Find attached a list of stocks with yields over 10 percent as well as positive 5 year sales growth. Each of the stocks have a market cap over 2 billion.

If you like to receive more high yielding stocks, you can easily get the full details from the screen. Just make a small donation and I send you the documents to your donation email adress.

This is only a small part of the full Dividend Yield Investor Fact Book Package. The full package contains excel sheets of essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth) and 204 Dividend Contenders (10 to 24 years of consecutive dividend growth). It's an open version, so you can work with it very easily.

Ticker

|

Company

|

P/E

|

Fwd P/E

|

P/S

|

P/B

|

Dividend

|

DDR

|

DDR Corp.

|

-

|

55.34

|

2.99

|

1.19

|

20.97%

|

CLNS

|

Colony NorthStar, Inc.

|

-

|

-

|

1.13

|

0.5

|

15.33%

|

SUN

|

Sunoco LP

|

53.25

|

11.22

|

0.23

|

2.6

|

12.22%

|

TWO

|

Two Harbors Investment Corp.

|

5.74

|

8.23

|

3.63

|

0.98

|

12.10%

|

UNIT

|

Uniti Group Inc.

|

-

|

184.81

|

3.63

|

-

|

12.02%

|

ETP

|

Energy Transfer Partners, L.P.

|

-

|

13.95

|

0.75

|

0.84

|

12.02%

|

TEO

|

Telecom Argentina S.A.

|

13.59

|

13.2

|

1.17

|

4.49

|

11.24%

|

NRZ

|

New Residential Investment Corp.

|

4.02

|

7.84

|

2.24

|

1.05

|

11.10%

|

CIM

|

Chimera Investment Corporation

|

6.06

|

7.8

|

2.86

|

0.93

|

11.03%

|

BX

|

The Blackstone Group L.P.

|

12.28

|

9.62

|

5.46

|

3.22

|

10.93%

|

PSEC

|

Prospect Capital Corporation

|

10.09

|

8.68

|

3.54

|

0.72

|

10.88%

|

MIC

|

Macquarie Infrastructure Corporation

|

19.14

|

15.91

|

1.77

|

1.03

|

10.61%

|

IEP

|

Icahn Enterprises L.P.

|

5.31

|

22.31

|

0.61

|

2.25

|

10.46%

|

MFA

|

MFA Financial, Inc.

|

9.75

|

10.46

|

5.11

|

0.95

|

10.42%

|

ARI

|

Apollo Commercial Real Estate Finance

|

12.34

|

8.82

|

6.38

|

0.86

|

10.05%

|

This is only a small part of the full Dividend Yield Investor Fact Book Package. The full package contains excel sheets of essential financial ratios from all 113 Dividend Champions (over 25 years of constant dividend growth) and 204 Dividend Contenders (10 to 24 years of consecutive dividend growth). It's an open version, so you can work with it very easily.

The idea to create Factbooks and Fact Excel Sheets was born when I were looking for free aggregated information on the web. As a student of economics, I had not much money to buy the expensive S&P Stock and Bond Guides by McGraw-Hill to educate myself. I must put all my efforts into research and web search. Finally I needed to put all information into one Word and Excel file.

The Dividend Yield Factbooks and Excel Sheets inform students and other persons with a great desire for big data of stock fundamentals and worldwide yields from corporations.

A small donation from you can help me to develop this books and improve the quality of the work. Together we can make the world a better and smarter place. A place with no information advantage between poor and rich persons who have enough budget to buy the expensive data from Reuters and Bloomberg.

As a gift, you will get the Dividend Yield Investor Fact Book Package each month. This compilation contains the following books and one Excel Sheet with financial ratios form all Dividend Champions and Dividend Contenders. Here is what you get for your donation:

- Foreign Yield Fact Book (updated weekly)

- Dividend Growth Stock Fact Book (updated

monthly)

- Dividend Growth Excel Sheet (updated

weekly)These books and Excel Sheets are regular updated and keeps you up-to date with current yield figures from the best Dividend Growth Stocks.

Every donation, even a tiny one, helps us to keep this blog free available for everyone. Help us to support people with no income or big budget to get free and easy information on the web.

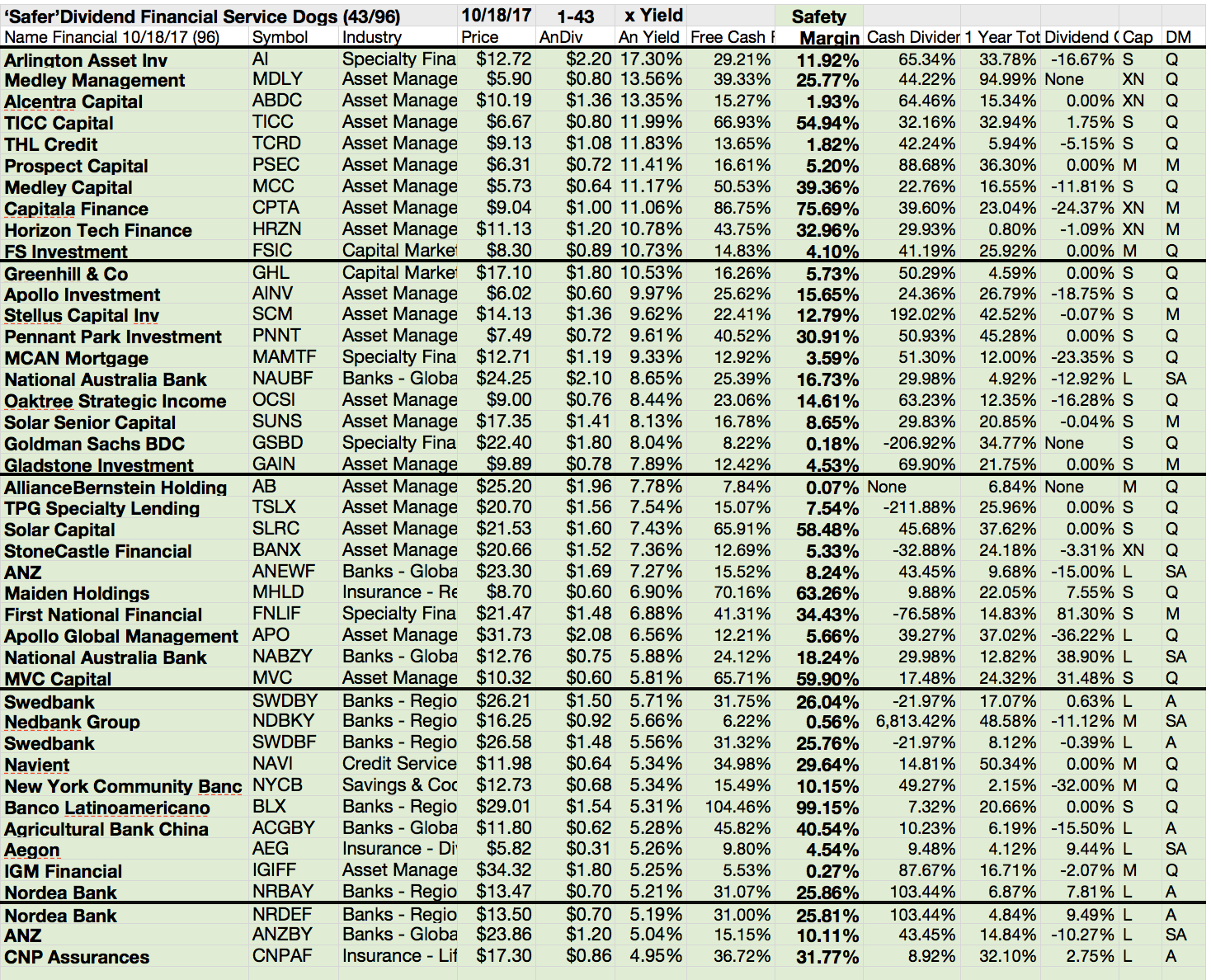

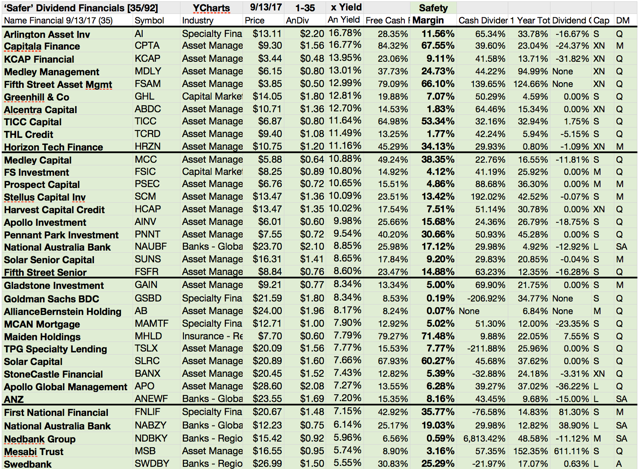

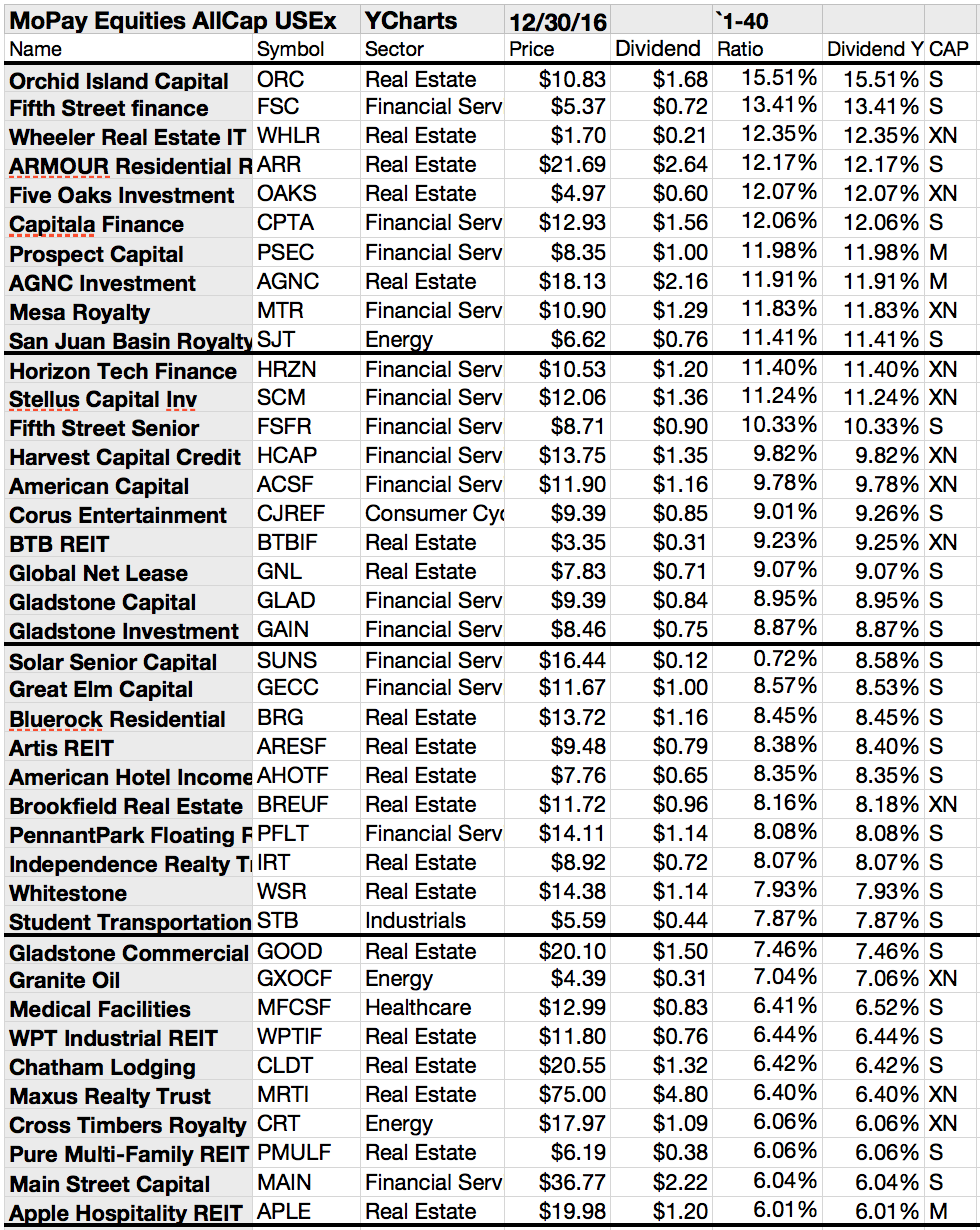

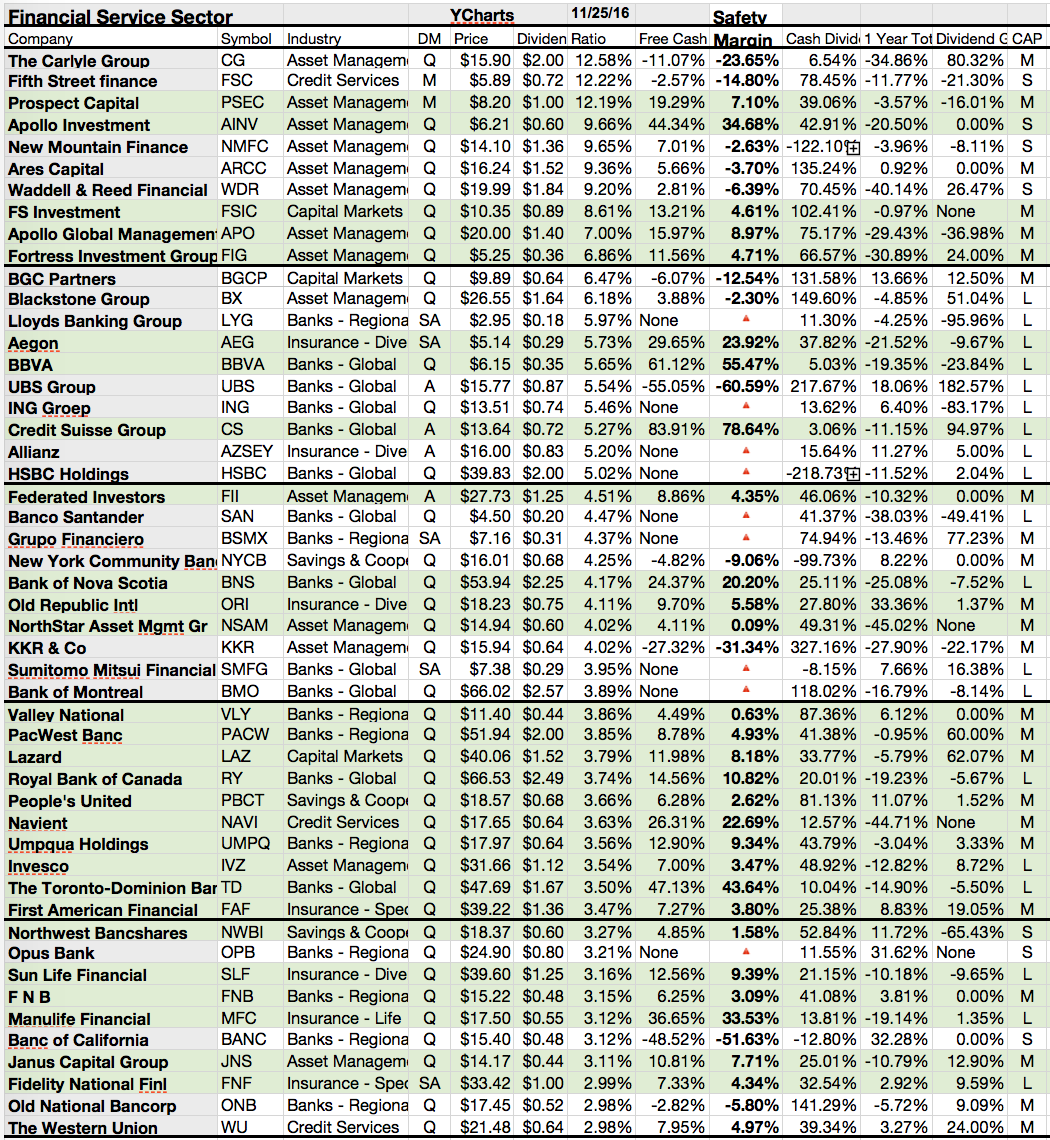

Here is a view of the content tables:

Thank you very much for your help. Thank YOU, it's a great pleasure!!!