| Ticker | Company | P/E | Fwd P/E | P/S | P/B | Dividend | Price | Target Price |

| CVRR | CVR Refining, LP | 5.82 | 4.67 | 0.36 | 1.65 | 15.6% | 16.15 | 21.00 |

| ARLP | Alliance Resource Partners, L.P. | 6.61 | 7.05 | 1.3 | 2.06 | 10.7% | 19.56 | 25.00 |

| SHI | Sinopec Shanghai Petrochemical Company Limited | 4.95 | 5.69 | 0.57 | 1.23 | 10.2% | 46.81 | 75.00 |

| SNP | China Petroleum & Chemical Corporation | 10 | 8.85 | 0.27 | 1.05 | 10.1% | 85.79 | 114.62 |

| ARI | Apollo Commercial Real Estate Finance, Inc. | 14.86 | 9.38 | 6.39 | 0.95 | 9.9% | 18.60 | 18.63 |

| AB | AllianceBernstein Holding L.P. | 9.95 | 11.24 | 9.87 | 1.94 | 9.7% | 29.65 | 32.17 |

| VIV | Telefonica Brasil S.A. | 8.59 | 11.74 | 1.72 | 1.08 | 9.5% | 12.17 | 14.06 |

| EQM | EQM Midstream Partners, LP | 10.59 | 10.85 | 4.42 | 1.08 | 9.2% | 48.45 | 57.73 |

| ENBL | Enable Midstream Partners, LP | 15.33 | 13.26 | 1.83 | 0.84 | 9.1% | 13.90 | 17.91 |

| VOD | Vodafone Group Plc | - | 14.38 | 1.01 | 0.78 | 9.1% | 19.60 | 25.60 |

| SEP | Spectra Energy Partners, LP | 11.11 | 12 | 8.45 | 1.53 | 8.5% | 36.65 | 40.44 |

| SHLX | Shell Midstream Partners, L.P. | 13.72 | 10.15 | 7.24 | 1.31 | 8.1% | 18.98 | 25.95 |

| BTI | British American Tobacco p.l.c. | 2.13 | 8.58 | 2.6 | 0.99 | 7.9% | 34.54 | 53.86 |

| EQGP | EQGP Holdings, LP | 13.86 | 12.43 | 3.66 | 16.33 | 7.8% | 16.17 | 22.27 |

| CVI | CVR Energy, Inc. | 16.85 | 11.82 | 0.56 | 2.98 | 7.8% | 38.58 | 48.00 |

| NYCB | New York Community Bancorp, Inc. | 12.19 | 11.92 | 2.82 | 0.73 | 7.2% | 9.42 | 10.50 |

| EOCC | Enel Generacion Chile S.A. | 10.37 | 10.72 | 2.19 | 1.73 | 7.1% | 18.82 | 23.80 |

| UMC | United Microelectronics Corporation | 13.44 | 11.73 | 0.9 | 0.62 | 6.8% | 1.76 | 2.34 |

| PSXP | Phillips 66 Partners LP | 12.93 | 12.99 | 5.27 | 1.95 | 6.7% | 47.70 | 57.96 |

| T | AT&T Inc. | 15.09 | 8.44 | 1.34 | 1.2 | 6.6% | 30.29 | 34.48 |

Creating such high-quality content is hard work and takes a lot of time. You might have noticed that we don't display ads or get paid for our posts. We deliver this information to you for free.

To keep this blog running free without ads, we need your help. For a small donation by using this link or clicking the paypal donation button below, you can help us to keep this blog alive. It would be great if you support us on a monthly basis.

As gift for your support, we send you our full Dividend Growth Stock Factbook Collection with over 800+ long-term dividend growth stocks in PDF and Excel. You can also join our distribution list to receive these tools every month.

Here is an example of our open Excel Database for your own research:

If you donate now, you will also get a fresh updated copy of our dividend growth database. The Excel File contains all dividend growth stocks and major buyback stock announcements since 2004.

Here is a preview:

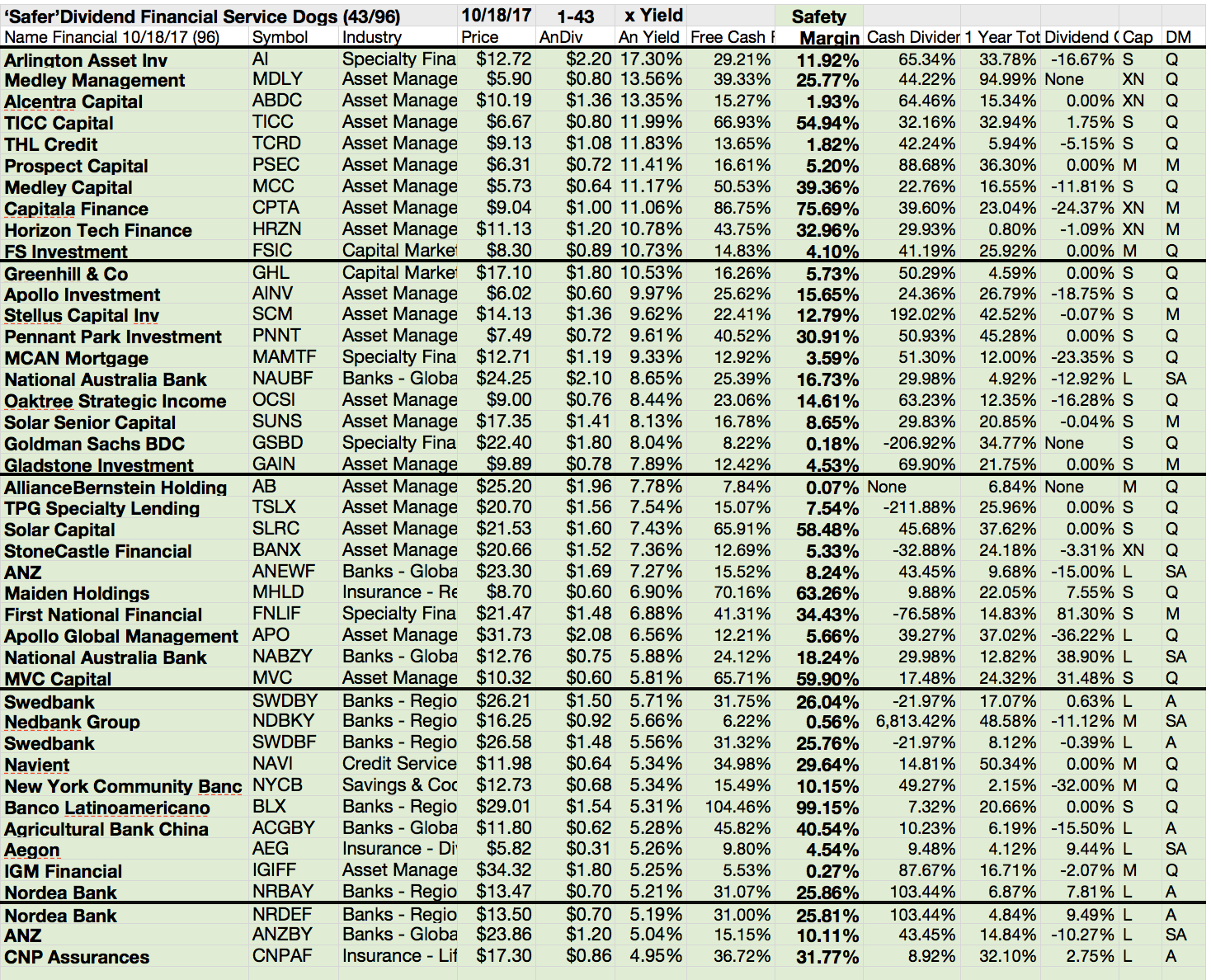

Finally, you will get every month a fresh update of our Foreign Yield Factbook. The PDF sorts dividend stocks from the most important economies in the world by yield. - Over 60 Pages!

Here is the preview:

Support us now with a small donation and get all of these PDF's and Excel Files every month!

Thank you!