Dividend-paying stocks that have gotten left behind in the rally now feature higher dividend yields, which may be attractive to investors.

But buyer beware: Many yields are high because some investors fear the stocks. But if you do extra research on specific companies and reach a certain comfort level, you may be looking at some bargains.

Long-time income investors are constantly facing the problem of how to replace income lost when older and higher-yielding bonds and callable preferred stocks are redeemed. And more than eight years into the bull market, while interest rates are still historically low, the problem keeps getting worse.

We have featured the S&P High-Yield Dividend Aristocrats, which are companies included in the S&P 1500 Composite Index that have raised dividends for at least 20 consecutive years.

But many have yields that aren’t attractive.

We also put together a list of dividend stocks culled with rather stringent criteria for free cash flow and sales growth. This time around, we are taking a far less stringent approach.

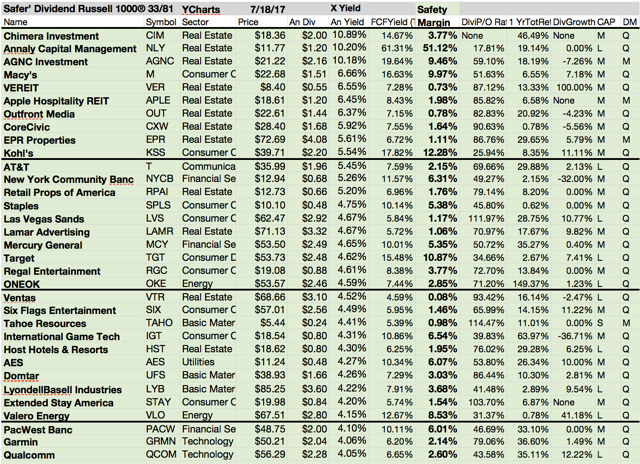

A total of 33 companies among the S&P 1500 met these criteria:

• Dividend yields of at least 5%.

• No cuts of regular dividends over the past five years

• A free cash flow yield, for the past 12 months, exceeding the current dividend yield.

These are the results...

Showing posts with label CXW. Show all posts

Showing posts with label CXW. Show all posts

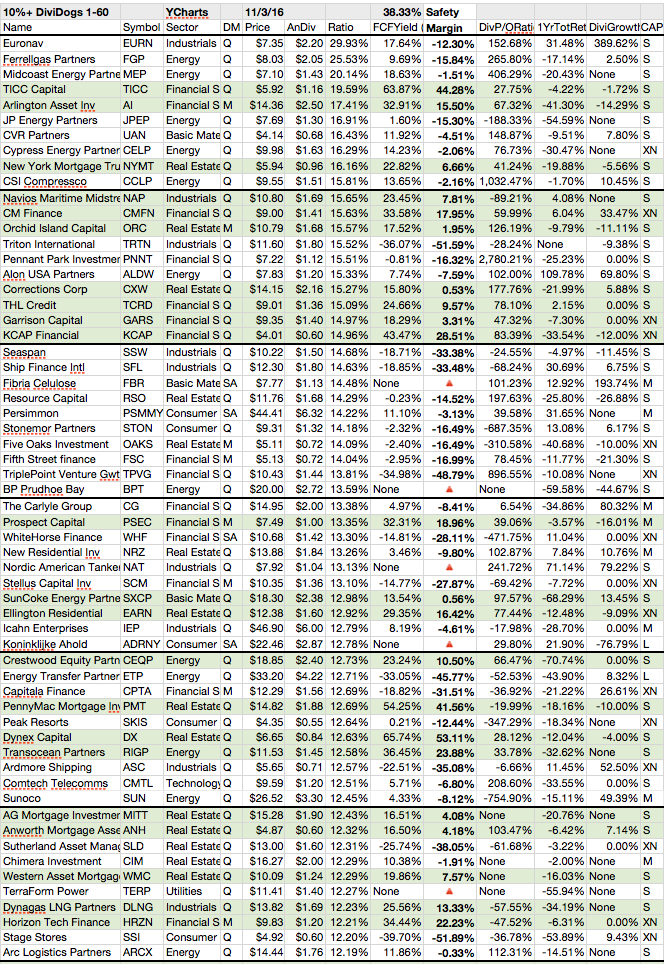

20 Great Dividend Stocks With Yields Between 10.20% and 20.63%

Any income investor is aware that with interest rates being so low for so long, market prices for bonds and dividend stocks are likely to fall as the Federal Reserve raises interest rates.

But even after the Fed changes direction and begins raising the federal funds rate above the range of zero to 0.25%, where it has been locked since late 2008, rates are likely to remain quite low for a long time.

So the market prices of income-producing securities may not fall as much as many investors fear, or maybe they’ll stage a recovery after the hysteria of the Fed’s likely near-term policy change wears off.

High-growth momentum stocks are nice, but many investors these days are more interested in stability and dependable dividends.

If you’re an income-oriented investor, the attached list of high yielding dividend stocks is ideal for further research. Each of the stocks has a double-digit dividend yield with positive ROA and positive 5 year earnings growth forecasts.

Some of these stocks may be boring, some of the yields may not be thrilling and some may not have impressive earnings growth in their future.

But all of the 20 dividend stocks are worth a deeper look when it comes to preserving capital and making regular dividend payments. Check out the list below and sort by company, yield or dividend history.

Here is the list...

But even after the Fed changes direction and begins raising the federal funds rate above the range of zero to 0.25%, where it has been locked since late 2008, rates are likely to remain quite low for a long time.

So the market prices of income-producing securities may not fall as much as many investors fear, or maybe they’ll stage a recovery after the hysteria of the Fed’s likely near-term policy change wears off.

High-growth momentum stocks are nice, but many investors these days are more interested in stability and dependable dividends.

If you’re an income-oriented investor, the attached list of high yielding dividend stocks is ideal for further research. Each of the stocks has a double-digit dividend yield with positive ROA and positive 5 year earnings growth forecasts.

Some of these stocks may be boring, some of the yields may not be thrilling and some may not have impressive earnings growth in their future.

But all of the 20 dividend stocks are worth a deeper look when it comes to preserving capital and making regular dividend payments. Check out the list below and sort by company, yield or dividend history.

Here is the list...

7 Safe And Cheap High Yielding Dividend Stocks

The Brexit vote pushed U.S. Treasury rates to record lows and the S&P 500 Index to new record highs, creating a sort of dash for stocks with a modicum of safety.

It's hard to discover nearly safe stocks. The truth is that you will not find any safeness at the stock market.

There are companies with a more risky growth strategy and companies with lower risk exposure.

Today I will share a couple of stocks with high dividends that might offer a bit safeness for you.

Here are the results...

It's hard to discover nearly safe stocks. The truth is that you will not find any safeness at the stock market.

There are companies with a more risky growth strategy and companies with lower risk exposure.

Today I will share a couple of stocks with high dividends that might offer a bit safeness for you.

Here are the results...

17 Profitable Growing High-Yielding Stocks

Growth is important for many investment strategies. More important is that the firm has a profitable growth.

Today I like to come back to my high-yield session. I like to screen companies with a positive return on assets and growing earnings.

The market cap of each company should be bigger than 2 billion. That's in my view enough to keep the big risks of smaller capitalized stocks away.

In addition, the debt-to-equity ratio should be under one.

Only seventeen stocks fulfilled the above mentioned criteria of which financials and basic materials are dominating the screen.

Here are my favorites of the results...

Today I like to come back to my high-yield session. I like to screen companies with a positive return on assets and growing earnings.

The market cap of each company should be bigger than 2 billion. That's in my view enough to keep the big risks of smaller capitalized stocks away.

In addition, the debt-to-equity ratio should be under one.

Only seventeen stocks fulfilled the above mentioned criteria of which financials and basic materials are dominating the screen.

Here are my favorites of the results...

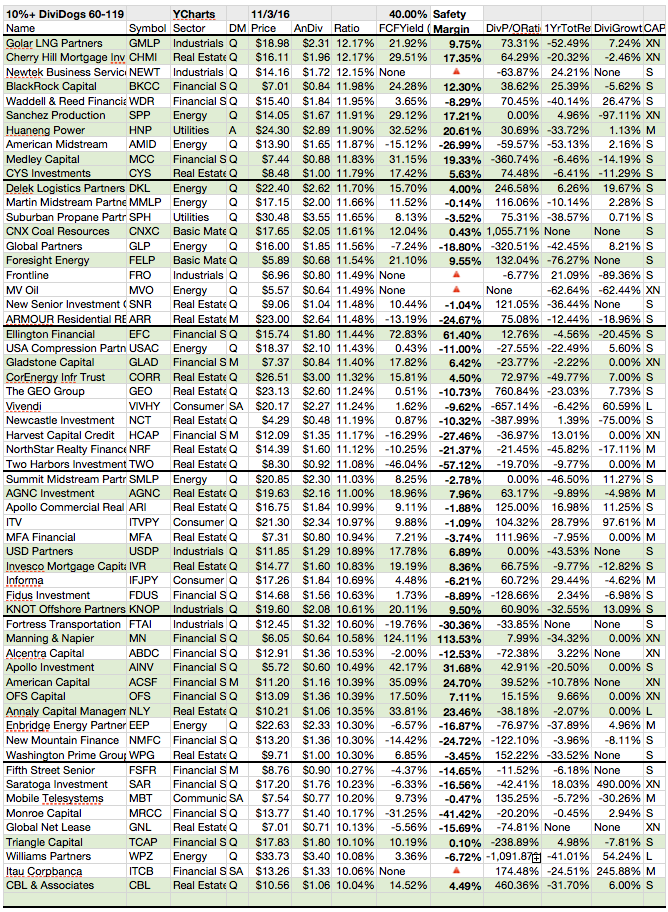

15 REITs With FFO Yields Over Dividend Yield

FFO is meant to provide the best measurement of a REIT’s cash flow available for dividend payments.

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

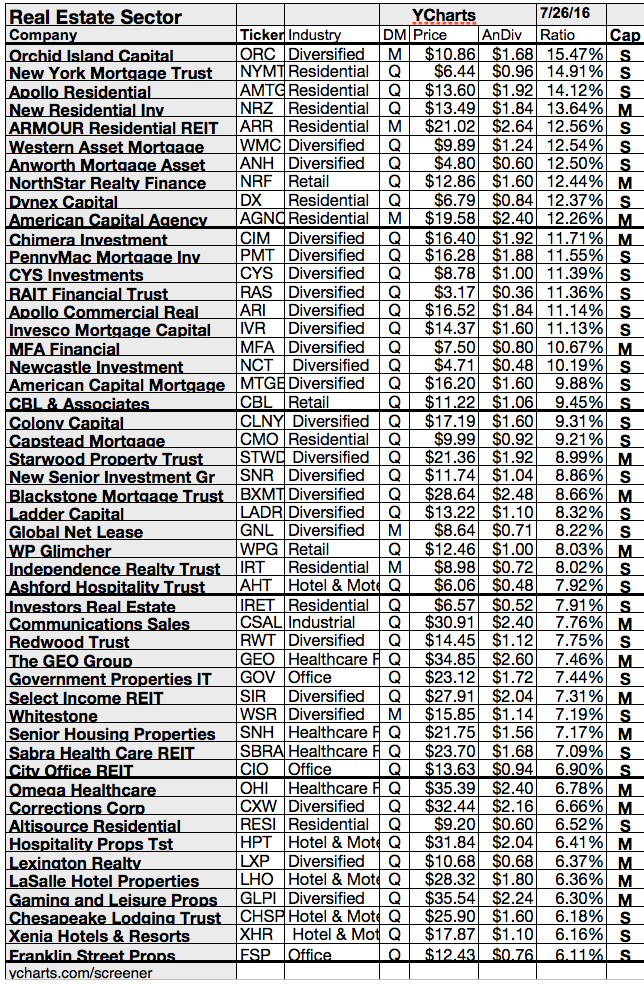

12 Best REITs With Solid Fundamentals To Finance Profitable Growth

Owning such things as office buildings and self-storage facilities, real estate investment trusts rake in rents and must pay at least 90 percent of their taxable income to shareholders.

As long as they can keep raising rents and dividend payments, the stocks should fare well.

Indeed, REITs’ underlying properties should post a 4.5 percent average gain in operating income this year, fueling dividend growth in the “high single-digit” range, says investment firm Lazard, and yields in the range of 2 percent to 6 percent.

Attached you will find a selection of Reits with Return on Assests over 5 percent and solid debt ratios.

This is in my view the best way to discover stocks with potential for profitable growth in the future.

Here are the results...

As long as they can keep raising rents and dividend payments, the stocks should fare well.

Indeed, REITs’ underlying properties should post a 4.5 percent average gain in operating income this year, fueling dividend growth in the “high single-digit” range, says investment firm Lazard, and yields in the range of 2 percent to 6 percent.

Attached you will find a selection of Reits with Return on Assests over 5 percent and solid debt ratios.

This is in my view the best way to discover stocks with potential for profitable growth in the future.

Here are the results...

4 Safe High-Yielding Dividend Stocks To Buy

Investing in the stock market can sometimes be a test of investors' patience. Over the past 15 years, the broad-based S&P 500 has plunged by more than 50%, only to completely erase these losses within a matter of years twice (the dot-com bubble and the Great Recession).

Investing in the stock market can sometimes be a test of investors' patience. Over the past 15 years, the broad-based S&P 500 has plunged by more than 50%, only to completely erase these losses within a matter of years twice (the dot-com bubble and the Great Recession).Long-term investors are well aware that the stock market tends to go up over the long-term, and has returned about 7% annually -- but that doesn't make it any easier holding onto stocks when the broad market indexes nosedive.

This is where dividend stocks come in. Dividend stocks offer a bounty of advantages over non-dividend stocks, which makes them attractive long-term holds.

The obvious difference is that dividends provide a hedge during a downturn. The average yield of the S&P 500 is just over 2%, and while that won't negate a stock market correction lower, it's better than nothing.

The two more important advantages of dividend stocks are that they usually imply a healthy business model and they can be reinvested to supercharge your long-term gains.

Companies typically won't pay a regular dividend to investors if they don't believe their business model is on solid footing.

By a similar token, being able to reinvest your dividends over the long run can allow you to buy more shares of dividend paying stocks, which yields bigger payouts, and even more shares. This compounding pattern is what lends to rapid wealth creation.

The thing about dividends is that investors can be lured solely based on yield, which isn't necessarily a good thing. As investors, we want the highest yield imaginable so we can boost our reinvestment potential.

But yields can rise because stock prices are falling. If investors aren't able to decipher whether a high yield is the result of a healthy shareholder return policy or a struggling business model, there could be problems.

With this in mind, I figured we'd take a brief look at four safe stocks with healthy dividend yields north of 5%. By "safe," I mean companies with below-average volatility and proven business models that won't leave you sleepless at night.

These are the results...

20 High-Yield Stocks With Extreme Low Beta Ratios (Half Of The Market)

Everyone has a different appetite for risk. Some people like to chase those high growth companies that have chances of doubling in a year or two, while others would likely never sleep at night while three out of 10 of its investments destroy the market while the other 7 crash & burn.

Everyone has a different appetite for risk. Some people like to chase those high growth companies that have chances of doubling in a year or two, while others would likely never sleep at night while three out of 10 of its investments destroy the market while the other 7 crash & burn. If you are one of those investors that don't have the sensibility to invest in those higher risk/higher reward type of companies, that's ok, there are plenty of lower risk companies that can generate good returns over time.

One ratio to measure the risk compared to the market is the beta ratio. A ratio under one shows us that the unique stock moves less than the overall market while a ratio far above one indicates that the stock is more volatile than the market.

If you look for more stability of your portfolio, you should look at low beta stocks. Mostly, you need to give up some of your return or dividend yield due to the higher safeness. But only sometimes.

Attached you can find a couple of stocks with the lowest beta ratio on the market while paying the highest available yields in their field. I've only included stocks with a market cap of more than 2 billion.

These are the results...

15 High Yields With The Lowest Dividend Payout Ratios

High

Yields with dividend payouts of less than 50 percent and room to boost future dividends

originally published at long-term-investments.blogspot.com. If you have only small amounts

of money available for investing, you need a higher yield. I do know this problem but

I always remember that higher dividend yields are also equally with a higher risk.

Today I would like to screen all higher yielding stocks with a dividend yield over 5 percent and a market capitalization above the 2 billion mark by its payout ratios. I’m hunting for opportunities that pay less than 50 percent of its earnings. I believe that there should be more room for a small dividend hike if earnings are not cyclic and grow over the time.

Fifteen high yielding stocks fulfilled these criteria of which eleven are currently recommended to buy.

Today I would like to screen all higher yielding stocks with a dividend yield over 5 percent and a market capitalization above the 2 billion mark by its payout ratios. I’m hunting for opportunities that pay less than 50 percent of its earnings. I believe that there should be more room for a small dividend hike if earnings are not cyclic and grow over the time.

Fifteen high yielding stocks fulfilled these criteria of which eleven are currently recommended to buy.

Next Week's 20 Top Yielding Ex-Dividend Shares - An Overview

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading week.

In total, 57 stocks go ex dividend

- of which 20 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the next week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Oi

SA

|

3.21B

|

5.76

|

0.61

|

0.23

|

13.27%

|

|

Chimera

Investment Corporation

|

3.14B

|

27.73

|

0.99

|

17.78

|

11.80%

|

|

Corrections

Corporation of America

|

3.78B

|

12.45

|

2.52

|

2.17

|

5.45%

|

|

Brandywine

Realty Trust

|

2.08B

|

-

|

1.09

|

3.70

|

4.47%

|

|

Kimco

Realty Corporation

|

8.30B

|

59.91

|

1.76

|

8.67

|

4.12%

|

|

DCT

Industrial Trust Inc.

|

2.12B

|

-

|

1.52

|

7.45

|

3.85%

|

|

The

Toronto-Dominion Bank

|

82.92B

|

13.47

|

1.87

|

3.81

|

3.66%

|

|

Sysco

Corp.

|

18.99B

|

19.18

|

3.66

|

0.43

|

3.50%

|

|

American

Eagle Outfitters, Inc.

|

2.76B

|

12.79

|

2.29

|

0.80

|

3.49%

|

|

Erie

Indemnity Co.

|

3.43B

|

24.10

|

5.30

|

0.59

|

3.22%

|

|

Bristol-Myers

Squibb Company

|

75.95B

|

56.34

|

5.29

|

4.81

|

3.03%

|

|

Cisco

Systems, Inc.

|

125.24B

|

12.54

|

2.12

|

2.58

|

2.91%

|

|

JPMorgan

Chase & Co.

|

197.59B

|

8.72

|

1.00

|

3.67

|

2.91%

|

|

Banco

Bradesco S.A.

|

59.00B

|

11.26

|

1.82

|

2.74

|

2.84%

|

|

Raytheon

Co.

|

25.58B

|

13.32

|

2.99

|

1.05

|

2.79%

|

|

Banco

Bradesco S.A.

|

66.19B

|

11.67

|

2.04

|

2.62

|

2.35%

|

|

Gentex

Corp.

|

3.65B

|

20.37

|

3.02

|

3.36

|

2.20%

|

|

Medtronic,

Inc.

|

53.51B

|

15.23

|

2.89

|

3.21

|

2.11%

|

|

Comcast

Corporation

|

117.71B

|

17.68

|

2.40

|

1.84

|

1.74%

|

|

Royal

Gold, Inc.

|

3.12B

|

43.78

|

1.33

|

10.79

|

1.66%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On September 30, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 8 stocks go ex dividend

- of which 3 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Oi

SA

|

3.26B

|

5.85

|

0.62

|

0.23

|

13.07%

|

|

Corrections

Corporation of America

|

3.81B

|

12.53

|

2.54

|

2.19

|

5.41%

|

|

American

Eagle Outfitters, Inc.

|

2.74B

|

12.71

|

2.28

|

0.80

|

3.51%

|

|

CVB

Financial Corp.

|

1.41B

|

18.27

|

1.88

|

5.86

|

2.96%

|

|

Raytheon

Co.

|

25.93B

|

13.50

|

3.03

|

1.06

|

2.76%

|

|

Village

Super Market Inc.

|

520.66M

|

19.88

|

2.23

|

0.35

|

2.59%

|

|

Mackinac

Financial Corp.

|

50.06M

|

13.25

|

0.80

|

2.01

|

1.78%

|

|

Comcast

Corporation

|

116.03B

|

17.43

|

2.36

|

1.81

|

1.77%

|

Subscribe to:

Posts (Atom)

.png)