Dividend growth is a wonderful thing, but you should also require the stocks you buy to look cheap. Here I seek out stocks trading at multiples of price to sales, earnings, and cash flow lower than five-year averages.

Stocks that trade at discounted valuations can be cheap for a reason, so I also require expected sales growth for the year ahead to be positive. Using these criteria, the 24 stocks shown in the table have proven themselves to be “dividend growth superstars” that kept on paying and even raising their dividends through the 2008-2009 financial crisis. They also trade at historically cheap valuations on at least two of the three ratios I use to determine value: price/sales, price/earnings, and price/cash flow.

If you follow a strategy of investing in temporarily cheap stocks of companies that habitually hike their dividends, not only will you experience significant capital gains when the stock falls back into favor with the market, but the yield you earn on your original investment can balloon to downright plump proportions.

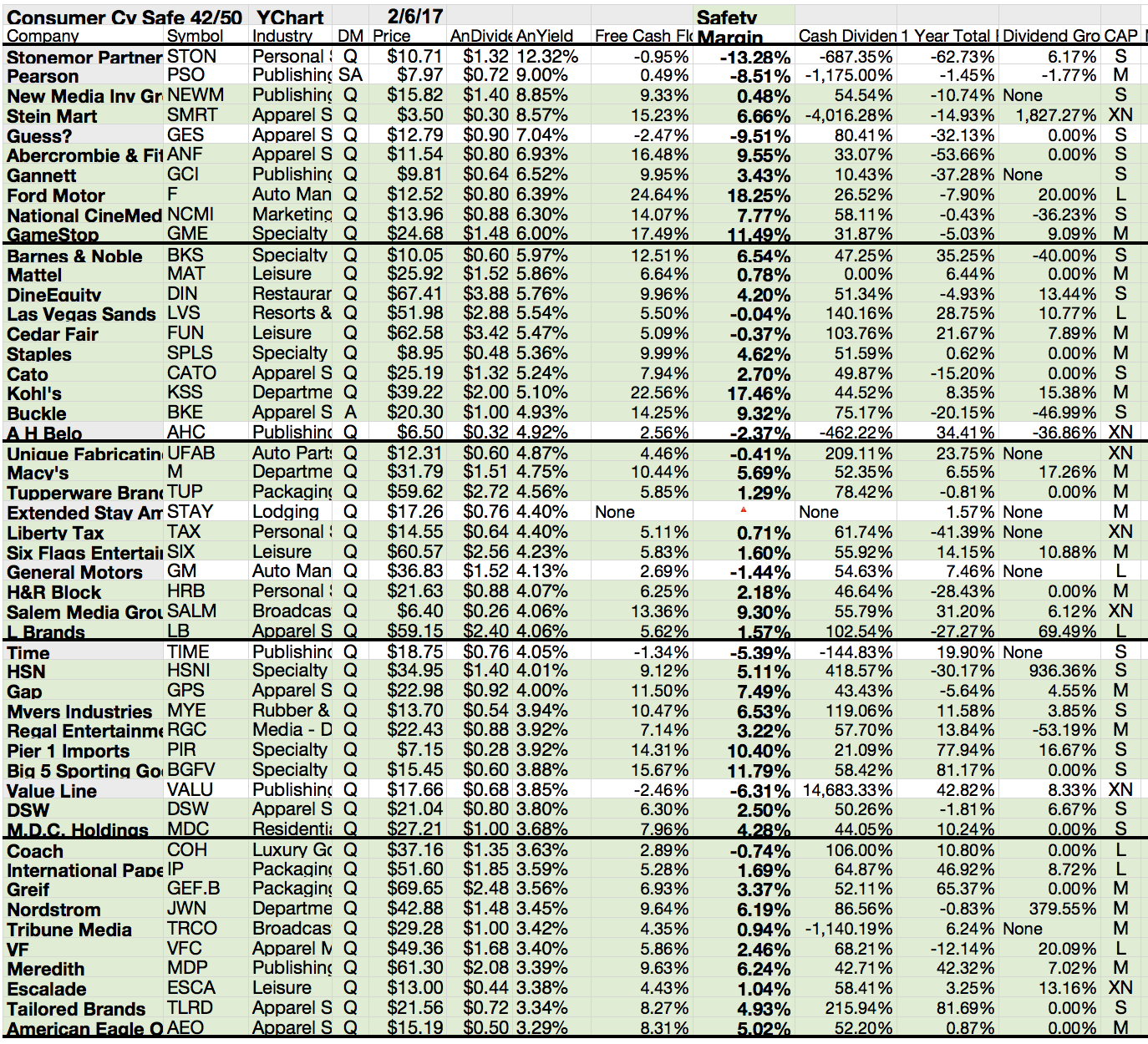

These are the results...

Showing posts with label JWN. Show all posts

Showing posts with label JWN. Show all posts

7 Good Dividend Stock Opportunities In The Retail Sector

There’s really nothing better than finding solid dividend stocks on the cheap.

The stability offered by a stable income stream, coupled with attractive upside stemming from a low stock price, can provide investors with an extremely rare mix of safety and growth. But the problem is that these opportunities are few and far between. Why?

Well, it’s simple: investors love companies that pay consistently rising dividends so much that they’re hardly ever trading at cheap valuations.

Furthermore, it’s nearly impossible to just accidentally come across inexpensive dividend stocks. Unless you’re closely paying attention to the market on a day-to-day basis, you’ll simply never know when a solid dividend stock falls in price enough to enter “buy” territory.

Luckily for readers, monitoring the market for attractive dividend opportunities is all we do here at Income Investors. And you better believe we took notice when the retail sector plunged on Friday, taking down several interesting dividend stocks in the process.

These are the results I'm talking about...

The stability offered by a stable income stream, coupled with attractive upside stemming from a low stock price, can provide investors with an extremely rare mix of safety and growth. But the problem is that these opportunities are few and far between. Why?

Well, it’s simple: investors love companies that pay consistently rising dividends so much that they’re hardly ever trading at cheap valuations.

Furthermore, it’s nearly impossible to just accidentally come across inexpensive dividend stocks. Unless you’re closely paying attention to the market on a day-to-day basis, you’ll simply never know when a solid dividend stock falls in price enough to enter “buy” territory.

Luckily for readers, monitoring the market for attractive dividend opportunities is all we do here at Income Investors. And you better believe we took notice when the retail sector plunged on Friday, taking down several interesting dividend stocks in the process.

These are the results I'm talking about...

34 Best Dividend Stocks With A 100 Year Long History

Blue chip stocks are established large-cap businesses that pay reliable dividends.

They have long corporate histories and provide well-known products and/or services.

This article examines every business in the S&P 500 with a 3% yield and a 100+ year corporate history. These are my criteria:

- Stocks with yields at or above 3%

- Low P/E ratios

- Strong competitive advantage

- Over 100 Years in Business

These are the best ideas that came into my minds...

They have long corporate histories and provide well-known products and/or services.

This article examines every business in the S&P 500 with a 3% yield and a 100+ year corporate history. These are my criteria:

- Stocks with yields at or above 3%

- Low P/E ratios

- Strong competitive advantage

- Over 100 Years in Business

These are the best ideas that came into my minds...

Is Traditional Apparel Retailing A Buying Opportunity?

Given the recent negative performance of many apparel retailers and some calls that traditional apparel retailing is dead, we are addressing our thoughts on these issues and discussing which subsectors and companies we see as positioned best for long-term success.

In our opinion, there has been a secular shift in apparel retailing that is a persistent force.

We believe the current trend toward value over brand is here to stay. Unless a product can perform notably better than the competition (keep you warmer, keep you drier, perform better in athletic situations), consumers appear unwilling to pay a premium simply to own a brand.

We also think that shifts in wallet share are here to stay, with experience (travel, restaurants) valued over apparel, and other costs--including healthcare, education, and housing--rising in share.

Finally, we think the shift in distribution channel toward digital will persist.

As a result, we agree that apparel retail growth is not likely to return to historical levels. Having acknowledged that, we do believe that we are at a low point in the apparel retail cycle and there is future upside.

We do not believe brick-and-mortar apparel retailing is dead; however, it will look much different in the future. We think there is a place for stores where consumers can touch fabrics, try sizes, and see fit.

However, the apparel industry has experienced much self-inflicted near-term malaise. Many management teams have been overly optimistic regarding inventory levels and have not converted to more modern, responsive supply chains.

This has resulted in a highly promotional retail environment that has forced even well-run companies to discount to remain competitive. Also, we think we are nearing the end of the athleisure fashion trend.

With consumers having enough skinny and yoga pants to clothe themselves for a while and no new fashion must-haves, nothing is driving discretionary purchases.

Check out a summary of the big fishes in traditional retailing:

In our opinion, there has been a secular shift in apparel retailing that is a persistent force.

We believe the current trend toward value over brand is here to stay. Unless a product can perform notably better than the competition (keep you warmer, keep you drier, perform better in athletic situations), consumers appear unwilling to pay a premium simply to own a brand.

We also think that shifts in wallet share are here to stay, with experience (travel, restaurants) valued over apparel, and other costs--including healthcare, education, and housing--rising in share.

Finally, we think the shift in distribution channel toward digital will persist.

As a result, we agree that apparel retail growth is not likely to return to historical levels. Having acknowledged that, we do believe that we are at a low point in the apparel retail cycle and there is future upside.

We do not believe brick-and-mortar apparel retailing is dead; however, it will look much different in the future. We think there is a place for stores where consumers can touch fabrics, try sizes, and see fit.

However, the apparel industry has experienced much self-inflicted near-term malaise. Many management teams have been overly optimistic regarding inventory levels and have not converted to more modern, responsive supply chains.

This has resulted in a highly promotional retail environment that has forced even well-run companies to discount to remain competitive. Also, we think we are nearing the end of the athleisure fashion trend.

With consumers having enough skinny and yoga pants to clothe themselves for a while and no new fashion must-haves, nothing is driving discretionary purchases.

Check out a summary of the big fishes in traditional retailing:

19 Top Yielding And Undervalued Stocks With A Predictable Business

Undervalued

stocks with a predictable business originally published at long-term-investments.blogspot.com. Today I would highlight you

some of the top results from the gurufocus undervalued

predictable screener. It’s a nice tool in my view to get fresh new investment

ideas for long-term orientated dividend growth and value seeking investors as well.

The screener plotted 77 results. You can find a list of the top yielding stocks below. Only nineteen stocks have a current yield over 2 percent; thirteen got a buy or better rating.

The screener plotted 77 results. You can find a list of the top yielding stocks below. Only nineteen stocks have a current yield over 2 percent; thirteen got a buy or better rating.

18 Undervalued Stocks With Good Dividends And A Predictable Business

Cheap

and undervalued stocks with good dividend yields and a predictable business originally

published at long-term-investments.blogspot.com.

I’ve received access to the gurufocus database recently. They run on their site several automated screener to find great value stocks.

Today I used the undervalued predictable screener and I will introduce the best yielding results (more than 2 percent dividend yield) here on my site for you. It's definitly a good source if you have no ideas what to buy for the long-run.

Eighteen stocks from the screen yielding over the mentioned level. Two of them got a high-yield and twelve stocks have a buy or better rating.

For more details about the methodic to find cheap predictable stocks, you should read the gurufocus guide about Discount Cash Flow and Discount Earnings to find undervalued stocks. Technology, services and consumer stocks dominate the results.

I’ve received access to the gurufocus database recently. They run on their site several automated screener to find great value stocks.

Today I used the undervalued predictable screener and I will introduce the best yielding results (more than 2 percent dividend yield) here on my site for you. It's definitly a good source if you have no ideas what to buy for the long-run.

Eighteen stocks from the screen yielding over the mentioned level. Two of them got a high-yield and twelve stocks have a buy or better rating.

For more details about the methodic to find cheap predictable stocks, you should read the gurufocus guide about Discount Cash Flow and Discount Earnings to find undervalued stocks. Technology, services and consumer stocks dominate the results.

Ex-Dividend Stocks: Best Dividend Paying Shares On August 29, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 64 stocks go ex dividend

- of which 18 yield more than 3 percent. The average yield amounts to 3.69%.

Here is a full list of all stocks with ex-dividend

date within the upcoming week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Realty

Income Corp.

|

7.83B

|

56.38

|

1.76

|

12.93

|

5.45%

|

|

Lockheed

Martin Corporation

|

39.50B

|

13.79

|

57.01

|

0.85

|

3.74%

|

|

McDonald's

Corp.

|

94.97B

|

17.37

|

6.26

|

3.42

|

3.25%

|

|

NV

Energy, Inc.

|

5.59B

|

17.32

|

1.57

|

1.90

|

3.20%

|

|

Kellogg

Company

|

22.43B

|

23.26

|

8.77

|

1.51

|

2.99%

|

|

Agnico-Eagle

Mines Ltd.

|

5.38B

|

28.34

|

1.57

|

3.09

|

2.82%

|

|

The

Wendy's Company

|

2.98B

|

253.00

|

1.52

|

1.18

|

2.64%

|

|

Northrop

Grumman Corporation

|

21.75B

|

11.54

|

2.27

|

0.86

|

2.63%

|

|

BlackRock,

Inc.

|

44.19B

|

16.82

|

1.73

|

4.51

|

2.59%

|

|

M&T

Bank Corporation

|

14.67B

|

12.91

|

1.49

|

4.94

|

2.45%

|

|

GameStop

Corp.

|

5.82B

|

-

|

2.70

|

0.68

|

2.23%

|

|

Abercrombie

& Fitch Co.

|

2.78B

|

13.13

|

1.65

|

0.63

|

2.22%

|

|

Hillshire

Brands Company

|

3.98B

|

21.74

|

8.24

|

1.02

|

2.16%

|

|

Nordstrom

Inc.

|

11.07B

|

15.02

|

5.45

|

0.89

|

2.12%

|

|

Hartford Financial Services

|

13.39B

|

-

|

0.70

|

0.47

|

2.02%

|

|

Associated

Banc-Corp

|

2.69B

|

15.09

|

0.96

|

3.79

|

1.98%

|

|

The Interpublic Group of Comp.

|

6.66B

|

20.08

|

3.14

|

0.95

|

1.92%

|

|

ITC

Holdings Corp.

|

4.62B

|

23.83

|

3.07

|

5.23

|

1.91%

|

|

Martin

Marietta Materials Inc.

|

4.44B

|

45.36

|

3.16

|

2.17

|

1.66%

|

|

Dun

& Bradstreet Corp.

|

3.97B

|

15.07

|

-

|

2.42

|

1.59%

|

Find more stocks with ex-dividend date on August 29, 2013 here.

Next Week's 20 Best Yielding Ex-Dividend Stocks

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks Between May 27 - June 02,2013. In total, 148 stocks and

preferred shares go ex dividend - of which 63 yield more than 3 percent. The

average yield amounts to 3.71%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Lorillard,

Inc.

|

16.58B

|

14.11

|

-

|

2.48

|

5.01%

|

|

|

Lockheed

Martin Corporation

|

34.30B

|

12.35

|

113.89

|

0.73

|

4.30%

|

|

|

Barrick

Gold Corporation

|

19.18B

|

-

|

0.85

|

1.34

|

4.18%

|

|

|

CNOOC

Ltd.

|

79.93B

|

7.73

|

1.58

|

1.98

|

4.14%

|

|

|

China

Mobile Limited

|

213.95B

|

10.29

|

1.82

|

2.34

|

3.87%

|

|

|

Northeast

Utilities

|

13.48B

|

24.76

|

1.44

|

1.88

|

3.43%

|

|

|

Perusahaan

Perseroan

|

25.07B

|

18.09

|

4.16

|

3.17

|

3.06%

|

|

|

Time

Warner Cable Inc.

|

27.65B

|

3.80

|

4.01

|

1.02

|

2.74%

|

|

|

Kellogg

Company

|

23.70B

|

25.47

|

8.38

|

1.62

|

2.73%

|

|

|

Corning

Inc.

|

23.10B

|

13.27

|

1.08

|

2.92

|

2.55%

|

|

|

Suncor

Energy Inc.

|

46.66B

|

17.89

|

1.15

|

1.24

|

2.55%

|

|

|

Principal

Financial Group Inc.

|

10.92B

|

14.83

|

1.12

|

1.19

|

2.47%

|

|

|

CSX

Corp.

|

26.06B

|

14.09

|

2.80

|

2.22

|

2.35%

|

|

|

Infosys

Ltd.

|

23.88B

|

13.84

|

3.26

|

3.23

|

2.30%

|

|

|

Nordstrom

Inc.

|

11.72B

|

16.77

|

6.17

|

0.96

|

2.00%

|

|

|

China

Telecom Corp. Ltd.

|

40.39B

|

16.64

|

0.94

|

0.88

|

1.98%

|

|

|

Magna

International, Inc.

|

15.18B

|

10.51

|

1.59

|

0.48

|

1.96%

|

|

|

Time

Warner Inc.

|

55.26B

|

18.30

|

1.84

|

1.93

|

1.94%

|

|

|

TE

Connectivity Ltd.

|

18.81B

|

15.94

|

2.44

|

1.42

|

1.86%

|

|

|

Dover

Corp.

|

13.55B

|

16.74

|

2.91

|

1.65

|

1.77%

|

Subscribe to:

Posts (Atom)