|

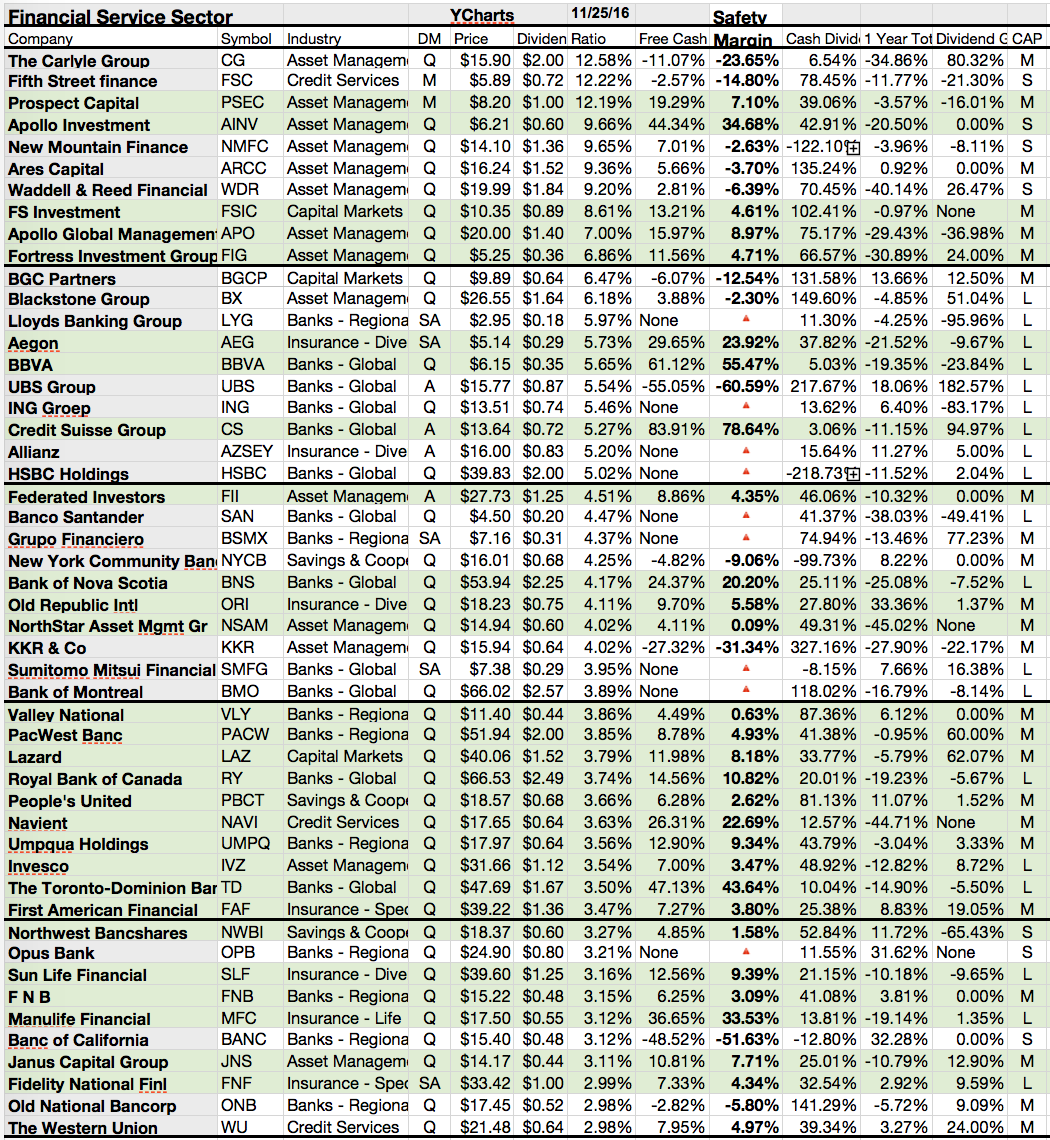

| 50 Financial Dividend Financial Dogs (Source: Seeking Alpha) |

Showing posts with label UBS. Show all posts

Showing posts with label UBS. Show all posts

Bank Stocks With Big Dividend Yields

When savvy investors hunt for great dividend stocks, one of the first things they look at is the dividend yield, which expresses a stock's annual dividend payout as a percentage of its stock price.

One of the reasons investors are often drawn to bank stocks is because they tend to pay generous dividends. But just like any other industry, some banks stocks are more generous than others when it comes to their quarterly payouts.

Which are the best from the perspective of an income-seeking investor on the hunt for a high yield? You can find the answer in the table below.

With this in mind, I drew up the table below, which ranks the nation's biggest banks by dividend yield.

Here are higher capitalized bank/money center stocks with dividend yields above 3 percent....

One of the reasons investors are often drawn to bank stocks is because they tend to pay generous dividends. But just like any other industry, some banks stocks are more generous than others when it comes to their quarterly payouts.

Which are the best from the perspective of an income-seeking investor on the hunt for a high yield? You can find the answer in the table below.

With this in mind, I drew up the table below, which ranks the nation's biggest banks by dividend yield.

Here are higher capitalized bank/money center stocks with dividend yields above 3 percent....

Why High-Yield Dividend Stock UBS Group Could Be A Buy

UBS is a $37 billion revenue-generating machine providing financial services to high net worth individuals and institutions throughout the world.

What makes UBS different from many others is that 50% of it business comes from fees from private wealth management. Investment banking accounts for 27% of all revenues while commodity banking services for personal and corporate clients contributes 15%. Asset management for corporate benefit plans takes up the remaining 8%.

In its core private wealth business, UBS has a loyal following among the world's wealthiest families. It takes about $10 million just to open a private bank relationship. Monthly fees are based on assets under management and do not vary greatly year to year.

Approximately 80% of its core income comes from recurring fees. UBS does not seek the highest absolute investment returns. Most clients are more concerned with capital preservation. This means that UBS enjoys some stability in its business.

UBS stock has fallen over 28% in 2016, pushing its $0.63 per share dividend to a yield of 4.5%. Dividend payments are limited to once a year so investors needing more frequent income will find their needs better met elsewhere.

UBS cut its dividend during the financial crisis and only recently began making payments again. Financial stocks usually employ a lot of leverage, which can make them riskier investments during recessions. As well, banks with heavy European exposure are being hit hard today, so investors should proceed with caution.

These are the corporate fundamentals and the dividend history compiled in two charts...

UBS Group’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $16,143.20 million. The EBITDA margin is 50.49% (the operating margin is 17.87% and the net profit margin 20.79%).

Financials: The total debt represents 18.84% of UBS Group assets and the total debt in relation to the equity amounts to 321.14%. Due to the financial situation, a return on equity of 11.71% was realized by UBS Group.

Twelve trailing months earnings per share reached a value of $1.29. Last fiscal year, UBS Group paid $0.88 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 10.90, the P/S ratio is 1.61 and the P/B ratio is finally 0.88. The dividend yield amounts to 6.20%.

Stock Charts:

These are several high yielding competitors of UBS...

What makes UBS different from many others is that 50% of it business comes from fees from private wealth management. Investment banking accounts for 27% of all revenues while commodity banking services for personal and corporate clients contributes 15%. Asset management for corporate benefit plans takes up the remaining 8%.

In its core private wealth business, UBS has a loyal following among the world's wealthiest families. It takes about $10 million just to open a private bank relationship. Monthly fees are based on assets under management and do not vary greatly year to year.

Approximately 80% of its core income comes from recurring fees. UBS does not seek the highest absolute investment returns. Most clients are more concerned with capital preservation. This means that UBS enjoys some stability in its business.

UBS stock has fallen over 28% in 2016, pushing its $0.63 per share dividend to a yield of 4.5%. Dividend payments are limited to once a year so investors needing more frequent income will find their needs better met elsewhere.

UBS cut its dividend during the financial crisis and only recently began making payments again. Financial stocks usually employ a lot of leverage, which can make them riskier investments during recessions. As well, banks with heavy European exposure are being hit hard today, so investors should proceed with caution.

These are the corporate fundamentals and the dividend history compiled in two charts...

UBS Group -- Yield: 6.20%

UBS Group (NYSE:UBS) employs 60,093 people, generates revenue of $13,714.23 million and has a net income of $6,646.89 million. The current market capitalization stands at $55.59 billion.UBS Group’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $16,143.20 million. The EBITDA margin is 50.49% (the operating margin is 17.87% and the net profit margin 20.79%).

Financials: The total debt represents 18.84% of UBS Group assets and the total debt in relation to the equity amounts to 321.14%. Due to the financial situation, a return on equity of 11.71% was realized by UBS Group.

Twelve trailing months earnings per share reached a value of $1.29. Last fiscal year, UBS Group paid $0.88 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 10.90, the P/S ratio is 1.61 and the P/B ratio is finally 0.88. The dividend yield amounts to 6.20%.

Stock Charts:

| Long-Term Stock Price Chart of UBS Group (UBS) |

| Long-Term Dividend Payment History of UBS Group (UBS) |

| Long-Term Dividend Yield History of UBS Group (UBS) |

These are several high yielding competitors of UBS...

10 Stocks Looking Cheap Now During The Cycle

The S&P 500 is already off more than 8%, which means the benchmark index has lost more than 1.7% per week on average for every full week of trading.

The S&P 500 is already off more than 8%, which means the benchmark index has lost more than 1.7% per week on average for every full week of trading.If anything, it’s highly unlikely that markets will keep falling so quickly — at that pace, most of the stock market would evaporate by the end of the year.

But any continued losses are unwelcome losses, so investors are rapidly fleeing to more risk-light assets. The problem is the 10-year Treasury yield now yields a mere 1.74%, and many traditional safe-haven stocks have actually enjoyed buying amid the downturn, helping to drive down their yields.

Investors do have a few options for meaningful yield, though. The very downturn that has investors scurrying to find safe-havens has created a bevy of cheap dividend stocks to buy, most of which yield about two or three times the miserable yield on the 10-year.

Here are the results...

Ex-Dividend Stocks: Best Dividend Paying Shares On May 06, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks May 06,

2013. In total, 39 stocks and

preferred shares go ex dividend - of which 20 yield more than 3 percent. The

average yield amounts to 3.98%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Penn Virginia Resource Partners

|

2.41B

|

-

|

1.90

|

2.40

|

8.72%

|

|

|

Linn

Energy, LLC

|

9.01B

|

-

|

2.03

|

5.08

|

7.56%

|

|

|

Atlas

Pipeline Partners LP

|

2.74B

|

38.67

|

1.52

|

2.20

|

6.38%

|

|

|

Inergy

Midstream LLC

|

2.19B

|

39.78

|

2.88

|

11.30

|

6.13%

|

|

|

Alliance

Resource Partners LP

|

2.76B

|

12.20

|

3.90

|

1.36

|

5.93%

|

|

|

DCP

Midstream Partners LP

|

3.55B

|

21.05

|

2.83

|

2.06

|

5.70%

|

|

|

American Realty Capital Prp.

|

2.50B

|

-

|

2.21

|

148.53

|

5.55%

|

|

|

Inergy,

L.P.

|

2.90B

|

5.18

|

2.60

|

1.63

|

5.27%

|

|

|

Federated

Investors, Inc.

|

2.32B

|

12.35

|

3.88

|

2.46

|

4.32%

|

|

|

Access Midstream Partners, L.P.

|

4.47B

|

36.89

|

1.94

|

7.35

|

4.28%

|

|

|

Magellan

Midstream Partners LP

|

11.81B

|

27.14

|

7.78

|

6.66

|

3.84%

|

|

|

Sanofi

|

140.50B

|

21.67

|

1.88

|

3.00

|

3.20%

|

|

|

Southern

Copper Corp.

|

27.91B

|

14.48

|

5.86

|

4.19

|

2.42%

|

|

|

Beam,

Inc.

|

10.31B

|

26.03

|

2.23

|

4.18

|

1.40%

|

|

|

Cheesecake Factory

|

2.08B

|

20.86

|

3.52

|

1.13

|

1.22%

|

|

|

Waste

Connections Inc.

|

4.61B

|

27.27

|

2.45

|

2.66

|

1.07%

|

|

|

UBS

AG

|

67.98B

|

-

|

1.35

|

4.03

|

0.90%

|

|

|

Companhia

Brasileira de Distribuicao

|

14.54B

|

27.54

|

3.39

|

0.57

|

0.33%

|

20 Of Europe’s Best Recommended Dividend Stocks

Best

yielding dividend stocks from Europe with buy rating published at "long-term-investments.blogspot.com". Europe’s roof is on

fire due to the debt crises. That was one of the major headlines in the press

of the recent year. Sure, the fire still burns but the worst seems to be over.

Europe’s economy still has values. It’s also an export-driven mainland with a GDP of 13,076 billion, the second largest figure in the world. Certainly, the economy is weak, unemployment rates are at a high level of 11.8 percent and growth slows with a contracting GDP growth of -0.6 percent year over year.

But the currency market turns and reaches the highest value since the debt crises was debated. More and more money comes back to Europe mainly because the ECBs easing policy which is one of the most reserved below the leading industrialized national banks.

Europe is not dead and I like to show you the best yielding investment opportunities with a current buy rating and a listing in the United States. 162 companies with headquarter in Europe are listed on an American Stock Exchange. 102 of them pay dividends and 57 have a current buy or better rating. In order to exclude the stocks with a higher risk due to a small business model, I selected only stocks with a market capitalization over USD 10 billion. 41 stocks still remain.

You can find a list of the 20 most recommended stocks below. The list shows that Europe has still completive companies with a dominant market position. I think about Novo Nordisk or Anheuser Bush. Also Deutsche Bank and National Grid are leading players.

Europe’s economy still has values. It’s also an export-driven mainland with a GDP of 13,076 billion, the second largest figure in the world. Certainly, the economy is weak, unemployment rates are at a high level of 11.8 percent and growth slows with a contracting GDP growth of -0.6 percent year over year.

But the currency market turns and reaches the highest value since the debt crises was debated. More and more money comes back to Europe mainly because the ECBs easing policy which is one of the most reserved below the leading industrialized national banks.

Europe is not dead and I like to show you the best yielding investment opportunities with a current buy rating and a listing in the United States. 162 companies with headquarter in Europe are listed on an American Stock Exchange. 102 of them pay dividends and 57 have a current buy or better rating. In order to exclude the stocks with a higher risk due to a small business model, I selected only stocks with a market capitalization over USD 10 billion. 41 stocks still remain.

You can find a list of the 20 most recommended stocks below. The list shows that Europe has still completive companies with a dominant market position. I think about Novo Nordisk or Anheuser Bush. Also Deutsche Bank and National Grid are leading players.

20 Highly Recommended Financial Dividend Shares | Stock Buy List

Financial

dividend stocks with highest buy recommendation originally published at "long-term-investments.blogspot.com". One sector I’ve

tried to avoid in the past was the financial sector. I have only stocks from financial

services provider like Thomson Reuters or some Stock Exchange Operator like the

NYX. Some major investors and hedge funds have started bets on the post

financial recovery earlier with no greater success.

The whole financial industry is still in a crises and this should go on. I don’t know how long. Jobs in the industry are still degraded and as long as the interest rates are low and there will be more and more jobs degraded.

Despite the bad sector news, Last year, the financial sector was the top performing bet with a 27.5 percent gain. I missed this opportunity but as of today, I cannot evaluate all the risks within the sector. I have no idea what kind of risk assets banks have and how they manage them.

What do you think about the sector? Do you have some shares from banks or related industries? Let me know and leave a comment in the box below.

Today, I like to show you the 20 best recommended financial stocks with a higher capitalization (over USD 2 billion). Below the results are five with a high yield.

The whole financial industry is still in a crises and this should go on. I don’t know how long. Jobs in the industry are still degraded and as long as the interest rates are low and there will be more and more jobs degraded.

Despite the bad sector news, Last year, the financial sector was the top performing bet with a 27.5 percent gain. I missed this opportunity but as of today, I cannot evaluate all the risks within the sector. I have no idea what kind of risk assets banks have and how they manage them.

What do you think about the sector? Do you have some shares from banks or related industries? Let me know and leave a comment in the box below.

Today, I like to show you the 20 best recommended financial stocks with a higher capitalization (over USD 2 billion). Below the results are five with a high yield.

Cheapest Large Caps With Highest Expected Growth As Of August 2012

Cheapest Large Capitalized Stocks With Highest

Earnings Per Share Growth By Dividend

Yield – Stock, Capital, Investment. Here is a

current sheet of America’s cheapest Large Caps with the highest expected growth

for the upcoming fiscal year. Stocks from the sheet have a market

capitalization of more than USD 10 billion and earnings per share are expected

to grow for at least 20 percent. Despite the strong growth, they still have a

P/E ratio of less than 15 and a P/S and P/B ratio of less than two. Twenty-one companies fulfilled the mentioned criteria of which thirteen companies have a

buy or better recommendation. Eighteen pay dividends.

The best yielding stock is now Energy Transfer Partners (ETP) with a yield of 8.41 percent. The company is followed by China Petroleum & Chemical (SNP) with a yield of 5.02 percent and Dow Chemical (DOW) whose yield is 4.24 percent.

The best yielding stock is now Energy Transfer Partners (ETP) with a yield of 8.41 percent. The company is followed by China Petroleum & Chemical (SNP) with a yield of 5.02 percent and Dow Chemical (DOW) whose yield is 4.24 percent.

Cheapest Large Caps With Highest Expected Growth As Of July 2012

Cheapest Large Capitalized Stocks With Highest

Earnings Per Share Growth By Dividend

Yield – Stock, Capital, Investment. Here is a

current sheet of America’s cheapest Large Caps with the highest expected growth

for the upcoming fiscal year. Stocks from the sheet have a market

capitalization of more than USD 10 billion and earnings per share are expected

to grow for at least 20 percent. Despite the strong growth, they still have a

P/E ratio of less than 15 and a P/S and P/B ratio of less than two. Twenty-two companies fulfilled the mentioned criteria of which fourteen companies have a

buy or better recommendation. Only nineteen pay dividends.

The best yielding stock is still Banco Bilbao (BBVA) with a yield of 9.59 percent. The company is followed by the oil and gas pipeline operator Energy Transfer Partners (ETP) and the Chinese oil and gas company China Petroleum (SNP).

The best yielding stock is still Banco Bilbao (BBVA) with a yield of 9.59 percent. The company is followed by the oil and gas pipeline operator Energy Transfer Partners (ETP) and the Chinese oil and gas company China Petroleum (SNP).

The Best Dividends On May 07, 2012

Here is a current overview

of the best yielding stocks with a market capitalization over USD 2 billion

that have their ex-dividend date on the next trading day. If your broker

settles your trade today, you will receive the next dividend. A full list of

all stocks with ex-dividend date can be found here: Ex-Dividend Stocks May 07,

2012. In total, 25 stocks and

preferred shares go ex-dividend of which 8 yielding above 3 percent. The

average yield amounts to 2.37 percent.

Richard Pzena - Hancock Classic Value Fund Portfolio Q4/2011

Richard Pzena Fund Investing Strategies By Dividend Yield – Stock Capital, Investment. Here is a current portfolio update of Richard Pzena’s - Hancock Classic Value - portfolio movements as of Q4/2011 (December 31, 2011). In total, he has 39 stocks with a total portfolio worth of USD 1,552,681,000.

Subscribe to:

Posts (Atom)