Showing posts with label MTGE. Show all posts

Showing posts with label MTGE. Show all posts

Ex-Dividend Stocks: Best Dividend Paying Shares On March 18, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 18,

2013. In total, 22 stocks and

preferred shares go ex dividend - of which 13 yield more than 3 percent. The

average yield amounts to 5.25%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

American

Capital Agency Corp.

|

13.16B

|

7.53

|

1.03

|

6.24

|

15.06%

|

|

American Capital Mortgage Investment

|

1.55B

|

3.13

|

1.02

|

10.63

|

13.73%

|

|

Navios

Maritime Holdings Inc.

|

452.28M

|

2.94

|

0.38

|

0.73

|

5.48%

|

|

LTC

Properties Inc.

|

1.22B

|

25.36

|

2.63

|

12.94

|

4.67%

|

|

Electro

Rent Corp.

|

431.04M

|

19.31

|

1.95

|

1.71

|

4.45%

|

|

CTC

Media, Inc

|

1.91B

|

605.00

|

2.75

|

2.46

|

4.30%

|

|

Ramco-Gershenson

Properties

|

822.39M

|

402.50

|

1.47

|

6.39

|

4.16%

|

|

EastGroup

Properties Inc.

|

1.73B

|

64.38

|

3.57

|

9.31

|

3.66%

|

|

Cincinnati

Financial Corp.

|

7.70B

|

18.35

|

1.41

|

1.87

|

3.46%

|

|

Tupperware

Brands Corporation

|

4.24B

|

22.90

|

9.10

|

1.64

|

3.16%

|

|

Chesapeake

Utilities Corporation

|

476.91M

|

17.82

|

1.90

|

1.23

|

2.94%

|

|

Cott

Corporation

|

915.55M

|

19.20

|

1.50

|

0.41

|

2.40%

|

|

Hudson

Pacific Properties, Inc.

|

1.28B

|

-

|

1.50

|

8.12

|

2.21%

|

|

Tiffany

& Co.

|

8.76B

|

21.32

|

3.57

|

2.34

|

1.85%

|

|

Noah

Holdings Limited

|

429.73M

|

21.28

|

2.57

|

5.65

|

1.57%

|

|

Activision

Blizzard, Inc.

|

16.74B

|

14.88

|

1.48

|

3.45

|

1.26%

|

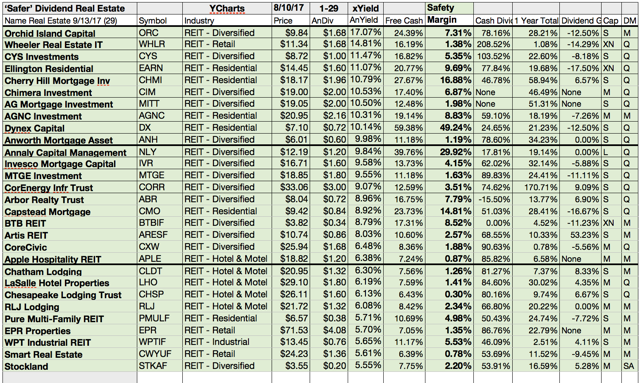

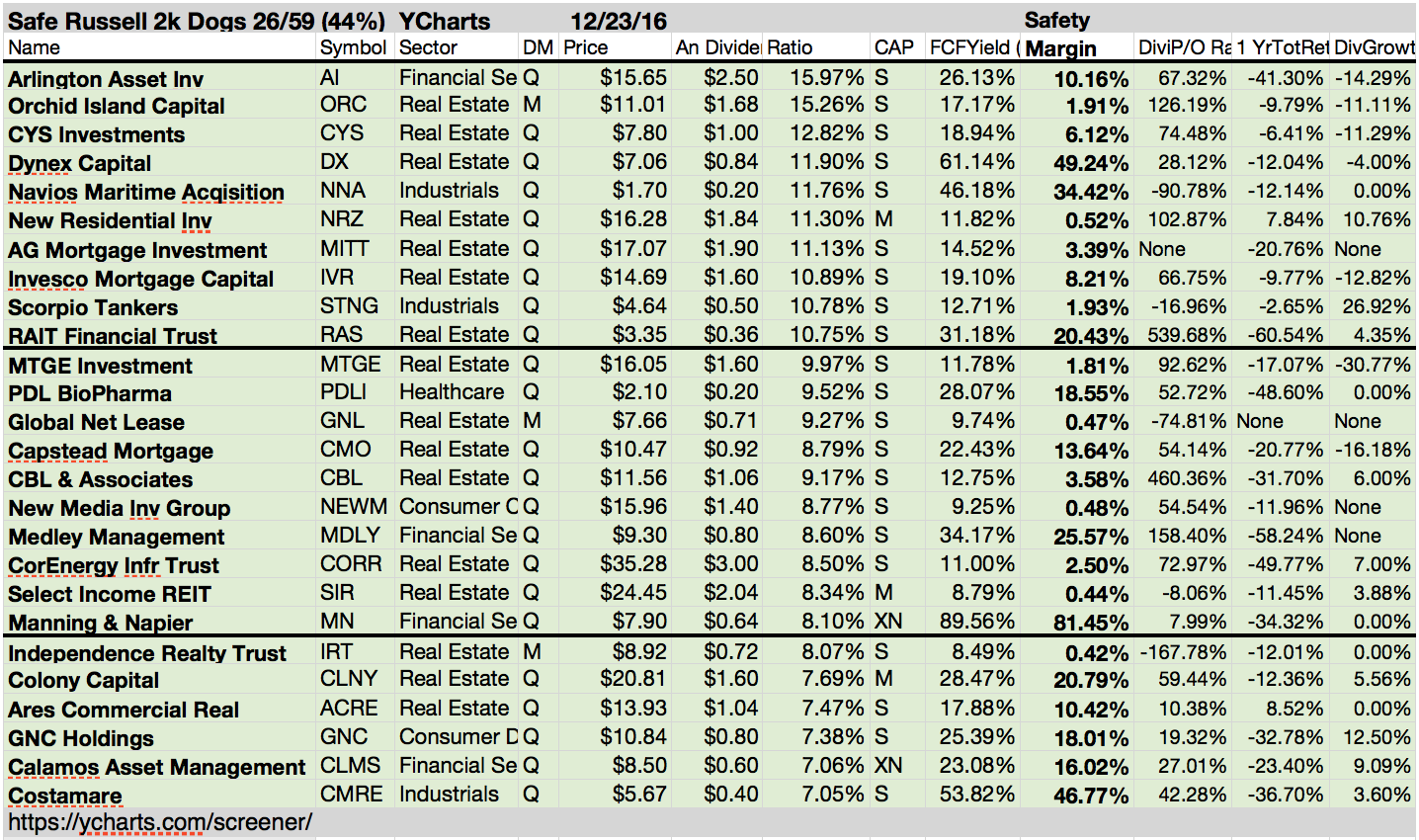

20 Stocks With Yields Over 10% And Highest Buy Ratings

Most

recommended stocks with very high yields originally published at "long-term-investments.blogspot.com". I love stocks with

high dividend yields but there are only a few with sustainable payments. I

think about Altria or Lorillard. Other stocks have a huge potential for a

dividend cut, also if they are a Dividend Champion or a stock with a very long

dividend growth history. I made this investment mistake with Avon Products. The

company was highly leveraged and became some operations problems. Finally they reduced

the dividend dramatically.

Most of the people need stocks with very high yields. I don’t because my private wealth is high enough to catch the dividend payments and live off it. In the past, I often thought it would be the only solution to put all my money into the highest yielding stocks with the most attractive fundamentals. This strategy failed and I lost much money within the closed-end shipping industry. That was a big mistake from which I learned and I like to share this with you.

Please don’t put all your money into one stock or make a single bet on a high-yield stock. This is very risky. That’s all I can say. Make a good research and try to avoid an overweighting of a stock or asset theme.

Each month, I made a regular screen about the stocks with the highest dividend yields because I believe there is a lot of value information in it for my readers. This month, I like to show you the 20 most recommended stocks with a double-digit dividend yield and a higher market capitalization (over USD 300 million). Out there are 95 companies with a very high yield but only 35 have a buy or better recommendation. The REIT industry is still a big player on my screen with 6 representatives.

Most of the people need stocks with very high yields. I don’t because my private wealth is high enough to catch the dividend payments and live off it. In the past, I often thought it would be the only solution to put all my money into the highest yielding stocks with the most attractive fundamentals. This strategy failed and I lost much money within the closed-end shipping industry. That was a big mistake from which I learned and I like to share this with you.

Please don’t put all your money into one stock or make a single bet on a high-yield stock. This is very risky. That’s all I can say. Make a good research and try to avoid an overweighting of a stock or asset theme.

Each month, I made a regular screen about the stocks with the highest dividend yields because I believe there is a lot of value information in it for my readers. This month, I like to show you the 20 most recommended stocks with a double-digit dividend yield and a higher market capitalization (over USD 300 million). Out there are 95 companies with a very high yield but only 35 have a buy or better recommendation. The REIT industry is still a big player on my screen with 6 representatives.

Best Dividend Paying Ex-Dividend Shares On December 24, 2012

The Best Yielding And

Biggest Ex-Dividend Stocks Researched By ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates. The ex dividend

date is the final date on which the new stock buyer couldn’t receive the next

dividend. If you like to receive the dividend, you need to buy the stock before

the ex dividend date. I made a little screen of the best yielding stocks with a

higher capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks December

24, 2012. In total, 10 stocks and

preferred shares go ex dividend - of which 6 yield more than 3 percent. The

average yield amounts to 5.87%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

American

Capital Agency Corp.

|

10.82B

|

10.49

|

0.96

|

5.72

|

15.79%

|

|

American Capital Mortgage Investment

|

917.38M

|

2.90

|

1.00

|

8.50

|

14.23%

|

|

One

Liberty Properties Inc.

|

308.01M

|

23.59

|

1.26

|

6.65

|

6.82%

|

|

Philip

Morris International, Inc.

|

142.83B

|

17.10

|

-

|

1.87

|

3.98%

|

|

Xcel

Energy Inc.

|

13.39B

|

14.76

|

1.51

|

1.32

|

3.93%

|

|

Cypress

Semiconductor Corporation

|

1.62B

|

63.06

|

6.84

|

1.95

|

3.88%

|

|

Getty

Realty Corp.

|

591.18M

|

-

|

1.59

|

5.25

|

2.82%

|

|

Bancolombia

S.A.

|

14.12B

|

14.29

|

2.28

|

3.49

|

2.38%

|

|

Tellabs

Inc.

|

1.26B

|

-

|

0.85

|

1.12

|

2.33%

|

|

Zimmer

Holdings, Inc.

|

11.94B

|

16.07

|

2.05

|

2.68

|

1.05%

|

24 Cheap Dividend Stocks At New 52-Week Highs

Dividend Stocks Close At New Highs By Dividend Yield – Stock, Capital, Investment. Here is a current sheet

of dividend stocks (positive yield) that have marked a new 52-Week High within

the recent days. Despite the turmoil’s at the markets, there are 200 companies

at one-year highs and 116 of them pay dividends. I screened the best performing

stocks and analyzed all with a P/E ratio below 15 and a yield over three

percent. Twenty-four companies fulfilled these criteria of which thirteen have

a buy or better recommendation. Five stocks have a yield over ten percent.

14 High Yield Stocks With Low Debt Ratios That Are Still Cheap In Terms Of Coming Growth

Stocks With Low PEG Ratios And Low Debt To Equity Researched By Dividend Yield - Stock, Capital, Investment. Sometimes, people only watch at the single P/E ratio which measures the price valuation of a company in relation to its earnings. A high P/E leads similar to a "not buy" decision. But high P/E ratios also express the growth of the company. A stock that doubles earnings every three years is it worth to pay 20 times of earnings. The price-earnings to growth (PEG) ratio is a figure that solves this problem. However, I’ve tried so screen the market by stocks that look cheap in terms of growth (a PEG ratio below one). In addition, the stocks should have a low debt to equity ratio (ratio below 0.3) and a dividend yield of more than five percent (high yields). Fourteen stocks fulfilled these criteria of which six have a double digit yield. Ten stocks have a buy or better recommendation.

Subscribe to:

Comments (Atom)