The following stocks have high dividend yields (over 10%) and positive expected earnings growth forecasts....Each of the results have a positive return on assets.

Here are the 19 stocks...

Showing posts with label FRO. Show all posts

Showing posts with label FRO. Show all posts

17 Top Yielding Value Small Cap Bargains

It has been almost 7 years of growth and momentum leading the value in returns. This year we have seen significant capital move out of growth and into value. Value stocks are now getting back in favor.

If you are an investor seeking great value investments but you are not fully confident of buying small caps, you should consider mid cap stocks.

These tend to show up more undervalued opportunities than large caps and the companies are generally better understood and more stable then smaller companies.

Mid cap stocks should also be less volatile. In this screen, I have stayed under a P/E ratio of 9 and a book value greater than the market value.

In addition, each of the stocks should have a solid capital finance ratio. The debt-to-equity ratio should therefore be under 1 while the company is profitable due to a positive return on asset.

Finally only growth makes sense in my view. That's also the reason why I'm looking for a positive 5-year earnings per share growth.

Most of these companies also pay great dividends which is always an attractive quality in a value stock. Mid cap stocks with good dividends that you can buy for cheap right now, what is not to like!

Here are the results...

If you are an investor seeking great value investments but you are not fully confident of buying small caps, you should consider mid cap stocks.

These tend to show up more undervalued opportunities than large caps and the companies are generally better understood and more stable then smaller companies.

Mid cap stocks should also be less volatile. In this screen, I have stayed under a P/E ratio of 9 and a book value greater than the market value.

In addition, each of the stocks should have a solid capital finance ratio. The debt-to-equity ratio should therefore be under 1 while the company is profitable due to a positive return on asset.

Finally only growth makes sense in my view. That's also the reason why I'm looking for a positive 5-year earnings per share growth.

Most of these companies also pay great dividends which is always an attractive quality in a value stock. Mid cap stocks with good dividends that you can buy for cheap right now, what is not to like!

Here are the results...

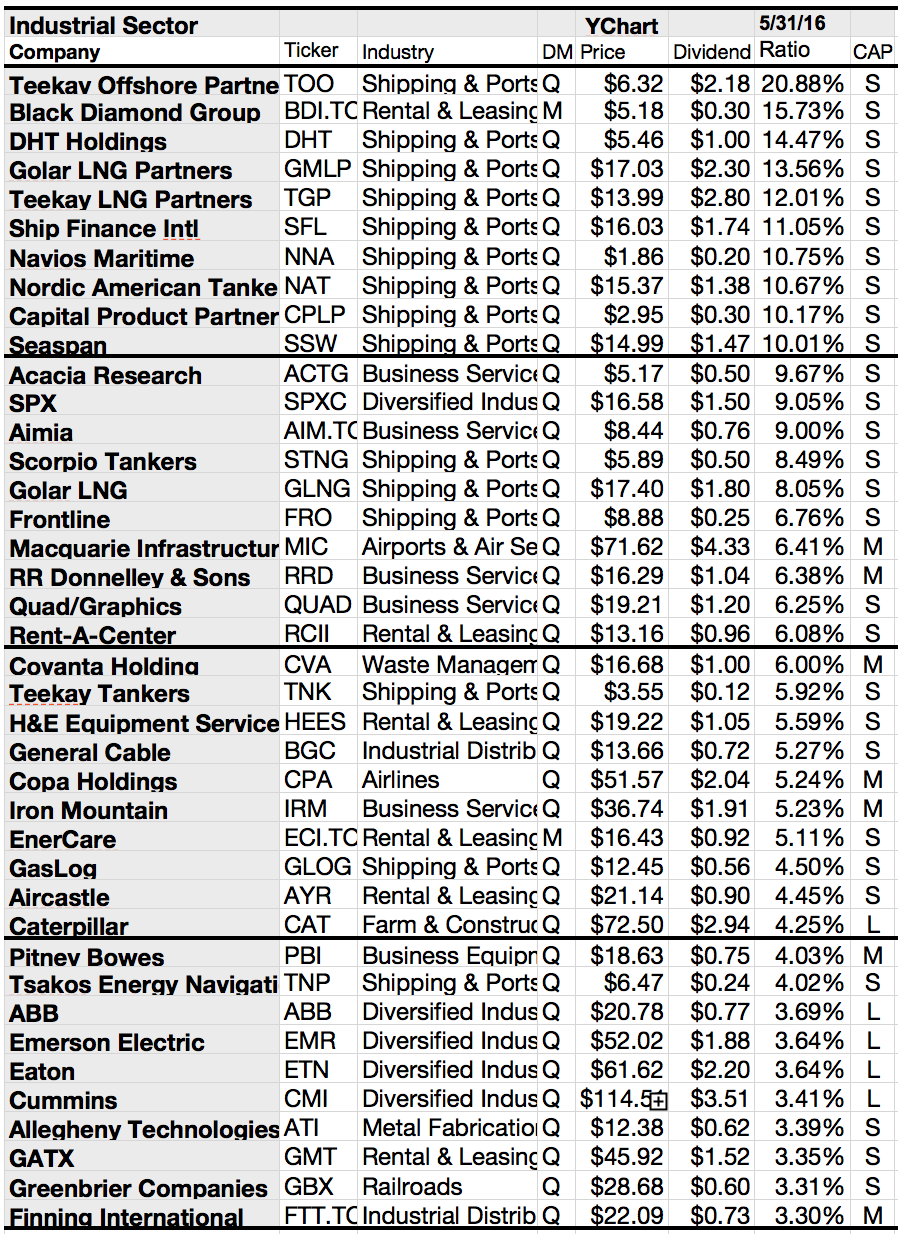

19 Shipping Stocks Far Below Book Value; Yields Still Up To 32%

If I screen the market by

interesting investing ideas, one industry often popped on my screen: The

shipping industry.

For sure, the global

trade slows down and commodity costs are at the lowest level for decades. What

looks like bad news for shipping stocks but also a great opportunity for long

term investors?

Let's try a look.

Ships are not equal. These are container ships, tanker etc. and each industry

has a different cyclic.

The recent

correction in share prices across shipping stocks, barring tanker operators,

has transpired into attractive valuations.

While investors

are skeptical of catching falling knives, sitting on the cash means missing

good bargains.

Investors should

adopt a diversified portfolio within the maritime space, to insulate from

heightened uncertainty in the sector.

We have followed

top-down approach to build our model portfolio, while considering company-specific

factors such as the balance sheet strength, financial performance and

management profile for stock selection.

It is important to

note that shipping is a high-beta sector and tends to underperform/outperform

the financial markets by a wide alpha on both sides.

Attached I've

tried to compile a few dividend paying shipping stocks that might look like

bargains due to low price to book ratios and earnings multiples. What du you

think? Are shipping stocks worth an investment? Leave a comment and we discuss

the idea.

Here are the

results...

10 Highly Profitable, High-Yield And Growth Orientated Stocks You Should Know

Right now there are roughly 1,400 companies in the U.S. that pay regular cash dividends, and they pay out in total about $410 billion.

Right now there are roughly 1,400 companies in the U.S. that pay regular cash dividends, and they pay out in total about $410 billion. The dividends are in effect the vegetables. They’re the nutrients underneath the stock market that allow it to grow over time. Over long periods, that American dividend stream has grown at roughly 5.5% per year.

Over the last five years dividends in the S&P 500 have compounded about 13% per year. That’s in a period where the S&P 500 returned 14.5% per year. So the lion’s share of the equity return was driven by aggregate dividend growth.

Dividends are important but growth too. The optimal way to invest is to mix growth with dividends. Secondly, a corporate should grow at highly profitable rates. It does not make sense to scale a money loosing system to get poor.

Attached you will find 10 highly profitable growth orientated stocks that might deliver solid returns in the future.

10 Stocks I found related to the issue are....

13 Service Dividend Stocks With Highest Short Float Ratio

Dividend Stocks From The Service Sector With Highest Short Float Ratio

Researched By Dividend Yield - Stock,

Capital, Investment. The services sector is the second basic stage of the economy behind the

agricultural. Stocks from the sector are characterized by low margins and undercapitalized

business models.

At the stock markets are 908 companies linked to the sector with a total

market capitalization of USD 48.2 trillion. The average sector yield amounts to

1.92 percent and the average P/E ratio is 20.11. The highest dividend paying

industries are consumer services, publishing and computer wholesale.

I screened the sector by dividend stocks with the highest amount of

short selling stocks, measured by the float short ratio. The ratio shows how

many stocks are shorted by investors. Companies with a high ratio of float

short have a little upside potential if investors need to close their short

position. Thirteen dividend stocks from the services sector have a float short

ratio of more than 25 percent.

Subscribe to:

Posts (Atom)