Showing posts with label BG. Show all posts

Showing posts with label BG. Show all posts

9 Potential Dividend Aristocrats You Need To Know

Long term dividend growth investing is a popular investing strategy. Investors are looking for stocks with a long dividend history and keep an eye on those companies with raising dividends.

There’s an elite sub-group of S&P 1500 stocks known as “Dividend Aristocrats” which have a distinguishing factor that income growth investors find very attractive: a history of consistently increasing dividends every year for at least 20 consecutive years.

And interestingly enough, for the last 10 years, this elite group has out-performed both the S&P 1500 and the benchmark S&P 500.

The lag of current Dividend Aristocrats is that they have shown a good past performance but this does not mean that they will perform in the future well.

In addition Dividend Aristocrats are very expensive due to the high quality they offer. That's in my view a good reason for looking into the second level.

Attached you will find 10 companies identified as “future dividend aristocrats contenders,” these being members of the S&P 1500 and not that many years away from showing the required two decades of dividend growth.

These are the results...

There’s an elite sub-group of S&P 1500 stocks known as “Dividend Aristocrats” which have a distinguishing factor that income growth investors find very attractive: a history of consistently increasing dividends every year for at least 20 consecutive years.

And interestingly enough, for the last 10 years, this elite group has out-performed both the S&P 1500 and the benchmark S&P 500.

The lag of current Dividend Aristocrats is that they have shown a good past performance but this does not mean that they will perform in the future well.

In addition Dividend Aristocrats are very expensive due to the high quality they offer. That's in my view a good reason for looking into the second level.

Attached you will find 10 companies identified as “future dividend aristocrats contenders,” these being members of the S&P 1500 and not that many years away from showing the required two decades of dividend growth.

These are the results...

Dividend Growth Stocks Of The Week 21/2016

Dividend growth investing is a popular model followed by the investing community to build assets.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns.

Following companies announced dividend increases this week. These are the dividend grower from the past week... If you like them to receive in the future, just subscribe to my free newsletter.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns.

Following companies announced dividend increases this week. These are the dividend grower from the past week... If you like them to receive in the future, just subscribe to my free newsletter.

Here are the latest dividend growth stocks compiled...

15 Fairly Priced Growth Orientated Dividend Achievers

Investing in dividend stocks isn't the only way to make money in the stock market, but it's a pretty effective one.

Buying dividend stocks and holding them for long periods of time can be a great way to generate income from your portfolio or help build a position over years through dividend reinvestment.

For this to be effective, though, investors need to find stocks of quality companies that are going to crank out dividends at a decent rate quarter after quarter.

A solid ground to start your research is the dividend Achievers list. Those stocks managed to raise dividends each year for more than 10 years in a row.

In total, there are 333 stocks with such an impressive dividend growth history.

Today I want to select only those that might look really interesting in terms of price to growth.

I selected those stocks with double-digit expected earnings per share growth while the forward P/E is still less than 15 and an acceptable debt burden weights on the balance sheet.

Only 15 stocks fulfilled these criteria. You find the full list at the end of this article.

Here are the top yielding stocks in detail...

Buying dividend stocks and holding them for long periods of time can be a great way to generate income from your portfolio or help build a position over years through dividend reinvestment.

For this to be effective, though, investors need to find stocks of quality companies that are going to crank out dividends at a decent rate quarter after quarter.

A solid ground to start your research is the dividend Achievers list. Those stocks managed to raise dividends each year for more than 10 years in a row.

In total, there are 333 stocks with such an impressive dividend growth history.

Today I want to select only those that might look really interesting in terms of price to growth.

I selected those stocks with double-digit expected earnings per share growth while the forward P/E is still less than 15 and an acceptable debt burden weights on the balance sheet.

Only 15 stocks fulfilled these criteria. You find the full list at the end of this article.

Here are the top yielding stocks in detail...

10 Dividend Growth Proven Stocks With Really Cheap PEG Ratios

While the market was in nearly nonstop rally mode for most of the past six years, investors didn't need to look far to uncover an abundance of growth stocks. But not all growth stocks are created equal.

While some look poised to deliver extraordinary gains going forward, the recent market turbulence has crushed some that were overvalued, burdening their shareholders with hefty losses.

What exactly is a growth stock? I'll define it as any company forecast to grow profits by an average of 10% or more annually during the next five years -- although that's an arbitrary number.

To gauge what's "cheap," I'll use the PEG ratio, which compares a company's price-to-earnings ratio to its forecast future growth rate. A PEG of around one or less could signal a cheap stock.

Attached I've compiled the results of my screen about the cheapest dividend growth stocks in terms of price to growth.

Here are the results...

While some look poised to deliver extraordinary gains going forward, the recent market turbulence has crushed some that were overvalued, burdening their shareholders with hefty losses.

What exactly is a growth stock? I'll define it as any company forecast to grow profits by an average of 10% or more annually during the next five years -- although that's an arbitrary number.

To gauge what's "cheap," I'll use the PEG ratio, which compares a company's price-to-earnings ratio to its forecast future growth rate. A PEG of around one or less could signal a cheap stock.

Attached I've compiled the results of my screen about the cheapest dividend growth stocks in terms of price to growth.

Here are the results...

18 Cheap Dividend Growth Stocks To Consider Now

Instead of just buying a stock that’s cheap, or one that’s growing earnings fast, we look for stocks that appear decently priced with respect to year-over-year growth.

For example, a company growing 15% annually with a price-to-earnings (P/E) ratio of 15 or less would be considered cheap by growth at reasonable price standards.

Attached you will find a compilation of dividend growth stocks that which I have screened by growth at reasonable price standards.

I only screened stocks with a 10 year plus dividend growth at 10% earnings growth and less than 15 P/E multiple.

In order to avoid debt overloaded stocks, I decided to select only those stocks with a debt to equity under 1.

18 stocks remain. Attached you will find the results compiled in a list with important fundamentals.

Here are the best yielding results in detail...

I only screened stocks with a 10 year plus dividend growth at 10% earnings growth and less than 15 P/E multiple.

In order to avoid debt overloaded stocks, I decided to select only those stocks with a debt to equity under 1.

18 stocks remain. Attached you will find the results compiled in a list with important fundamentals.

Here are the best yielding results in detail...

20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

I'm also focused on higher yielding stocks because I

do believe that those companies offer a better risk compensation and their

business model allows it to generate a higher amount of free cash which could

be distributed to shareholders.

But you need to look more into the balance sheets and

income statements of a company in order to identify such a cash flow strength.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

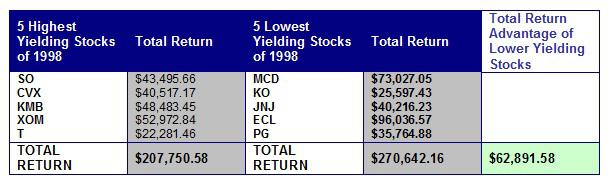

The attached chart spells out the cost to the investor of focusing on yield over a long period of investing history.

Investors who emphasized yield when purchasing stocks from this group of beloved cherry-picked Dividend Growth stocks missed out on earning the equivalent of a year's worth of a nice middle-class salary over the 18 years studied here.

You might see that a portfolio with lower yielding stocks delivered more total return due to a larger stock price appreciation than higher yielding stocks with lower growth possibilities.

Today I would like to introduce a few lower yielding Dividend Achievers with a fantastic future prediction. The attached list ranks midcap plus Dividend Achievers by its future EPS growth forecast. Only stocks with a debt to equity ratio under 1 were observed.

Here are the 20 top results, sorted by growth...

|

| 20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks (click to enlarge) |

21 Dividend Achiever With A Single P/E

Valuation is a key element when you consider putting money into stocks. A high valuated stock should also have high secured growth. If not, you might overpay the stock.

Valuation is a key element when you consider putting money into stocks. A high valuated stock should also have high secured growth. If not, you might overpay the stock.But a cheap valuation could also indicate the corporate is significant shrinking.

Each investor needs to evaluate the risk of the stock.

Today I like to show you the cheapest stocks below the Dividend Achievers. Those stocks have risen dividend year over year for a decade without a break and offer a single forward P/E.

21 Companies have such a low valuation measure. Attached you will find the complete list with a few essential fundamentals.

Here are the top yielding stocks in detail...

40 Cheapest Dividend Growth Stocks By P/E And PEG

Value investors have a strong focus

on stocks with a low valuation compared to its expected earnings. A very

popular tool for investors to identify an undervaluation is the P/E ratio.

Value investors have a strong focus

on stocks with a low valuation compared to its expected earnings. A very

popular tool for investors to identify an undervaluation is the P/E ratio.

The P/E ratio

often looks cheap but they are cheap for a reason. Mostly a dying operating

business is responsible for the low P/E. On the other side, a high P/E could

show that we have to deal with a high-growth company.

This general

problem could be solved with the PEG ratio. By definition, it describes the

value compared to its growth or Price-Earnings-To-Growth Ratio.

Definitions

The P/E ratio is simply: Price / Earnings

Essentially, this tells you how much an investor is willing to pay for each unit (year) of earnings. If a stock is trading at a P/E ratio of 30, it is said to be trading at 30x times its annual earnings.

In general, the lower the P/E ratio the better. A common threshold for many investors is a P/E of 20 or less. (For the record, at the time of this writing, the S&P 500 Index was trading at a P/E (using F1 Estimates) of 15.33.)

A PEG ratio is the: P/E Ratio divided by the Growth Rate

Conventional wisdom says a value of 1 or less is considered good (at par or undervalued to its growth rate), while a value of greater than 1, in general, is not as good (overvalued to its growth rate).

Many believe the PEG ratio tells a more complete story than just the P/E ratio. (The S&P at the time of this writing had a PEG ratio of 1.93.)

Comparison

Let's take a look at both of these in action.

For example: a company with a P/E Ratio of 25 and a Growth Rate of 20% would have a PEG ratio of 1.25 (25 / 20= 1.25).

While a company with a P/E Ratio of 40 and a Growth Rate of 50% would have a PEG Ratio of 0.80 (40 / 50= 0.80).

Traditionally, investors would look at the stock with the lower P/E ratio and deem it a bargain (undervalued). But looking at it closer, you can see it doesn't have the growth rate to justify its P/E.

The stock with the P/E of 40, however, is actually the better bargain since its PEG ratio is lower (0.80) and is trading at a discount to its growth rate.

In other words, the lower the PEG ratio, the better the value. That's because the investor would be paying less for each unit of earnings growth.

So which one is better?

They both have their usefulness. I do like how the PEG positions the P/E ratio in relation to its growth rate to put everything into perspective.

Quite frankly, I use both, so I'm going to say it's a tie. Plus, you couldn't even create the PEG ratio without the P/E.

Attached you can find the 20 cheapest dividend growers by PEG and P/E. The results include only stocks with a constant dividend growth history of at least 10 years. They are classical Dividend Achievers.

Here are the results:

10 Cheaply Valuated Stocks Boosting Earnings For The Next Years

Companies delivering superior growth in sales and earnings tend to be winning names over the long term. However, these companies rarely sell for low valuations, so you generally need to pay premium prices for top-growth stocks. With this in mind, it makes sense to look for strong-growth companies going through temporary challenges and trading at convenient valuations.

I've created a screen of dividend paying stocks with a solid growth momentum. Those stocks have shown investors increasing sales over years while analysts predicting a rosy future. Earnings should grow for the mid-term at double-digit rates.

In addition, my focus is on higher capitalized stocks with a lower beta and debt. Twelve stocks fulfilled my criteria of which one has a yield of more than 3 percent and ten are recommended to buy.

These are the highest yielding results:

I've created a screen of dividend paying stocks with a solid growth momentum. Those stocks have shown investors increasing sales over years while analysts predicting a rosy future. Earnings should grow for the mid-term at double-digit rates.

In addition, my focus is on higher capitalized stocks with a lower beta and debt. Twelve stocks fulfilled my criteria of which one has a yield of more than 3 percent and ten are recommended to buy.

These are the highest yielding results:

Why You Should Look At These 16 Stocks With Cheap Free Cash Flows

When you put money into the market,

you should be aware of the market valuation. One of the major problems in valuation

is definitely to predict future cash-flows.

Nobody of us has a

crystal-ball and no one can predict the future.

The second problem

is that there are companies that must invest massively into the business model

in order to boost growth or to replace old machines or buildings.

Investors often

calculate with free cash flows. Those are the real income of the company, available

for dividends, buybacks or mergers and acquisitions.

Today I like to

introduce the cheapest Dividend Achievers with a low price to free cash flow of

less than 15.

16 companies

fulfilled my criteria of which four have a dividend yield over 3 percent. The

most of the results come from the property and casualty insurance industry.

Insurer generates massive cash but

they have also big problems with decreasing premiums and increasing

competition. There are always good reasons why some companies are cheap.

You may also like my article about the best dividend stocks from the title insurance industry. I still prefer, like Warren Buffett, the fastest growing companies from the insurance sector. Those are ACE, UNH and TRV.

You may also like my article about the best dividend stocks from the title insurance industry. I still prefer, like Warren Buffett, the fastest growing companies from the insurance sector. Those are ACE, UNH and TRV.

What do you think

about the screen?

Cheapest Dividend Paying Large Caps As of October 2013

Cheap large

capitalized stocks with high growth originally published at “long-term-investments.blogspot.com. I always look for stocks with a cheap valuation and modest growth perspectives.

While the interest

environment is low, the market valuation is extraordinary high and it’s more important

to take care about a solid price in order to ensure not to overpay a stocks.

Each month I create

a quick list that allows me to observe the market by the cheapest growth picks.

You can find my criteria below.

These are the criteria for my cheapest dividend

paying large cap screen:

- Market Capitalization

over USD 10 billion

- Expected Earnings

per share growth over 10 percent for the next five years

- Forward P/E

ratio under 15

- P/S under 1 and

P/B ratio under 2

- Positive

Dividends

Only fourteen stocks fulfilled these criteria of which twelve have a current buy or better rating

by brokerage firms.

17 Cheap Large Cap Dividend Contenders Close To New 52-Week Highs

Cheaply

valuated dividend growth stocks close to new 52-Week-Highs originally published

at long-term-investments.blogspot.com. I published recently a

small article about Large Cap stocks close to

new one-year highs with a single P/E.

The idea behind is that there could be more room for a higher stock price due to the low valuation and the break-out signal. I know that this kind of method is more technically but it should give you some new ideas from a different perspective of the capital market.

Today I would like to screen my dividend income growth stock database by shares with 10 to 25 years of consecutive dividend growth that are 5 percent or less away from new one-year highs. In addition, the earnings income multiple for the next year should be under 15 and the market capitalization over USD 10 billion.

Only 17 stocks fulfilled these criteria of which ten are currently recommended to buy.

The idea behind is that there could be more room for a higher stock price due to the low valuation and the break-out signal. I know that this kind of method is more technically but it should give you some new ideas from a different perspective of the capital market.

Today I would like to screen my dividend income growth stock database by shares with 10 to 25 years of consecutive dividend growth that are 5 percent or less away from new one-year highs. In addition, the earnings income multiple for the next year should be under 15 and the market capitalization over USD 10 billion.

Only 17 stocks fulfilled these criteria of which ten are currently recommended to buy.

Labels:

52-Week High,

ACE,

BG,

CAH,

Cheap Stock,

CNQ,

COP,

CVS,

DCM,

Dividend Contenders,

Dividend Growth,

GD,

LMT,

MSFT,

MUR,

NSC,

NTT,

QCOM,

SJR,

TEVA

Cheapest Dividend Paying Large Caps As of September 2013

Cheap large

capitalized stocks with high growth originally published at “long-term-investments.blogspot.com. Cheap stocks, bargains or undervalued companies can promise you good

returns if you believe that they receive a better valuation within the next

months or years. It’s very difficult to discover those stocks because of the

hundreds of thousands technical and fundamental measures.

I often used my

static ratios like earnings multiples or book ratios to identify cheaply

valuated stocks. Today I like to change my recent criteria about cheapest

dividend paying large caps a little bit. I tighten the restriction

Price-To-Sales to a value of less than one and look at forward P/E’s. In the past,

I’ve looked at current earnings multiples.

These are the criteria for my cheapest dividend paying

large cap screen:

- Market Capitalization

over USD 10 billion

- Expected Earnings

per share growth over 10 percent for the next five years

- Forward P/E

ratio under 15

- P/S under 1 and

P/B ratio under 2

- Positive

Dividends

The number of my

results rose. Eighteen stocks fulfilled these criteria of which one pays a high

yield of more than five percent. Nearly all, fourteen in total, got a buy or

better rating by brokerage firms.

19 International Dividend Achievers With Double-Digit Earnings Growth Forecasts

International

Dividend Achievers stock list with high predicted earnings per share growth for

the mid-term originally published at long-term-investments.blogspot.com. Dividend growth investors

like you or me should always have a focus on stocks from abroad. It diversifies

your portfolio and gives you more opportunities from different countries.

International

Dividend Achievers stock list with high predicted earnings per share growth for

the mid-term originally published at long-term-investments.blogspot.com. Dividend growth investors

like you or me should always have a focus on stocks from abroad. It diversifies

your portfolio and gives you more opportunities from different countries. But you always have a currency risk if you stock is traded in a foreign currency. But you also own these risks with U.S. stocks that have a huge share of foreign sales. The corporate manages these risks for you.

Today I would like to discover my International Dividend Achievers list by stocks with the highest earnings per share growth forecast for the mid-term (5 Years). You can find a list attached about those stocks with double-digit earnings predictions by brokerage firms.

Only 19 of 55 dividend growth stocks from abroad with a dividend growth history of more than 5 consecutive years fulfilled my restrictions. Six of them still have a low forward P/E of less than 15 and eleven got a current buy or better rating. The yields are low in this environment thanks to Ben Bernanke who said that the tapering must wait until the economy improves stronger. The highest yielding stock from the list has a 3.45 percent yield.

17 Cheap Dividend Achievers With Very Low P/S Ratios

Cheaply

priced stocks traded below its own book values originally published at long-term-investments.blogspot.com. I love it to look for

high quality dividend stocks with a proven long-term track record but one thing I often

noticed in my research is that the market gets more and more expensive. But if you would like to make a solid return, you definitely need cheap stocks.

With low yields, the valuation rises in an inflationary environment. That's the key premise in our economy.

Today I would like to try my best to discover some of the best dividend growth stocks with a current cheap valuation. I use two criteria for screening the Dividend Achievers database: A forward P/E below 15 as well as a price to sales ratio below one.

Exactly 17 dividend growth stocks fulfilled the mentioned criteria. Eight of them got a buy or better rating by brokerage firms. The yields are between 0.95 and 2.91 percent. That’s not much in my view but growth forecasts are positive for all of the results.

With low yields, the valuation rises in an inflationary environment. That's the key premise in our economy.

Today I would like to try my best to discover some of the best dividend growth stocks with a current cheap valuation. I use two criteria for screening the Dividend Achievers database: A forward P/E below 15 as well as a price to sales ratio below one.

Exactly 17 dividend growth stocks fulfilled the mentioned criteria. Eight of them got a buy or better rating by brokerage firms. The yields are between 0.95 and 2.91 percent. That’s not much in my view but growth forecasts are positive for all of the results.

17 Cheap Dividend Contenders With Buy Ratings And Double-Digit Growth

Cheap

Dividend Contenders with high growth and buy ratings originally published at long-term-investments.blogspot.com. Dividend growth and passive

income strategies for normal investors is the core content of this blog. I personally

create these articles to share my thoughts about good dividend paying stocks.

The underlying aim is to build a portfolio with high-quality dividend stocks that hike dividends in the future and boost your passive income. If they pay a good dividend and they grow, the share price must follow one day and reflect the corporate success.

Today I would like to present some dividend growth stocks with 10 to 25 years of growing dividends and buy or better ratings. These are my criteria in detail:

Seventeen stocks fulfilled the above mentioned criteria of which one pays a high yield over

five percent. Two companies have a strong buy rating.

The underlying aim is to build a portfolio with high-quality dividend stocks that hike dividends in the future and boost your passive income. If they pay a good dividend and they grow, the share price must follow one day and reflect the corporate success.

Today I would like to present some dividend growth stocks with 10 to 25 years of growing dividends and buy or better ratings. These are my criteria in detail:

- 10 to 25 years of consecutive dividend growth

- Cheap forward P/E of less than 15

- EPS growth for the next five years over 10 percent

yearly

- Buy or better rating by brokerage firms

11 Cheap High Beta Consumer Goods Dividend Stocks

Cheap

high beta dividend stocks from the consumer goods sector originally published

at long-term-investments.blogspot.com. You might know that I really

love stocks from the consumer goods sector. They offer a very good risk profile

for income seeking investors with a desire for future dividend growth. The

problem is that they are also highly valuated. This was one of the reasons why

I needed to purchase more and more stocks from other sectors like industrials

and healthcare stocks.

I’m not worried about this because with every single stock purchase of other industries and sectors, my diversification rises. The second negative item in terms of consumer good stocks is that most of them are low beta stocks. If you like to make money in a strong upside market, you lose performance with low beta stocks.

This is the reason why I discovered some high beta stocks with attractive valuation figures this month in an article serial. If you are interested, here are the links to the articles:

Back

the current screen about high beta consumer dividend stocks. I observed this

time large capitalized consumer dividend stocks with a low forward P/E and a

beta ratio above one.

My screen produced only eleven results with yields between 0.71 percent and 2.58 percent. Nearly all of them (10 stocks) have a current buy or better rating by brokerage firms.

I’m not worried about this because with every single stock purchase of other industries and sectors, my diversification rises. The second negative item in terms of consumer good stocks is that most of them are low beta stocks. If you like to make money in a strong upside market, you lose performance with low beta stocks.

This is the reason why I discovered some high beta stocks with attractive valuation figures this month in an article serial. If you are interested, here are the links to the articles:

My screen produced only eleven results with yields between 0.71 percent and 2.58 percent. Nearly all of them (10 stocks) have a current buy or better rating by brokerage firms.

Subscribe to:

Posts (Atom)