While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks. And you don’t have to wander far to find attractive payers. Just look at Standard & Poor’s 500-stock index.

Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

There are stocks on the S&P 500 that pay nearly 10%, but that doesn't make them great investments.

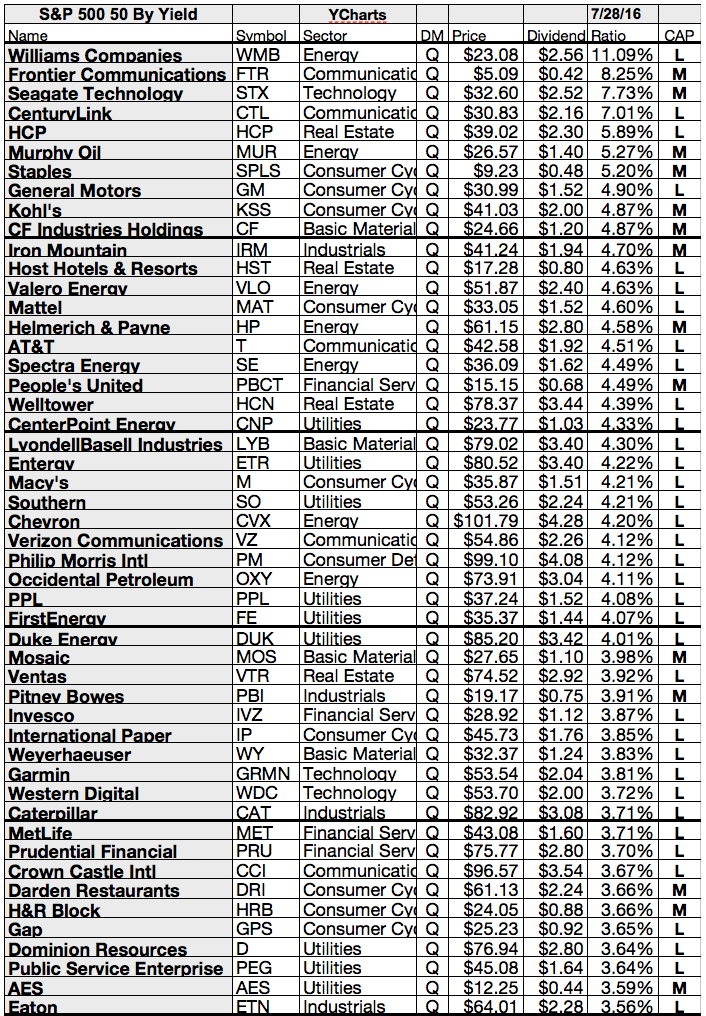

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Here are the highest yielding S&P 500 and the Dogs of the S&P 500...

Showing posts with label HST. Show all posts

Showing posts with label HST. Show all posts

10 Highest Dividend Stocks on the S&P 500

The average stock on the S&P 500 index pays a dividend yield of 2.41%, but some are paying much more. Here's a chart of the 10 highest-paying dividend stocks on the S&P 500, and which ones might be the best choices to buy and hold for the long term.

Before moving on, it's important to mention that a high dividend doesn't necessarily translate into a good stock to invest in.

For example, Frontier Communications (NASDAQ: FTR), the highest-paying company in the S&P 500, has struggled to turn a profit for several years now. In my opinion, it's at serious risk of a dividend cut in the near future.

With that in mind, there are a few stocks on this list worth buying. Here are my three favorites in no particular order.

These are the results...

Before moving on, it's important to mention that a high dividend doesn't necessarily translate into a good stock to invest in.

For example, Frontier Communications (NASDAQ: FTR), the highest-paying company in the S&P 500, has struggled to turn a profit for several years now. In my opinion, it's at serious risk of a dividend cut in the near future.

With that in mind, there are a few stocks on this list worth buying. Here are my three favorites in no particular order.

These are the results...

These 3 Stocks Quadrupled Dividends And Should Grow Them Further

Companies that can afford to keep paying their shareholders are great, but dividend stocks that have the potential to pay their shareholders more over time are even better.

We have found three such stocks which have proven themselves with regards to growing dividend payouts significantly over the last five years.

They also appear well-positioned to see continued dividend growth over the long run.

Here are the stocks...

We have found three such stocks which have proven themselves with regards to growing dividend payouts significantly over the last five years.

They also appear well-positioned to see continued dividend growth over the long run.

Here are the stocks...

12 Best REITs With Solid Fundamentals To Finance Profitable Growth

Owning such things as office buildings and self-storage facilities, real estate investment trusts rake in rents and must pay at least 90 percent of their taxable income to shareholders.

As long as they can keep raising rents and dividend payments, the stocks should fare well.

Indeed, REITs’ underlying properties should post a 4.5 percent average gain in operating income this year, fueling dividend growth in the “high single-digit” range, says investment firm Lazard, and yields in the range of 2 percent to 6 percent.

Attached you will find a selection of Reits with Return on Assests over 5 percent and solid debt ratios.

This is in my view the best way to discover stocks with potential for profitable growth in the future.

Here are the results...

As long as they can keep raising rents and dividend payments, the stocks should fare well.

Indeed, REITs’ underlying properties should post a 4.5 percent average gain in operating income this year, fueling dividend growth in the “high single-digit” range, says investment firm Lazard, and yields in the range of 2 percent to 6 percent.

Attached you will find a selection of Reits with Return on Assests over 5 percent and solid debt ratios.

This is in my view the best way to discover stocks with potential for profitable growth in the future.

Here are the results...

20 Stocks With A Free Cashflow Inital Yield Over 5%

A profitable company is solid and a good investment if it growth and

scales its profits. That's a fact.

But often we see earnings that are no earnings. The cash flow is often higher or lower and the need for capital expenditures makes it more complicated to evaluate the true earnings for return orientated investors.

But often we see earnings that are no earnings. The cash flow is often higher or lower and the need for capital expenditures makes it more complicated to evaluate the true earnings for return orientated investors.

A High free cash flow can be used for so many interesting things like

organic growth, merger and acquisitions or even buybacks and special dividends.

Attached I've compiled a few stocks that offer a free cash flow yield

over 5 percent. That’s a good initial yield in my view.

Here are my favorite results...

20 Value Income Stocks With Dividend Yields Over 10 Year Treasury Yield

I found a great list of stocks that combine value investing criteria with growth. The list contains a number of attractive looking stocks with current yields above the bond yield.

It's a classical leveraged view. If you borrow money and put it into investments with a yield over your capital cost, you will make money. Dividends are not stable.

You need a huge spread yield. However, take a look at the attached list. I believe there are a few good names on it.

Here is the table....

It's a classical leveraged view. If you borrow money and put it into investments with a yield over your capital cost, you will make money. Dividends are not stable.

You need a huge spread yield. However, take a look at the attached list. I believe there are a few good names on it.

Here is the table....

Stocks With The Highest Annual Dividend Growth Of The Past 3, 5 and 10 Years

Recently, I showed you how your investment portfolio grows over 30 years if you own sustainable long-term dividend growth stocks.

Recently, I showed you how your investment portfolio grows over 30 years if you own sustainable long-term dividend growth stocks. The key notice from the article was that if you buy high yielding stocks with fast dividend growth, you could maximize your portfolio return.

It sounds quite easy but it’s hard to find those stocks because no one of us can look into the future or has crystal ball.

Today I like to show you those stocks with the highest short, mid and long-term dividend growth of the past 3, 5 and 10 years.

Over the next upcoming days, I will also deliver a few stocks with the highest 10year dividend growth rate of the most consistent dividend raiser in the market.

Here the best dividend growers of the past decade....

5 High Yield Dividend Stocks With High Beta Ratios

While investing in

stocks with high dividends may be a good scheme to reinforce your loss-aversion

principle, playing the market to dodge volatility requires some extra cautious

steps. Beta measures the extent to which a fund’s return may be affected or how

much the price fluctuates owing to market conditions.

While investing in

stocks with high dividends may be a good scheme to reinforce your loss-aversion

principle, playing the market to dodge volatility requires some extra cautious

steps. Beta measures the extent to which a fund’s return may be affected or how

much the price fluctuates owing to market conditions.

A high beta shows

normally how the performance of a single stock differs from the overall market.

The higher the ratio, the bigger the out- or underperformance develops.

It's great if you

like to be different, a star or a looser on the market.

Today I like to

show you those higher capitalized dividend stocks with beta ratios over 1.5 and

dividend yields over 5%. In order to keep the over levered stocks off the list,

I only observed stocks with a debt to equity ratio under 1.

14 stocks

fulfilled my criteria of which eight have a low forward P/E.

Here are the results...

Here are the results...

40 Highest Yielding Ex-Dividend Stocks Of The Coming Week

Here I share all higher capitalized stocks going ex-dividend next week. A huge number of stocks plan to go ex-dividend, in total 271 dividend stocks. 132 of them are capitalized over 2 billion. Attached you can find those stocks with the highest payment

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

These Top Dividend Growth Stocks Should Boost Dividends By 15% Next Year

If you want to know what professional investment analysts predict about the best dividend growth stocks, you need to read the latest study from Goldman Sachs. The investment bank created a dividend growth basket of 50 best stocks with potential.

Goldman's Dividend Growth basket consists of 50 stocks with a median expected 2016 dividend yield of 3%. Goldman expects these companies to raise their dividends by an average of 12% in 2016. In comparison, the median S&P 500 stock has an expected dividend yield of 2.2% and an expected median dividend growth of 7% next year.

The basket has a large-cap bias because larger firms are more likely to pay dividends. Investors should use this basket to identify stocks returning cash to shareholders through strong dividend growth and high dividend yields.

Attached are 9 stocks with potential to grow dividends in 2016 by more than 15%. Those stocks have better fundamentals than 40 others in the basket.

Goldman's Dividend Growth basket consists of 50 stocks with a median expected 2016 dividend yield of 3%. Goldman expects these companies to raise their dividends by an average of 12% in 2016. In comparison, the median S&P 500 stock has an expected dividend yield of 2.2% and an expected median dividend growth of 7% next year.

The basket has a large-cap bias because larger firms are more likely to pay dividends. Investors should use this basket to identify stocks returning cash to shareholders through strong dividend growth and high dividend yields.

Attached are 9 stocks with potential to grow dividends in 2016 by more than 15%. Those stocks have better fundamentals than 40 others in the basket.

These are the results...

Top 10 S&P 500 Companies By Dividend Growth

Dividend growth is better than dividend yield because over the long-term, each investor could receive a higher return due to the growing business of a corporate.

Today I like to show you those stocks from the popular S&P 500 that have the fastest twelve trailing months dividend growth.

The screen excludes companies with current dividend yield of less than 2%. The growth rate methodology is based on trailing twelve-month DPS compared to the value one year ago.

You may also like my older articles about dividend growth stocks with solid yields and growth persectives.

These are the results, sorted by dividend growth....

Today I like to show you those stocks from the popular S&P 500 that have the fastest twelve trailing months dividend growth.

The screen excludes companies with current dividend yield of less than 2%. The growth rate methodology is based on trailing twelve-month DPS compared to the value one year ago.

You may also like my older articles about dividend growth stocks with solid yields and growth persectives.

These are the results, sorted by dividend growth....

Dividend Growth Alert: 38 Stocks With Higher Dividends

Within the recent week, 38 companies have raised their dividend distributions - A good number in my view. On the list are again higher capitalized stocks with a solid track record. I talk about General Electric or 3M.

You can find, like each week, a detailed overview about the biggest stocks below. In addition, there is a full list of all stocks and funds attached.

My favorite Lage Cap dividend grower with recent dividend hikes are...

You can find, like each week, a detailed overview about the biggest stocks below. In addition, there is a full list of all stocks and funds attached.

My favorite Lage Cap dividend grower with recent dividend hikes are...

Ex-Dividend Stocks: Best Dividend Paying Shares On September 26, 2013

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 155 stocks go ex dividend

- of which 86 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

PG&E

Corp.

|

18.65B

|

20.09

|

1.34

|

1.22

|

4.31%

|

|

|

TransCanada

Corp.

|

31.26B

|

21.68

|

2.05

|

3.80

|

4.03%

|

|

|

Avalonbay

Communities Inc.

|

16.74B

|

82.01

|

1.96

|

13.50

|

3.30%

|

|

|

The

Dow Chemical Company

|

46.39B

|

18.89

|

2.41

|

0.82

|

3.27%

|

|

|

Edison

International

|

15.32B

|

11.55

|

1.64

|

1.23

|

2.87%

|

|

|

Fifth

Third Bancorp

|

15.48B

|

9.39

|

1.17

|

3.85

|

2.66%

|

|

|

U.S.

Bancorp

|

68.01B

|

12.55

|

1.95

|

5.41

|

2.49%

|

|

|

Host

Hotels & Resorts Inc.

|

13.25B

|

94.32

|

1.85

|

2.34

|

2.46%

|

|

|

Boston

Properties Inc.

|

16.29B

|

27.14

|

3.00

|

8.31

|

2.43%

|

|

|

Deere

& Company

|

32.52B

|

9.67

|

3.79

|

0.85

|

2.42%

|

|

|

Agrium

Inc.

|

12.86B

|

9.47

|

1.76

|

0.78

|

2.32%

|

|

|

Xerox

Corp.

|

12.69B

|

11.09

|

1.08

|

0.58

|

2.23%

|

|

|

Illinois

Tool Works Inc.

|

35.07B

|

14.83

|

3.43

|

2.07

|

2.15%

|

|

|

St.

Jude Medical Inc.

|

15.18B

|

25.22

|

3.95

|

2.79

|

1.87%

|

|

|

Mondelez

International, Inc.

|

57.31B

|

29.96

|

1.82

|

1.63

|

1.75%

|

|

|

Western

Digital Corp.

|

15.39B

|

16.58

|

1.95

|

1.00

|

1.55%

|

|

|

Stryker

Corp.

|

26.77B

|

23.77

|

3.11

|

3.05

|

1.50%

|

|

|

Humana

Inc.

|

15.17B

|

10.21

|

1.62

|

0.38

|

1.13%

|

|

|

Agilent

Technologies Inc.

|

17.49B

|

19.25

|

3.65

|

2.56

|

0.93%

|

|

|

Morgan

Stanley

|

52.02B

|

38.96

|

0.84

|

1.52

|

0.73%

|

24 Stocks With Fresh Dividend Hikes

Stocks with dividend hikes from last week originally

published at long-term-investments.blogspot.com.

24 companies increased its dividends within the recent week. Compared to 15

stocks from the previous week, it’s a small improvement but not the big numbers

of 50 or more. The average dividend growth amounts to 32.07 percent.

Several recent dividend growth stocks have a market capitalization

over $10 billion. Those are big names like McDonald’s, or Microsoft. The technology

and software giant also announced to buy back $40 billion in own shares. That’s

around 14 percent of the current market value.

I’ve attached a list for you of all dividend growers from the past week. You can also find there a list of the current valuations of the stocks. Half

of the results still have a low forward P/E below 15 and eleven received a buy or

better rating by brokerage firms.

20 Stocks And Funds With Dividend Growth

Stocks with dividend hikes from last week originally

published at “long-term-investments.blogspot.com”.

I enjoy it really to see how dividends grow. One company with monthly payments that

hiked its dividends with an impressive speed is the retail real estate trust Realty

Income. Last week they announced only a small hike of 0.2 percent but this bigger

dividend will be paid every month.

I personally don’t like REITs and financials because of

the high debt. They also invested huge amounts into assets of which I have no idea

how they could perform. I stay by my core research competence and let them do their

work.

Last week, 19 companies and one fund announced a dividend hike. Only half of them have a current buy or better rating. The average dividend growth of the top dividend growers from last week amounts to 53.73 percent.

Ex-Dividend Stocks: Best Dividend Paying Shares On March 26, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 26,

2013. In total, 128 stocks and

preferred shares go ex dividend - of which 65 yield more than 3 percent. The

average yield amounts to 4.72%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Canadian Imperial Bank of Commerce

|

32.03B

|

10.40

|

1.93

|

2.76

|

4.61%

|

|

|

PG&E

Corp.

|

19.22B

|

22.81

|

1.44

|

1.28

|

4.16%

|

|

|

Kraft

Foods Group, Inc.

|

30.37B

|

18.61

|

8.50

|

1.66

|

3.91%

|

|

|

The

Dow Chemical Company

|

39.48B

|

46.83

|

1.89

|

0.70

|

3.90%

|

|

|

Philip

Morris International, Inc.

|

150.97B

|

17.72

|

-

|

1.95

|

3.71%

|

|

|

TransCanada

Corp.

|

34.23B

|

26.93

|

2.06

|

4.37

|

3.69%

|

|

|

Avalonbay

Communities Inc.

|

14.51B

|

45.62

|

2.12

|

13.97

|

3.37%

|

|

|

Nucor

Corporation

|

14.66B

|

29.21

|

1.92

|

0.75

|

3.19%

|

|

|

Sempra

Energy

|

19.44B

|

22.88

|

1.88

|

2.01

|

3.16%

|

|

|

Edison

International

|

16.42B

|

11.05

|

1.47

|

1.38

|

2.68%

|

|

|

Xerox

Corp.

|

10.53B

|

9.66

|

0.89

|

0.47

|

2.67%

|

|

|

Boston

Properties Inc.

|

15.31B

|

59.40

|

3.00

|

8.16

|

2.57%

|

|

|

Illinois

Tool Works Inc.

|

28.11B

|

11.75

|

2.68

|

1.57

|

2.44%

|

|

|

St.

Jude Medical Inc.

|

11.98B

|

17.80

|

3.19

|

2.18

|

2.36%

|

|

|

Host

Hotels & Resorts Inc.

|

12.26B

|

850.00

|

1.81

|

2.32

|

2.35%

|

|

|

Deere

& Company

|

34.17B

|

10.99

|

4.57

|

0.93

|

2.33%

|

|

|

U.S.

Bancorp

|

62.57B

|

11.82

|

1.61

|

4.86

|

2.32%

|

|

|

ACE

Limited

|

29.97B

|

11.18

|

1.09

|

1.67

|

2.22%

|

|

|

Western

Digital Corp.

|

11.54B

|

5.81

|

1.40

|

0.74

|

2.09%

|

|

|

Agrium

Inc.

|

15.02B

|

10.52

|

2.17

|

0.90

|

1.99%

|

Subscribe to:

Posts (Atom)