|

| Source: Seeking Alpha |

Showing posts with label STNG. Show all posts

Showing posts with label STNG. Show all posts

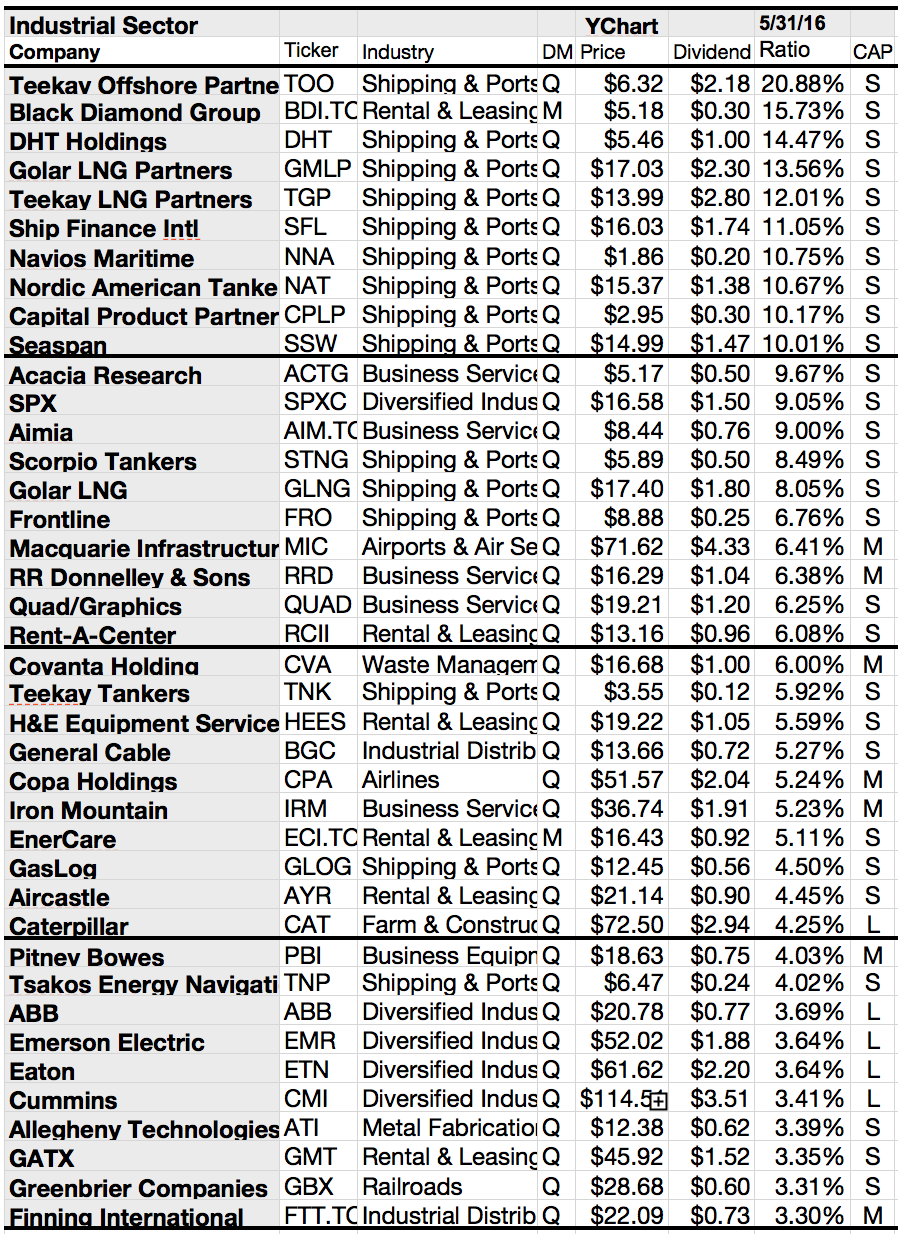

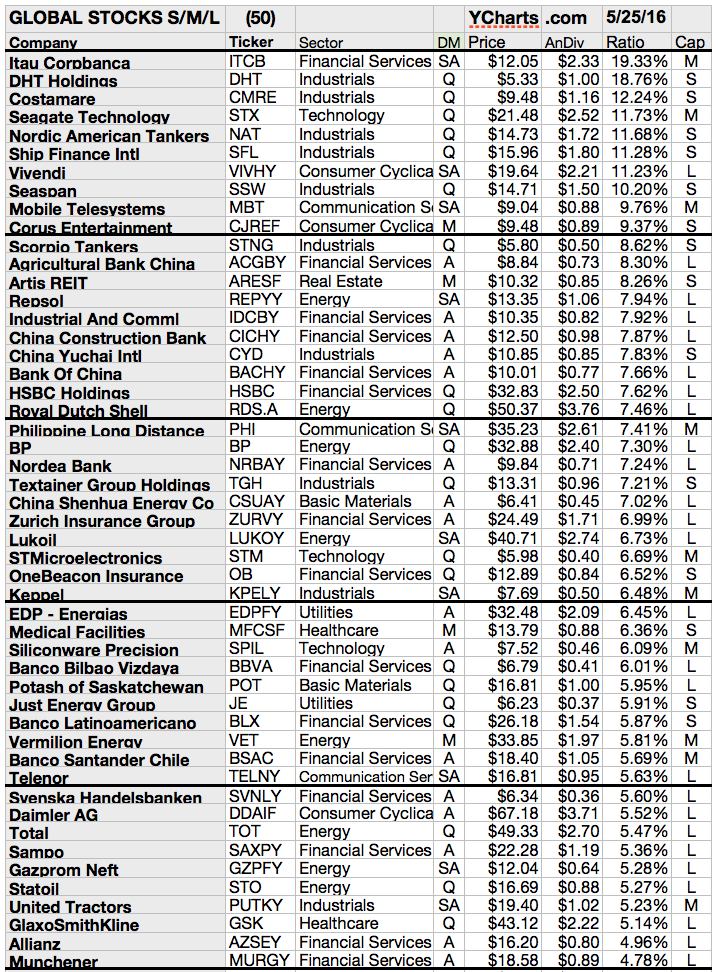

Global Dividend Dogs For May 2016

Please find attached the current list of the Dividends Dogs for May 2016. The list contain 50 stocks with yields between 4.78% and 19.33%.

What is a dividend dog?

The "dog" moniker is earned in three steps:

(1) any stock paying a reliable, repeating dividend

(2) whose price has fallen to a point where its yield (dividend/price)

(3) has grown higher than its peers (here in the Global collection) is tagged as a dividend dog.

|

| Global Dividend Dogs For May 2016, Source: Seeking Alpha |

Ex-Dividend Stocks: Best Dividend Paying Shares On June 07, 2013

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 07,

2013. In total, 12 stocks and

preferred shares go ex dividend - of which 2 yield more than 3 percent. The

average yield amounts to 1.99%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

China

Petroleum & Chemical

|

87.49B

|

8.74

|

1.02

|

0.19

|

5.73%

|

|

|

Laclede

Group Inc.

|

1.48B

|

16.70

|

1.67

|

1.39

|

3.61%

|

|

|

Prologis,

Inc.

|

19.36B

|

-

|

1.44

|

9.60

|

2.88%

|

|

|

Best

Buy Co. Inc.

|

9.20B

|

-

|

3.14

|

0.19

|

2.51%

|

|

|

Firstbank

Corporation

|

109.16M

|

11.69

|

0.82

|

1.74

|

1.77%

|

|

|

Legg

Mason Inc.

|

4.19B

|

-

|

0.87

|

1.60

|

1.55%

|

|

|

Scorpio

Tankers Inc.

|

1.44B

|

-

|

0.65

|

10.97

|

1.13%

|

|

|

Ross

Stores Inc.

|

14.06B

|

17.38

|

7.51

|

1.42

|

1.06%

|

|

|

W.R.

Berkley Corporation

|

5.47B

|

11.59

|

1.25

|

0.92

|

1.00%

|

|

|

GAMCO

Investors, Inc.

|

1.42B

|

19.48

|

4.02

|

4.06

|

0.36%

|

|

|

Gardner

Denver Inc.

|

3.70B

|

14.65

|

2.53

|

1.64

|

0.27%

|

|

|

UniFirst

Corp.

|

1.88B

|

17.49

|

1.96

|

1.44

|

0.16%

|

Subscribe to:

Comments (Atom)