valuewalk.com |

The Best Monthly Dividend Stocks For High-Yield Income Investors

The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

A handful of these businesses even have investment grade credit ratings.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.

MLPs and crude oil trusts are not stocks and their accounting and financial reporting is sufficiently different that they should be covered separately.

If you like to receive more list and high yield dividend tables, you should subscribe to my daily newsletter here. It's completly free for everyone. Thank you.

Here is the list...

Ex-Dividend Stocks: Best Dividend Paying Shares On October 22, 2013

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 10 stocks go ex dividend

- of which 7 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Solar

Senior Capital Ltd

|

216.92M

|

21.66

|

1.04

|

10.74

|

7.48%

|

|

|

Select Income REIT Common Share

|

1.08B

|

12.56

|

1.18

|

6.85

|

6.72%

|

|

|

Eaton Vance California Municipal Bond Fnd II

|

43.65M

|

7.71

|

0.84

|

11.73

|

6.49%

|

|

|

Grupo Aeroportuario Centro Norte

|

1.37B

|

21.51

|

2.84

|

5.61

|

4.58%

|

|

|

MVC

Capital, Inc.

|

317.30M

|

11.02

|

0.81

|

12.02

|

3.89%

|

|

|

Royal

Bank of Canada

|

97.53B

|

12.87

|

2.37

|

4.79

|

3.83%

|

|

|

New Hampshire Thrift Bancshares

|

104.70M

|

13.04

|

0.80

|

2.75

|

3.53%

|

|

|

Sinopec Shanghai Petrochemical

|

2.81B

|

177.64

|

1.04

|

0.18

|

1.84%

|

|

|

ADTRAN

Inc.

|

1.48B

|

40.49

|

2.41

|

2.37

|

1.41%

|

|

|

Johnson

Outdoors

|

260.36M

|

13.44

|

1.34

|

0.61

|

1.10%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On September 17, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 39 stocks,

preferred shares or funds go ex dividend - of which 11 yield more than 3

percent. The average yield amounts to 6.69%. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

AG Mortgage Investment Trust

|

492.05M

|

11.31

|

0.88

|

3.38

|

18.25%

|

|

|

BlackRock

Kelso Capital

|

733.55M

|

13.38

|

1.06

|

5.03

|

10.51%

|

|

|

Harvest

Capital Credit

|

64.96M

|

3.95

|

0.72

|

10.65

|

8.82%

|

|

|

Solar

Senior Capital Ltd

|

210.59M

|

21.02

|

1.01

|

10.43

|

7.71%

|

|

|

Retail Properties of America, Inc.

|

3.30B

|

707.00

|

1.38

|

5.94

|

4.67%

|

|

|

Xcel

Energy Inc.

|

13.76B

|

13.96

|

1.48

|

1.29

|

4.05%

|

|

|

EastGroup

Properties Inc.

|

1.76B

|

58.65

|

3.59

|

9.21

|

3.68%

|

|

|

SmartPros

Ltd.

|

9.46M

|

-

|

1.00

|

0.58

|

2.97%

|

|

|

Safeway

Inc.

|

6.73B

|

14.54

|

2.12

|

0.16

|

2.84%

|

|

|

Goldcorp

Inc.

|

21.47B

|

-

|

1.03

|

4.40

|

2.27%

|

|

|

Avago

Technologies Limited

|

9.67B

|

18.13

|

3.55

|

4.03

|

2.15%

|

|

|

Altisource

Residential

|

385.95M

|

166.00

|

0.93

|

37.11

|

2.01%

|

|

|

U.S. Silica Holdings, Inc.

|

1.33B

|

17.05

|

4.97

|

2.73

|

1.99%

|

|

|

International

Game Technology

|

5.30B

|

18.14

|

4.11

|

2.26

|

1.97%

|

|

|

Total

System Services, Inc.

|

5.45B

|

23.29

|

3.59

|

2.88

|

1.37%

|

|

|

Synovus

Financial Corp.

|

2.78B

|

3.85

|

1.07

|

2.93

|

1.22%

|

|

|

Cognex

Corporation

|

2.68B

|

40.83

|

4.36

|

8.14

|

0.71%

|

|

|

Alliance Fiber Optic Products

|

327.04M

|

24.75

|

4.86

|

5.87

|

0.67%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On July 23, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks July 23,

2013. In total, 7 stocks go ex dividend

- of which 3 yield more than 3 percent. The average yield amounts to 5.24%.

Here is the sheet of the best yielding ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Solar

Senior Capital Ltd

|

214.21M

|

17.19

|

1.02

|

10.15

|

7.32%

|

|

|

Pembina

Pipeline Corporation

|

9.68B

|

31.75

|

2.04

|

2.24

|

4.96%

|

|

|

Royal

Bank of Canada

|

90.76B

|

12.17

|

2.30

|

4.48

|

3.87%

|

|

|

Lakeland

Financial Corp.

|

513.44M

|

14.35

|

1.67

|

4.63

|

2.43%

|

|

|

ADTRAN

Inc.

|

1.57B

|

53.08

|

2.57

|

2.57

|

1.36%

|

|

|

HB

Fuller Co.

|

2.06B

|

21.69

|

2.52

|

1.02

|

0.97%

|

Subscribe to:

Comments (Atom)